Summary:

- Intel recently updated its reporting segments in early April 2024, with our deep dive further bolstering our confidence surrounding TSM’s foundry execution and long-term prospects.

- With a healthier balance sheet despite the expansion in Japan/ US and growing market share, we believe that TSM may very well retain its title as the global market leader.

- TSM has managed to achieve the trifecta of node advancement, volume manufacturing, and profitability, building upon its technological moat since 1987, one that remains uncertain for Intel.

- Based on the January and February 2024 reported revenues, we may very well see TSM beat its own FQ1’24 guidance, further underscoring the durability of generative AI-based demand globally.

- As we enter the new super-cycle of cloud computing, interested readers may still add this market leader at any dips.

imaginima/iStock via Getty Images

We previously covered Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in January 2024 and discussed its impressive performance in the FQ4’23 earnings call, with the optimistic FY2024 guidance further cementing the semiconductor investment thesis, as generative AI provided the long-term growth tailwinds over the next decade.

Combined with the stock’s attractive risk/ reward ratio, we rated the stock as a Buy, no matter the ongoing trade war and uncertain geopolitical issues.

In this article, we shall be reviewing how INTC’s recent foundry segment has performed against TSM’s market dominance in FY2023, with our deep dive further bolstering our confidence in the latter’s forward execution and profitability, significantly aided by the healthy balance sheet.

While the global foundry market remains big enough to accommodate multiple players, we believe that TSM may very well retain its title as the market leader for many years to come, attributed to the trifecta of node advancement, volume manufacturing, and profitability.

TSM’s Foundry Investment Thesis Remains Robust – With Competition Still Lagging Behind

INTC’s Growing Cash Burn In The Foundry

For now, INTC has recently updated its new reporting segments by early April 2024, with the Intel Foundry currently reporting declining revenues of $18.91B (-31.2% YoY) and widening operating losses of -$6.95B (-34.6% YoY)/ margins of -36.7% (-18 points YoY) in FY2023.

This is compared to TSM at $69.29B (-4.5% YoY), $29.53B (-17.8% YoY), and 42.6% (-6.9 points YoY) in FY2023, respectively.

At the same time, the INTC management only guides “breakeven operating margin” by approximately 2027 and “60% non-GAAP gross margins and 40% non-GAAP operating margins by 2030.”

INTC’s numbers are underwhelming indeed, especially since it only reports a “lifetime deal value with external customers of more than $15B,” with the bulk of its future foundry opportunities likely attributed to its internal pipelines.

As a result of this development, we believe that the near-term risks to TSM’s ongoing dominance in the global foundry market are relatively minimal, especially since the company has already diversified their global footprints in Japan and US, partly balancing the geopolitical headwinds.

In addition, while TSM has yet to report their FQ1’24 earnings, with the call scheduled for April 18, 2024, we believe that it may outperform expectations, based on the January and February 2024 sales reported thus far.

For example, the foundry reported impressive January 2024 revenues of 215.78B NTD (+22.3% MoM/ +7.9% YoY) and February 2024 revenues of 181.64B NTD (-15.8% MoM/ +11.3% YoY), despite the tougher YoY comps (and the Chinese New Year festivities in February 2024) while reversing ten consecutive months of negative YoY comps.

Assuming a similar trend in March 2024, we may very well see TSM beat its own FQ1’24 revenue guidance of approximately 572.24B NTD at the midpoint (-8.5% QoQ/ +12.5% YoY), based on the management’s exchange rate assumption of $1 to 31.1 NTD.

Most importantly, based on the foundry’s FQ1’24 gross margin guidance of 53% (inline QoQ/ -3.3 points YoY) and operating margin of 41% at the midpoint (-0.6 points QoQ/ -4.5 YoY), we believe that the management expects minimal margin impact as the Japanese plant ramps up its operations from February 2024 onwards and manufacturing from end of 2024 onwards.

At the same time, TSM has been able to achieve much of its footprint expansion in the US and Japan without overly relying on debt, with its balance sheet still robust at a net cash situation of $25.16B (+6.2% YoY/ +35.1% from FQ4’19 levels) as of FQ4’23.

This is compared to INTC at growing net debts of -$24.23B (+82.8% YoY/ +92.1% from FQ4’19 levels) as of FQ4’23, further exemplifying the TSM management’s focus on delivering sustainable and profitable growth.

This is partly aided by the $6.6B in grants from the US government and approximately $8B from the Japanese government for TSM’s foundry expansions.

Furthermore, TSM’s FQ4’23 gross margins of 53% (-1.3 points QoQ/ -9.2 YoY/ +2.8 from FQ4’19 levels) remains exemplary, despite the “sweetheart deal” with Apple Inc. (AAPL) for the 3nm chips, the estimated 30% wastage, and the 15% revenue share from 3nm nodes.

These developments suggest that TSM has managed to achieve the trifecta of node advancement, volume manufacturing, and profitability, building upon its technological moat since 1987, one that remains uncertain for INTC despite the IDM 2.0 ambitions.

Combined with the growing global foundry market share of 61.2% as of Q4’23 (+3.3 points QoQ/ +2.7 YoY/ +8.5 from Q4’19 levels), we believe that TSM may very well retain its title as the market leader for many years to come.

So, Is TSM Stock A Buy, Sell, or Hold?

TSM 5Y Stock Price

For now, TSM has charted an impressive recovery over the past few months, buoyed by NVIDIA Corporation’s (NVDA) excellent earnings call and promising forward guidance, further underscoring the durability of generative AI-based demand globally.

With the TSM stock consistently breaking out of the 50/100/200-day moving averages while retesting the 2021/ 2022 top of $140s, it is apparent that the market remains exuberant as we enter the new super-cycle of cloud computing.

TSM Valuations

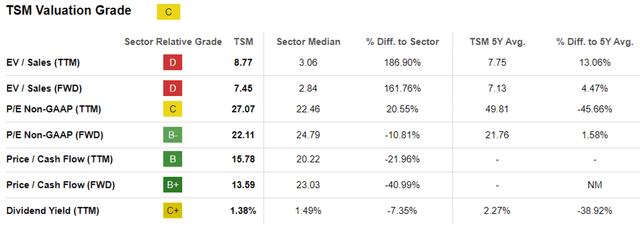

For now, the same exuberance is also embedded in TSM’s forward valuations at P/E of 22.11x and Price/ Cash Flow of 13.59x, compared to its 1Y mean of 18.79x/ 10.32x and 3Y pre-pandemic averages of 17.27x/ 11.20x.

However, when compared to its foundry peers, such as INTC at 28.38x/ 10.93x, Samsung Electronics Co., Ltd. (OTCPK:SSNLF) at 38.01x/ 12.47x, and Micron Technology, Inc. (MU) at 178.56x/ 15.5x, we believe that TSM is not expensive here, especially given the consensus projected top/ bottom line growth at a CAGR of +18%/ +20.3% through FY2026.

Based on the FY2023 adj EPS of $5.18 and the FWD P/E valuations of 22.11x, the TSM stock appears to be trading way above our fair value estimates of $114.50, with a notable +23.4% premium at current levels.

Then again, based on the consensus FY2026 adj EPS estimates of $9.02, there is an excellent upside potential of +41% to our long-term price target of $199.40.

As a result of the potential double beat in the FQ1’24 earnings call and the attractive risk-reward ratio, we are maintaining our Buy rating for TSM, with the premium valuations well-deserved given its position as the inherent foundry market leader globally.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.