Summary:

- TSMC stock has been breaking records due to strong demand for chips and positive investor sentiment in the semiconductor sector.

- The company’s fundamentals, however, have shown zero growth in revenue and a drop in net income.

- TSMC’s long-term prospects remain compelling due to its technological leadership, relationships with major tech players, and opportunities in AI and high-performance computing.

Annabelle Chih/Getty Images News

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) is one of the world’s undisputed leaders in the semiconductor foundry business. This behemoth specializes in the fabrication of cutting-edge integrated circuits, serving as the backbone for many of the tech giants we use daily. TSMC’s clients include titans like Apple (AAPL), NVIDIA (NVDA), Qualcomm (QCOM), and countless others who rely on the company’s advanced chip manufacturing prowess.

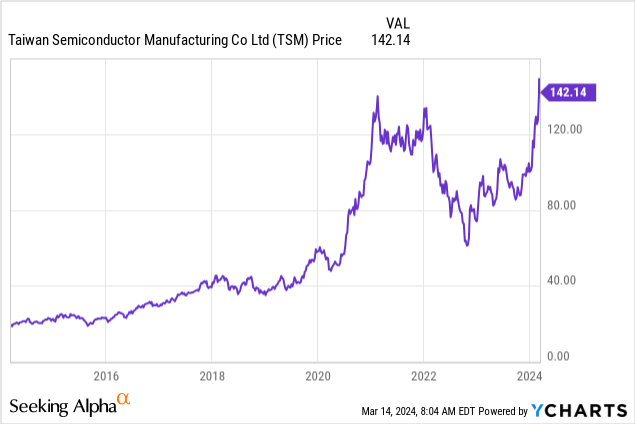

TSMC Stock Breaking Records

Recent quarters have been remarkable for TSMC stock, reflecting the broader semiconductor sector’s outperformance. The company has experienced robust growth, fueled by strong demand of chips for artificial intelligence and high-performance computing as well as positive investor sentiment in the sector. Additionally, investors have been bullish as inflation eases and interest rate cuts appear to be around the corner, signaling a potential global economic upswing. The following graph shows the recent stock price performance:

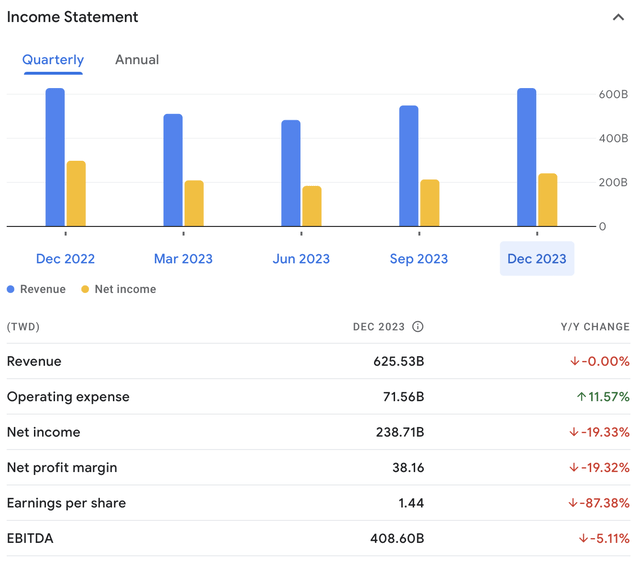

The company’s fundamentals, however, are not supporting the more than 100 percent surge in the stock price in the last year; in fact, TSMC’s quarterly revenue has shown zero growth year-over-year and its net income has dropped by 19 percent, driven by ongoing margin deterioration, as the following chart and table illustrate:

Google Finance

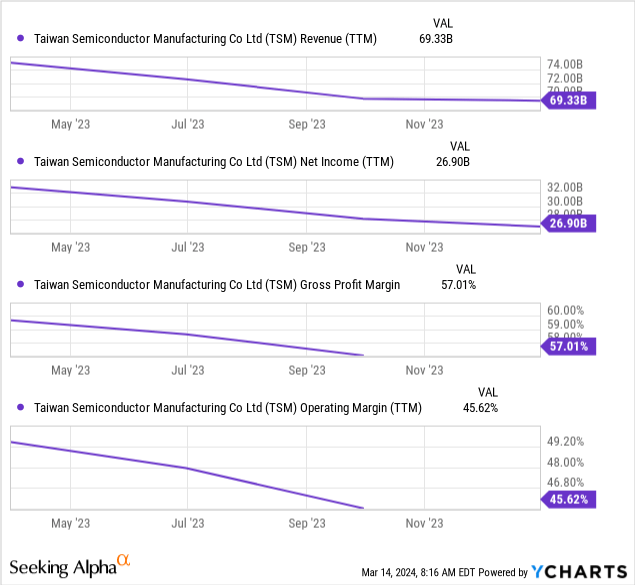

The following trailing-twelve-month revenue, net income, and gross profit margin charts illustrate that the decline in TSMC’s fundamentals has been ongoing throughout the last year, as the stock price persistently surged:

I’ve been pondering what is driving the recent decoupling between stock price performance and company fundamentals across the semiconductor sector?

Animal Spirits

I’ve been covering the sector in my recent articles and have discussed the red flags I see from extreme sentiment and recent insider selling at Nvidia, to low margins and intensifying competitive threats at AMD, to elevated supplier and customer credit risks at Super Micro. I recommend reading those three articles as well for a full picture of my skepticism on Semiconductors. If you have any feedback for me or would like to ask any questions, I’m active daily in the comments sections below my articles, and I’d love to learn from you.

Specifically, I believe two upcoming events on March 18 are driving investor sentiment in the sector to levels likely unsustainable in the longer term:

- Super Micro Computer Inc. (SMCI) will be added to the S&P 500 index at market open on March 18; and

- Nvidia will kick off its annual GTC Conference on March 18.

I believe that bullish expectations regarding these events are likely baked into both stocks. For example, on Wednesday, Bank of America analysts boosted their respective price targets on the companies ahead of Nvidia’s annual GTC event, which they named “AI Woodstock” – where were the signs.

With that backdrop in mind, let’s dig into TSMC’s long-term prospects.

Beyond the Short-Term: TSMC’s Bright Future

Despite the stretched valuation multiples, TSMC’s long-term value proposition remains compelling. The company is unmatched in its ability to produce chips at the smallest and most advanced nodes. This technological leadership has cemented its relationships with major tech players, ensuring a steady stream of orders even in times of unprecedented industry shifts.

Moreover, several secular trends bode well for TSMC’s future growth. The explosion of artificial intelligence requires increasingly sophisticated chips, pushing the boundaries of semiconductor design. TSMC is well-positioned to ride this long-term wave in the coming decades, having invested heavily in cutting-edge manufacturing processes. Additionally, the growing adoption of high-performance computing in cloud services and data centers represents another lucrative opportunity for TSMC.

Furthermore, the continued push for global semiconductor self-sufficiency will likely play into TSMC’s favor. Plans by the United States, Europe, and others to bolster domestic chip production could potentially lead to strategic partnerships with TSMC, expanding its geographic footprint and diversifying its revenue streams.

The company’s relentless technological pursuit, diverse client base, and expanding role in the global semiconductor landscape make it a compelling play for the future of technology.

Geopolitical Risks To TSMC Investors

An article on TSMC would not be complete without the many geopolitical risks that seem to linger in the back of the minds of market participants:

-

Heightened Taiwan-China Tensions: TSMC’s core operations are situated in Taiwan, making it inherently exposed to the escalating tensions between Taiwan and China. Any military escalation in the Taiwan Strait could lead to significant disruptions in TSMC’s manufacturing facilities, potentially halting production and causing catastrophic losses within the global tech supply chain. This geopolitical risk remains a key long-term concern for investors.

-

US-China Tech Rivalry: The intensifying technological competition between the US and China places TSMC in a precarious position. The US has implemented export controls designed to slow China’s progress in advanced semiconductor development. This could potentially restrict TSMC’s access to certain US technologies and equipment critical for maintaining its cutting-edge manufacturing capabilities. Navigating these restrictions and balancing relationships between the two superpowers is a delicate task for TSMC management.

-

Supply Chain Disruptions: Geopolitical events, such as the Russia-Ukraine war, have highlighted the fragility of global supply chains. Disruptions in the flow of raw materials or logistics could impact TSMC’s production processes. Additionally, sanctions placed on key countries involved in the chip-making supply chain could further complicate the situation.

-

Incentives for Geographic Diversification: Governments worldwide are incentivizing greater domestic semiconductor production to reduce reliance on a few concentrated manufacturing hubs. While TSMC is expanding its presence in the US and Japan, this push for diversification could eventually create new competitors as regions build up their own industries. This potentially lessens TSMC’s overall dominance in the long run.

Geopolitical risks are an inescapable reality for TSMC investors. I will monitor the ever-shifting political landscape and its potential effects on the company.

Valuation

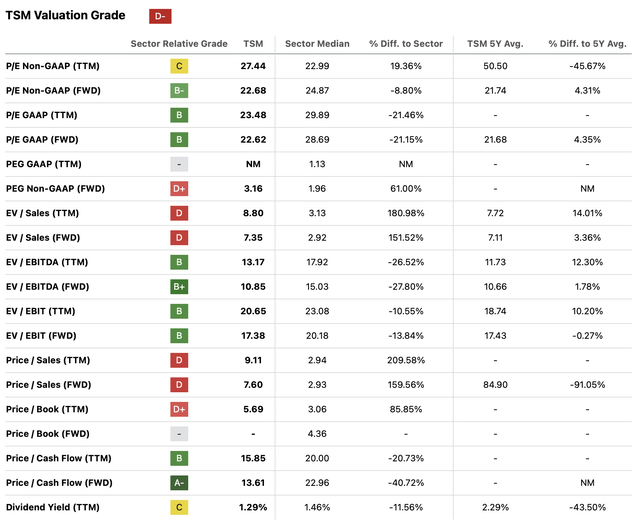

The following table illustrates an array of valuation multiples for the company:

Seeking Alpha Premium Tool

My two key takeaways from the above table are:

- Price-to-earnings ratios are at reasonable levels at the 22x to 27x range, both on a historical and on a forward-looking basis;

- Valuation multiples based on Sales appear to be high but are currently justified by the company’s industry-leading profit margins; and

- Price-to-cash flow multiples appear attractive, both on a historical and forward-looking basis.

Let’s bring it all together.

Conclusion

While recent stock price exuberance might seem out of sync with TSMC’s softening fundamentals, the company remains a technological force to be reckoned with. Its market leadership, manufacturing excellence, and positioning to benefit from long-term secular trends make it an attractive investment. However, investors should remain mindful of the inherent volatility in the semiconductor sector, fueled by both cyclical factors and evolving geopolitical events. The key is to look beyond the near-term hype, focusing on TSMC’s long-term prospects and assessing whether your risk tolerance and time horizon align with the stock’s potential ride. I rate the stock Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.