Summary:

- Taiwan Semiconductor Manufacturing is poised for a strong Q3 earnings release next week, driven by record demand for AI hardware.

- TSMC’s August revenue surged 33% Y/Y, indicating robust demand for AI chips. September revenues are set to be released shortly.

- TSMC’s market dominance (62% global foundry share) and attractive valuation (forward P/E ratio of 21.7X) make it a compelling AI investment.

- Risks include potential gross margin contraction, but the secular nature of AI hardware spending supports long-term growth prospects for TSMC.

shih-wei

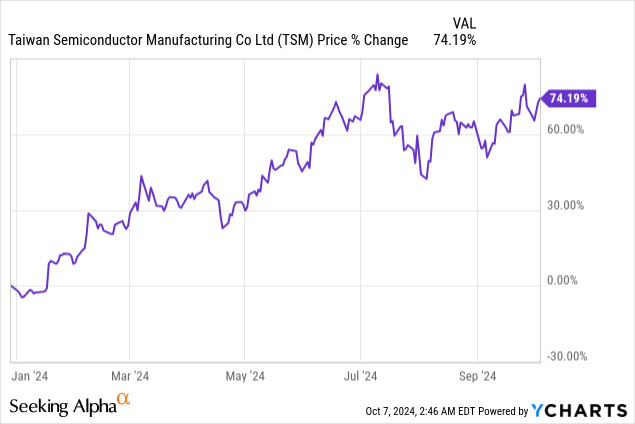

Enthusiasm about chip companies has moderated lately, but Taiwan Semiconductor Manufacturing (NYSE:TSM) (OTC:TSMWF) is set, in my opinion, for a very strong earnings release on October 17, 2024. The chip manufacturer likely saw record demand for chip production capacity in its third fiscal quarter and guided for a sequential gross margin increase. The earnings revision trend for Taiwan Semiconductor Manufacturing is also highly favorable, and the pre-release of revenue figures for August indicates that hardware companies are still scrambling to secure chip production orders. I believe TSMC is a very promising investment ahead of the Q3’24 report, and the company has a good chance of crushing estimates.

Previous rating

I rated shares of Taiwan Semiconductor Manufacturing a strong buy in July after the company submitted a strong earnings sheet with improving gross margins (which came in ahead of guidance) and massive growth in the high-performance computing (+28% Y/Y): A Stellar Bargain, Buy The Fear. TSMC’s pre-release of August revenues showed a strong order situation and fab utilization and September revenues, which will be released this week, could be a catalyst for an upside revaluation even before the company reported earnings next week.

Top line growth and CapEx up-trend support a TSMC investment

Taiwan Semiconductor Manufacturing is in a secular revenue up-trend that is driven by explosive demand for AI hardware solutions. Companies like Taiwan Semiconductor Manufacturing are strategically positioned in the AI hardware supply chain, as the company owns the market for semiconductor production.

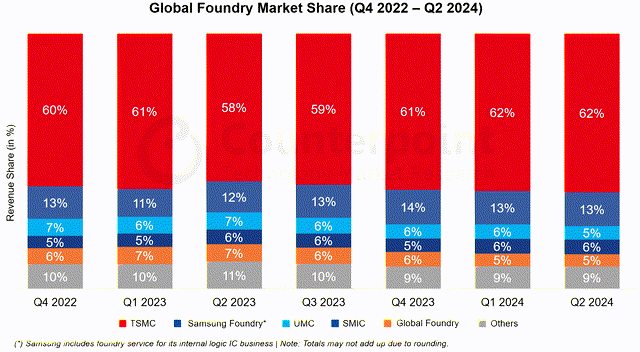

According to Counterpoint Research, Taiwan Semiconductor Manufacturing had a market share of 62% in the global foundry market in the second-quarter, which makes the company uniquely positioned to take advantage of the current spending boom on AI hardware infrastructure.

Counterpoint Research

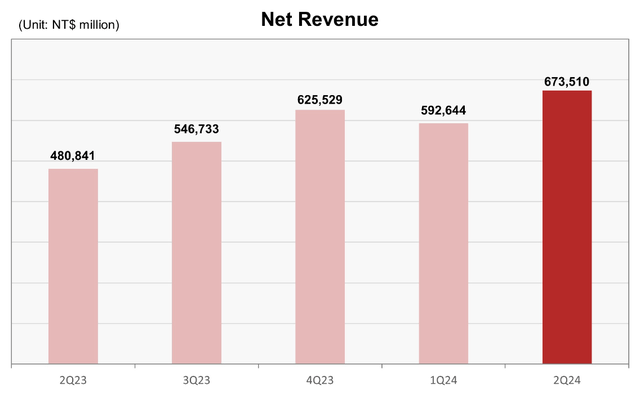

In the second-quarter, TSMC generated NT$673.5 in revenue ($20.8B), showing 40.1% year-over-year growth (in Taiwanese Dollar terms). According to TSM’s monthly revenue report, TSMC generated NT$250.9M in revenue in August, showing a growth rate of 33.0% Y/Y.

Taiwan Semiconductor Manufacturing

September revenue figures, which will be disclosed on October 9, 2024, are likely going to be great as well (I expect 30%+ Y/Y growth for September revenues) as we have a number of indications that demand for AI chips remained very robust throughout the second-quarter.

One reason is that Micron Technology (MU) reported soaring demand for its highest-capacity, high-bandwidth solution HBM3E in the last quarter which is needed in Data Centers to support AI applications: A 9X FWD P/E Is Unacceptable.

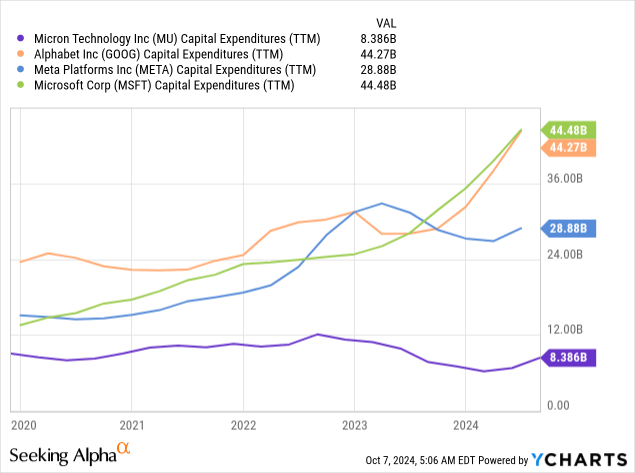

Since strong demand for HMB3E memory products indicates an equally strong demand for Data Center-oriented GPUs, which TSMC produces for companies like NVIDIA (NVDA), chances are that TSMC is headed for a very strong earnings report next week. Micron’s surging CapEx also indicates that it does not expect this momentum to slow: in Q4’24, Micron spent $8.1B in CapEx and has guided for a ~35% revenue-to-CapEx share in FY 2025. I expect Micron to spend $12-13B in CapEx in FY 2025, which would mark a 50% increase in spending, which is due to persistent AI Data Center spend.

Large tech companies at the forefront of the AI revolution have all ramped up their CapEx spending lately, which is a trend I expect to continue in the long term.

There is another trend in the AI chip market that could propel TSMC to record revenues and gross margins in the quarters ahead: more companies are turning directly to fabs to produce their own AI chips and thereby try to circumvent companies like Nvidia which can charge nose-bleed prices for their next-gen AI chips.

TikTok owner ByteDance, as an example, recently turned to TSMC to make its own AI chips. With prices for the latest Nvidia’s AI GPUs being above $30k per-unit, there is an incentive for companies to develop their own chips which could benefit TSMC in the long term (incremental revenues, higher gross margins from custom chip production) and help diversify its customer base.

Favorable estimate trend

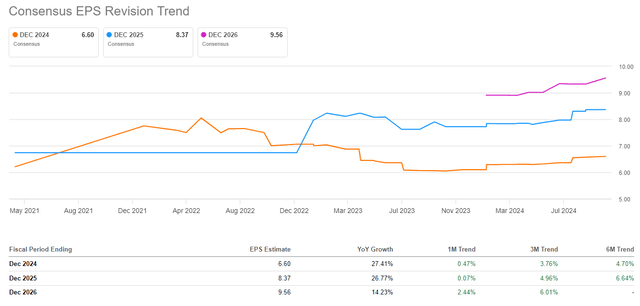

In the last ninety days, EPS estimates for Taiwan Semiconductor Company have increased, indicating that analysts widely expect a strong earnings release: during this time period, analysts have up-graded their FY 2025 EPS estimates to the upside 8 times and to the downside 0 times. Quarterly estimates for Q1’25 went up 4 times compared to 1 EPS downside revision. In general, the EPS trend — both for the last quarter as well as for the current fiscal year — is favorable.

Seeking Alpha

TSMC’s valuation

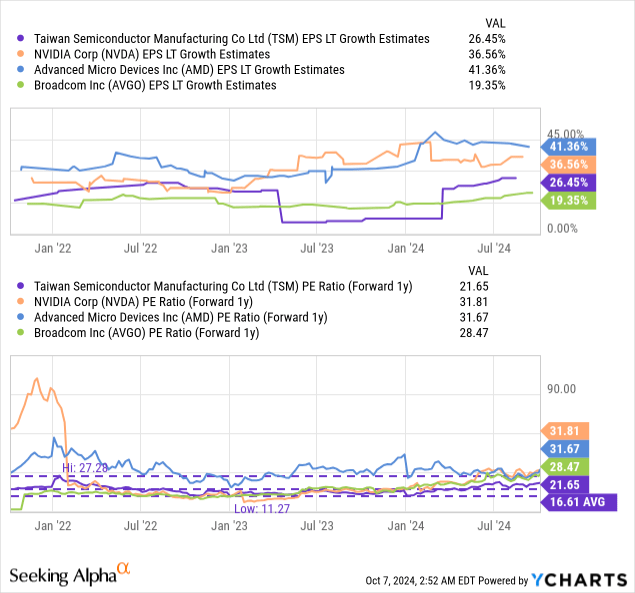

Taiwan Semiconductor Manufacturing is currently trading at a price-to-earnings ratio — based off of FY 2025 earnings — of 21.7X which makes TSMC one of the most attractively priced chip companies to invest in for investors that seek exposure to the spending boom in artificial intelligence solutions.

Nvidia, AMD (AMD), Broadcom (AVGO) are other AI plays that have had very strong runs lately, but TSMC, due to historically cyclical gross margin picture, has trailed behind. When investors realize that AI-related hardware spending is not cyclical, but rather secular in nature, I believe that there is a strong revaluation case to be made for Taiwan Semiconductor Manufacturing in the long term.

In my last work on TSMC I suggested a fair value P/E ratio of 26X for TSMC given its long-term growth record and strong gross margin picture: the chipmaker projected a gross profit margin between 53.5% and 55.5% for Q3’24, implying a 1.3 PP gross margin expansion Q/Q, based off of the mid-point.

TSMC is also expected to grow its long term EPS at a decent 26% annually, which the company owes to the red-hot demand situation for AI-optimized chips. A 26.0X P/E ratio translates to a fair value estimate of $218 per-share, showing an increase of $3 compared to my last estimate (which is owed to rising consensus estimates). Relative to other chipmakers/hardware companies like Nvidia, AMD and Broadband, shares of TSMC would still be undervalued if shares repriced to 26X forward earnings.

Risks with TSMC

The biggest risk for TSMC, as with all semiconductor companies, lies in a potential contraction of gross margins. Weaker fab utilization could translate to deteriorating pricing strength and a weaker gross margin profile. Since I assume that AI hardware spending will be secular, a cyclical contraction to gross margins would be a major red flag. What would change my mind on TSMC, therefore, would be if the company issued a weak margin outlook or failed to grow its top line in double-digits.

Final thoughts

Micron’s earnings report for the last quarter indicated surging demand for high-bandwidth memory which is used in Data Centers handling AI workloads… which is a strong indication that demand for TSMC’s chip remained red-hot as well. TSMC’s August revenues surged 33% year-over-year. The chipmaker also continues to dominate the fab market, is seeing direct approaches by large tech companies to manufacture chips individually and the EPS trend is favorable. All of this leads me to believe that TSMC could massively out-perform EPS expectations on October 17, 2024. The fact that TSMC could also directly manufacture custom chips for large tech companies (like ByteDance) is something that could accelerate the firm’s revenue growth, lead to higher gross margins, and diversify its customer portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, NVDA, AMD, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.