Summary:

- TSMC’s dominant market position, strategic alliances with Apple and Nvidia, and cutting-edge technologies make its current valuation too cheap to ignore despite geopolitical risks.

- TSMC’s Q3 2024 financials show strong revenue growth, high gross margins, and robust demand for its advanced semiconductor technologies, particularly in AI and smartphones.

- The company’s solid financial health, strategic CapEx investments, and bullish Q4 2024 guidance underscore its resilience and potential for continued growth.

- Despite geopolitical and client concentration risks, TSMC’s competitive advantage and undervaluation make it a compelling “Buy” with a projected 27% upside.

photoman

My Thesis

I think the moat Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) has, its market position and AI tailwinds all around it make the current valuation too cheap to ignore, even if we take geopolitical and cyclicality risks into account.

My Reasoning

I think it’s clear that TSMC has a very large competitive moat in the semiconductor space being the world’s largest contract chip manufacturer and occupying approximately 56.4% of the semiconductor foundry market and is thus in control of the segment. Its capacity to manufacture more than 90% of the world’s most powerful semiconductors makes it a crucial alliance partner for high-end computing and AI technologies. TSMC’s strategic alliances with such clients as Apple (AAPL) and Nvidia (NVDA) further entrench the company in its market position. As of note, according to wccftech.com’s data, in 2023 Nvidia paid TSMC $7.73 billion – that’s effectively over 35% of NVDA’s total COGS amount and so the largest GPU maker is now the second-largest TSM client in terms of sales (~11%) after Apple (~25%).

With Taiwan manufacturing over 60% of the world’s semis, and TSMC providing the bulk of the supply, Taiwan also dominates the world’s supply chain, according to The Economist data. So TSMC’s technology advantage and moat – with its near-monopoly in the 5nm chip market and its moves towards smaller nodes – ensures its dominance and lead in the semiconductor market.

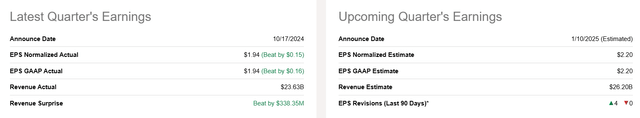

The latest financial and operational data – Q3 FY2024 released in mid-October – speak the loudest about TSM’s market dominance. The company reported a healthy profit in Q3 2024 as demand for its high-performance semiconductors, especially in the smartphone and AI markets, continued to rise. Its industry-leading 3-nanometer and 5-nanometer technologies enabled the company to achieve 12.8% sequential revenue growth in New Taiwan dollars. This expansion reflected a 36% YoY increase to $23.5 billion, which was significantly higher than management’s guidance and consensus estimates for the quarter.

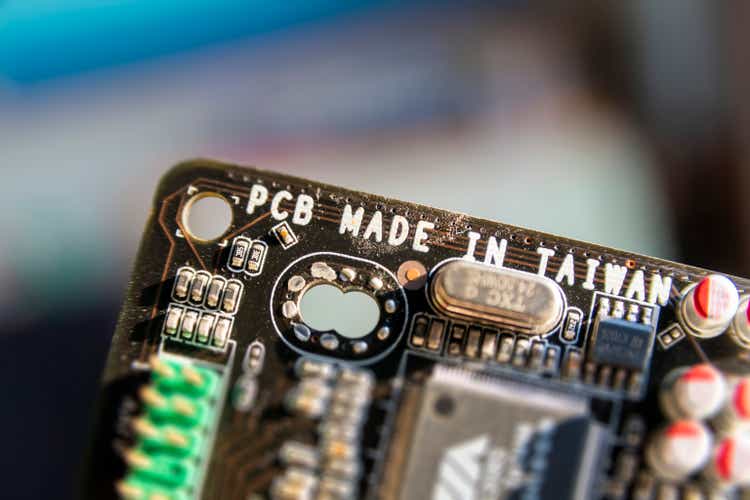

TSM’s gross margin jumped strongly, growing 4.6% over time to 57.8% due to “enhanced capacity utilization and cost reductions.” We also could see an increase in EBIT margin, which reached 47.5% (a 5% improvement over the previous period). So the marginality levels stabilise quite rapidly on a TTM basis:

TSMC’s higher-performance technologies (7-nanometer and below) represented ~69% of wafer revenue and the 3-nanometer process represented ~20% of wafer revenue during Q3. I think the increasing growth in this segment speaks to the technology leadership of TSMC. The 5-nanometer and 7-nanometer processes were also huge contributors -respectively 32% and 17% of wafer revenue. This company’s ability to increase the volume of production of these advanced nodes has been essential to keeping up with the exponential growth in use cases like AI and smartphones where computation is required to scale and deliver high performance.

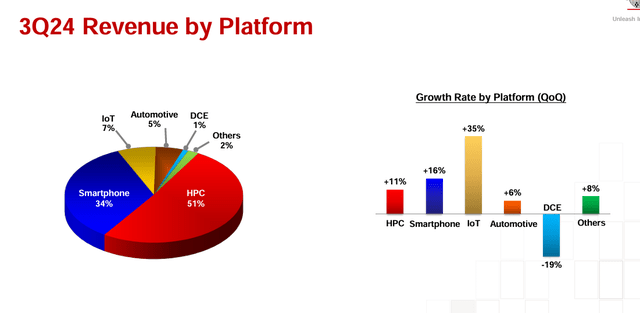

High-performance computing (HPC) was the leading contributor in terms of platform revenue, with 51% of total revenue and rising 11% QoQ, reflecting the growing data center demand that is being driven by the widespread adoption of generative AI tools. The smartphone business likewise performed very well, growing 16% sequentially to reach 34% of revenue in Q3. This demonstrates the seasonal strength of smartphone demand and the increasing sophistication of smartphone chips, which need higher-level semiconductor technologies. Both the IoT and automobile industries, while smaller, were gaining in growth as well, with IOT revenues up 35% and automotive revenue up 6% each on a YoY basis.

TSMC’s IR presentation for Q3 2024

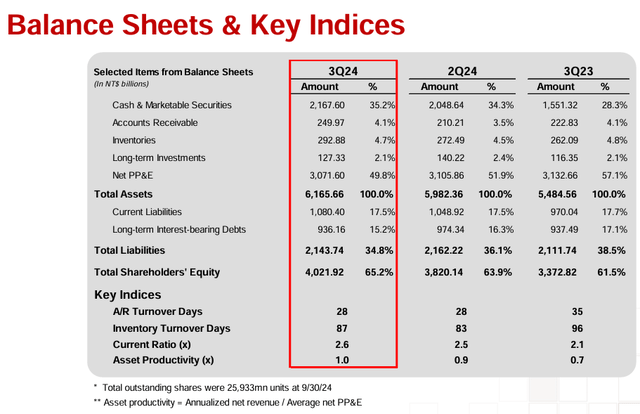

The firm’s balance sheet remained healthy, with cash and marketable securities totaling ~$69 billion at the end of Q3. The company has solid debt control, having lowered long-term debt by 1.6% QoQ, even as it had grown its current liabilities. This financial viability is further bolstered by an average account receivable turnover of 28 days and inventory days of 87, resulting from the pre-build of N3 and N5 wafers.

TSMC’s IR presentation for Q3 2024

TSMC’s operating cash flows were also quite strong, accounting for ~$12.3 billion (Seeking Alpha data), allowing the company to fund capital expenditures and dividend payments while increasing its cash reserve. TSMC’s CapEx in 2024 should be ranging just over $30 billion with much of that – around 70% to 80% – being dedicated to cutting-edge process technologies (another indication of TSMC’s insistence on staying ahead of the game, in my view). The rest of the budget is split between niche technologies and sophisticated packaging, testing, and mask manufacture, according to the management’s commentary. This strategic move should be essential to help sustain the predicted growth in AI demand and TSMC’s ability to accommodate the next wave of market demands.

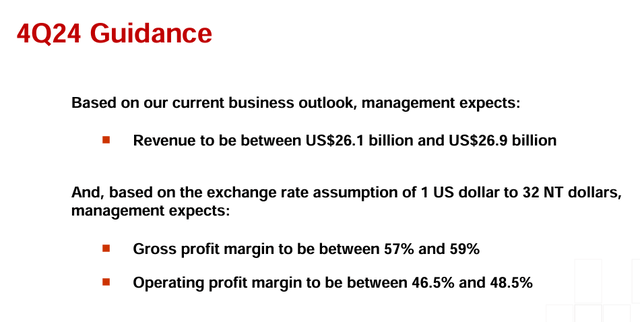

Looking ahead, TSMC’s management team released quite bullish guidance for Q4 2024: $26.1 billion to $26.9 billion in total revenue, which is an increase of 13% QoQ and 35% YoY at mid-point. So Wall Street analysts had to adjust their expectations to the upside.

TSMC’s IR presentation for Q3 2024

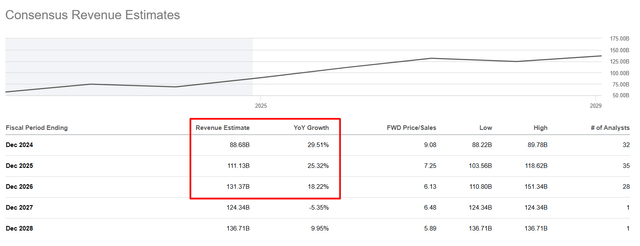

TSMC’s management expects the demand for the firm’s state-of-the-art process technologies to remain robust, particularly in AI-related use cases. For FY2024 and beyond, TSMC’s revenue is projected to increase by almost 30% in US dollars, as it “continues to benefit from continued growth in AI and high-performance computing sectors.” The Street agrees with this view and projects a continuation of the business’ strength for the next 3 years at least:

Seeking Alpha, TSM, Oakoff’s notes

Based on recent operating data and news, demand for certain types of TSM products is growing significantly faster than what the company can currently produce, so I think the current analyst forecasts are still quite pessimistic as they do not contain any premium to the old management forecasts.

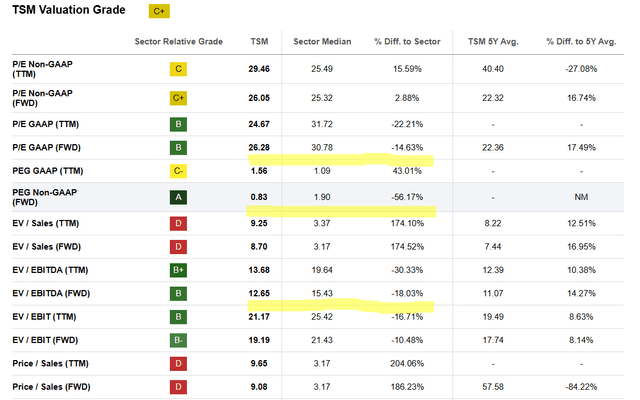

At the same time, the lack of a positive reaction after the third quarter (TSM stock is down 2% since October 16, 2024) makes the stock quite cheap against the backdrop of even a modest increase in Q4 earnings estimates. If we look at the FWD P/E ratio and also take a look at the FWD PEG, which weights the P/E ratio with the projected EPS growth rate, we’ll see a very strong undervaluation (relative to the entire sector and the traditionally accepted 1x in general):

Seeking Alpha, TSM’s Valuation, Oakoff’s notes

According to Morningstar Premium’s model (proprietary source), TSM stock is undervalued by ~17% at the current price. That may not look like much, but you’ll rarely find an undervalued semiconductor stock among large caps today, and you’re unlikely to find an undervalued stock among companies with a similarly wide moat.

Morningstar, TSM [proprietary source]![Morningstar, TSM [proprietary source]](https://static.seekingalpha.com/uploads/2024/11/27/53838465-17327072364785063.png)

I think TSM should be fairly valued at 25x earnings by the end of FY2025, which is just slightly lower compared to the multiple it trades at today. Assuming the upward earnings revisions keep going and that TSMC beats the final consensus for FY2025 by 1-2%, the implied fair price would arrive at ~$233.36/sh, based on my calculations. So the upside from today’s stock price is almost 27% if my math isn’t mistaken.

Based on all that, I rate TSM as “Buy” as I believe it’s one of the best undervalued AI plays among large-cap wide-moat semiconductor firms right away.

Risks To My Thesis

I may be underestimating the geopolitical risks that might affect the business and the value of TSMC. There is no question of TSMC’s market share and technology dominance, but the fact that the company is tied to Taiwan as a manufacturing base makes it vulnerable to geopolitical pressures, especially between China and Taiwan. Any spike in these tensions could potentially break TSMC’s supply chain or prompt more regulatory scrutiny, which would compromise its capacity to serve global demand. So the other may be a discount in TSMC’s valuation – which I believe is there even today – and it’s far from certain that that discount will get lower any time soon.

Also, though TSMC’s alliances with large clients such as Apple and Nvidia are strengths, they also pose a concentration risk. TSMC revenue could suffer if these clients expanded their supply chains or experienced market pressures of their own. And so, even though I find TSMC’s price attractive, these geopolitical and client concentration risks could present significant challenges that might not be fully included in my valuation right now.

Moreover, I might be overestimating the longevity of the AI-fuelled demand explosion. While AI and high-performance computing continue to provide TSMC with significant growth, the semiconductor business is by nature seasonal and demand depends on the overall economy. The current AI boom might lead to overcapacity if demand stabilizes or slows, causing TSMC to lose margins and profitability. Moreover, the high rate of technological change means that TSMC is forced to continually devote massive R&D and capital resources to keep up with the competition. This can clog financial resources if the promised returns from these investments aren’t forthcoming.

Your Takeaway

Even with geopolitical and cyclical risk, I believe the strong financial results and healthy balance sheet of TSMC support its resilience and prospects for continued growth. I believe that TSMC has a huge competitive advantage being the largest contract chipmaker in the world with about 56.4% of the foundry market. Its deep collaborations with major customers such as Apple and Nvidia, combined with the ability to build >90% of the world’s most powerful semiconductors make TSMC a leading innovator in high-performance computing and AI. Its cutting-edge 3N and 5N technologies have given significant increases in revenues as it is at the forefront of technology. I think the valuation right now is too cheap to overlook with the share trading less than 1x next year’s PEG ratio – it should be far higher given the norms in the industry today, not to mention TSMC’s market position and tailwinds from AI demand. According to my calculation, TSM stock is undervalued by ~27%.

All this makes TSM stock a great attractive investment opportunity, in my opinion, so I give it a “Buy” rating today.

Good luck with your investments!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.