Summary:

- Taiwan Semiconductor boasts a massive competitive moat due to its leadership in advanced chip manufacturing, strong customer relationships, and scale-driven R&D efficiency, making it a critical player in artificial intelligence.

- Despite its dominance, TSMC faces risks from potential overcapacity, geopolitical tensions, and competition from Samsung and Intel, which motivated Warren Buffett’s decision to sell his stake in the company.

- TSM’s fortress balance sheet and sustainability practices further solidify its position, even as it faces competition from competitors such as Samsung and Intel.

- Despite its dominance, TSMC faces risks from potential overcapacity and geopolitical tensions, which motivated Warren Buffett’s decision to sell Berkshire Hathaway’s stake in the company.

BING-JHEN HONG

If you gave me $100 billion and said, ‘Take away Coca-Cola’s leadership in the global soft drink market,’ I’d give it back and say it cannot be done. – Warren Buffett

We often talk about competitive moats and some of the financial indicators that reflect when a company possesses strong competitive advantages. These include abnormally high profit margins and returns on invested capital, market share gains, and high levels of efficiency and innovation. Perhaps a simpler test is the one proposed by Berkshire Hathaway’s (BRK.A)(BRK.B) CEO Warren Buffet, and asks if you could displace a company from its leadership position with enough money. He famously said that if someone gave him a hundred billion dollars to displace The Coca-Cola (KO) company as the global soft drinks leader, he would give the money back because he does not think it could be done.

Even though competitors like PepsiCo (PEP) spent billions on marketing, as far as we know nobody has really tried to significantly outspend The Coca-Cola company to the degree Buffett referenced. However, the Chinese state is spending about a hundred billion dollars trying to dominate chip manufacturing, without making much of a dent to Taiwan Semiconductor’s (NYSE:TSM)(OTC:TSMWF) competitive moat so far. Their “Big Fund” semiconductor investing initiative was started in 2014, with approximately $19.5 billion dollars, then in 2019 they added another roughly $28.7 billion dollars, and recently they announced that $47.5 billion dollars would be budgeted for “Big Fund III”. This brings the total to $95.7 billion dollars in investments for their local semiconductor sector from the public sector.

Still, even TikTok owner ByteDance (BDNCE), arguably one of China’s most successful technology companies, is planning on manufacturing its own AI chips with the help of TSM. Another technology company that will have Taiwan Semiconductor manufacture their custom AI chips is Tesla (TSLA) with their D1 chip.

Massive Competitive Moat

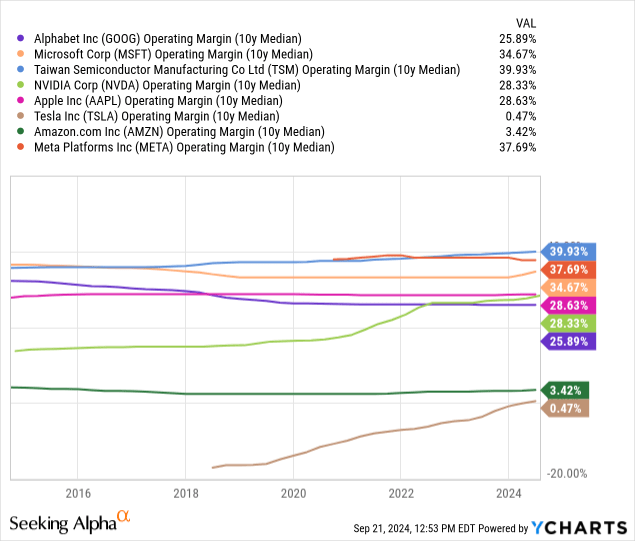

Taiwan Semiconductor has one of the strongest competitive moats we have ever seen in a company. Quantitatively, this is reflected in its 10-year median operating margin, which exceeds that of all “Magnificent Seven” companies, even if recently NVIDIA (NVDA) and Microsoft (MSFT) have delivered higher operating margins in recent quarters, but it remains to be seen if they can sustain them for a long period of time like TSM has been able to do. In fact, TSM’s competitive moat is so strong that some have suggested it not only protects its profitability, but Taiwan itself. Some refer to Taiwan Semiconductor as Taiwan’s “Silicon Shield”, protecting it from a potential invasion. According to the Unites States Institue for Peace, roughly 90 percent of the world’s most advanced computer chips are made in Taiwan, mostly by Taiwan Semiconductor, and even China has a strong incentive to avoid disrupting the global technology supply chain.

We don’t think any one factor is responsible for such a strong moat, but rather a combination of them, or what the late Charlie Munger would describe as the “Lollapalooza effect”, which is when several factors team up to create a huge impact. In Taiwan Semiconductor’s case we find, for example, scale advantages which allow the company to spend more on R&D in absolute terms, but less as a percentage of revenue. The company also leads in technology, being the leader in advanced node chip production, and has a culture of manufacturing excellence. Taiwan Semiconductor also benefits from enormous customer goodwill, as it focuses only on chip manufacturing, taking away the risk that the company might use customer IP to compete with them. In fact, it does the opposite, creating an ecosystem where IP is shared, including that of chip design tool developers such as Cadence Systems (CDNS) and Synopsis (SNPS). Finally, Taiwan Semiconductor has an advantage when buying and fine-tuning chip making tools. As the largest customer for many of these companies, it can negotiate better prices, and because it produces such massive volumes it has gotten extremely good at fine-tuning them. For example, ASML (ASML) makes key lithography equipment and, at times, TSM has represented almost half of ASML’s revenue. These are complex machines where optimizing for high throughput and yield takes time and effort. This means TSM has significant trade secrets over how to fine-tune these expensive machines, as well as other advanced equipment from the likes of KLA Corporation (KLAC), Tokyo Electron (OTCPK:TOELY), Applied Materials (AMAT), Lam Research (LRCX), and other suppliers of advanced chip manufacturing and inspection equipment.

Buffett’s Selling Mistake

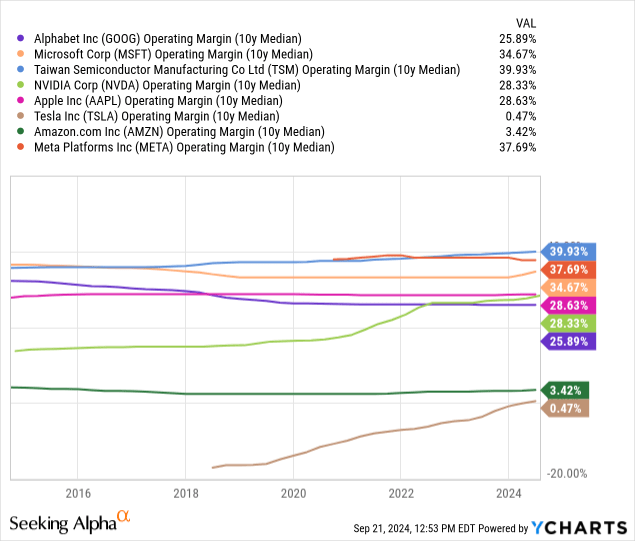

We have been optimistic about Taiwan Semiconductor’s prospects for some time, and felt validated when Buffett decided to invest billions in TSM shares. This appeared like a your classic Buffett investment in a company strengthening its competitive moat, taking market share, growing revenue and profit rapidly, and at a very attractive valuation. Unfortunately for Berkshire Hathaway shareholders he then got nervous about the geopolitical risks and quickly sold the investment. Still, when asked about it at the annual Berkshire Hathaway shareholders’ meeting he admitted that Taiwan Semiconductor is one of the world’s most important companies, and likely will remain so for the foreseeable future. He added that he had a problem with the “location”. This meant that the company left billions of dollars in potential profits on the table, with shares outperforming the S&P 500 Index (SPY) by roughly threefold since then.

“Taiwan Semiconductor is one of the best managed and most important companies in the world, and you’ll be able to say the same thing five, 10, or 20 years from now,” Buffett said. “I don’t like its location.”

Seeking Alpha

Second Quarter Results

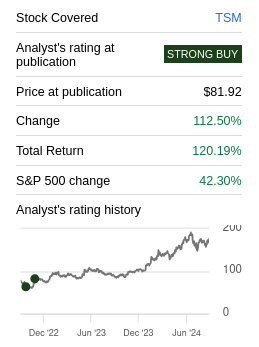

Taiwan Semiconductor’s second quarter shows to what degree the company is benefiting from growth in AI applications. While several end-markets showed disappointing growth, including smartphones with -1% year-over-year growth, high-performance computing more than made for it with +28% growth. High-performance computing is a proxy for AI and data center chips, and during the second quarter of FY2024 it represented more than half of revenue for Taiwan Semiconductor at 52%.

If an investor has any doubts that Taiwan Semiconductor is no ordinary company, all she has to do is take a quick look at the income statement. The number of companies with an operating margin in the 40’s, and net profit margin (after taxes) in the 30’s, and with revenues in the billions of dollars, is limited to a handful of companies. The return on equity is also quite impressive at ~26%, despite how capital intensive chip manufacturing can be.

TSMC Investor Presentation

Fortress Balance Sheet

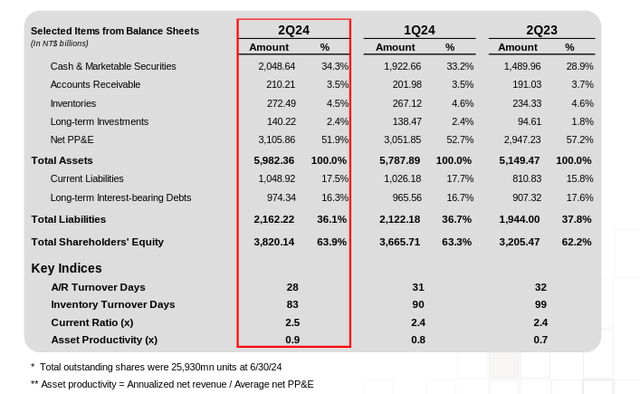

In large parts thanks to the high profitability and free cash flow generation, Taiwan Semiconductor has been able to maintain a fortress balance sheet while investing tens of billions in new manufacturing capacity around the world. In fact, the company has more than twice the amount of long-term interest-bearing debt in cash and short-term investments.

TSMC Investor Presentation

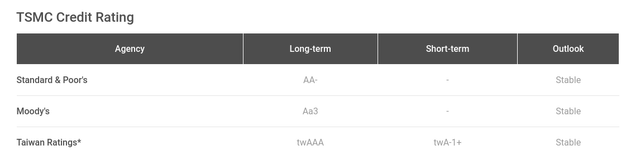

Unsurprisingly, Taiwan Semiconductor benefits from very strong investment grade credit ratings, by both S&P Global (SPGI) and Moody’s (MCO).

TSMC Investor Presentation

Competitors

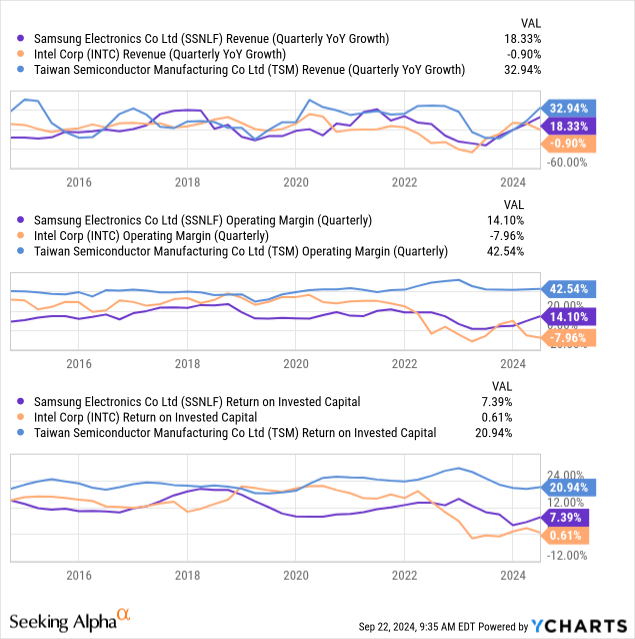

While Taiwan Semiconductor appears to be operating in a league of its own, it still has a few competitors left that remain committed to pursuing leading-edge chip manufacturing. The closest peer is probably Samsung Electronics (OTCPK:SSNLF), followed by Intel (INTC). Still, it is clear that Taiwan Semiconductor is gaining market share, as its revenue growth has been significantly higher compared to these two competitors.

Taiwan Semiconductor has been gaining share directly as a foundry, and indirectly as some of its customers have gained market share. These include customers like AMD (AMD) and NVIDIA that have been taking market share from Intel. A good example being the lost contract by Intel to manufacture chips for the PlayStation 6 to AMD, and manufactured by Taiwan Semiconductor.

Sustainability

Taiwan Semiconductor’s impressive operations extend to its sustainability practices. The company has been part of the Dow Jones Sustainability Indices for more than two decades and has low sustainability risk according to Morningstar’s (MORN) Sustainalytics. The company is also a member of the FTSE4Good Emerging Index/All-World Index and was awarded the ISS ESG’s “Prime” status.

Valuation

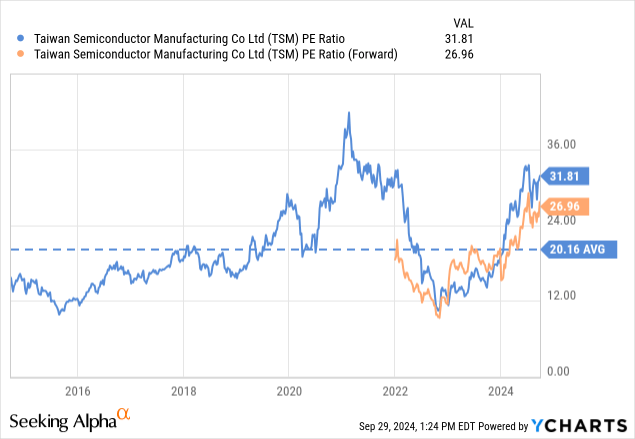

We have mixed feelings with respect to Taiwan Semiconductor’s valuation. On the one hand it is currently clearly above its historical average. On the other hand, the company has clearly widened its competitive advantage and growth from artificial intelligence chip demand is providing a strong tailwind that could last for several years.

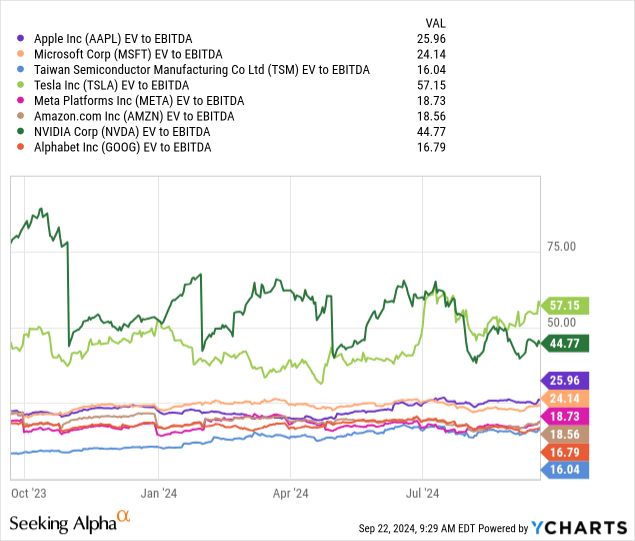

Still, if we compare the company on an EV/EBITDA basis to the “Magnificent Seven”, Taiwan Semiconductor is the one with the lowest valuation multiple. This is one of the reasons why it is out preferred way to gain exposure to growth from AI.

Based on our estimated future earnings we calculate a net present value of $183 per share, which is very close to where the company is currently trading. We therefore see Taiwan Semiconductor as fairly valued at the moment. We use a 10% discount rate as it is the minimum return we aim for when investing in stocks, and for the terminal growth rate we believe something around 3.5% to be appropriate, as we believe the semiconductor industry will continue outpacing global GDP for a long time. For comparison, our fair value estimate for NVIDIA, arguably the Magnificent Seven company with the most exposure to AI growth, is about $78, which would imply an overvaluation of more than 50%. We have to lower the discount rate to 5% to get close to NVIDIA’s current share price.

| EPS | Discounted @ 10% | |

| FY 24E | $6.60 | $6.00 |

| FY 25E | $8.36 | $6.91 |

| FY 26E | $9.40 | $7.06 |

| FY 27E | $10.53 | $7.19 |

| FY 28E | $11.79 | $7.32 |

| FY 29E | $13.21 | $7.45 |

| FY 30E | $14.79 | $7.59 |

| FY 31E | $16.57 | $7.73 |

| FY 32E | $18.55 | $7.87 |

| FY 33E | $20.78 | $8.01 |

| FY 34E | $23.27 | $8.16 |

| Terminal Value @ 3.5% terminal growth | $319.70 | 101.87 |

| NPV | $183.16 |

Risks

There are many risks that should be taken in consideration when evaluating Taiwan Semiconductor. These include the risk that competitors like Samsung and Intel, or some of the Chinese fabs, might catch up with the company in terms of leading-edge chip manufacturing. There is also customer concentration risk, with Apple believed to represent a very significant percentage of Taiwan Semiconductor’s revenue.

Then there is the geopolitical risk that motivated Buffett to sell shortly after investing in the company. This is a difficult to quantify risk, but it would certainly impact other companies that operate with a fab-less business model and depend on Taiwan Semiconductor for the production of their chips, such as AMD and NVIDIA.

Finally, we see some overcapacity risk in the coming years as countries around the world, from the U.S. to Germany and Japan have incentivized new local chip fabs to reduce external dependency. While this can be good for the national security of countries, it also risks causing manufacturing overcapacity. Taiwan Semiconductor has also agreed to build new fabs in Germany, Japan and Arizona, even though it is believed that operating costs will be significantly higher at these locations.

Conclusion

Taiwan Semiconductor continues to deliver impressive financial results, both in terms of revenue growth and profits. A main driver in recent quarters has been the growth in artificial intelligence chip demand, with customers such as AMD and NVIDIA rapidly growing their high-performance computing revenues. Despite its impressive performance, Taiwan Semiconductor is trading at a lower EV/EBITDA multiple compared to the “Magnificent Seven”. This is one of the main reasons that it is our preferred way to gain exposure to AI growth, even if the company is currently trading above its own historical valuation multiples. We currently see Taiwan Semiconductor as fairly valued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.