Summary:

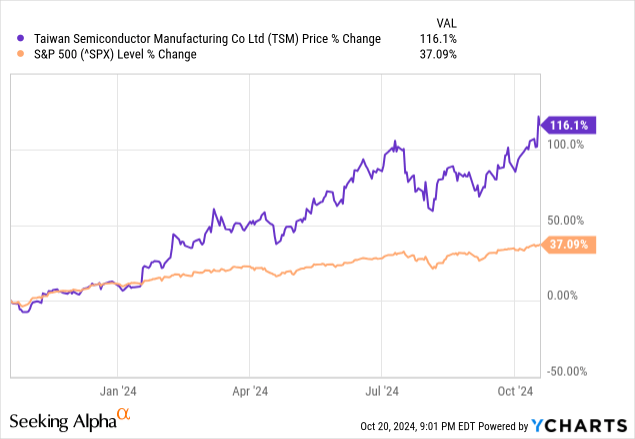

- TSMC’s stock has surged 105.15% since my strong buy recommendation in November 2023, driven by a rebound in smartphones and PCs and a positive semiconductor cycle.

- The company’s Foundry 2.0 expansion includes packaging, testing, and mask-making, broadening its market opportunities and potentially mitigating antitrust concerns.

- TSMC’s robust AI demand and advanced process technologies are expected to drive near-30% annual revenue growth over the next four years.

- Despite higher valuation, TSMC remains a strong buy due to its growth prospects in AI infrastructure, smartphones, and IoT markets.

JHVEPhoto

I last discussed Taiwan Semiconductor Manufacturing (NYSE:TSM), also known as TSMC, on November 28, 2023, giving it a strong buy. My reason for making that recommendation at the time was a belief that its largest end markets would bounce back amid a global economic rebound, and the semiconductor cycle would turn up. Additionally, in late 2023, I believed the market undervalued the company’s growth prospects in 2024 and 2025. That assessment turned out to be valid. The stock doubled, up 105.15% since my recommendation compared to the S&P 500’s (SPX) 29.02% rise as of the market’s October 18, 2024 close.

TSMC management forecasts the upcycle to continue, with a near-30% annual increase in revenue over the next four years, driven by robust Artificial Intelligence demand. Chief Executive Officer (“CEO”) C. C. Wei said on the third quarter fiscal year (“FY”) 2024 earnings call:

At TSMC, we define server AI processor as GPUs, AI accelerators, and CPUs performing training and inference functions, and do not include networking, edge, or on-device AI. We now forecast the revenue contribution from server AI processors to more than triple this year and account for mid-teens percentage of our total revenue in 2024. Supported by our technology leadership and broader customer base, we are well-positioned to capture the industry’s growth opportunities.

Although the valuation is not as good as a year or two ago, it is still reasonable, considering the company’s excellent prospects over the next several years. This article will discuss how TSMC has redefined the foundry industry. It will also review the company’s third-quarter fiscal year (“FY”) 2024 fundamentals and examine a few risks, its valuation, and why the stock remains a strong buy.

Redefining the foundry industry

The original definition of the foundry industry was contract manufacturing of integrated circuits (ICs) based on designs provided by other companies. In the company’s second quarter FY 2024 earnings call, CEO Wei defined Foundry 2.0 as follows: “At this time, we would like to expand our original definition of foundry industry to Foundry 2.0, which also includes packaging, testing, mask making, and others and all IDM (Integrated Device Manufacturer), excluding memory manufacturing.” His commentary means that the company is expanding from simply manufacturing chips to offering additional services such as enclosing the semiconductor die in a container to protect it from damage (packaging), ensuring the final product lives up to specifications (testing), and creating templates for chip design (mask making).

CEO Wei explained the reasons the company expanded its services in additional commentary on the same earnings call (emphasis added):

We believe this new definition [Foundry 2.0] better reflects TSMC’s expanding addressable market opportunities in the future. However, I want to emphasize here that TSMC will only focus on the most advanced backend technologies which help our customers in leading-edge products. Under this new definition, the size of the foundry industry was close to $250 billion in 2023, as compared to $115 billion under the previous definition. With our new definition, we forecast the foundry industry growth to be close to 10% year-over-year in 2024. TSMC’s share of the foundry industry, under our new definition, was 28% in 2023, supported by our strong technology leadership and broader customer base, we expect this one to further increase in 2024.

In other words, under Foundry 2.0, TSMC expands its total addressable market, widening its opportunities in a faster-growing market. A side effect of Foundry 2.0 is that it may defuse antitrust concerns. According to TrendForce, under Foundry 1.0, TSMC had a market share of 61.2%. As the above quote states, under the new definition of Foundry 2.0, its market share was 28% in 2023. The decline in market share is because services such as packaging, testing, and mask-making are large marketplaces in which TSMC has a much lower market share. As a Foundry 2.0 company, it will compete more directly with IDM companies like Intel (INTC) and Samsung.

Company fundamentals

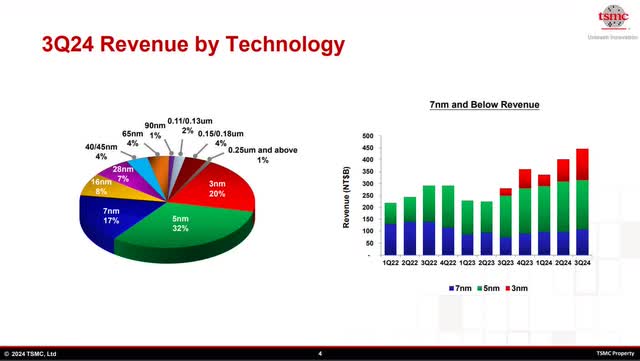

The following pie chart shows that 52% of TSMC’s revenue comes from 3nm (nanometers) and 5nm process nodes, primarily chips that go into AI servers and HPC (High-Performance Computing) applications. The AI infrastructure build-out in the cloud and the enterprise are the primary drivers of TSMC’s revenue growth. The 7nm process node is 17% of the revenue; customers have used these 7nm chips since 2020 for 5G and HPC products. In 2021, they expanded to consumer and automotive electronics products. Some automotive and industrial applications rely on larger process nodes in the 12, 16, and 28 nm technologies. Last, some applications that don’t require the most powerful chips still use 40nm and above process technologies.

TSMC Third Quarter FY 2024 Earnings Presentation.

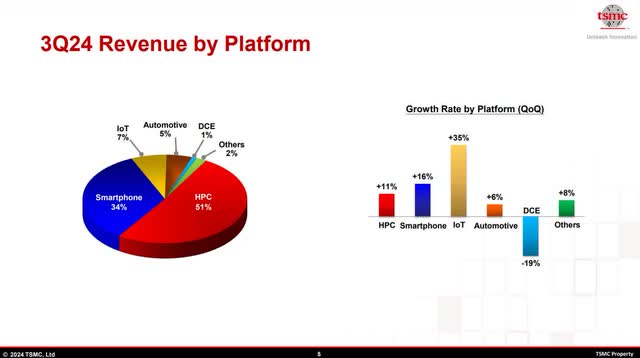

The following chart shows the end markets for TSMC’s chips. HPC has various purposes, from analyzing and computing large datasets such as DNA sequencing and automating stock trading to performing image and speech recognition. AI is also a use case within HPC that comprises a mid-teen percent of TSMC’s total revenue. Smartphones are the second highest use-case for TSMC’s chips, so the revival of the smartphone market boosts the company’s revenue. The IoT (Internet of Things) and auto market collectively comprise 12% of TSMC’s revenue. DCE stands for Digital Consumer Electronics, which are devices such as digital TVs, set-top boxes, and cameras.

TSMC Third Quarter FY 2024 Earnings Presentation.

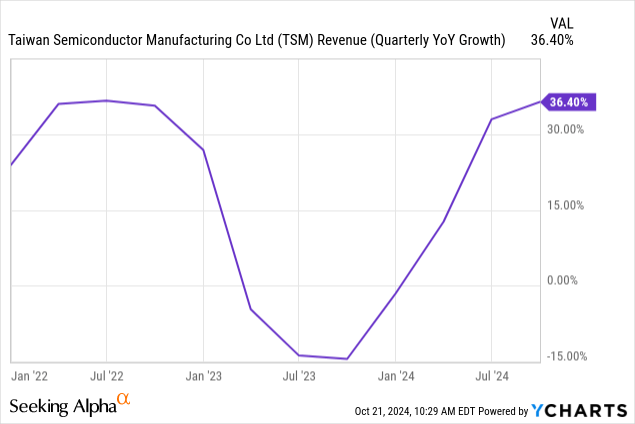

The following chart shows year-over-year revenue growth in negative territory throughout much of 2023, as the chip industry was in a cyclical decline. Revenue growth has since rebounded, achieving 36.40% in the third quarter of FY 2024.

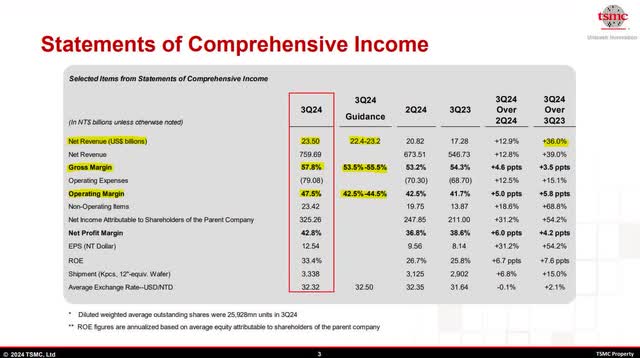

TSMC’s third-quarter FY 2024 revenue of $23.55 billion beat analysts’ estimates by $338.35 million and exceeded the company’s third-quarter guidance. TSMC’s third-quarter gross margins grew 460 basis points (“bps”) sequentially and 350 bps points year-over-year to 57.8%, exceeding the high end of company guidance by 230 bps. Chief Financial Officer (“CFO”) Wendell Huang said on the earnings call that the rise was “primarily due to a higher capacity utilization rate and better cost improvement efforts, including productivity gains.” A higher capacity utilization rate means TSMC increased its chip production closer to its maximum capacity, leading to increased revenue. When combining increased revenue with lower costs, gross margins improve.

TSMC Third Quarter FY 2024 Earnings Presentation.

TSMC’s third-quarter FY 2024 operating margins exceeded the upper end of the company’s guidance by 300 bps to reach 47.5%. Its GAAP (Generally Accepted Accounting Principles) earnings-per-share (“EPS”) was $1.94, beating analyst estimates by $0.15.

A word of warning when reading TSMC’s financial statements. All numbers are in New Taiwan (“NT”) dollars, unless indicated as denominated in U.S. dollars. For instance, in the above table, revenue is in U.S. dollars, but EPS is in NT dollars.

In the semiconductor industry, investors associate increased capital expenditures (“CapEx”) spending with more growth opportunities over the next several years. CFO Huang said the following about CapEx on the third quarter earnings call:

We now expect our 2024 CapEx to be slightly higher than $30 billion U.S. dollars. Between 70% and 80% of the capital budget will be allocated for advanced process technologies. About 10% to 20% will be spent for specialty technologies, and about 10% will be spent for advanced packaging, testing, mass making, and others.

The company recorded annual CapEx of around $32 billion and $23 billion in 2022 and 2023, respectively. So, a 2024 CapEx of $30 billion would be a return to growth mode after the 2023 downturn. CFO Huang also indicated on the third-quarter earnings call that CapEx should rise in 2025 without giving a specific number. Overall, management is reluctant to give any hard forecasts for 2025. However, TrendForce wrote on July 1, 2024:

TSMC’s capital expenditure is set to surge again in 2025 due to strong demand. According to a report from Economic Daily News citing sources, due to continued investment in the most advanced 2nm process and strong demand for 2nm technology, production capacity will be allocated to the Southern Taiwan Science Park. TSMC’s capital expenditure in 2025 is expected to reach between USD 32 billion to USD 36 billion, marking the second-highest in its history, with a year-over-year increase of 12.5% to 14.3%.

If true, TSMC should produce excellent growth over the next several years.

TSMC’s TTM unlevered free cash flow rose from $2.96 billion in September 2023 to $19.31 billion in September 2024. At the end of the September quarter, it had $68.215 billion in cash and marketable securities and $28.628 billion in long-term debt. The company’s debt-to-equity is 0.23, which means it finances its operations with more equity than debt. Its debt-to-EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is 0.65, which means the company’s core operating profits can cover its debt.

TSMC Third Quarter FY 2024 Earnings Presentation.

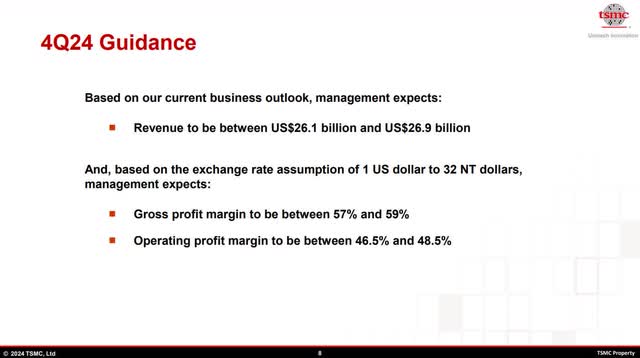

If TSMC hits the midpoint of its fourth-quarter FY 2024 revenue guidance, it will grow revenue by 35% over the previous year’s fourth quarter. The midpoint of its fourth-quarter FY 2024 gross margin guidance is 58%, an increase of 20 basis points sequentially and 500 bps year-over-year. CFO Huang stated the following on the earnings call about gross margin guidance: “This [gross margin] is primarily due to a higher overall capacity utilization rate in the fourth quarter, partially offset by continued dilution from N3 ramp up, higher electricity prices in Taiwan, and N5 to N3 tool conversion cost.” In other words, he is saying that gross margins should rise in the fourth quarter due to TSMC raising its output closer to maximum capacity. Gross margin guidance is not forecasted to be higher because ramping up chip production for 3nm chips and converting tools from 5nm to 3nm depresses gross margins. The midpoint of fourth quarter FY 2024 operating margin guidance is 47.5%, up 590 bps year-over-year.

On the third-quarter earnings call, one analyst asked what considerations should go into 2025 gross margins. CFO Huang highlighted several costs that could depress gross margins in 2025. The company expects the ramping up of chip fabrication in locations outside of Taiwan to decrease gross margins by 2% to 3%. TSMC will also have preparation costs for ramping the 2nm node, which will further hold back gross margins. The last factor Huang mentioned that will lower the 2025 gross margin is electricity costs. He said, “So next year, we think that electricity price for us in Taiwan will be the highest in all the regions that we operate.” Investors should expect a 1% gross margin headwind due to electricity costs in 2025.

Risks

The newest, most advanced AI semiconductors require 3nm and 5 nm chips manufactured using extreme ultraviolet (EUV) lithography systems because the older Deep Ultraviolet (DUV) lithography technology has difficulties manufacturing chips smaller than 7nm. Since EUV requires far more power than DUV, TSMC started having problems sourcing enough energy in the Taiwan market at affordable prices. One Taiwanese news source called EUV systems a “power-guzzling monster.” EUVs can consume ten times as much power as DUVs. What’s worrying is that the company’s energy consumption increased in 2023 using EUVs despite a semiconductor downturn. What will happen as capacity utilization rises to maximum capacity? The Taiwanese article stated (emphasis added):

TSMC publishes its sustainability report, which often runs over 200 pages, at the end of July every year. Tech reporters and people concerned about Taiwan’s energy future always flip through the pages with bated breath, looking for that one crucial number that may influence how the country moves forward: TSMC’s annual power consumption figures. The number at the end of 2023 was 24.78 billion kWh, which was 8.9% of all of Taiwan’s power consumption. This was a new record.

One answer to the company’s increasing power woes is nuclear power. An article from WCCFtech stated:

With TSMC accounting for most of Taiwan’s power consumption, the country’s lawmakers are open to changing the current rules regulating nuclear power in the country. Members of the current planning body of the Taiwanese national legislature, the Executive Yuan, showed a willingness to amend laws after the incoming economic minister set to succeed Weng Mei-hua, J.W. Kuo, remarked in the Executive Yuan that he believed nuclear energy was a clean power source.

On the company’s third-quarter earnings call, CEO Wei discussed how TSMC plans to mitigate the energy risk through cooperation with the Taiwanese government:

Yes, we are building many fabs in Taiwan, and that requires electricity, water, and the land. We continue to work with the government. Actually, we have a very close communication with government, and to tell them that our requirement, our plan, and we got assurance from the government saying that they will support TSMC’s growth, and we believe that. And so how they prepare for the electricity from the nuclear power plant or from just some kind of other sources like green energy, something. We are not ready to share with you yet, but we got assurance that we’re going to get enough electricity support, including the water and the land.

The company also has energy concerns everywhere that it builds plants outside Taiwan. For instance, IndustryWeek published an article in March 2024 that stated (emphasis added):

In 2022, the White House signed the CHIPS and Science Act into law, a bipartisan effort to increase domestic advanced semiconductor manufacturing. The legislation made a historic $52 billion investment in American semiconductor research, manufacturing, and workforce development. Over a year later, new projects are facing construction delays and permitting issues, raising concerns over efforts to expand domestic manufacturing despite legislative support. Worse yet, the country might be unable to generate enough electricity to power new fabrication plants, leaving billions of dollars in federal funds stranded and one of its most critical supply chains vulnerable.

So, investors must remain aware that energy concerns may constrain TSMC’s chip manufacturing ability.

Another issue is rising tensions between mainland China and Taiwan, which is concerning since the International Trade Commission says, “Around 92 percent of the world’s most advanced chip manufacturing capacity is located in Taiwan.” A lot of that capacity is from TSMC. The company is in the process of diversifying away from Taiwan by constructing manufacturing plants in Germany, the U.S., and Japan while partnering with Samsung to build “chip mega-factories” in the United Arab Emirates. However, it may take many years to diversify away from manufacturing chips in Taiwan.

Last, TSMC’s Foundry 2.0 initiatives are not guaranteed to alleviate U.S. antitrust concerns, especially since much of its manufacturing capacity is close to mainland China.

Valuation

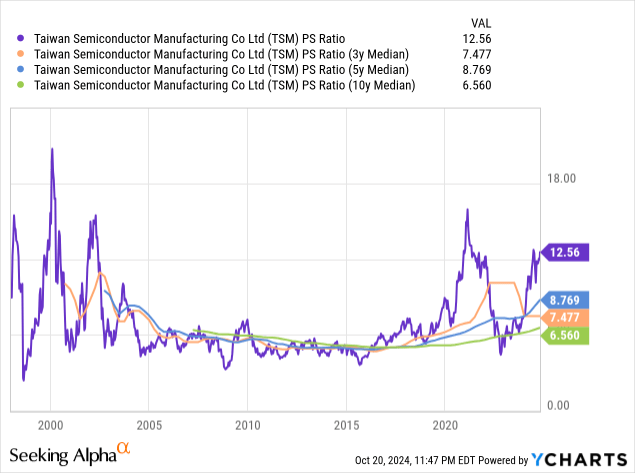

TSMC’s TTM price-to-sales (P/S) is 12.56, well above its three-, five-, and ten-year median. Some may consider the stock overvalued because it trades substantially above its median. However, the stock price does not necessarily need to drop for the valuation to return to its median. If the company’s sales grow faster than its market capitalization rises, it can return to its median across all periods.

The above valuation focuses on the past, but the market tends to value stocks based on future expectations. TSMC’s one-year forward price/earnings-to-growth (“PEG”) ratio is 0.95 (One year forward P/E of 23 divided by analysts’ 2025 estimated EPS growth of 24.13%). Generally, the market will allow a quality growth stock to reach a PEG ratio of 2.0 before considering it overvalued. Suppose it traded at a PEG ratio of 2.0; the stock price would be $421.30, a rise of 109% above the October 18 closing price of $200.78. So, the stock could potentially double again over the next year before the market considered it overvalued based on its PEG ratio.

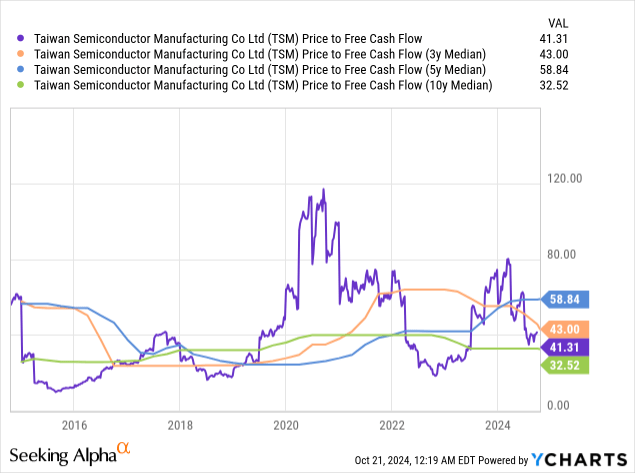

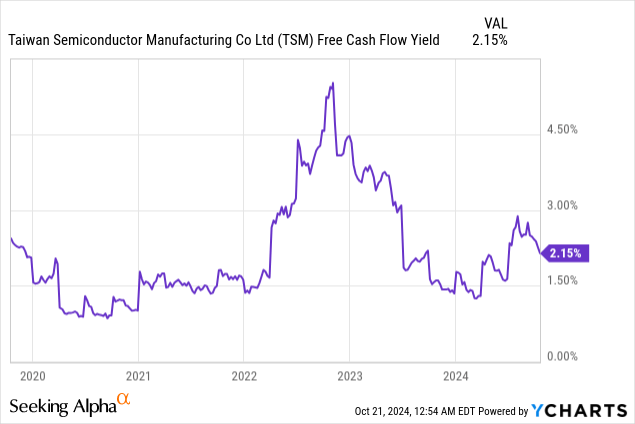

TSMC’s price-to-FCF is 41.31, below its three—and five-year median but above its ten-year median. Some might consider the stock undervalued in the short term but overvalued in the long term based on its price-to-FCF.

TSMC has an FCF yield of 2.15%. Considering the trading range over the last five years, I consider the stock undervalued when its FCF yield is above 3% and overvalued when it is below 1.50%. Consequently, based on its FCF yield, it may sell at a fair valuation.

However, remember that backward-looking metrics like FCF yield can sometimes deceive the market. TSMC may grow FCF faster than its market capitalization rises, and the FCF yield rises, or FCF growth may stay even with its market capitalization growth, and the FCF yield could remain at 2.15%. It is also possible that the FCF yield could go below 1% and stay there as long as the market perceives TSMC is in an upcycle. Market sentiment goes a long way into what FCF yield the market is willing to accept. In the early stages of a semiconductor upcycle, positive market sentiment toward TSMC may make tech investors increase or maintain their investment even when investors that emphasize valuation believe the stock’s valuation is too high.

The stock remains a strong buy

While some soured on the chip industry because ASML Holding (ASML) recently issued disappointing 2025 guidance, TSMC’s earnings report tells a different story. I maintained my strong buy recommendation because, based on its revenue growth potential in manufacturing AI chips and its increasing profitability, 2025 could be an excellent year for this contract chip manufacturer. Considering the demand for chips going into AI infrastructure use cases and the rebounding smartphone and IoT markets, the stock has solid market-beating potential over the next two to three years. The stock’s valuation is higher than when I first recommended it. However, I don’t view the valuation as excessive at this point of a likely semiconductor upturn. I maintain a strong buy recommendation for TSMC.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.