Summary:

- TSMC’s advanced node technologies and strong Q3 2024 financial performance position it as a key player in the AI revolution, similar to Nvidia.

- TSMC’s upcoming 2nm chips and strategic global expansion, including new fabs in the U.S., Japan, and Europe, bolster its competitive edge.

- TSMC’s valuation metrics indicate it is undervalued compared to peers like Nvidia and AMD, offering significant growth potential in the AI semiconductor space.

- Despite geopolitical risks, TSMC’s dominance in advanced nodes and robust financial health make it a compelling buy for investors seeking AI sector exposure.

Editor’s note: Seeking Alpha is proud to welcome Hataf Capital as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

BING-JHEN HONG

Taiwan Semiconductor (NYSE:TSM) is Poised To Dominate By New 2nm Chip Technology due to its pivotal role in the semiconductor industry, particularly in the artificial intelligence AI revolution. TSMC’s latest node technologies are driving the AI boom, evidenced by its Q3 2024 financial performance which not only surpassed expectations but also set records in terms of revenue, net income and profitability. As the demand for high-performance AI chips grows, TSMC’s expansion into new 2nm Chip technology and manufacturing capabilities will continue to fuel its impressive growth trajectory.

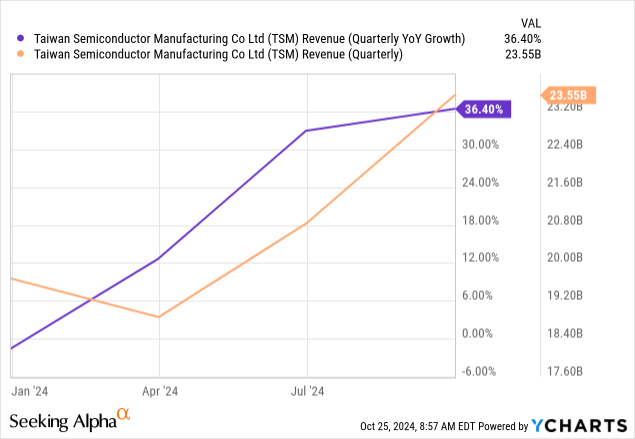

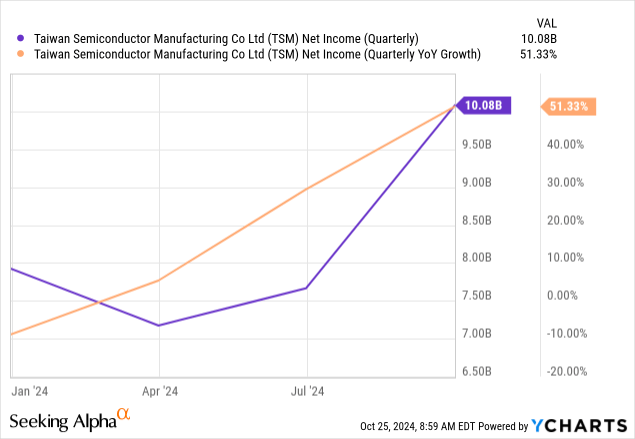

Recent Q3 2024 results demonstrated remarkable revenue growth of 36.4% YoY and a 51.3% YoY jump in net income, reaching NT$325.26 billion, highlighting the exceptional demand for TSMC’s advanced node technologies underscoring its ability to meet increasing demand for AI related technologies. TSMC’s leadership in advanced node technologies (3nm, 5nm, and 7nm) will continue to drive substantial growth as evidenced by 69% of its wafer revenue from these cutting-edge processes in Q3 2024. Its unparalleled market position, strong financial health, and aggressive expansion into new geographic regions make it a compelling investment.

TSMC’s current valuation metrics show that it is undervalued relative to peers like ASML, Nvidia and AMD, making it a compelling buy for investors seeking exposure to the AI boom and semiconductor sector. I’ll break down why I think TSMC is not just maintaining its leadership in the semiconductor market but is also setting itself up to dominate the AI space over the next years.

New 2nm Chips

TSMC is advancing toward the next significant node in chip manufacturing: N2 or the 2nm technology. Based on the company’s roadmap I expect the first N2 chips to hit the market in early 2026 starting a new era of even more efficient and powerful semiconductor solutions. TSMC’s N2 node introduces the gate-all-around GAA transistor structure, a significant technological leap that will drive better power efficiency and performance compared to the current FinFET architecture used in N3 and its predecessors.

This innovation is essential as demand for high-performance chips continues to rise, especially in areas like artificial intelligence, high-performance computing, and next-generation consumer electronics. In my opinion, adoption of GAA technology positions the company to maintain its competitive edge over rivals like Samsung and Intel, which are also exploring advanced nodes in the same timeframe.

To start mass production of N2 chips, TSMC built a new fab in Baoshan, Hsinchu County, Taiwan, referred to as Fab 20. TSMC has started the trial production of 2nm chips in its Baoshan Plant in northern Taiwan for scheduled mass production of 2nm in 2025. Based on my analysis of the construction timeline and equipment installation processes, I believe that TSMC may even accelerate its schedule if the fabrication process meets its performance and yield targets sooner than anticipated. This accelerated timeline could enable TSMC to pull forward N2 mass production by a quarter or more, potentially beginning as early as Q3 2025.

TSMC’s N2 technology will offer 10% to 15% performance gains at the same power and complexity, while also cutting power consumption by 25% to 30% compared to N3E. The shift to N2 will enable a 15% improvement in transistor density, allowing chip designers to pack more computing power into smaller spaces, a critical requirement for next-generation AI and high-performance computing HPC applications. These advancements combined with NanoFlex technology will allow designers to mix and match high-performance, low-power, and high density standard cells to optimize performance, power efficiency and die size.

More N3 Iterations: Bridging the Gap to N2

While N2’s arrival is a game changer, N3 and its evolutionary iterations will remain TSMC’s leading-edge offering through 2025. TSMC is planning several enhancements to the N3 node including N3E and N3X which are expected to cater to a variety of performance and power efficiency needs, particularly for datacenter ASICs and CPUs.

The N3 nodes are crucial in bridging the gap between current technologies and the next-generation N2. These nodes will keep TSMC competitive, especially against Samsung’s 3GAP and Intel’s RibbonFET-based 20A, which are set to emerge as alternatives by 2024 and 2025. According to reports, the price for a 2nm wafer using TSMC’s N2 process could exceed $30,000, a dramatic increase from the estimated $18,500 price tag for N3 wafers. Also, N4/N5 wafers, which are currently priced around $15,000. This would represent a near 65%-100% increase in cost.

Why Advanced Node Dominance is the Key to TSMC’s Success

One of the most compelling aspects of TSMC’s business is its dominance in advanced node technologies. In Q3 3nm technology alone contributed to 20% of TSMC’s total wafer revenue with 5nm and 7nm technologies accounting for an additional 49%. Collectively, these advanced nodes are the backbone of AI and high-performance computing applications, both of which are experiencing exponential growth.

Why does this matter? The AI boom is not just a trend, it’s a technological shift. AI applications, particularly those in machine learning, autonomous systems and natural language processing, require the most advanced chips available. This creates a significant entry barrier for competitors, as TSMC’s leadership in advanced node technology ensures it has a near-monopoly on these high-demand chips. In my opinion, this advantage is sustainable due to the enormous capital and technical expertise required to produce these chips at scale, companies that are leading in the AI race are TSMC’s largest customers.

TSMC’s Top 10 Customer By Revenue (Moomoo)

It also focuses on advanced packaging technologies such as Chip-on-Wafer on Substrate (CoWoS) and Small Outline Integrated Circuits (SOIC) which provide it an additional competitive advantage. These technologies enhance the performance and efficiency of AI chips, giving TSMC a critical edge over competitors like Intel and Samsung. As these new fabs come online in the coming years. Looking forward, TSMC’s 3nm production capacity is set to triple by the end of 2024, further cementing its dominance in the AI and HPC chip space.

Strategic Global Expansion

The company is currently building seven new fabrication plants with notable projects in the United States, Japan, and Europe. These plants will increase TSMC’s production capacity and solidify its position as the world’s leading semiconductor foundry.

In particular, TSMC’s $11 billion investment in a new semiconductor fabrication plant in Dresden, Germany, represents a significant strategic shift toward regional diversification. In my opinion, this move is a response to geopolitical tensions and global supply chain vulnerabilities which have pushed governments and corporations to localize chip production. By expanding into Germany, TSMC is not only able to meet the demand from Europe’s automotive and industrial sectors, but also creating a more resilient and diversified manufacturing footprint.

Notably, TSMC’s expansion into the U.S. market with its 4nm fab in Arizona expected to begin mass production in 2025 further underscores its commitment to meeting the growing demand for advanced semiconductors across key global markets. From my perspective, these investments will allow TSMC to capture more market share and strengthen its partnerships with major tech firms, particularly those involved in AI and HPC applications.

Is TSMC Fairly Valued?

I remember back in early March 2024 when Nvidia (NVDA) was trading around $800 ($80 Split Adjusted) and there was a lot of talk about how AI was just a bubble. Many people, myself included, thought that Nvidia’s valuation was way too high. It seemed like every headline was declaring that AI was overhyped and that Nvidia’s stock price couldn’t be justified and that the market would inevitably correct itself. Honestly, I shared these concerns: how could Nvidia sustain such a massive market valuation? Could the AI sector really justify the astronomical growth projections?

But by April 2024 I started to shift my thinking. I began to realize that AI and the semiconductor industry were fundamentally different from the speculative bubbles we’d seen in the past, like the dot-com crash or even the overhyped SaaS (Software as a Service) sector. The key difference? AI isn’t a fleeting trend, it’s an essential transformative technology that requires immense computational power to solve complex problems, especially when processing the vast amounts of data we’ve collected over the past two decades.

The AI journey is just beginning. We’re still in the training phase of large language models (LLMs), a phase that will last until 2030. After that, we’ll enter a period where AI will evolve into reinforcement learning for specific tasks and by around 2035 AI will shift toward inference tasks requiring less computational power for the models to make decisions, analyze data and operate more efficiently. By this time, there will be an abundance of open-source LLMs accessible to the general public and AI will become more integrated into various sectors.

That’s when I can see AI reaching a saturation point, perhaps even becoming a bubble like many fear today. But here’s the critical point: TSMC won’t be impacted by this potential AI bubble because it’s a bedrock in the semiconductor and AI infrastructure industry. Whether we are in the AI training phase, reinforcement learning phase, or inference phase, TSMC will remain essential because of its business model. It manufactures the high-performance chips required for AI computations, and no matter how AI evolves, the demand for advanced semiconductor technology will persist.

Despite its pivotal role in the AI ecosystem, TSMC’s valuation is more reasonable, even though it arguably provides more critical infrastructure for AI growth than these companies.

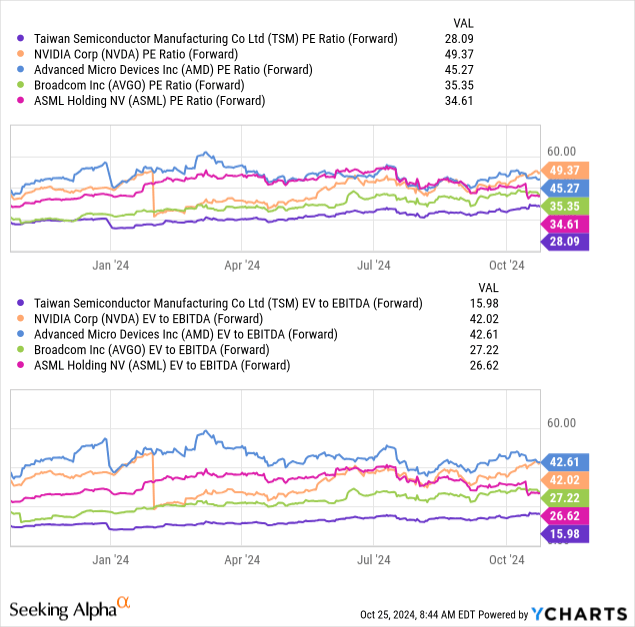

From a valuation perspective, I see TSMC as undervalued relative to its competitors, especially given its growth prospects. TSMC is currently trading at a forward P/E ratio of 28.09 which is significantly lower than Nvidia’s 49.37, AMD’s 45.27, and Broadcom’s 35.35. This suggests that TSMC is not fully priced for its potential as a leader in the AI semiconductor space. Looking at the forward EV/EBITDA ratio TSMC’s 15.98 is much more attractive than Nvidia’s 42.01 and AMD’s 42.61 reinforcing the idea that TSMC is undervalued relative to its peers.

One of the most interesting aspects of TSMC’s financials is its levered FCF growth of 590.73% YoY which is remarkable. Additionally TSMC has a gross profit margin of 54.45% TTM which is competitive within the industry though slightly lower than Nvidia’s 75.98%. However, TSMC’s ability to maintain high profitability in the face of rising demand and production costs shows its pricing power and operational efficiency.

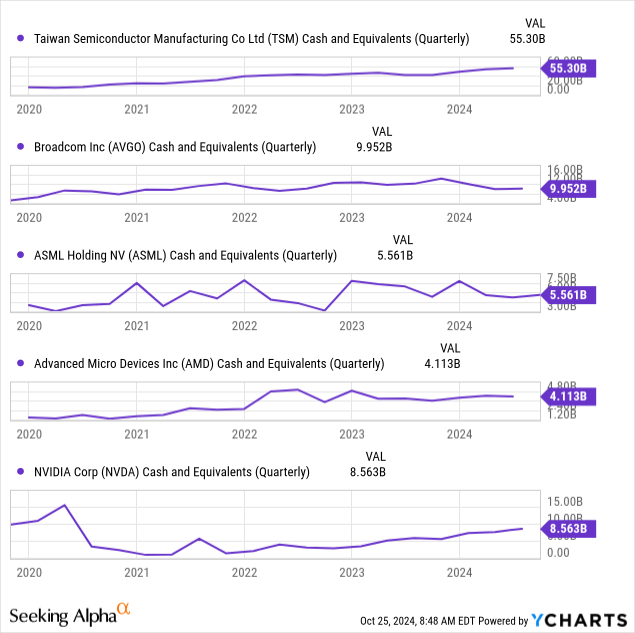

Compared to Intel (INTC) which is struggling to catch up in the advanced node space, TSMC has a significant technological lead. Intel’s production delays in 7nm and 5nm processes have allowed TSMC to widen the gap, particularly in AI chip production. Moreover, TSMC’s partnerships with companies like Nvidia and Apple position it well ahead of Intel in the AI revolution. In fact, TSMC has more cash than (AVGO), (AMD), NVDA And (ASML) combined, a testament to its strong financial position and ability to weather challenges in the industry. This cash flow growth positions TSMC to reinvest in its business, further expanding its manufacturing capabilities and R&D efforts, particularly in advanced AI chip technologies.

In my opinion, Nvidia’s reliance on TSMC for its chips is perhaps the most telling indication of TSMC’s competitive strength. Nvidia’s AI chips, particularly those used in data centers and autonomous vehicles, are some of the most advanced in the world and TSMC is the only company capable of manufacturing them at the required scale and quality. This dynamic ensures that as Nvidia grows, so too does TSMC.

Given TSMC’s growth potential, particularly in the AI sector, I believe the stock is currently undervalued. Investors looking for a high-growth opportunity in the semiconductor space should strongly consider TSMC, especially as the AI market continues to expand over the next decade.

Risk Factors

While TSMC’s prospects are undoubtedly bright, there are some risks that could impact its growth trajectory. Geopolitical tensions between China and Taiwan pose the most significant risk to TSMC’s operations. Another risk is overcapacity in the semiconductor market due to its cyclical nature, particularly in mature nodes. While TSMC is heavily focused on advanced nodes, any significant downturn in demand for semiconductors could lead to excess capacity, impacting profitability. However, given the booming demand for AI and HPC chips, I see this risk as relatively low in the near term.

TSMC is a Strong Buy

I believe TSMC is poised to dominate the semiconductor space with its new 2nm chip technology in terms of growth, influence, and leadership. The company’s dominance in advanced node technology coupled with its aggressive expansion plans positions it to capture a significant share of the growing AI chip market.

The company is uniquely positioned to benefit from the AI boom, and its valuation compared to peers suggests significant upside potential. While risks remain, particularly geopolitical and operational challenges, I believe TSMC’s long-term growth story is intact. For investors looking for exposure to the AI boom without the sky-high valuations of companies like Nvidia, TSMC offers a compelling alternative. With strong financial performance, ambitious expansion plans, and a dominant position in the semiconductor market, TSMC is well positioned for long-term growth.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.