Summary:

- The arguments that made Taiwan Semiconductor a winning company years ago are still alive and thriving today, securing a strong outlook for the company.

- Continued market share growth, technological leadership, and an ability to execute and deliver make TSM the leading company in its industry.

- The company is trading above its historical mean on P/S and P/E ratios but is expected to grow into its valuation, making the current price an acceptable entry point.

- Given the current valuation, I would dollar cost my way into the stock to smoothen potential volatility in the stock and broader market.

luza studios

Introduction

Taiwan Semiconductor (NYSE:TSM) has been one of my best picks in recent years. I covered the stock in October 2022 as I went long at what turned out to be a multiyear low in terms of both P/S, P/E and EV/EBITDA and my position is up almost 200% since – sometimes you get lucky. In August last year, I covered the stock once more as I expanded my position, and in just over a year, the stock is up 90.4% with a total return, if you include the dividend, of 94.4%. After such a run-up, the company is now the 9th largest company by market capitalization globally. One of only three non-US companies amongst the fifteen largest companies. This raises the question of how far the company can go.

I haven’t added to my position since August last year, but given the company seems to be trading in a band between $150-$190 per share, I deemed it was time once more to have a look at this semiconductor behemoth. I continue to be interested in adding to my position if the price is right, but I do have the luxury of being able to be patient as semiconductor companies in total already make up 18.9% of my portfolio across Texas Instruments (TXN), Taiwan Semiconductor, Qualcomm (QCOM), Lam Research (LRCX), and Broadcom (AVGO) which alone makes up just above 10% of my portfolio as it’s up 750% as I’m writing this.

I’m no mastermind, however, as I left the Nvidia (NVDA) ship much too early, holding only a very small position today – congrats to all those who stayed.

The reason I remain bullish on Taiwan Semiconductor, is that the underlying reasons why I went long in 2022, are just as alive today as they were back then, so let’s have a closer look.

Leading The Industry From A Position Of Strength

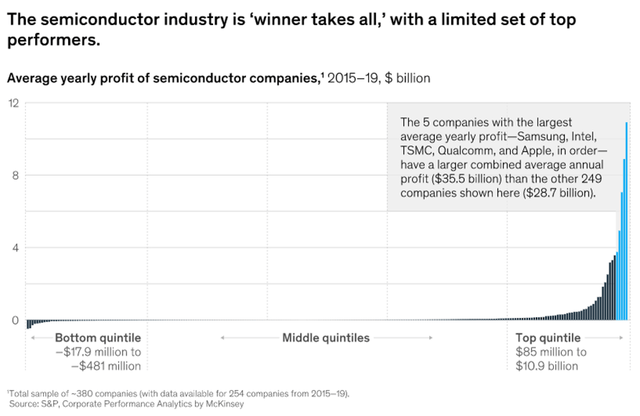

I’ve hammered the same argument again and again when I cover companies operating in this industry. It’s a cutthroat marketplace, where winners take the lion share of the spoils. Such a market dynamic fosters a sort of perpetual snowball effect, unless you lose your footing, as has been the case for several companies in this niche throughout the last decades.

Semiconductor Industry Earnings Distribution (McKinsey)

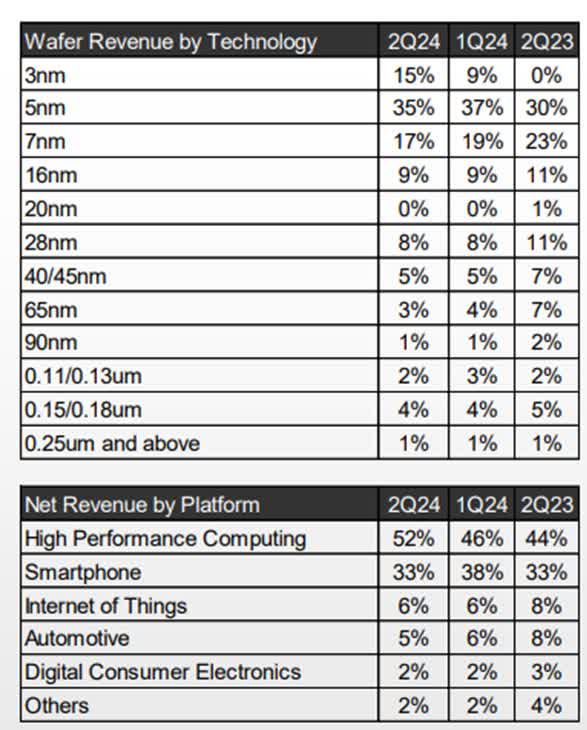

Taiwan Semiconductor has a proven track record as the technology and process leader within the industry. If we go back to October 19th last year, the company reported its first revenue within the leading 3nm chip, making up 6% of total revenue for that period. If we fast-forward to July 18th this year, when the company reported its Q2-2024 results, the 3nm technology already makes up 15% of total revenue as many leading devices, for instance most of Apple’s (AAPL) product portfolio, utilizes this technology. 7nm and smaller is what the company itself labels as the advanced technology portfolio, and as can be seen below, that revenue base now makes up 67% of total revenue compared to 53% a year ago. Unsurprisingly, we also see that high-performance computing is a strongly growing segment, which is of little surprise with all the cloud and datacenter infrastructure CAPEX going around.

Taiwan Semiconductor Revenue Distribution Q2-2024 (Taiwan Semiconductor Investor Relations)

Taiwan Semiconductor is not alone in having successfully made the leap to the next generation of nanometre production, as both they and Samsung Electronics (OTCPK:SSNLF) are mass-producing, but their chips do field the largest transistor density. Diving into the technical aspects is a very complex exercise, especially as chip performance measurement has become more tenuous to digest with integrated circuit designs having undergone technological advancements that make it more difficult to understand than simply talking about nanometre and transistor size reductions.

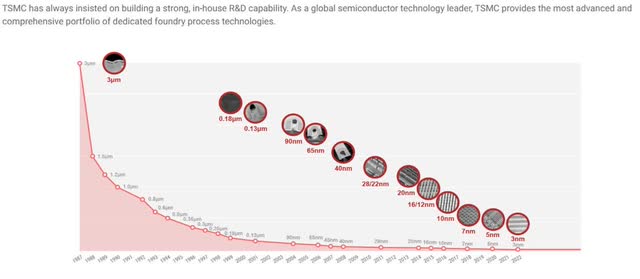

Point being, however, that this has always been an industry about R&D budgets and process mastery. If you want to make it to the next plateau, you need to master the process landscape of the prior one. You will not just skip past the 5nm technology and adopt the 3nm technology if your prior capability was to manufacture the 7nm technology. Lack of process mastery is one reason why a company such as Intel (INTC) has been lagging its peers, and why we see an extremely skewed distribution of profits, as evident from the prior illustration. So, this really is an industry, where I believe it’s worth betting on the winner.

Taiwan Semiconductor History Of Manufacturing (Taiwan Semiconductor Company History)

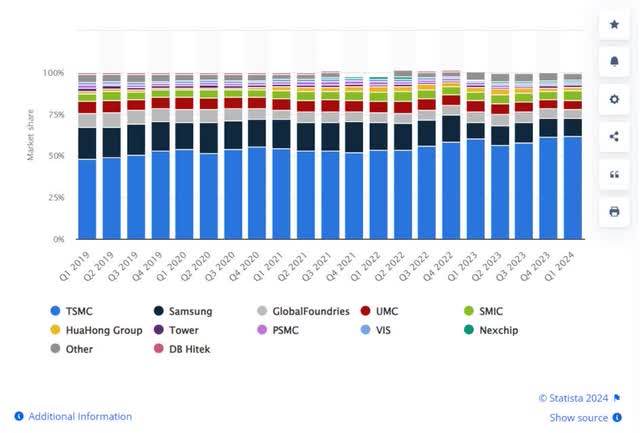

Despite the fact that 3nm is still climbing aggressively as a share in the financial accounts of Taiwan Semiconductor, the company is already well underway to operationalize the next generation, the 2nm technology, which is expected to enter volume production in 2025. Once more, Taiwan isn’t alone as both Samsung and Intel have a similar technological roadmap, but there is a reason why Taiwan is leading in the foundry market with a market share of just above 60% as per the most recent quarters. In fact, it’s a market share that has been growing, as can be seen in the illustration below, showing foundry revenue share worldwide between 2019 and 2024.

Foundry revenue share worldwide between 2019 and 2024 (Statista)

While it isn’t confirmed, speculation is, that Taiwan Semiconductor’s order book for the 3nm chip, is full beyond the coming twelve months, as well as the fact that prior reports have stated that Nvidia has agreed to price hikes. Why? Because you have pricing power when you command such a share of the total market combined with the fact, that you are a mission-critical supplier and partner of customers demanding leading edge chips, which brings me to the next point.

The Trusted Partner Of Its Customers

I recently covered Intel, with a bearish perspective, which can be read here. One major difference between a company like Intel and Taiwan Semiconductor, at least in my opinion, is that Intel is currently in a spot where it’s heavily reliant on partners being willing to take a bet on them being able to deliver. Everybody knows that Taiwan Semiconductor can deliver, so they don’t need to enter into agreements on unfavourable terms. What exactly am I alluding to here? I’m pointing to the recent deal struck between Intel and Amazon (AMZN), where Intel will co-develop and produce an AI fabric chip for AWS on its leading technological platform, the 18A platform. The companies have a long-standing strategic relationship, and this deal operates under a multi-billion dollar framework, but I also imagine that Amazon were able to achieve some very luxurious pricing points and probably has first right to foundry capacity, something that makes Intel less flexible and effectively could impact margins, meaning it would have less financial firepower it can add to its R&D and CAPEX budgets.

However, there is also reason to stay vigilant, as not all is bad with Intel. Intel outsources upwards of 30% of its wafer production to Taiwan Semiconductor, contributing with a significant portion of growth as a consequence, and if Intel does succeed, it would reduce the outsourcing pace and outlook, effectively hurting Taiwan Semiconductor. There has also been recent speculation about Qualcomm acquiring Intel, and guess who is a major client at Taiwan Semiconductor. Yes, you guessed it, Qualcomm is.

Only the future will show how all this unveils, but as investors we like stability in operations and financial planning, and that is something that Taiwan Semiconductor can offer, while leading the marketplace. I would suspect an executive team would prefer relative certainty when planning their next product launch, that the backbone of those products e.g. the chips, will be able to arrive on time and in the right volume.

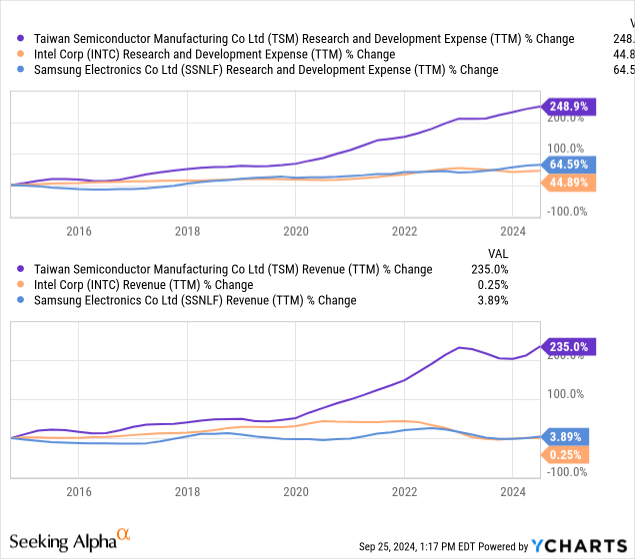

This R&D and revenue comparison is a highlight in my opinion. On a numerical scale, both Samsung and Intel easily eclipse the R&D budget of Taiwan Semiconductor as they are, respectively, almost four and three times as large, but in my opinion, there is one company who derives more value from theirs. To be fair, Samsung is spread over several business units, so their R&D budget will cover more than what we are discussing here, but the difference is striking.

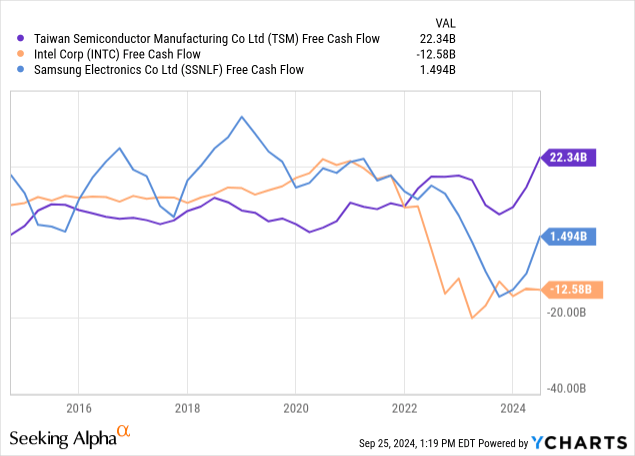

If we then add the observation of free cash flow, there is a clear discrepancy between them. It should be mentioned, however, that Samsung has a very strong net cash position, same as Taiwan Semiconductor, with the two companies having almost similar CAPEX outflows. Intel is behind both of them on these aspects, and also carries more debt relative to cash.

With these facts in mind, I would anticipate that Taiwan Semiconductor will remain a preferred option with customers, as they should be able to continue operation from a point of strength, driving technological advancements, pushing their competitors.

The Industry Outlook

One prime reason why semiconductor companies have provided strong returns, almost across the board, is the very favorable industry outlook. Juggernauts have little room for error, as the saying goes “the larger they are, the harder they fall”, and with a market cap approaching $800 billion, Taiwan Semiconductor has little room for error.

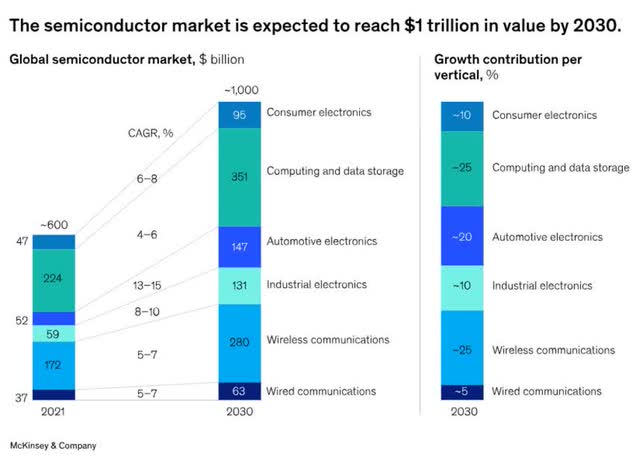

The Semiconductor Industry Outlook Towards 2030 (McKinsey)

With the semiconductor market expected to grow at above 7% CAGR between 2023-2030, there is a lot of opportunity over the coming years, and while it’s close to impossible to estimate an outlook even beyond the end of the decade, the development could continue as some analysts suggest.

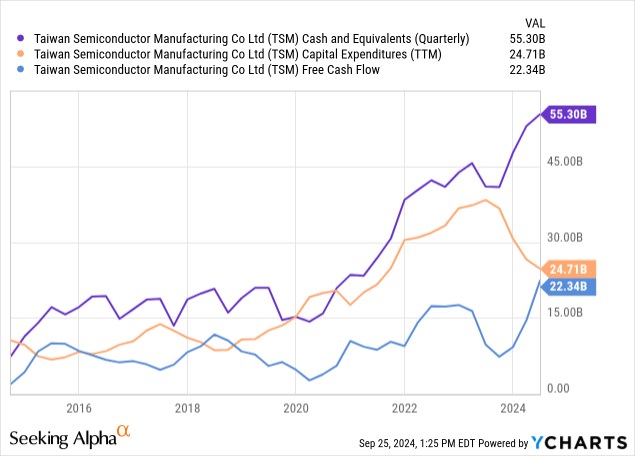

The industry is characterized by its capital heavy nature, with new foundries costing anywhere from a couple billion dollars to upwards of $20 billion dollars or above. As chip manufacturing have become a national security concern, governments have begun to offer tax grants to attract investments, such as the US chips act, but despite this, it requires some serious financial muscle to operate in this business and stay competitive. If you remember the graph showing free cash flows earlier, you already know where I’m heading.

Taiwan Semiconductor currently has a total debt of $31.6 billion, but a cash position including short-term investments of $62.9 billion, meaning they could eliminate their debt immediately should they wish to. In the most recent years, annual CAPEX has hovered between $24-$35 billion and having to expand 3nm production while reaching mass production for the coming 2nm, it will inevitably impact the free cash flow in the coming years, but when you have almost $63 billion in the bank, that hardly presents an issue. Even with the elevated and growing CAPEX in recent years, the cash position has been growing steadily.

I don’t think it requires more to solidify the point that Taiwan Semiconductor is a very healthy company from a financial standpoint.

What Does It All Sum Up To?

Here are my observations, same as they were a couple of years ago.

- Taiwan Semiconductor is a technology leader in one of the toughest industries out there.

- The company is growing its market share, underlining its appeal amongst customers and ability to deliver the most advanced products on the largest scale.

- The marketplace overall has a very positive outlook, expected to grow at a compounding rate that is much larger than general GDP globally.

- Despite the massive CAPEX and R&D budgets required to succeed in this industry, Taiwan Semiconductor continues to expand its net cash position, while growing its organic investments.

If I were to add one thing here, it’s the everlasting risk of what will happen to Taiwan’s status as a standalone nation, which is of course highly relevant given that most of Taiwan Semiconductor’s production assets are located in Taiwan. I’ve gone about this risk in lengthy detail in my prior articles, so I’ll propose to have a look there if it’s cause for concern.

We are, however, back to the perpetual snowball that I alluded to earlier, and I only see it becoming larger for Taiwan Semiconductor.

Valuation

Alright, so then the question is whether it’s currently at a pricing point that’s worth to consider.

Taiwan Semiconductor Revenue Consensus Estimates (Seeking Alpha)

Before we get to the valuation, I think it is worth to dwell on the consensus revenue outlook for a second. Please note, that beyond 2026, the coverage is very thin, but still, the company is expected to grow at a pace well beyond the general GDP, and I’m not surprised.

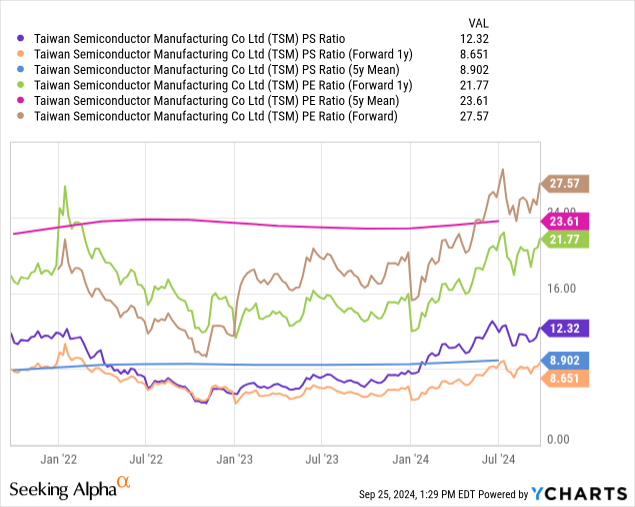

Valuation wise, I believe it’s worth comparing the current valuation to the historical tendency for the company.

It’s worth remembering that there is a valuation trend before- and after the Covid-19 tech fury. I’ve inserted the mean levels for the past five years, as to not cloud the picture too much. If I had included the 10-year mean level, we would see a P/E mean of roughly 19 and P/S mean of 7.2, which could draw different conclusions, suggesting there was farther for the valuation to catch up. I’m stating this for the purpose of transparency, and for you to also be able to draw your own conclusions.

From my perspective, however, I see a company that is currently trading above its historical mean in recent history, but with a forward-looking consensus that will allow the company to grow into its valuation, should it deliver on the consensus.

Forward P/E ratio is 27.6 compared to the 5-year mean of 23.6, but with a forward 1-year P/E ratio of 21.8, the valuation is expected to catch up. The same would be the case for the P/S ratio. Any investor would prefer to be well below the 5-year mean without having to rely on the uncertainty associated to the 1-year forward consensus, but it suggests to me, that it isn’t a terrible place to add shares of the company, especially if it historically has managed to meet, or even exceed the consensus expectations.

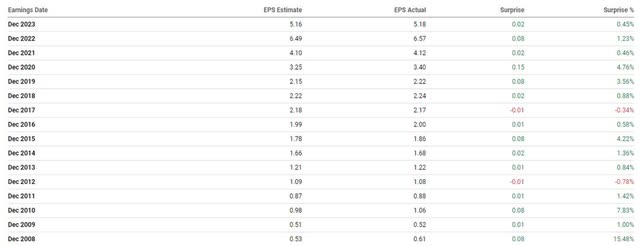

Taiwan Semiconductor EPS result History (Seeking Alpha)

One quick look at the EPS estimates versus actuals, and we see the company has a long track record of meeting expectations, and more often than not, exceed them slightly. As such, it’s probably a fair assumption that Taiwan Semiconductor will be able to meet the forward-looking consensus from an average perspective, therefore growing into its valuation.

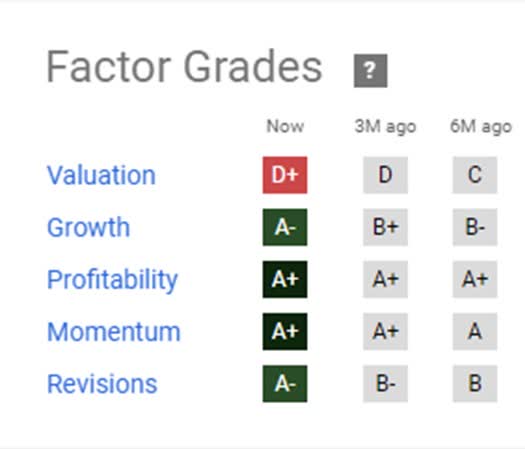

Factor Grades (Seeking Alpha)

One last reality check would be to have a look at the Factor Grades, where the valuation does stand out as the weak point. We would all prefer it was a clear-cut and obvious buy, but it isn’t as the case just two years ago, but if we observe the other grades for growth, profitability, momentum and revisions, there isn’t much to be disappointed about. Remember, these factor grades are built around comparison with peers, so it showcases the strength of Taiwan Semiconductor.

Takeaway & Conclusion

As was the case last year, and the year before, Taiwan Semiconductor still holds a strong position, even critical, in a very attractive industry where winners take the lion share of profits, and Taiwan Semiconductor is a winner. The company continues to deliver and increase its market share, which is impressive considering that it already is a dominating company.

Personally, I’m already long the company with a full position, so I’m looking to go overweight, but I would await a pullback as I already have close to 20% of my portfolio exposed to semiconductors thanks to letting my winners run.

If I, for one, second assumed I had nowhere near that exposure, then I would conclude the current price is an acceptable entry point. I would, as always, dollar cost average my way into the stock, assigning a specific sum and then invest it in tranches across the coming four quarters to smoothen the peaks and valleys caused by stock price- and market volatility.

The last point is of course the geopolitical risks associated with the company having a majority of its assets in Taiwan. However, they have a plant in Arizona, Phoenix under construction, and I would expect the company to continue along that path throughout the decade and beyond. The consequence for investors is, that we need to be mindful of the allocation in our portfolio depending on our risk profiles.

Regardless, I remain bullish on Taiwan Semiconductor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN, AVGO, LRCX, TSM, QCOM, NVDA, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.