Summary:

- Taiwan Semiconductor Manufacturing is a major chip manufacturing company that gets the bulk of NVIDIA and Apple’s business.

- TSMC’s non-NVIDIA business can sustain growth even if NVIDIA’s growth goes bust.

- TSMC’s competitive position and strong financials make it an attractive investment which I value at $211.

- I sold all my TSM shares a little over a month ago. Though I realized an 18% total return, I consider the move to have been a severe mistake.

View of the Taiwan Semiconductor Manufacturing Company (TSMC) plant.

BING-JHEN HONG/iStock Editorial via Getty Images

Taiwan Semiconductor Manufacturing (NYSE:TSM) is one of the most important chip companies in the world. The contract manufacturer to NVIDIA (NVDA), Apple (AAPL) and other chip giants, it has one of the most important roles in the entire chip market. Thanks to its relationship with NVIDIA, TSMC allows investors to get indirect exposure to that company’s growth and success. At the same time, TSMC’s relationship with other large companies like Apple means that it doesn’t need for NVIDIA’s big orders to keep coming in, as a matter of survival. If NVIDIA were for whatever reason to disappoint investors, then TSMC would be OK. NVIDIA comprises 11% of TSMC’s order book; if that were to go to zero, then TSMC’s non-NVIDIA business would require just 12.3% growth to make up for it. In the meantime, TSMC is far cheaper than NVIDIA is, trading at 26 times earnings and 22 times the best estimate of next year’s earnings.

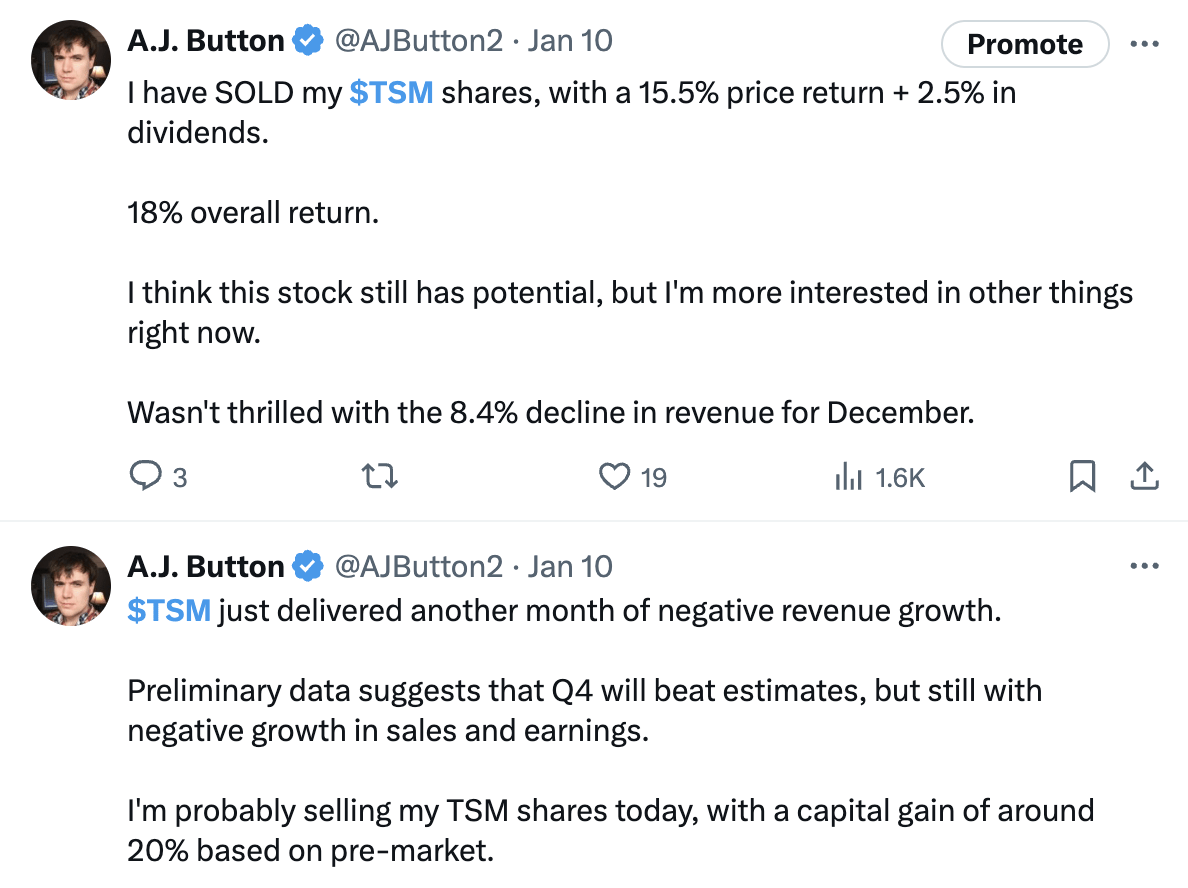

At the beginning of this year, I knew about all of these advantages. I was especially thrilled with TSMC’s combination of a strong competitive position and relatively low multiples. It’s more expensive now, but when I started buying it, TSM traded at less than 19 times earnings. Nevertheless, I sold all of my TSM shares when I saw a revenue report that showed a year-over-year revenue decline for December. It was the company’s 10th consecutive revenue decline in 2023. Spotting a trend, and sitting on an 18% gain, I decided to take profits.

Although I realized a gain on my TSM shares, I got out far too early. Mere days after my sale, TSM put out an earnings release that beat on guidance, specifically forecasting a return to positive revenue growth. I did not see this coming. I thought that the declining revenue all through 2023 meant that NVIDIA’s business was not enough to move the needle for TSM as a whole. Seeing no catalysts other than whatever NVIDIA could provide, I decided to sell all of my shares, announcing the move to my X followers in advance.

In hindsight, this was a pretty major mistake. I essentially just got impatient with the seemingly endless series of revenue reports showing negative growth. I knew that the company’s competitive position was still rock solid, but I just had a feeling that the revenue trend had been going on too long to be a fluke. I realized that TSMC’s competitive advantages remained intact, but still reacted with disgust to the 10th consecutive disappointing revenue report.

It was ultimately just impatience. My last article on TSM rated it a buy, and my Tweet announcing my sale noted that I thought the stock still had potential. I opted not to change my rating on Seeking Alpha because I still believed the stock had long term potential (see Tweet below) and was pretty much just selling because I got fed up after one lousy revenue report too many. The decision not to change my rating was a good one because the rating has since produced a 30% total return–only a few percent of which was enjoyed by the author himself!

Selling with some conflicted feelings (X/the author)

Today, I’m upgrading my TSM rating to strong buy. That might sound like a strange move from somebody who sold the stock recently but remember that I consider that move my biggest investment mistake of the year. I have gained new insights into TSM’s competitive position that have improved my opinion on the company. Basically, I don’t think the company’s competitors are anywhere near as big a threat as I thought they were when I wrote the previous article–which already said that TSM had a better competitive position than them. So, I now see TSM as a strong buy with a $211 price target. I’ll explain my reasons for this change of opinion in the ensuing paragraphs.

Competitive Landscape

The biggest thing TSM has going for it is its competitive position. It is the only major pure play semiconductor manufacturer, all three of its biggest competitors are more focused on chip design than manufacturing.

Other companies, like Samsung (OTCPK:SSNLF), GLOBALFOUNDRIES (GFS) and Intel (INTC), do contract manufacturing like TSMC does, but are not anywhere near the latter company’s scale, and do not have all of the same capabilities. TSM’s “pure play” focus on manufacturing makes it the go-to company for complex orders like NVIDIA’s. Companies like Samsung and Intel both design and manufacture chips, which means that they are less focused. TSMC’s laser focus on manufacturing leaves it free to dedicate more resources to that one activity, which results in it typically being a generation or two ahead of competitors in terms of process nodes. Thus, in courting clients who require the latest and best chips, TSMC effectively has no competitors. Some would argue that Intel has designed a lower process CPU than TSMC has, but it’s not in production yet. TSMC’s 3nm process node is the densest in wide production; Samsung technically has the 3nm process too, but its chips lag TSMC’s on performance and power, and production volumes are being reportedly held back by Japanese export controls. The end result of this is that the big 3nm orders from Apple and 4nm orders from NVIDIA all go exclusively to TSMC.

TSMC – Growth and Margins

TSMC’s competitive strength is reflected in its growth and margins.

First, let’s take a look at the most recent quarter. In the fourth quarter, TSM delivered:

-

$19.62 billion in revenue, down 1.5% year over year, but up 13.6% sequentially.

-

A 53.6% gross margin.

-

A 41.6% operating margin.

-

A 38.2% net margin.

Right away, we can see the wide margins, which are typical of a company that has advantages over its competitors. The growth for the quarter would appear to be negative, but let’s look at the long term CAGR averages from Seeking Alpha Quant:

|

3 year CAGR |

5 year CAGR |

10 year CAGR |

|

Revenue: 17.3%. EBIT: 17.6% Net income: 17.97%. |

Revenue: 15.95%. EBIT: 18.91% Net income: 18.2% |

Revenue: 13.73%. EBIT: 15.94%. Net income: 16.38% |

These are all good growth rates. And, semiconductors are a cyclical industry–a cyclical industry in which TSMC has competitive advantages. We can therefore reasonably surmise that TSM and other semis’ return to positive revenue growth early this year reflects a sector wide uptrend, and that TSM itself will enjoy an outsized share of next cyclical upturn.

As for the valuation: I already touched on multiples in the introductory paragraphs. We’re assuming a cyclical recovery here, so some growth will probably occur. The company’s trailing 12 month earnings per share (“EPS”) was $6.25. If we assume that grows for the next five years at the ten year CAGR earnings growth rate, and at 5% perpetually thereafter, then with a 10% discount rate, TSM is worth $211. That’s 56% upside to today’s price, and the discount rate used here incorporates a large 6% risk premium.

The Bottom Line

With a company like TSM, it helps to conclude with a note of caution. Although this company’s numbers are good, it is exposed to several risk factors. If China invades Taiwan, then production at TSMC facilities could be disrupted. If the U.S. keeps shovelling subsidies at Intel, then that company could grow into a serious TSMC competitor. These risks are just possibilities though: the CCP’s present plan is not to invade Taiwan, and Intel still has an extremely long way to go before it catches up with TSMC in manufacturing. On the whole, TSMC’s competitive advantage is rock solid.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.