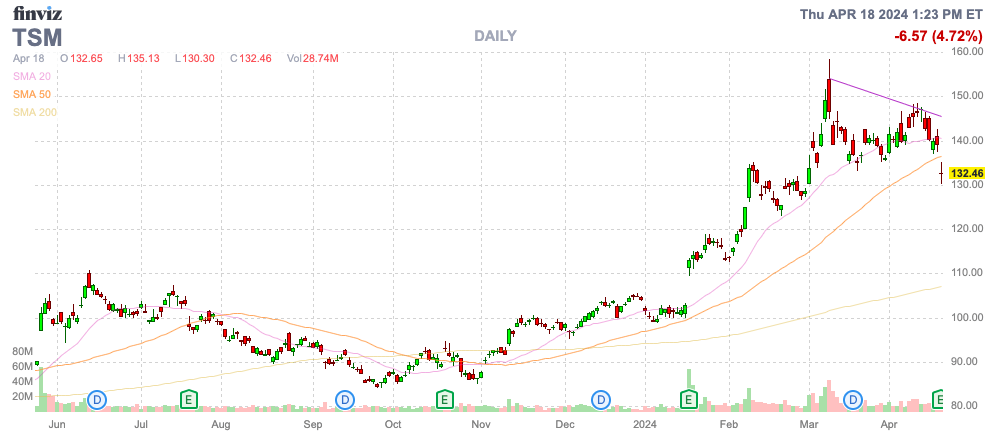

Taiwan Semiconductor Stock: Still Riding AI Boom With Strong Guidance

Summary:

- Taiwan Semiconductor is back in growth mode, with 12.9% sales growth and expectations to reach 20% growth rates in the next few years.

- The foundry company’s growth is being held back by smartphone revenues, but the HPC business is growing and the IoT and Automotive sectors are expected to improve.

- TSMC stock is down due to a downgrade in semiconductor growth, but the company maintains robust growth estimates and has limited competition in the HPC segment.

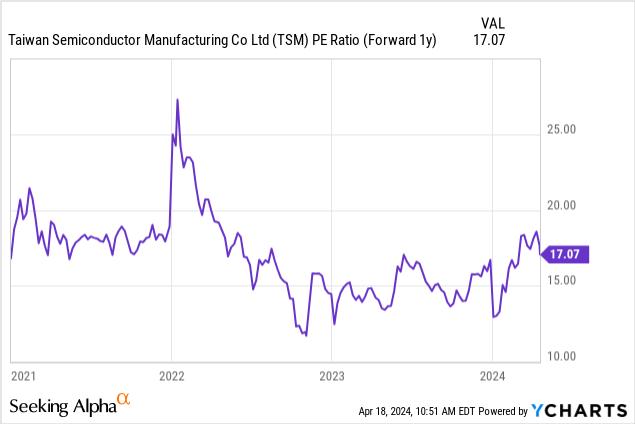

- TSM shares are cheap again at only 17x ’25 EPS targets with growth rates in excess of 20%.

BING-JHEN HONG

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM), aka TSMC, has slumped as the market enthusiasm for AI chips fizzles in the short term. The company foresees 20% growth rates long into the future, making the stock a value play here on dips. My investment thesis remains bullish on the chip company with strong growth prospects ahead.

Source: Finviz

Taiwan Semiconductor’s Growth Story Is Intact

TSMC is most definitely back in growth mode with the seasonally slow Q1’24 generating 12.9% sales growth based on US dollars and 16.5% growth in local currency. The chip company even reported a $0.06 EPS beat of $1.38.

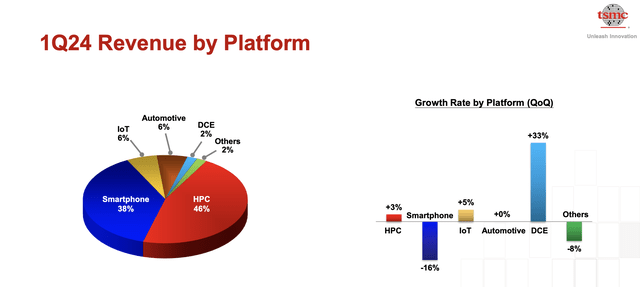

The foundry company faced a tough 2023, but TSMC is back in full growth mode with expectations to reach 20% growth rates for the next few years. The current growth rates are being held back due to 38% of quarterly revenues from smartphones. The HPC business is now up to 46% of sales, up from 43% last Q1.

Source: TSMC Q1’24 presentation

TSMC was even facing headwinds in IoT and Automotive sectors unlikely to repeat as the year goes one. Both sectors are long-term growth drivers, unlike the mature smartphone segment.

TSM stock is down 4% in early trading due to the chip company downgrading semiconductor growth for the year, though TSMC maintained robust growth estimates due to the AI demand. The key HPC sector is where all of the growth is occurring. The company has higher market share in the AI-enabled chips vs. traditional server CPUs, where Intel (INTC) makes chips for internal sales.

TSMC guided up Q2’24 revenue targets to $19.6 to $20.4 billion vs. consensus estimates at only $19.1 billion. The company reaffirmed full year revenue to increase by low to mid-20% growth rates, which is what should drive the market growth, not discussions of weak sales in areas where TSMC has lower market share.

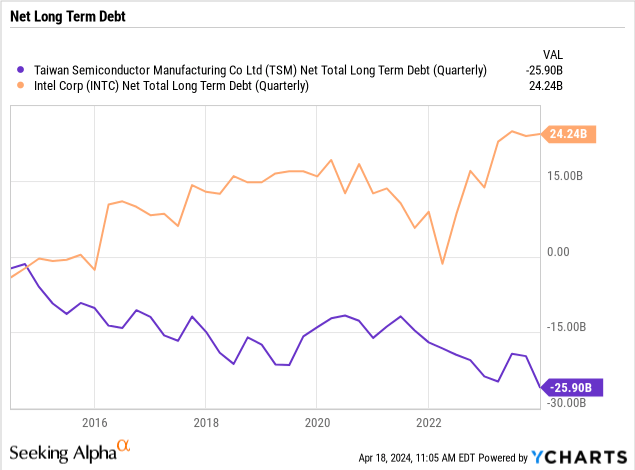

The foundry company has limited competition in the high-performance chips segment. Intel continues working toward catching up with TSMC on both the design and foundry side, but the chip giant doesn’t have the balance sheet to compete with TSMC effectively.

Intel recently announced that the foundry business was losing $7 billion annually with limited external customers. The other key is that TSMC has a massive net cash balance of $26 million, while Intel now has a net debt position of $24 billion.

TSMC still plans to spend $28 to $32 billion in capex this year, far above the levels of Intel. TSMC also got a $6.6 billion grant from the U.S. government to build the fabs in Arizona, along with the potential for a $5 billion loan.

The company has plans fabs in Arizona, Japan and Germany to shift chip production away from Taiwan and the threats of China. The Arizona plan now includes three fabs with the first fab reaching production volumes in 2026 and the second fab focused on the most advanced 2nm process starting in 2028.

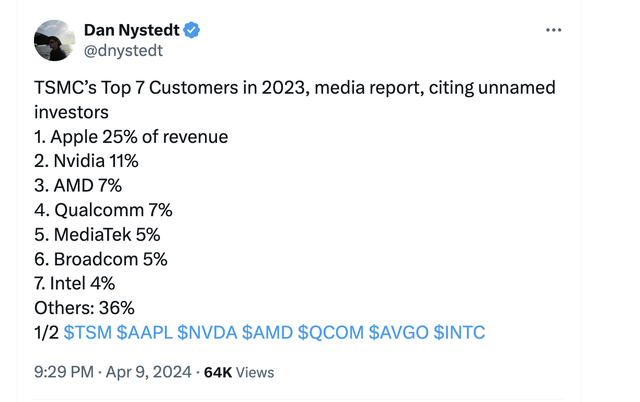

The big key is that TSMC called out AI demand as the major driver of growth. The fab company has the majority of customers that compete with Intel in AI chip design, providing the foundry company with a major moat. AMD (AMD), Nvidia (NVDA), Apple (AAPL), and Qualcomm (QCOM) all rely on TSMC for chip manufacturing and have competed with Intel on chip design for either PCs, smartphones and especially now AI chips.

Source: Twitter/X

TSM Stock Is Still Cheap

TSM stock has fallen back to $132 on negative views tied to the AI chip hype. TSMC is talking about Q2 sales growth of ~27% highlighting how the growth story remains intact, but the stock is no longer valued based on this growth after the dip from a high near $160.

TSMC now trades at only 17x 2025 EPS targets of $7.88. The chip company discussed some margin pressures from higher electricity costs in Taiwan and the shift to 3nm wafers this year, but the company will sail pass these small hiccups.

The Taiwan company still guides to 53% gross margins over the longer term with operating margins topping 40%. A company growing revenues at a 20% clip will easily generate massive profit growth whether or not margins are impacted by some higher costs.

TSMC forecasts sales growth topping 20%, yet the stock trades below 20x EPS targets. The market constantly makes this mistake at undervaluing the stock due to fears with China, but investors selling at $90 last year already missed the stock run to nearly $160 while worrying about a fear that would currently impact all of the largest semiconductor and tech stocks in the world reliant on chip production in Taiwan or Chinese manufacturing.

The current market weakness is likely to persist offering an opportunity to buy TSMC even cheaper. The stock is too good of a deal to pass up on with the balance sheet advantage and moat over a prime competitor like Intel.

Takeaway

The key investor takeaway is that TSMC is too cheap on this dip. The company has locked up the major AI chip leaders and the major risk is those customers losing market share to Intel, which appears highly unlikely.

Investors should use the weakness to load up on the premium chip foundry company or continue holding the stock for long-term gains to ride the AI wave.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.