Summary:

- Taiwan Semiconductor trades at a discount despite strong growth, driven by Nvidia’s booming AI GPU demand, with August sales up 33% YoY.

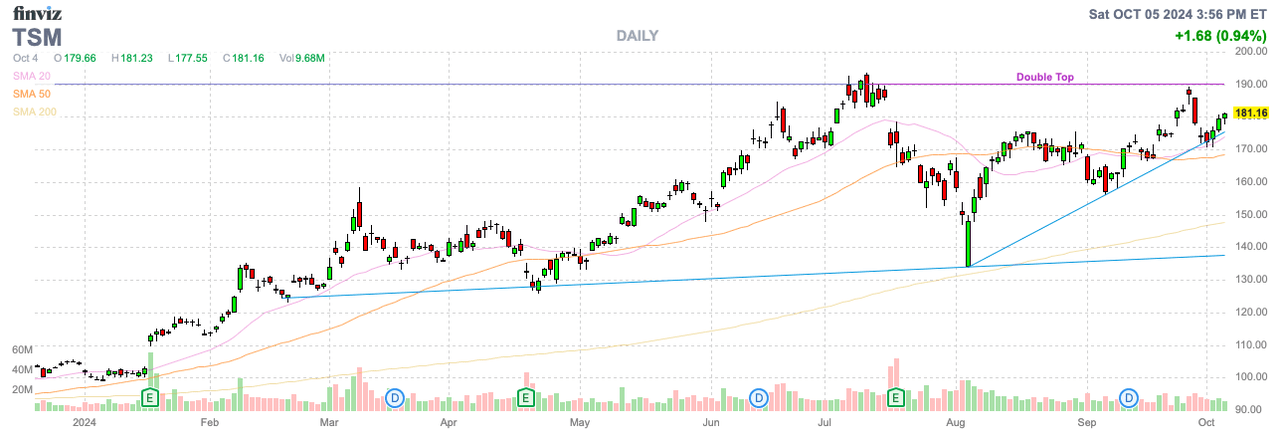

- Concerns over China-Taiwan tensions keep TSMC undervalued, yet the stock remains poised for a breakout past the $190 resistance.

- Apple’s flattish demand contrasts Nvidia’s explosive growth, positioning Nvidia to become TSMC’s top customer, possibly by 2025.

- The stock trades at only 22x 2025 EPS estimates, making TSMC a prime investment for capitalizing on the AI boom.

AlexSecret

With a top customer talking about insane demand, Taiwan Semiconductor Manufacturing Company Limited aka TSMC (NYSE:TSM) still trades at a massive discount. The stock has recently run into strong resistance at $190, but the news should help provide the final boost for TSMC to hit new all-time highs. My investment thesis remains very Bullish on the foundry company, with the stock trading at a discount due to fears regarding China invading Taiwan.

Big Q3 On The Way

TSMC has already reported huge numbers to start Q3. The foundry company just reported August sales surged to $7.8 billion, up 33% from August 2023.

The numbers follow TSMC reporting July sales were up an even more impressive 45% YoY. Analysts have the company on pace for $23.4 billion in Q3 sales for 38% growth.

The Nvidia (NVDA) CEO suggesting demand for AI GPUs remains strong only reinforces the concept of TSMC being on a path for very strong growth over the next year. On CNBC, CEO Jensen Huang made the statement that demand for the next-generation Blackwell GPU was seeing “insane” demand.

Nvidia keeps smashing analyst estimates, and the consensus is for 106% revenue growth this fiscal year. The forecast is for growth to top 40% in FY26, and TSMC will be a huge beneficiary of this strong growth.

The one major hiccup to the TSMC growth story is that iPhone demand actually appears weak. Apple (AAPL) is the largest foundry customer and their demand appears flattish, if not down, with the AI iPhone demand apparently weak.

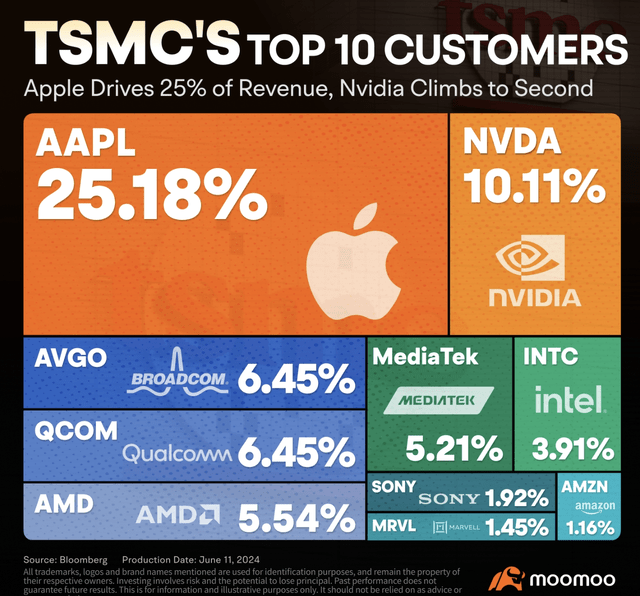

According to data, Apple was the biggest TSMC customer in 2023, accounting for $17.5 billion of sales. Nvidia had already jumped to 10% of sales, hitting $7.7 billion in sales last year.

Nvidia is on pace for sales to more than double in 2024 suggesting the chip company is on pace to catch up with Apple as the cop customer. Just assuming sales trends match spending at TSMC, Nvidia would spend at least $15.4 billion at TSMC in 2024 while Apple would be nearly flat with last year.

The key here is that Nvidia sales are far more important to TSMC at the end of 2024 compared to back at the start of 2023 when the GPU company was part of the pack. Also, Intel (INTC) was only a 3.9% customer in 2023, so the struggles at the foundry competitor only leaves more sales for customers, whether Nvidia, Qualcomm (QCOM) or Advanced Micro Devices (AMD).

TSMC is poised to continue capturing strong AI related growth. The incredible part is that the stock only trades at 22x 2025 EPS targets of $8.37. The strong AI growth could lead to the company beating the current analyst EPS targets, making the stock even cheaper.

Major Discount Remains

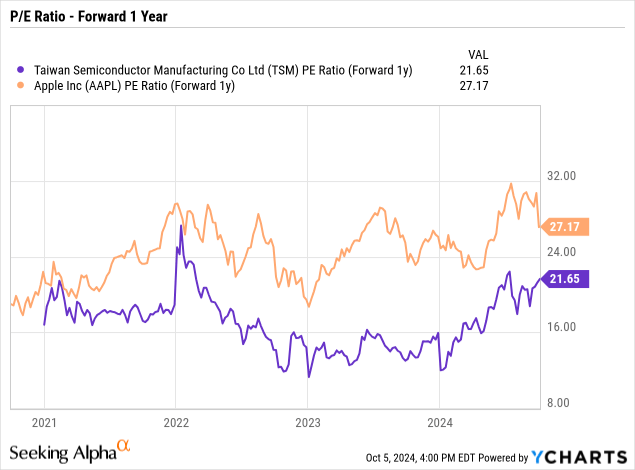

As discussed in prior research, TSMC still appears to trade at a major discount due to the location in Taiwan. The company just reported several months of revenues growing in excess of 30%, yet the stock still trades at a major discount to their top customer, who isn’t even growing.

If Apple was actually reporting strong growth, TSMC might top 40% growth right now with the release of the AI iPhone. The ironic part is that Apple still trades at 27x forward EPS targets despite the questions about growth.

Analysts are still forecasting Apple grows revenues at a solid 7% clip in the just started FY25, but the negative signs from the iPhone 16 launch aren’t supportive here. J.P. Morgan just downgraded iPhone 16 growth to just a few percentage points at just 148 million units.

Either way, though, TSMC has explosive growth and shouldn’t trade at a major discount to Apple. As mentioned above, the stock has run into resistance at $190 on a couple of occasions, and the demand trends remain supportive for the stock to break through this resistance.

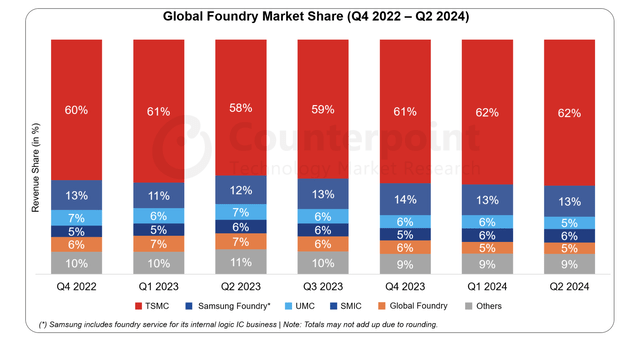

The global foundry market isn’t able to compete with TSMC. Samsung is a distant 13% market share compared to TSMC and Intel is in shambles with sales slumping this year.

Recently, Intel appeared a threat with an aggressive capex plan, but the chip company is struggling to regain market share. The company has even seen rumors of companies approaching the struggling business for a buyout, further suggesting Intel is nowhere close to catching up with the foundry leader.

The story definitely faces risks similar to other tech stocks. China invading Taiwan would slam the stock while indirectly impacting most of the tech world.

A long-term risk is for foundry competitors to gain a competitive advantage over TSMC. Both Intel and Samsung face difficult hurdles in getting TSMC customers to switch, considering both companies directly compete with Apple and other top customers.

The biggest risk to the stock story is a dramatic slowdown in AI demand. If Nvidia suddenly stopped growing, TSMC would see a dramatic dip in their growth rates and the stock would likely dip back to a lower valuation multiple.

Takeaway

The key investor takeaway is that TSMC remains in major growth mode with a leading customer seeing insane growth, while the stock remains exceptionally cheap. Investors should buy the stock looking for a major breakout of the recent resistance around $190. The foundry company appears to have several years of strong growth ahead due to booming AI demand, and the stock remains one of the cheapest ways to play the AI boom.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market to start October, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to start finding the best stocks with the potential to double and triple in the next few years.