Summary:

- TSMC warns about overall semiconductor market growth in 2024, but expects healthy growth for itself.

- TSMC’s share price fell by 5% following its earnings call, but later rebounded after strong revenue in April 2024.

- TSMC faces vulnerabilities due to industry fluctuations, competition, and geopolitical risks, but maintains a dominant position in the foundry market.

- TSMC is also vulnerable to semiconductor slowdown due to reliance on trailing edge chips and broader economic trends.

Jordan Siemens

In its Q1 2024 earnings call on April 18, Taiwan Semiconductor (NYSE:TSM) (or TSMC) CEO C. C. Wei warned about the overall semiconductor market growth in 2024, stating:

“We lowered our forecast for the 2024 overall semiconductor market, excluding memory, to increase by approximately 10% year-over-year, while foundry industry growth is now forecast to be mid- to high-teens percent, both are coming off the steep inventory correction and/or base of 2023. Having said that, we continue to expect 2024 to be a healthy growth year for TSMC.”

This subtle trend in revenue growth agrees with my assessment of the 2024 semiconductor revenue market when I noted in my March 4, 2024 Seeking Alpha article entitled “Applied Materials’ WFE Market Share Plummets 5% Below ASML In 2023.”

“For 2024 I see a recovery of WFE revenues, which dropped double digits in 2023, but because of pull-ins from 2024, primarily by Chinese semiconductor companies, this recover won’t happen until 2H 2024.”

My 2H recovery forecast was also confirmed during the Microchip Technology (MCHP) earnings call on May 6 when the company indicated it does not expect a return to sequential revenue growth until the September quarter.

But based on Wei’s earning call statement, TSMC’s share price fell by 5% following its earnings call, in a broader downturn seen across semiconductor and equipment stocks for a second day, influenced by disappointing results and guidance from ASML. The downturn was linked to a 26.9% quarter-over-quarter drop in revenue, attributed to decreased purchases of lithography systems by semiconductor manufacturers.

This share price drop reversed on May 10 after the company’s revenue for April 2024 surged 59.6% year-over-year. Revenue for the four months, January through April 2024, rose to NT$828.67B, rising 26.2% compared to the same period in 2023.

Analyzing the Semiconductor Slowdown That Impacted TSMC (and ASML)

TSMC, a leader in semiconductor manufacturing known for its advanced technology and strong market position, is still vulnerable to the industry’s cyclical nature, fluctuations in global demand, client-specific factors, technology transitions, competition, pricing pressures, and geopolitical risks.

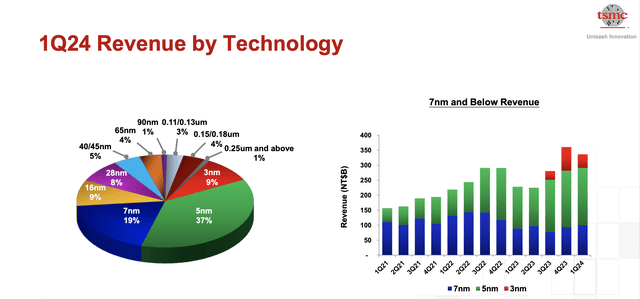

TSMC’s exposure to these vulnerabilities is evidenced by its product mix: the company leads in sub-7nm processing nodes, but also produces less advanced, trailing edge chips. In the first quarter, 35% of TSMC’s revenues came from the 16nm and above nodes, while the more advanced 3-7nm nodes accounted for 65% of revenues.

Chart 1

Importantly, these are the chips that are going into numerous electronic products, and not those used in high-performance processing such as AI, data centers, mobile computing, and high-performance computing (HPC)

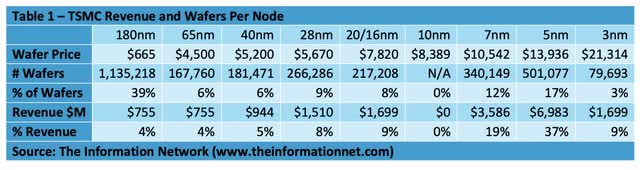

While the 3-7nm nodes represent 65% of total revenues, as noted above, it represents just 32% of completed total wafers. Table 1 shows calculated TSMC’s Revenues by node. But based on Wafer Price Per Node, I calculate the number of wafers produced by TSMC in Q1 2024.

The large number of wafers produced at Trailing nodes, also known as mature nodes or older-generation nodes, are used in less advanced compared to leading-edge nodes. These trailing nodes typically have larger transistor sizes and are used to manufacture chips that do not require the latest technology for performance or power efficiency.

According to CSIC:

“Chinese firms account for a growing share of global front-end manufacturing for mature semiconductors. This market share differs by node, with around 27 percent for 28-65 nm process node production, falling to around 20 percent for 90-180 nm.”

Semiconductor Industry Slows Amid Economic Uncertainties

The global economic landscape is currently marred by uncertainties including inflationary pressures, fluctuating interest rates, and unpredictable fiscal policies. These factors undermine consumer and business confidence, potentially leading to more conservative spending patterns. This shift in behavior can negatively affect the demand for electronic devices and semiconductors, pointing towards a looming slowdown in the chip industry.

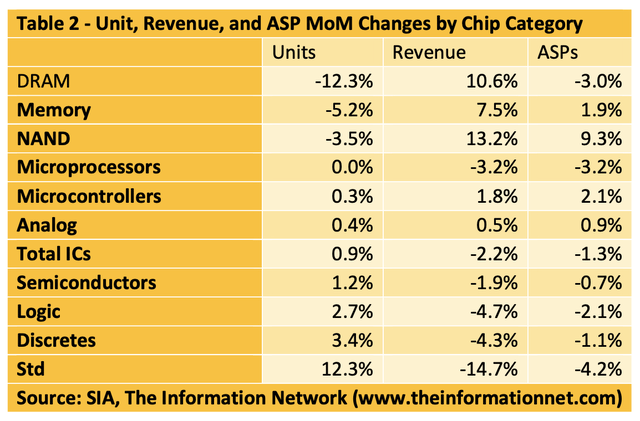

Recent data from March 2024, using Semiconductor Industry Association (“SIA”) classifications, reveals a slowdown in the semiconductor and integrated circuits (IC) sectors, and a slight downturn in memory. According to the statistics presented in Table 2, there is a visible month-over-month decline in production across almost all categories.

The details of Table 2 illustrate that Memory experienced the most significant reduction, with a 5.2% decrease in units. Overall, the IC group—which includes microcontrollers, microprocessors, analog devices, logic devices, and memory—saw just a 0.9% increase in units.

This data underscores the impact of economic uncertainties on the semiconductor industry, with reduced production volumes hinting at potential challenges ahead.

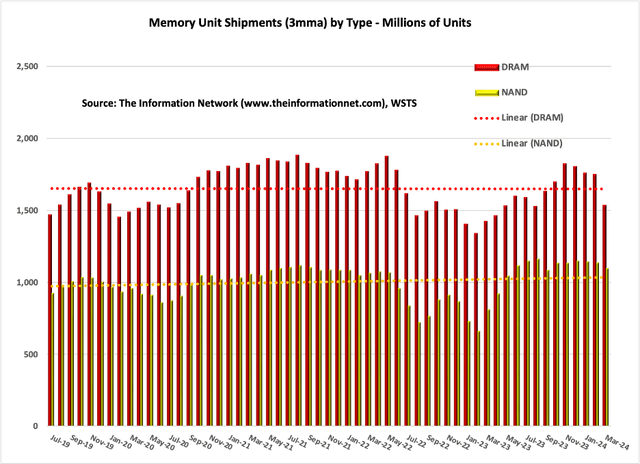

In Chart 2, I show Memory Units change between July 2019 and March 2024.

Chart 2

Key Insights for Investors in the Semiconductor Sector

In 2023, TSMC served 528 customers and manufactured 11,895 products for various applications, according to the company.

While most of the press surrounding TSMC is centered on its leading-edge nodes, making AI chips for Nvidia (NVDA) or processor chips for Apple (AAPL), two of its largest customers, there are another 500 companies that TSMC makes trailing-edge nodes for. Most of these semiconductor manufacturers are located in China, according to The Information Network’s report entitled Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends. However, TSMC is facing increased competition from Chinese Foundries, particularly SMIC and Hua Hong.

In the first quarter, shipments of 3-nanometer accounted for 9% of total wafer revenue; 5-nanometer accounted for 37%; 7-nanometer accounted for 19%. Advanced technologies, defined as 7- nanometer and more advanced technologies, accounted for 65% of total wafer revenue.

Hence, we see a bifurcation in the semiconductor industry, strong growth in the leading-edge market and a slowdown in trailing-edge, impacted by macroeconomic and geopolitical uncertainty persists, potentially further weighing on consumer sentiment and end-market demand.

On their earnings call, TSMC revised its 2024 forecast for the overall semiconductor market, excluding memory, predicting a growth of about 10% year-over-year. This adjustment is a response to a steep inventory correction from 2023. Additionally, growth for the foundry industry specifically is now expected to be in the mid- to high-teens percentage range, also reflecting the impact of the inventory adjustments from the previous year.

Foundry Dominance

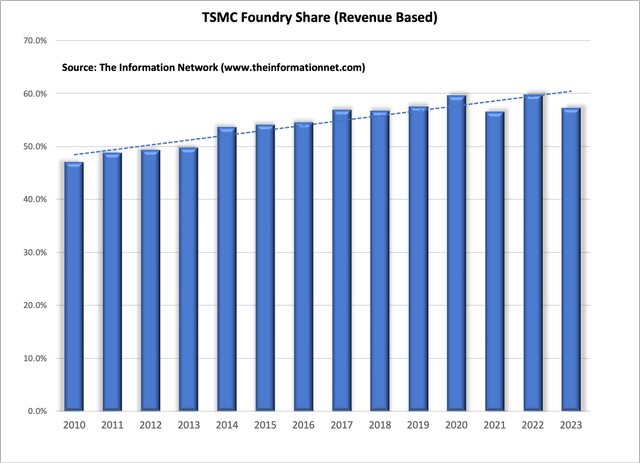

TSMC continues to dominate the foundry market with a 57% share in 2023, down slightly from a 60% share in 2022. It continues to push the envelope in small nodes, even though it is taking manpower and financial resources, as shown in Chart 4.

Chart 4

N3 is taking longer time to reach the corporate margin than the other nodes like N5 or N7. N5 or N7 before, it was like 8 to 10 quarters to reach the corporate. But for N3, ASML thinks it will take about 10 to 12 quarters. And this is probably because N3 process complexity has increased.

There has been concern that TSMC doesn’t have the capacity to meet demand from AMD. However, this is not the case at the fabrication foundry, but is the case for TSMC’s packaging foundry. I discussed this in a February 13, 2024 Seeking Alpha article entitled “Intel’s Secret Weapon.”

What has happened at the fabrication foundry is that TSMC has adjusted capacity utilization, due to the semiconductor slowdown in 2023. In Q3 2022, TSMC’s capacity utilization was at 111%, meaning demand was 11% greater than supply. In Q4 2022, utilization started dropping until it reached a low of 73% in Q3 2023 before increasing to 76% in Q4 2023. This means that currently supply is outpacing demand by 24%, and in principle, in Q4, 24% of fabs were idle.

This oversupply was in trailing-edge chips (>20nm), which dropped to 35% in Q1 2024 fringe 37% of revenues in Q4 2023 and from 41% in Q3 2023. This is the key for the company, as it continues to spend for leading-edge technology – the move to 3nm and 2nm technology.

In response, TSMC cut capex towards the lower end of the 32% to 36% range for 2023 because of the overhang of slow sales to PC and Smartphones. In addition, TSMC has a strategy so that some of its N3 capacity can be supported by N5 tools, enabling higher capital efficiency without WFE spend. TSMC’s 2024 capex plans are $28 billion to $32 billion.

TSMC is my No. 1 semiconductor stock for 2024. Macro headwinds will impact the company, but less than other foundries. TSMC is still a solid long-term investment as it dominates the foundry model.

I rate TSMC a Buy as micro factors appear to be improving, and the Company continues to dominate the foundry and <7nm node sectors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free 2 week trial now.