Summary:

- The rapid scaling of AI infrastructure by major tech companies has led to challenges in estimating AI investment costs and returns for enterprises, but this is temporary, in my view.

- Despite TSMC’s crucial role in AI development, Nvidia is attracting more investor attention due to political uncertainties surrounding Taiwan.

- TSMC’s revenue and earnings growth are strong, with stable margins, making it a sound investment for those who see the potential for AI growth.

- TSMC’s management is confident in achieving higher gross margins, especially with high utilization rates, indicating robust future performance.

BING-JHEN HONG

The biggest challenge to Artificial Intelligence or AI today is the inability of many organizations to estimate the returns on their AI investments. I believe that’s a temporary phase that was born of the rapid scaling up of AI infrastructure by cloud service providers like Amazon’s AWS (AMZN), Microsoft Corp (MSFT), et al, as well as super-premium smartphone incumbents like Apple Inc. (AAPL) and their respective pushes into the realm of artificial intelligence. The rest of the enterprise world was taken by surprise at how generative AI grew to become industry-agnostically ubiquitous. I suppose that’s one of the reasons many analysts and investors feel that AI is a bubble or a fad, but that couldn’t be further from the truth, in my opinion.

At the core of this apparent frenzy is the need for faster compute power, and that essentially comes from surprisingly few sources, the dominant one being the Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM), or TSMC. As such, one would assume that TSMC would be growing much faster than the likes of Nvidia Corp. (NVDA), which accounted for about 11% of its 2023 revenues, based on analyst estimates. I suspect that’s significantly higher now, as evidenced by Nvidia’s rapid revenue growth over the past two quarters.

My point, however, is that the investments seem to have flowed to the designer and provider of the finished GPU goods, as it were, rather than the manufacturer of the underlying processors, which is TSMC.

On the surface, it would appear that even though TSMC is the true enabler of HPC or high-performance computing, advanced smartphone chips, and powerful IoT device circuitry, Nvidia seems to be getting all the attention from investors.

Of course, a major headwind for TSMC in terms of attracting investor dollars in the United States is the fact that it’s a big bet on the political status of Taiwan. I prefer staying away from political discussions, but suffice it to say that U.S. investors are still unsure of TSMC because of the ‘ambience of political uncertainty’ surrounding it, and the resulting implications, should things tip in favor of one side over the other, as it were.

Political considerations aside, my opinion is that TSMC’s importance to the development of AI as an industry cannot be overstated. That’s why I’m surprised when I look at its fundamentals vs its valuation multiples, particularly on a forward earnings basis now that revenue growth is firmly back on track.

As such, I’d like to dive into discussing its core strengths, and what makes it a sound investment for any investor who takes AI seriously – not as a bubble that will suddenly pop, nor as a fad that will gradually fade away into oblivion. To that end, I present my bullish arguments for TSMC.

Revenue Growth and Gross Margin Stability

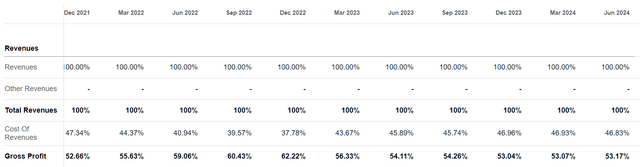

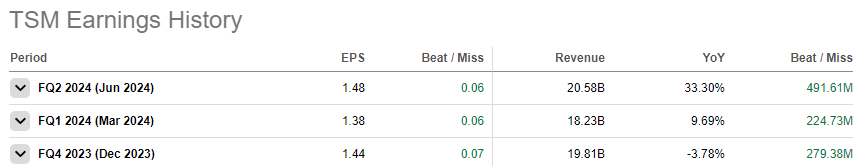

If you look at the cadence of revenue growth over the past three quarters, it’s amply clear that TSMC is dealing with high levels of demand from its customers.

SA

You’ll also notice that earnings growth has been in lock step with revenue growth, which is a sign of stable margins all the way down the P&L. If you look at little closer at the income statement, that stability at the gross margin level is clear, and management seems confident that +53% is the sweet spot for now, unless their utilization rates remain at the current high levels, in which case there’s a clear trajectory back to the +60% levels we saw in the final two quarters of FY 2022.

Per CFO Wendell Huang at the Q2 2024 earnings call, in response to an analyst question regarding reclaiming the higher gross margin levels seen in FY 2022:

We’re repeating and confident to say that 53% and higher gross margin is achievable.

Yes, if we have a very high utilization rate, everything else stays the same, possible.

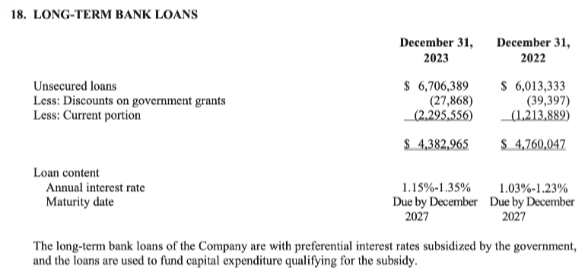

That said, we’ll definitely see some margin pressure from the new facilities in Arizona (TSMC Arizona) once Phase 1 production begins next year, but the positive here is that the initial capital investment will get an offset from the CHIPS and Science Act funding. So far, several countries have committed to funding corporations that can boost their domestic semiconductor manufacturing capabilities, and TSMC will be a significant beneficiary of those subsidies across the U.S., Europe, China, Japan, and South Korea. In some cases, it’s outright funding, while in others, it’s in the form of “preferential interest rates” as low as 1.03%.

TSMC 2023 Annual Report

Still on gross margins, there’s every indication that demand is high, of course, but it’s apparent that this demand is shifting toward smaller nodes, which put additional pressure on the company’s cost of revenue. One example that the CFO cited on the Q2 call was the high demand for N3 that is forcing a conversion from N5 tooling:

We are not ruling out the possibility of further converting more N5 to N3 because we’re seeing very strong demand for N3. If we decided to do that, of course, there will be a negative impact on the year that we do that, but in the future years, that will be beneficial. We continue to face cost challenges, inflation cost challenges, including electricity prices, et cetera.

Putting all those perspectives together tells me the company is firm on holding ground at the 53% gross margin level, at a minimum. Once the investment years are lapped and utilization rates improve on new fab facilities, particularly in Arizona and Japan, both of which are slated to go into production in 2025, we could see a gradual move toward the 60% level. One important takeaway is that management expects Q3 2024 gross margins to come in at 54.5%, based on productivity gains and higher utilization rates over H2 2024. There’s likely to be a bit of an offset from additional conversions from N5 to N3, but it’s good to note that the net effect will be positive.

Bottom-line Growth

The cascade effect of higher revenues and steady (and improving) gross margins is clearly impacting the bottom line in a positive way. Over the two most recent quarters, net income has increased by 4% and 30% YoY, respectively. When you compare that with YoY gross profit increases of 5% and 32%, there would appear to be a lack of any operating leverage on the income statement. However, much of that was from the gradual drop in gross margins not being fully offset by improvements at the operating level. Moreover, TSMC’s tax expenses have risen from 6.4% of revenue in Q4 2023 to 7% in Q1 2024 and 8.7% in Q2 2024.

Nevertheless, it’s a positive that net income growth is at a very strong 30% YoY for the second quarter, and I expect that the stronger cyclical demand from the smartphone segment, as well as higher utilization rates, will boost the top and bottom lines over the next two quarters, bridging the company’s growth prospects to 2025 when the new fabs in the U.S. and Japan start volume production and add momentum to the current growth rates.

The Question of Value

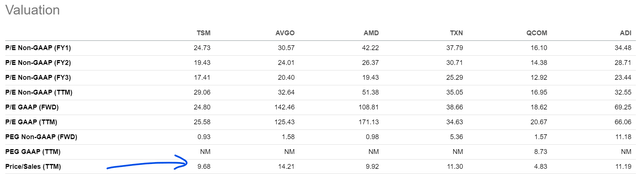

When you look at TSMC’s valuation metrics, you get a mixed picture. On the one hand, we can see adjusted-earnings-based multiples falling from 29x in the TTM period to 24.7x in the forward period. That indicates a growing bottom line with room for the share price to catch up. It’s still a tad higher than the 23.2x multiple for the sector median, but I think that’s a very reasonable price to pay for a company with a majority market share in a very niche but extremely vital area of technological development.

Investors should also consider the fact that TSMC is spreading its production out to several strategic off-shore locations that will eventually make it a truly global company. Admittedly, that buildout will take a few years, but the way I look at it is that the company is attempting to gradually moving away from the political overhang that has made it a risky investment thus far. In other words, the risk-reward dynamic will eventually shift toward greater rewards and lower risk levels, and that represents a significant long-term upside.

From a trailing revenue multiple perspective, it would seem that 9.7x (against a sector median of under 3x) for TSM is expensive, but I beg to differ. Take a step back and look at how the stock’s sales multiple has disconnected from actual underlying revenue growth, and it should be quite clear that there’s plenty of upside remaining.

The volatility factor has certainly impacted the stock’s recent attractiveness to investors, but there’s no denying that it was strongly on the path to a more realistic valuation at higher levels. Still, the question remains as to whether or not investors are willing to rerate the stock to a more appropriate level closer to 11x to 12x, which translates to a potential upside of around 23% at the optimistic end and at least 13% at the lower end.

Regardless of that, even if investor enthusiasm remains muted, if the current 9.7x multiple holds through 2025, at a projected revenue of $108.4 billion for FY 2025 (per analyst consensus estimates on SA), we should still be able to see the market cap increase from the current $728 billion to $1.05 trillion for a 44% increase. If my upside assumptions are fully realized, we could be looking at a market cap in excess of $1.3 trillion by the end of FY 2025. Highly optimistic? Perhaps, but even a much more conservative 7x P/S multiple would leave you with a 4% upside if revenue for FY 2025 hits that $108.4 billion estimate.

TSM Valuation – Peer Comparison

Truth be told, I don’t see TSM’s sales multiple going anywhere near the 7x level, and when you look at a mixed basket of semi peers, that becomes evident. Aside from Qualcomm (QCOM), which seems to be struggling with the overhang from a possible loss from a major customer transitioning to its own in-house chips, most are currently trading around the 10x to 12x range.

Please note that the risks are considerable. Any drop in its customers’ capex spending due to interest rates remaining high through 2025 is likely to impact its top line. While the chances of that are remote, considering the cash-rich clientele that TSMC primarily caters to, it’s certainly a material risk to my thesis. Another major risk is the still-uncertain political overhang that could take years to nullify, if at all. For now, the balance is precarious, and investors would do well to take that into consideration.

On balance, though, I’m confident enough in TSMC’s future growth prospects to recommend a Buy for TSM at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.