Summary:

- TSMC reported strong sales growth of over 40% YoY in 2Q24, exceeding expectations and indicating a solid earnings report.

- Majority of TSMC’s net sales come from high-performance computing industry, with demand for 5 nanometer chips driving growth.

- TSMC’s accelerating sales momentum and potential for record-breaking earnings in 2Q24 make it an attractive investment opportunity.

SweetBunFactory

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) just released its sales report for the most of June and the chip company is crushing it.

The sales report gives investors an early view into the books of Taiwan Semiconductor Manufacturing’s 2Q and investors can expect a strong earnings presentation, to say the least.

With more than 40% sales growth YoY in 2Q24, the chip company is poised for a solid earnings report next week and estimates may get reset to the upside in the meantime.

Though TSMC is selling at all-time highs, I think the stock is not too expensive when taking into account the company’s accelerating sales growth.

TSMC: A Chip Maker With Substantial Sales Momentum

Taiwan Semiconductor Manufacturing is a semiconductor foundry with manufacturing facilities in China, Taiwan and the United States. As a leading fab, TSM is manufacturing semiconductors for its customers in the electronics, automotive, IoT, smartphone and HPC (high-performance computing) industries.

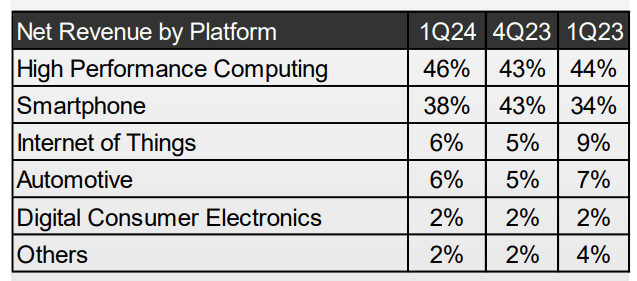

High-performance computing is in such high demand of semiconductors that the majority of Taiwan Semiconductor Manufacturing’s net sales come from this industry: 46% of net sales, a percentage that increased 3 percentage points QoQ in 1Q24, is driven by the high-performance computing industry which is typically understood to mean data centers.

Net Revenue By Platform (Taiwan Semiconductor Manufacturing Company Limited)

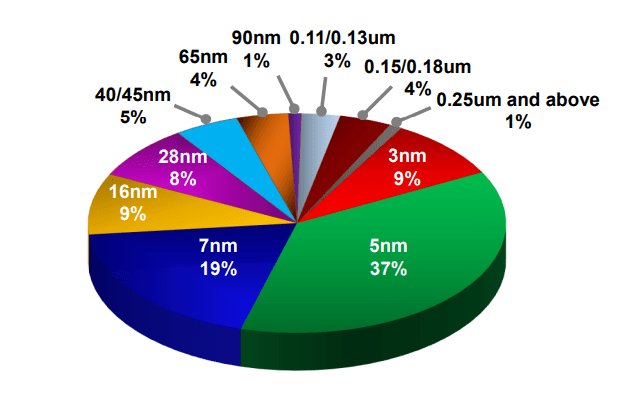

The majority of net sales come from Taiwan Semiconductor Manufacturing’s 5 nanometer and 7 nanometer process technologies, which accounted for a whopping 56% of the company’s net sales in the first quarter. The company’s 5 nanometer nodes represent 37% of net sales and are primarily utilized as AI chips.

Taiwan Semiconductor Net Sales (Taiwan Semiconductor Manufacturing Company Limited)

Demand for 5 nano-meter chips is skyrocketing, and HPC is the driving factor here, for the most part.

In the first quarter, TSM’s net sales decreased 5.3% QoQ due to what the company described as seasonality in smartphone demand which was offset by strength in HPC. In total, Taiwan Semiconductor Manufacturing produced NT$592.64 million in 1Q24 sales.

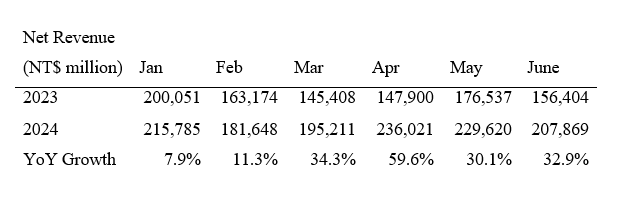

According to TSM’s sales update for the second quarter, which was released just a week before the company’s second quarter earnings are due, the chip company produced NT$207.87 million in net sales in June and NT$673.51 million in 2Q24.

The YoY growth rate for June was 32.9% and June was the fourth month in a row in which sales growth exceeded 30%. TSM’s quarterly sales went up by 40.1%, meaning the AI boom is poised to lead to record results for Taiwan Semiconductor Manufacturing’s 2Q earnings which will be released on July 18, 2024.

Taiwan Semiconductor Manufacturing’s 40% sales growth rate in 2Q24 also crushed the average Street estimate of 36% and it shows that TSM’s business is continuing to accelerate, and not slowing down, as some investors might have feared.

As a matter of fact, net sales in 1Q24 were up only 16.5% YoY, so the chip company is poised to report a more than doubling of its sales growth next week, compared to 1Q24.

TSM’s strong sales report is thus likely to see estimate correction momentum that in its favor and that could push the stock to reach new highs ahead of the earnings release.

Net Revenue (TSM Net Revenue Report)

TSM Profit Upside And Multiple

Ahead of the company’s second quarter earnings, the market may reset its profit estimates given the strength of TSM’s robust sales growth, continuing AI boom and probably blockbuster earnings release. Presently, the market models profits of $1.41 per share for Taiwan Semiconductor Manufacturing, which would reflect YoY growth of 24%.

EPS Estimate (Taiwan Semiconductor Manufacturing Company Limited)

With $7.98 per share anticipated in 2025 earnings, TSM is presently valued at a 23.8x profit multiple. The valuation is based on the assumption that Taiwan Semiconductor Manufacturing will generate 26% profit growth YoY in the coming year.

Nvidia Corp. (NVDA) is selling for 36.5x leading profits and the chip company is anticipated to produce 36% profit growth YoY next year. Micron Technology Inc. (MU) which profits from the AI boom by supplying high bandwidth memory to companies like Nvidia is selling for a profit multiple of 13.6x. This multiple implies a profit growth estimate of 780% next year.

Micron Technology, in my view, is particularly a steal, but TSM is also looking really nice here from a profit growth and valuation angle.

Why The Investment Thesis Might Disappoint

Taiwan Semiconductor Manufacturing is growing its sales at break-neck speed and the sales report for June, which was just released, indicates that TSM is garnering momentum, driven by demand for semiconductors by the high-performance computing industry.

Moderating growth in high-performance computing and data centers would thus be a big hurdle for Taiwan Semiconductor Manufacturing and could throw the investment thesis off balance.

My Conclusion

The AI boom is not going anywhere and TSM just proved it. Taiwan Semiconductor Manufacturing’s pre-release of June’s sales figures is showing a notable acceleration of the chip company’s sales growth QoQ.

With a 40% jump in 2Q24 sales compared to the year ago period, I think that TSM is going to see new profit estimate corrections that they could act as a catalyst to drive Taiwan Semiconductor Manufacturing’s stock to new all-time highs.

Obviously, we can infer from the pre-release that Taiwan Semiconductor Manufacturing is headed for blockbuster 2Q earnings release next week and I have, thus, opened up a long position on the chip company.

I think that TSM, taking into account its significant sales momentum and sales growth acceleration QoQ, is not too expensive, and the stock has room to run higher.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.