Summary:

- Tesla, Inc. remains profitable despite sector struggles, with plans to launch affordable vehicles in 2025 and expecting 20-30% vehicle sales growth.

- The company is reshaping its business model with a focus on autonomous ride-hailing and energy storage, driven by FSD and Megapack production.

- Lower interest rates and increased energy demand from tech firms could boost sales and prompt revenue estimate revisions, enhancing TSLA’s growth prospects.

- Tesla’s valuation reflects its dual identity as a profitable EV maker and an AI-driven company, with significant potential in FSD and energy segments.

JHVEPhoto

In the Q3 earnings release, Tesla, Inc. (NASDAQ:TSLA) noted that the sector, especially in electric vehicles, is struggling with declining order volumes. However, Tesla has remained profitable during this period. There are bright spots among the company’s business segments. The company highlighted, for instance, the higher demand for energy storage solutions and improved margins. It intends to launch more affordable vehicles in the first half of 2025, while volume production for the Cybercab is poised to start in 2026. The management team expects vehicle sales growth for 2025 to be around 20% to 30%.

We will keep tracking how estimates evolve going forward. It will be interesting to see if there is a wave of revisions in the following weeks. There definitely seems to be room for adjustments, and the lower interest rate regime might also help – that is our thesis at this moment.

Business model reshaping narrative

The company seems to be increasingly looking at autonomy as the future of its business models. The Cybercab service is being touted more frequently as a major catalyst for the company. For that to happen, the company needs to come up with an FSD version that is unequivocally better than humans. Executives point to a 1000x improvement in critical interventions as the milestone that will allow the FSD software to be reliable in real-world use.

There is a lot of uncertainty regarding the autonomous ride-hailing service that the company intends to launch. We anticipate benefits accruing from this in the form of Full Self-Driving (“FSD”) paid subscriptions, but there will be significant regulatory scrutiny and uncertainty. Therefore, I wouldn’t count on any substantial additional revenue from ride-hailing in the upcoming years. The Optimus robot is likely even more years away from providing any meaningful revenue stream. Yes, it might become a very interesting part of the company, but the path to high-volume production of a robot with a broad range of commercially viable use cases will likely take years to become a reality.

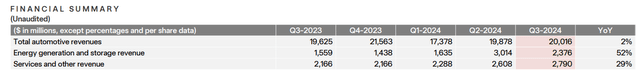

Nevertheless, there was higher service revenue recognition coming from Tesla’s earnings in the 3rd quarter. FSD revenue recognition added $326 million to the top line during the quarter. The energy segment showed very appealing growth too. The Lathrop Megapack factory is now producing 200 Megapacks per week, which means close to 40 gigawatt-hours per year. They disclosed aims to reach 100 GWh of stationary storage globally per year in the near future.

Catalysts going forward

More than the mentioned autonomy-related developments, I think the most intriguing developments in the near future will be the decline in interest rates and the demand for energy that seems to be coming from large tech firms.

Interest rates have a significant impact on purchase decisions by consumers. They tend to focus on monthly payments, and lowering interest rates is akin to price cuts for the whole industry.

On the other hand, large technology companies racing to deploy energy-hungry AI computing power will need reliable energy supplies. They have cut deals to buy nuclear power, but while some of these will take years to come online, purchasing power packs to store renewables might provide a bridge in the short to medium term.

This might be complemented by an affordable model starting at under $30 thousand with incentives, but Tesla will not go after a $25 thousand non-robotaxi model, the management revealed in the earnings call.

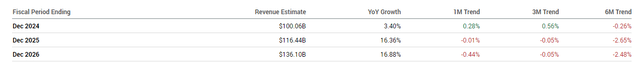

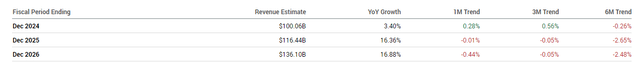

Together, the lower rates and lower-priced models could unlock a new sales burst and prompt revenue estimate revisions by several analysts. So far, the numbers do not reflect the management team’s optimistic outlook.

Other products

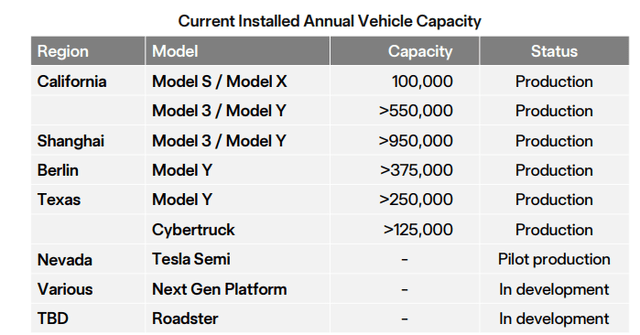

The company also updated the roadmap for new production capacity. It plans to start pilot production of the Semi-Truck in the second half of 2025, with volume production starting in 2026. Management insists that the total cost of ownership of this product will be lower than conventional trucks and will have the necessary hardware for FSD, which might be a game-changer for driving safety.

Tesla believes that the energy business will keep growing, driven by the ramp-up in the Shanghai Megafactory. The factory is expected to produce more Megapacks to support further storage deployments. The company is very optimistic regarding the 4680 battery due to its increased energy density and lower manufacturing costs, which should also help with the energy storage business. Another tailwind might come from the company’s refinery in Texas is about to start production, ensuring a steady supply of battery-grade lithium hydroxide.

Financials

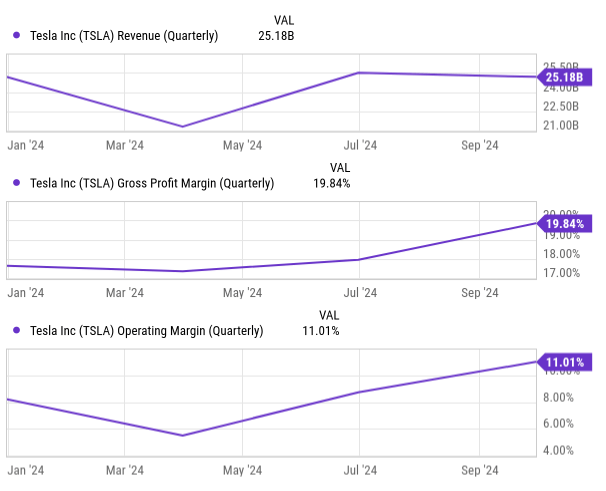

For all the talk about new products and revenue streams, Tesla’s revenues have been stagnant in 2024. This is not specific to the company, as other car manufacturers have struggled with the cooling auto market.

YCharts

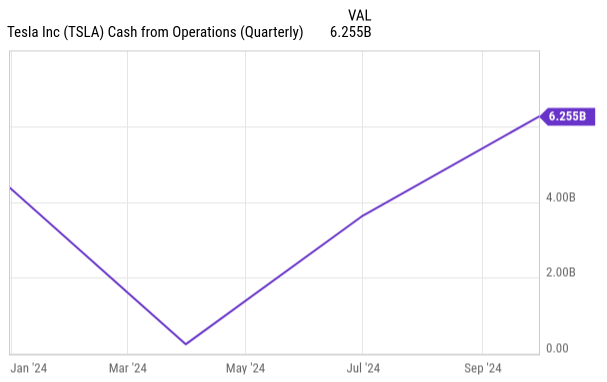

However, Tesla has compensated for what looks like a bump in the road for top-line growth with greater efficiency. The improvement in gross margin and operating margin reflects this, helping cash flow from operations to reach very interesting levels.

YCharts

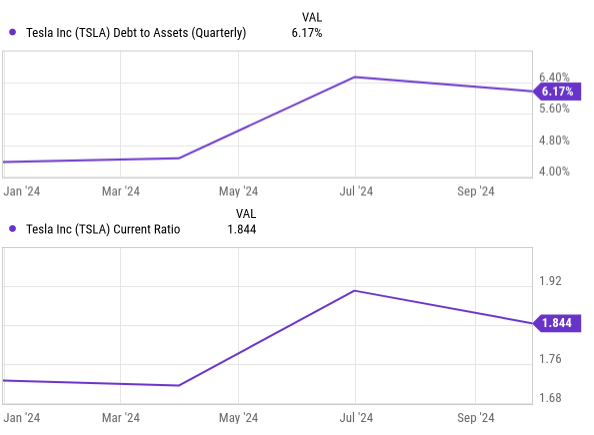

The balance sheet remains in excellent shape, with low debt levels and an adequate current ratio.

YCharts

Valuation

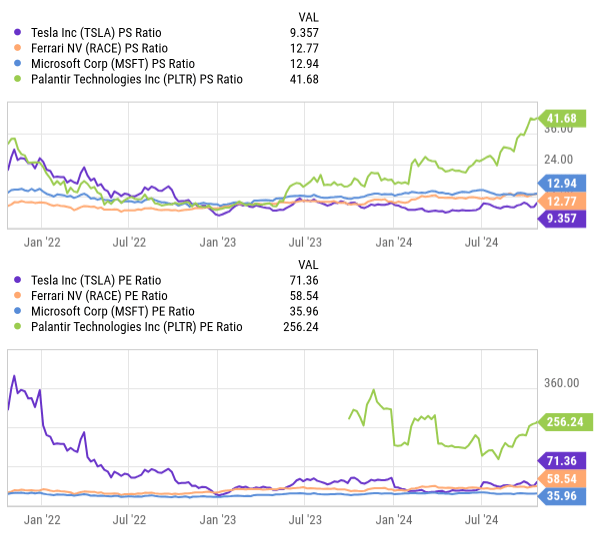

Tesla’s valuation is challenging to frame, as it is perceived very differently from other auto manufacturers. We argue for the following breakdown: Tesla is viewed as one of the few profitable EV makers in a supply-constrained field, and on the other hand, it is perceived as one of the few technology companies with an AI real-world application (autonomous driving). For these reasons, we can argue that companies like Ferrari N.V. (RACE), Palantir Technologies Inc. (PLTR), and Microsoft Corporation (MSFT) are more apt peers than traditional automakers like Ford Motor Company (F) or Toyota Motor Corporation (TM).

YCharts

Looking at the valuations of these peers, there is room for Tesla to expand its multiples. My thesis is that with an acceleration of Tesla’s revenues, we could see an approximation of Microsoft’s sales multiple. We could see further expansion if the FSD segment gives positive indications. However, the short-term test would be to see the sales valuation converge with Microsoft’s.

Risks

Manufacturing at scale and profitably is a difficult endeavor. Periods of cooling sales add to logistical complexity, making it harder to dilute fixed costs, and companies tend to see a decline in profits. Furthermore, automobiles are expensive acquisitions, often financed by credit, making the industry sensitive to high-rate environments. Rates now seem to be coming down, but a possible resurgence in inflation might change the Fed’s stance, posing a risk to the company and our thesis.

Tesla also has some highly differentiated product designs, like the Cybertruck. While this has served them well so far, in the future, there is always the risk of some product flops. Given long development cycles in the auto industry, a flop for a company with relatively few mass-market models could have a sizable impact on its bottom line.

Additionally, investors seem to rely heavily on future business segments that are unconventional for automakers and untested in real-world markets. The FSD, Optimus Robot, or Cybercab represent ambitious endeavors, with outcomes that cannot be completely assured.

Tesla has historically succeeded with bold goals, but investors should remember that success is not guaranteed.

Conclusion

Tesla entered its earnings release with modest estimates, and the company’s outlook for next year should prompt a wave of analyst revisions. The current Fed interest rate tilt provides some support for higher sales in the upcoming year.

We can also expect demand for energy storage to drive growth in Tesla’s energy segment, with the Shanghai facility positioned to meet new demand. The ability to also be competitive in this segment comes from the vertical integration approach to battery production. This has allowed them to better control logistics, avoiding bottlenecks and grinding out efficiencies. On the other hand, it has also allowed Tesla to play the “game of pennies” and relentlessly shave off costs from components.

However, given the current valuation, the company is clearly valued at more than a very efficient automaker. When investors pay for Tesla, they are also paying for the option to own an AI-driven company. The company seems to be progressing fast in its autonomous endeavors, with the FSD expected to be approved in Texas and California in 2024. The Robotaxi and FSD subscription models could be game changers for the company, in the same way cloud computing was a game changer for Amazon. Nevertheless, given the time remaining until the materialization of these endeavors, we should discount part of these prospects.

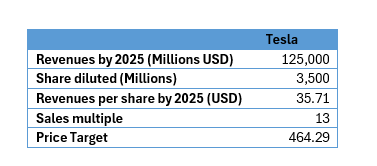

At the current stage, Tesla is very profitable as it is. I believe the market will test the growth thesis for Tesla once more, supported by improvements in the core business segments but also by the potential of its other more speculative endeavors. If Tesla meets its management outlook of $125 billion at the midpoint, and the market revisits its growth story, we could see the following:

Author’s computations

This scenario offers a potential 73.8% annual return over the next 12 months, presenting a compelling risk-return opportunity. Given Tesla’s share price has been relatively stagnant over the past three years, this may be the moment to test it.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.