Summary:

- Target is a massive company, but not massive enough to no longer have space to grow.

- This solid American business has shown resilience during the pandemic, supply chain crisis, and consumer fears, with an impressive track record of beating earnings estimates.

- Their marketing expertise helps them reach the upper middle class and retain a loyal and very attractive customer base.

- With solid margins and a very safe dividend supported by 55 years of dividend growth, the 2.96% dividend yield makes it an interesting stock for safe and reliable income.

- Overall, this strong business is an excellent stock for safety and potential growth.

Vuk Saric/E+ via Getty Images

Investment Thesis

Target Corporation (NYSE:TGT) is a giant, but even so, it still has plenty of room to grow and has proven resilience in adverse conditions, making it a bulwark company. With a very efficient business model, great marketing, robust brand recognition, and a solid and safe dividend of 2.96% and cheaply valued relative to its competitors, I consider this a great opportunity for buying a solid stock.

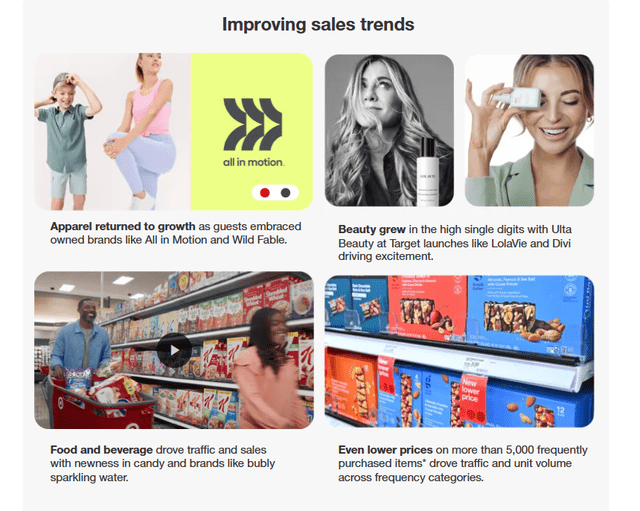

Target In Recent Years

Target is one of the leading retail companies not only in the U.S. but also in the world, with 1,956 locations and a history stretching back to 1902.

It leads not by focusing on price, like its bigger competitor Walmart, but by offering a wider selection of products, including more niche selections and exclusive deals.

With a customer base built around middle-class and upper-middle-class buyers, Target has proven its resilience in the face of inflation, supply chain crises, and market gloom.

With a marketing department that I consider very aligned with consumers’ needs and trends, especially in apparel and beauty.

This synergy makes TGT a strong business in price, marketing, trendiness, and resilience.

With a long history coupled with high adaptability.

American Retail And Online Sales

Despite concerns by some economists, the consumer side of the U.S. economy proved how tough it is, with an increase in sales in September; this was boosted by an added 250,000 jobs.

This brings further opportunities for sales and growth in the industry as a whole and could potentially continue until the holiday season and Black Friday when the consumer market shines the brightest.

The positive trend has improved consumer sentiment, but it remains to be seen if the snowball can keep rolling until December.

Black Friday And Holiday Sales

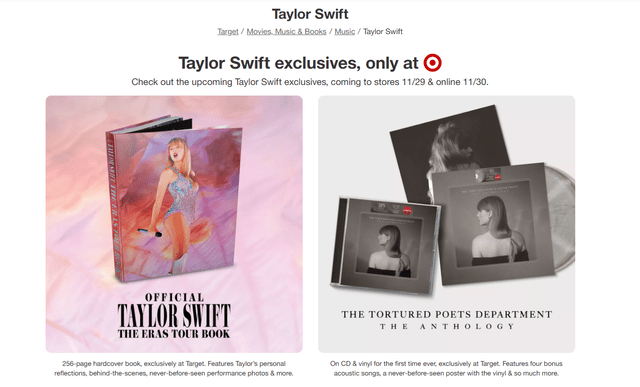

One of the big hopes for increased sales is the dual strategies of lower prices and Taylor Swift.

For this, TGT is lowering 2000 prices ahead of the holidays and capitalizing on an exclusive merchandise deal with the American megastar.

This strategy arises from the worries about U.S. consumers’ purchasing power amid inflation and a shorter holiday season, with only five days this year.

I think this is a pretty good strategy; exclusive deals do bring an added pull and a fan favorite with unmatched magnetism and fan loyalty like Taylor Swift.

Lower prices are another tried and true strategy for Target, which built its reputation on offering low deals.

I rate this as a solid business strategy that could surprise with forecasts, a synergy of great prices, and attuned marketing to the most famous artist of the current time. Target is the leading retail chain for physical albums, and Taylor’s continued choice of TGT for exclusive launches is a clear sign that this dominance will not be challenged soon.

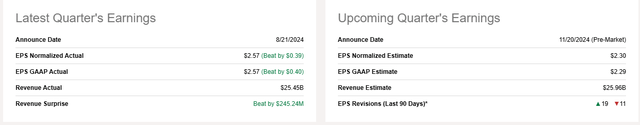

Earnings For Target

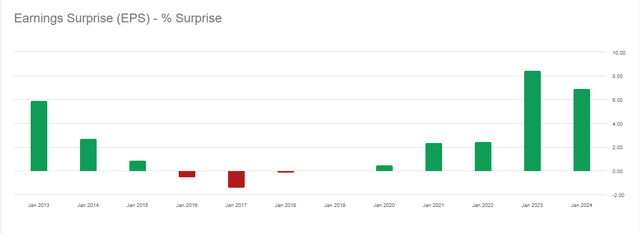

TGT increased its Q2 sales and earnings with a surprise beating of $2.57 EPS vs. the estimate of $2.18, showcasing how Q2 got Target back on track. 8.7% of digital sales took the lead in this growth.

This is very positive for the stock and could be a first step towards a year of further growth, highlighted by the coming holiday season when Target aims to excel.

TGT Corporation has a strong track record of beating earnings estimates in the last few years, showing a remarkable capacity to surprise analysts.

Seeking Alpha Premium Seeking Alpha Premium

If things play out well for Target, we could have further beats estimates, especially in Q4, bringing the potential for stock price gains.

A company that is underestimated again and again by estimates makes for a great candidate for buying.

Here, we have a strong point for a bullish thesis: TGT has proven to be reliable at increasing earnings and beating expectations.

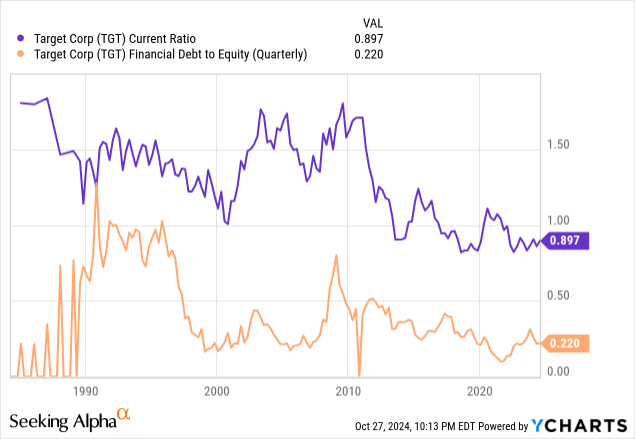

Target Balance Sheet

Target has more current liabilities than current assets. While typical in the consumer staples and retail sector, the $0.897 could improve.

On a longer time frame, the situation is worse with a Financial Debt to Equity at 0.220 making clear that TGT operates with plenty of leverage.

On closer inspection, we find that the debt and interest are currently well covered, with an operating cash flow of $8,562m and only $1,152m of debt repayments for Q2.

While Target remains a solid business with a strong capacity to pay its current debt, I believe it should take further steps to reduce its debt, especially long-term debt, and improve its Debt to Equity ratio.

I will continue to watch the evolution of debt with particular interest.

Overall, this is not the strongest point for a bullish thesis, but as long as debt payments remain under control and debt does not continue to increase, I rate this as a neutral situation.

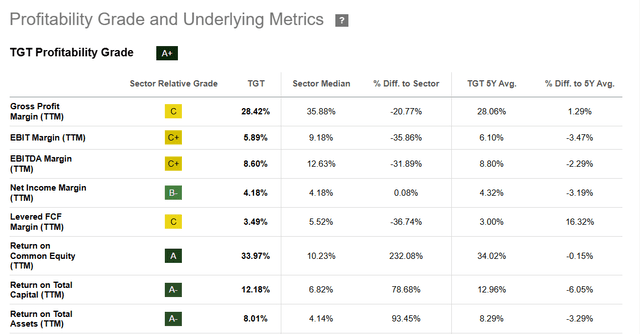

Profitability And Costs

Target is a profitable business, with an average profit margin of 28.42%, but very strong on its bottom line, with a Net Income Margin of 4.18%, Return on Common Equity of 33.97, and ROA of 8.01%.

This showcases how TGT has refined its business model and operations through the years, making for an efficient, wide-scale operation that can retain more revenue than its competitors.

The superior capacity to turn a profit is something I consider a pillar of any bullish case; with this competence, you only need to increase your top line to prosper as a business, something I consider much easier than creating and maintaining an efficient company.

I rate this as excellent and something that highlights the great business quality of Target Corporation.

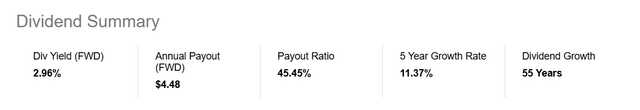

Target Dividend

TGT offers a 2.96% dividend yield. While not particularly high, it offers a very high degree of safety and continued growth, with a hard-to-beat track record of 55 years of dividend growth.

The 45.45% Payout ratio also adds to the safety of this dividend, as less than half of earnings go to dividend payments.

I believe Target’s dividend yield, while low, offers rock-solid safety and is best served with a DRIP program that compounds the investment in the overall very solid Target.

The quarterly nature of the dividends also helps make compounding into the stock easier.

Competition And Risks

TGT faces competition in two big markets: online commerce and brick-and-mortar stores. With a growing bet on the online side, Target has formed a strategic alliance with Shopify to better compete with Amazon and has seen continued growth in its online sales.

What I consider probably the biggest danger currently is Walmart finding itself as the biggest fish in their pond and trying to encroach on TGT’s dominion.

Walmart has targeted Target’s customers, particularly the higher-income segment, while TGT sales come mostly from non-food items, with around 60% vs. 40% of Walmart.

There is some specialization, with Walmart focusing more on food for lower-income people, while Target is mostly centered around apparel, households, beauty, and care for higher-income people.

Now, WMT has decided to move in on Target, with more brands and deals in the previously mentioned departments, while TGT has also decided to cut prices in food and other staples.

There is a risk of an escalating situation, with both companies deciding to race to the bottom in all areas, creating a scenario where margins shrink as competition grows.

This can be avoided with personalized, strategic discounts rather than sheer price slashing.

Valuation

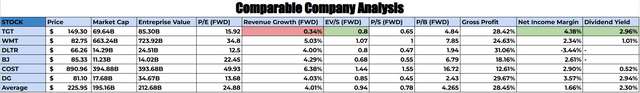

Google spreadsheets, calculations by author using Seeking Alpha Premium Data

On the valuation side, Target has a clear advantage with the highest Net Income Margin of 4.38% and the highest dividend yield of the group at 2.96%.

Earnings and growth presented a cheaper valuation than the rest, with a well below-average P/E of $15.92 vs. the average of $24.88. Its revenue Growth (FWD) was the worst of the group, something I marked in red for transparency.

At key valuation metrics, it was tied for the best place of EV/S at $0.8; it had a below-average P/S of $0.65 vs. the average of $0.78 and a slightly above-average P/B of $4.84 vs. the average of $4.265. Brick-and-mortar stores with hundreds, if not thousands, of locations should be evaluated considering their Price to Book to avoid overpaying for assets. Price to Sales also helps avoid overpaying and should be mainly analyzed when companies have massive sales but low margins, such as in retail.

Profitability also showed strength for TGT, with an average Gross Profit of 28.42% but a very strong Net Income Margin of 4.38%, at 2.63X the group average, making it the strongest stock at retaining revenue.

Overall, I rate this as excellent for Target Corporation; it appears to be cheaper or average on several metrics, and in an industry with such thin margins like massive retail, it proves to be very robust at making a profit.

Finally, it has a middle-of-the-road quality, without the massive market caps of Walmart or Costco but still being a large-cap stock, giving it a potential for moderate growth while retaining the safety that size brings.

It could have an exciting combination of safety and the prospect of further growth.

Conclusion

Target remains a giant in the U.S. consumer market, with higher-than-average key margins, a proven track record, resilience in any market situation, a decent dividend yield of 2.96%, and great marketing expertise.

Even more, it is cheaper than its competitors and has been proven repeatedly as an earnings grower. I rate it as a BUY.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TGT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.