Summary:

- Target has faced challenges, including political backlash, shrinkage, and declining same-store sales, but has successfully navigated competition from e-commerce.

- Target is using AI to improve customer experience and operational efficiency, with a GenAI-powered chatbot rollout planned for later this year.

- I believe Target’s stock is undervalued with a forward P/E ratio below the sector median, presenting a compelling investment opportunity if operational challenges are addressed.

Joe Raedle/Getty Images News

Investment Thesis

Target (NYSE:TGT) has faced significant challenges over the past two years, including political headwinds, shrinkage, and declining same-store sales. Despite these adversities, Target has successfully navigated one of retail’s largest threats: competition from online ecommerce and Amazon (AMZN). Considering Target was able to withstand pressures from e-commerce, I am confident that the company’s current issues, while serious, are manageable.

In order to navigate these risks, Target has announced they will be using AI to improve customer experience and operational efficiency. The company’s rollout of the Store Companion GenAI-powered chatbot will occur later this year in August.

Financially, Target’s stock is trading at the lower end of their multi-year forward P/E ratio range. As of now, their forward P/E Non-GAAP stands at 15.59, which is below the sector median of 17.26. Looking at Target’s five-year average of 19.07, the current P/E ratio is 18.26% lower than this. I believe this undervaluation presents a compelling investment opportunity, particularly if the company can address their current operational challenges and improve their margins. Target’s growth metrics also show potential, with a forecasted EPS forward GAAP growth rate that is 90.23% higher than the sector median. While their FWD P/E ratio is lower than other companies in the industry, I think that with the right strategies, Target will be able to lower shrinkage and improve their margins.

Despite the current economic environment, with Target’s resilient performance against the rise of e-commerce giants like Amazon, and new AI initiatives, I am confident they will continue to deliver promising results. I believe Target is a strong buy.

Background

Target has experienced significant backlash over the past two years due to their political and social stance, which some consumers have labeled as “woke.” For example, last June, their pride month collection led to a boycott. This backlash led to declined sales in their second quarter, stating their comparable sales fell 5.4%. Not only did in person sales fall, but ecommerce sales fell 10.5%. Compounding this issue is the overall weakness in the American consumer market, with retail sales growth slowing considerably. In May 2024, retail sales increased by only 0.1% month-over-month and 2.3% year-over-year.

In addition, Target is also facing issues of shrinkage, including theft and loss, which is affecting their profitability. Shrinkage has become a significant problem for the retail industry, with Target not being an exception. The company has reported that shrink is one of the key factors compressing their margins. In Q2 of 2023, Target reported a loss of about $219.5 million, more to shrinkage than they did a year prior. Looking at margins, over the same quarter, shrinkage cut into Target’s gross margins by 0.9 percentage points.

While this may be concerning to investors, Target has been pushing back. In order to combat this, Michael Fiddelke, CFO of Target stated during their most recent earnings call,

As I mentioned at our financial community meeting in March, we’ve been encouraged to see a growing focus on retail theft at the federal, state, and local levels, and we continue to take our own steps to reduce theft in our stores. -Q1 2024 earnings call

So far, this initiative has proven to be successful as Fiddelke followed up this statement saying:

Based on our recent physical inventory counts, we continue to believe that shrink rates are positioned to reach a plateau this year. And in Q1, the results of those inventory counts were favorable versus our expectations. As a result, we now expect to see a full year gross margin rate benefit related to shrink, most notably in the second quarter. -Q1 2024 earnings call

Therefore, while shrinkage may have been an issue in the past for Target, it seems to be turning the corner and actually becoming beneficial for the company.

Target has also faced pressures from declining same-store sales, reflecting the broader trend of consumers shifting their spending habits away from discretionary categories. In the first quarter of 2024, Target’s comparable sales were down 3.7%, caused by softness in home and hardlines categories and less benefit from pricing compared to a year ago. However, the company has seen some resilience in specific categories such as beauty and apparel. Digital sales are also up, largely credited to their same day services, in-store pickup, drive up, and same-day delivery.

Management has recognized the need for a turnaround strategy to address these issues. This includes leveraging generative AI to enhance operational efficiency and customer service, thereby reducing shrink and improving margins. The rollout of the Store Companion GenAI-powered chatbot is a key component of this strategy, aimed at supporting store operations and improving team member productivity, which I will expand on below.

AI, Online Shopping To Help

Target is leveraging artificial intelligence (AI) and enhancing their online shopping capabilities to address the key challenges I listed above and improve operational efficiency. This new technology also aims to tackle issues like shrink and margin compression, while boosting overall profitability.

Target is rolling out their Store Companion GenAI-powered chatbot later this year. This AI chatbot is set to be deployed across Target’s nearly 2,000 stores by August 2024, helping store team members with on-the-job process questions, coaching new employees, and supporting store operations management. Mark Schindele, Executive Vice President and Chief Stores Officer, stated:

The tool frees up time and attention for our team to serve guests with care and to create a shopping destination that invites discovery, ease and moments of everyday joy. -Press Release

By providing immediate answers and resources, the Store Companion aims to streamline day-to-day tasks, allowing team members to focus more on customer service and less on administrative duties.

The early feedback from pilot teams has been positive, indicating that the tool is making a noticeable impact on their daily work. In fact, at one of the piloted stores in Champlin, Minnesota the store director, Jake Seaquist, stated:

We’re hearing great feedback from our team about the new app

-Press Release

This chatbot is not Target’s first time using AI, the company has also introduced AI-driven personalization capabilities that enhance product recommendations and search results to improve the online shopping experience. During the latest earnings call Christina Hennington, Chief growth officer of Target discussed results of this technology stating:

We recently engaged in a pilot with one of our biggest vendors to test our latest personalization capabilities with guests shopping our personal care categories. We’re very encouraged by early test results, which showed a nearly three times lift in conversion rates from personalized promotions versus mass offers, including higher sales lift across the rest of the category as well -Q1 2024 earnings call.

These results demonstrate the potential for revenue growth. I think this, combined with the new chatbot, is likely to produce promising results for investors and customers. This chatbot will help online and in-store sales.

Furthermore, Target’s investment in AI extends to their e-commerce platform. The company is enhancing thousands of product display pages on Target.com using generative AI to summarize reviews and make product descriptions more relevant. This helps shoppers make informed purchasing decisions and find products faster. The guided search functionality, which allows customers to use conversational language to search the site, further improves the shopping experience by curating intelligent, relevant results.

Valuation

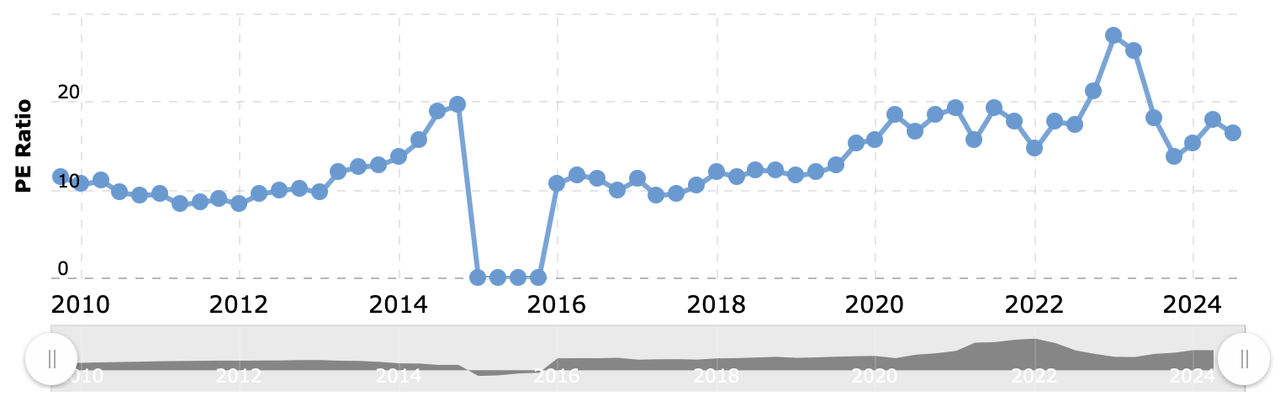

Target currently trades at a forward price-to-earnings (P/E) ratio of 15.59, which is significantly lower than their five-year average of 19.07 and the sector median of 17.26. Historically, this P/E ratio is about mid-range, as seen below.

TGT Historical P/E (Macrotrends)

As presented in the chart, between 2014 and 2016, their P/E ratio dropped down to near zero (due to the company losing money from when Target was hacked), then in 2023, it rose to nearly 30. As mentioned above, the current P/E ratio is 15.59, roughly in the middle. I think as Target’s EPS and net income grow at a much faster rate than the sector median, their P/E ratio will soon converge on at least sector median. Looking at their EPS GAAP forward growth rate, it currently stands at 19.90% which is 90.23% higher than the sector median of 10.46%. Moreover, their net income (TTM) has increased by roughly 51.78% in the last year. Considering this, I think we will see their P/E increase to at least the sector median, meaning an upside potential of 10.7% for shares.

I think this undervaluation presents a promising buy opportunity for investors, particularly if the company can address their operational challenges and enhance profitability. The stock’s depressed valuation is largely attributed to recent headwinds I described earlier in this article, including shrinkage, declining same-store sales, and political backlash. However, I think with the initiatives they are taking, these troubles will be short term.

This undervaluation translates to other aspects of their valuation, including their FWD EV/Sales ratio. The company’s enterprise value-to-sales (EV/Sales) ratio stands at 0.79, which is 54.69% below the sector median of 1.73. Additionally, the EV/EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio of 9.68 is also lower than the sector median of 10.60.

With Target’s current valuation metrics, coupled with their strong growth prospects and operational initiatives, I believe their stock is undervalued, and set up for growth.

Risks

While I believe Target presents a compelling strong buy, several risks could impact their turnaround. One significant risk is the broader economic environment, particularly the sluggish growth in retail sales. In May 2024, retail sales increased by only 0.1% month-over-month, highlighting the challenges faced by retailers amid a weaker consumer spending environment. This macroeconomic backdrop could diminish Target’s efforts to boost same-store sales and overall revenue.

Another critical risk is the ongoing issue of shrink, which includes theft and inventory loss. Shrink has been a substantial problem for Target, contributing to margin compression and impacting profitability. If shrink continues to escalate, it could significantly affect the company’s margins. However, as I mentioned above, I think this issue has begun to turn the corner for Target.

I believe Target is an iconic brand that will continue to draw in customers. Assuming the turnaround takes hold, the conservative valuation provides a margin of safety for investor to get in the stock. I believe the market is applying a reward for taking a risk here.

Bottom Line

I believe Target is set up for a potential turnaround despite facing significant challenges over the past two years. The company’s strategic initiatives, particularly the adoption of generative AI and enhanced digital capabilities, are designed to reduce shrinkage, improve margins, and drive growth. Target’s current undervaluation, with a forward P/E ratio of 15.59, presents a compelling investment opportunity, especially if the company can address their operational inefficiencies and enhance profitability.

However, I believe investors must remain cognizant of the risks, including a weak consumer spending environment. Target’s resilience and proactive measures position themselves well for future success. If management executes effectively, the stock has significant upside potential. I believe it is a strong buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.