Summary:

- Target’s price has struggled despite strong business fundamentals, because of short-term headwinds caused by macroeconomic conditions.

- The current dividend yield is 3.1% and the payout ratio remains healthy. Future dividend raises are likely to continue.

- Factors such as interest rate hikes, inflation, and rising unemployment have impacted Target’s growth. However, the company is making active strides to offset these challenges.

- Based on my dividend discount model, I estimate a double-digit upside potential.

JannHuizenga/iStock Unreleased via Getty Images

Overview

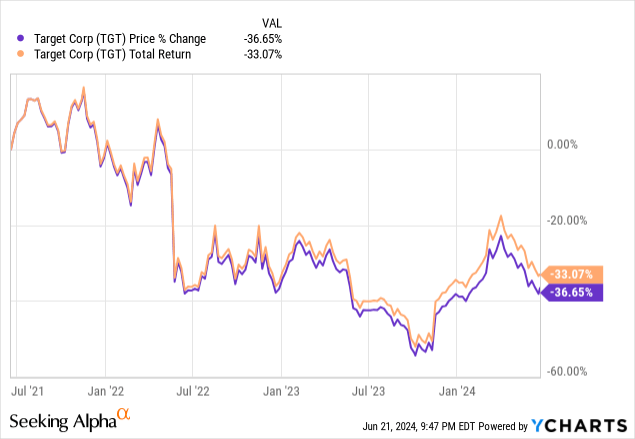

Target (NYSE:TGT) is arguably one of the most popular retailers across the US at the moment. Their wide variety of product offerings, affordable pricing, and ability to keep up with trends has propelled Target into such a strong cultural relevance that visiting your local target with your partner is a totally viable option for a date night. If this is the case, you might ask why Target’s price has struggled to gain any momentum then. Over the last three years, Target’s price is down over 36% and the total return is still negative at over 33%.

Despite the short term weakness, I believe that target’s business is extremely strong. These short term headwinds are more of a result of macroeconomic conditions, rather than a fundamental issue of the company as a whole. I previously covered Target back in February and the total return has been mostly flat since then. However, I would like to reassess the company and provide an updated valuation by taking the projected growth and performance into account.

Target still holds its title as a dividend king with over 55 years of consecutive raises. Despite the generally low yield of 3.1%, Target has been able to growth their dividend by an average double digit rate. This means that the growth of the dividend is impactful enough to create a large stream of income from your portfolio. I believe that the strength of the dividend makes it entirely possible to receive a superior return that’s comprised of both capital appreciation as well as income growth. Before we dive into the dividend or valuation, I would like to first discuss some of the vulnerabilities that may be contributing to the lack of growth recently.

Vulnerabilities

A mistake that I see a lot of investors make is that they let short term fuzz cloud their judgement on a solid long-term holding. I believe that’s currently the case with Target as the pessimism surrounding the consumer markets have had an effect on their earnings growth. The key is understanding that retailers can be considered cyclical in nature, and we are currently in a cycle of unfavorable conditions, which is likely to improve over time.

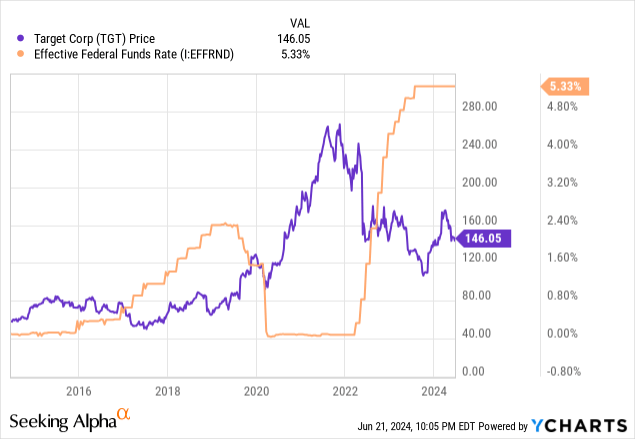

One of the more obvious factors that’s been a weight on TGT’s growth is the rapid hikes of interest rates over the last two years. Interest rates started to get hiked rapidly at the start of 2022 and the chart below really helps visualize the inverse relationship that interest rates had on TGT. As rates rose, TGT’s price consistently traded downward and only recently started to stabilize. Conversely, when interest rates were cut to near zero levels in 2020, TGT’s price sky rocketed to the upside.

This inverse relationship has many layers to it but in short, higher interest rates has the power to shrink operating profit margins for TGT. As rates rise, so does the interest payments required on any debt that TGT may hold on a variable rate basis. Similarly, interest rate decreases makes it easier to get access to capital at a more affordable rate. This debt capital can help TGT increase capex spend, deploy growth initiatives, fund acquisitions, or even help improve operational efficiencies. The Fed has left rates unchanged in their most recent meeting but they do still forecast one interest rate cut happening by the end of 2024.

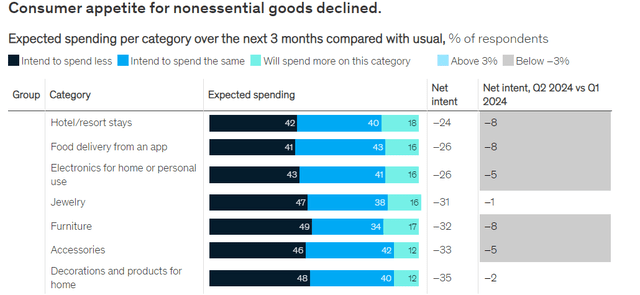

Accompanying decade high interest rates was higher levels of inflation that consistently came in above the projected 2% to 3% level. We saw inflation reach as high as the 8% mark at the tail end of 2022 and as the cost of goods started to rise, this naturally started to effect the levels of consumer spending that we saw. Data compiled by McKinsey shows us that the consumer spending levels for nonessential items started to decline. We can see that nearly 50% of all people across multiple categories say that they plan on spending less.

To make matters even more unfavorable for Target, the levels of unemployment has very slightly ticked upward at a consistent rate since 2022. The unemployment rate has now reached the 4% mark and further increases will likely result in consumers cutting back spending even more. Therefore, it comes as no surprise that Target’s earnings growth are a bit stifled at the moment.

Financials

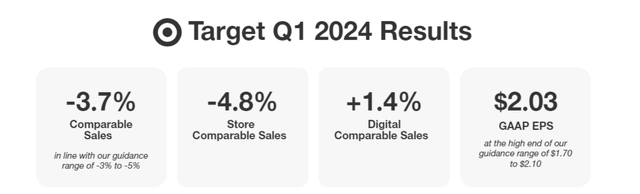

TGT reported their Q1 earnings around the end of May and the results were a bit mixed, which can be expected given the vulnerabilities that I just mentioned. We can see that earnings per share amounted to $2.03 but comparable sales were down by 3.7% while store comparable sales were down 4.8% over the quarter. However, this was slightly offset by digital comparable sales growth of 1.4%, which can be described as the amount of sales that come through Target’s mobile app or website channels. They’ve invested heavily into growing their online interface and useability as a way to strategically encourage customers to use their drive up and ordering ahead services.

Revenue for the quarter amounted to $24.5B, which represents a slight 3.1% decrease from Q1 of the prior year. This was primarily driven by lower sales volumes but this isn’t concerning in my opinion as volumes will always be shifting based on the factors previously discussed.

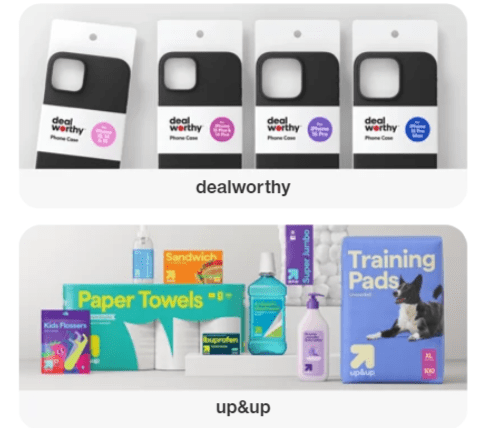

In fact, drive up sales have seen some major growth since the pandemic happened. Target brought in over $2B in revenue from drive up sales in this most recent Q1. This was an increase of over 30x from the sale figures of drive ups in Q1 of 2019. Additionally, managed has realized that lower consumer spend has severely affected their revenues so they’ve aimed to offset this by investing in the diversity and formulas of their owned brands.

Target’s owned brands have a wide range of coverage of products and are usually priced at much lower levels than the national brand alternatives. The recent high cost environment for consumers have caused a shift in spending that now shows that more than 54% of shoppers would opt for the store branded alternative goods as a way to save money. As they develop better pricing margins and distribution systems for their owned brands, I believe that this will continue to be a growing source of revenue. This is especially reinforced by the fact that Target’s loyalty program welcomed more than 1M new users in Q1.

Target Q1 Earnings

Despite these unfavorable conditions, TGT has maintained a steady level of growth and investment. They are projecting to invest between $3B to $4B into their business throughout the course of 2024. So far, they’ve already opened seven new locations in Q1, which should soon contribute to the total net income growth. Even though they did not announce any future repurchases happening, the company still has $9.7B of remaining capacity for their stock repurchase program.

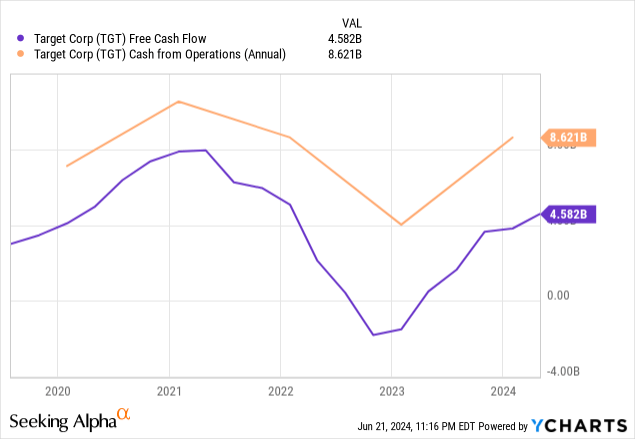

Right now the main goal to efficiently manage capital until sales volume starts to increase again and I think they’ve done well at this. We can see that free cash flow and cash from operations have both crossed back above its pre-pandemic levels. Liquidity remains sold with cash and cash equivalents totaling $3.6B. In addition to this, TGT decreased their amount of long term debt down to $13.6B, marking an improvement from last year’s total of $14.1B.

Dividend

Target recently raised their dividend by 1.8%, further reinforcing that they value the dividend growth. As of the latest declared quarterly dividend of $1.12 per share, the current dividend yield sits at 3.1%. Future raises are very likely to continue when we consider that the dividend payout ratio sits at a solid 49%, which almost perfectly aligns with the sector median payout ratio of 50%. The dividend growth has also been quite impressive for a company with over 55 years of consecutive increases. There are quite a handful of dividend kings out there that have maintained their dividend streak by issuing very tiny raises.

This has not been the case for Target as they have managed to continue growth the dividend at an average rate that’s in the double digit territory. For instance, the dividend has managed to increase at a CAGR (compound annual growth rate) of 11.44% over the last five year period. Even zooming out to a ten year period, the dividend has increased at a CAGR of 9.85%. With this sort of growth being sustained for such long periods of time, TGT has the compounding power to create a large stream of income through a long holding period and consistent investments.

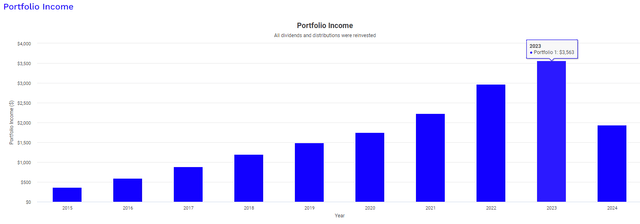

In order to better visualize this concept, I ran a back test by using Portfolio Visualizer. This graphic assumes an original investment of $10,000 a decade ago in 2015. This back test calculation also assumes that you continued to invest a fixed amount of $500 per month for every single month throughout the entire holding period. Lastly, the calculation also assumes that all dividends received were reinvested back into TGT and bought more shares at whatever the price was during issuance of that dividend.

The dividend income starts out small at first, with your annual income amounting to $366 in 2015. However, fast forwarding to over a decade later, we can see that the dividend income received would now total $3,563 in 2023. This means that your dividend income would have growth by nearly 10x over the course of a decade through maintaining consistency and a long term outlook. Not to mention, the dividends received here are classified as qualified dividends, which are the most tax efficient form of dividend income.

Undervalued

Since the price has failed to catch any upside momentum in such unfavorable conditions, TGT currently looks attractively valued based on a few different metrics. For instance, TGT currently trades at a price to earnings ratio of 16.07x, which undercuts the sector median price to earnings ratio of 19.95x. Additionally, TGT also trades at an average price to earnings ratio closer to 19.44 over the last five years and this can indicate to undervaluation. In addition, TGT’s current price to cash flow ratio is 7.84x, which undercuts its five year average price to cash flow ratio of 10.72x.

As another source of reference to the undervaluation, Wall St. currently has an average price target of $174.49 per share which represents a potential upside of over 19% from the current level. The highest price target is at $210 per share and the lowest is at $116 per share. However in order to get another idea for an estimated fair price value, I thought that a dividend discount calculation would be ideal here.

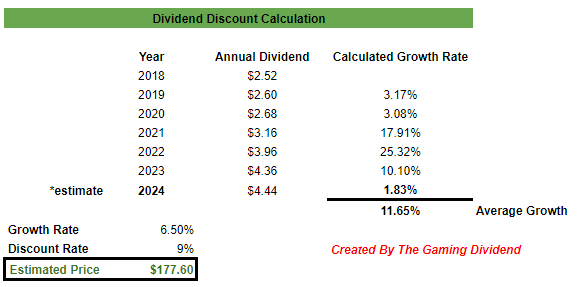

I first started by compiling the annual dividend payout amounts dating back to 2018. In addition, I used an annual payout of $4.44 per share for 2024 to represent the recent 1.8% raise. We can see that the dividend grew at an average annual rate of 11.65% since 2018. When it comes to an estimated growth rate, I decided that using Target’s performance averages were fair inputs here rather than using the most recent guidance estimates. The most recent guidance estimates a slight increase of 0% – 2% growth in comparable sales. This lowered estimate is expected when taking the previously mentioned vulnerabilities into consideration.

I decide to use the averages since they are more representative of TGT’s long term performance and I believe that the performance of TGT will fall in closer to these averages when conditions improve. For instance, TGT’s year over year EBITDA growth has averaged a rate of 6.1% over the last five years while year over year revenue growth has averaged 7.8% over the same time period. Therefore, an estimated growth rate of 6.5% that falls in the middle of these two metrics is fair.

Author Created

With these inputs in mind, I come to an estimated fair value of about $177 per share, which falls pretty closely aligned with the Wall St. average price target. This estimated fair price value represents a potential upside of over 21% from the current level. When you combine this with the strong dividend growth, you have the opportunity to lock in a solid double digit return assuming that TGT can reach this 6.5% growth rate when conditions improve. Even if the environment takes a little longer to recover, this only gives us a larger window of opportunity to continue accumulating shares.

Takeaway

In conclusion, Target still remains to be a well-run business with strong liquidity and cash flow to navigate these unfavorable conditions. I believe that interest rate cuts may be on the horizon and this may serve as a strong catalyst for growth going forward. Additionally, inflation has started to cool which may mean that we’ll see increased consumer spend to offset the lower sales volumes. From a valuation perspective, TGT still remains very attractive based on traditional metrics, Wall St. price targets, and my dividend discount calculation. Therefore, I maintain my Buy rating on Target.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TGT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.