Summary:

- Target Corporation is set to report its Q1 earnings on May 22nd.

- The company has seen improvements in margins and a rebound in revenues.

- Analysts have mixed expectations for Q1, but the company’s overall performance and financial health are decent.

JHVEPhoto

Introduction

Target Corporation (NYSE:TGT) is due to report its Q1 on May 22nd before the market opens according to Seeking Alpha, so I wanted to see how the company has performed in 2023 and whether my concerns have been eased. Since my first article on the company was published with a Hold rating at the end of September ’23, the shares have rebounded around 47%, but at that time my concerns about controversies and deteriorating margins kept me away from the stock even though it was a buy on paper. Fast-forward to today, these concerns have been addressed; however, I am still going to wait for the company’s next earnings call before deciding whether I should start a position or not. Therefore, I am sticking with my hold rating.

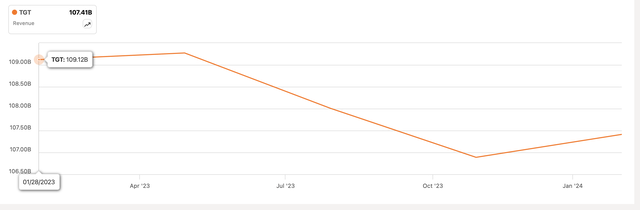

Briefly on Financial Performance

TGT’s revenues saw a slight decline in October of last year, and since then, it seems to be rebounding. Whether it’s a temporary rebound remains to be seen, which I will cover in more detail in the next section. The company experienced declines in Apparel & Accessories, Hardlines, and Home Furnishings & Decor segments of the business, which were slightly offset by an increase in Beauty & Household Essentials and Food & Beverage.

Seeking Alpha

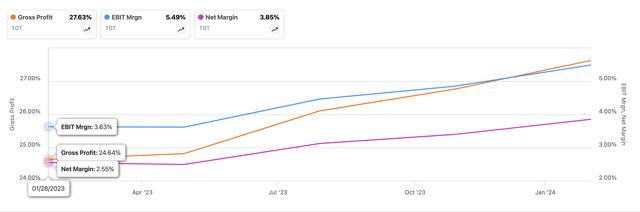

In terms of margins over the same period, we can see a decent improvement across the board, which is a positive development. The company benefited from a decent decrease in freight costs. During 2023, to match the inventory levels to the demand, the company aggressively reduced inventory, which positively impacted the company’s margins. Furthermore, TGT’s digital fulfillment costs also decreased. For a company like TGT, it is not easy to increase efficiency and profitability across the board. The retail sector is known to have low margins, so any improvement is welcome.

Seeking Alpha

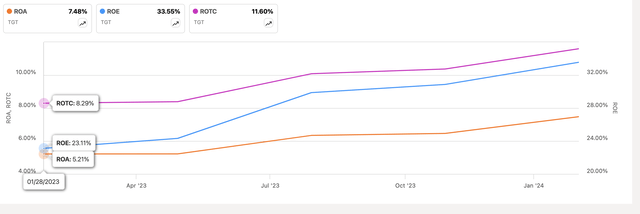

Continuing with efficiency and profitability, the company’s ROA and ROE have also seen an increase over the same period due to the company’s improved bottom line. It appears that the management is very competent in utilizing the company’s assets and shareholder equity to create value, which shows in the company’s share price appreciation. Similarly, the company’s return on total capital, or ROTC, has steadily increased to almost 12% and is above my 10% requirement. The management is adept at using the capital available to generate above-average profits.

Seeking Alpha

Looking at the company’s financial position, as of FY23, which was filed on March 13th ’24, the company had around $3.8B in cash and equivalents, against around $15B in long-term debt, which has decreased by around $1B y/y. I still don’t think that amount of leverage on the books is a problem. The company pays around $500m in interest expenses, which is a decent chunk. However, the company made around $5.7B in EBIT, which means that the interest expense is covered around 11 times. That is well above 2x, which is what many analysts consider to be a healthy position. If the company continues to pay it down slowly, that risk continues to come down. The company does have some floating interest rate debt, which increased the company’s annual interest expense slightly. However, I don’t expect this to continue and expect the rates to come down, or at least stay where they are right now in the longer term.

Overall, the company’s performance and financial health are decent, in my opinion. The improvements in margins across the board, and what seems to be a rebound in revenues, should help the company continue to operate at a decent level going forward.

What to Expect from Q1

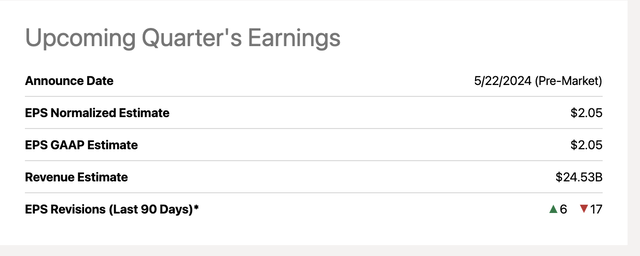

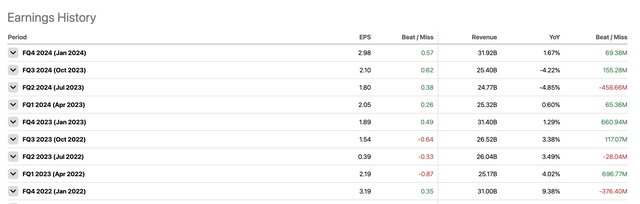

Analysts are expecting the company to do $2.05 in EPS on around $24.5B in revenues, which matches EPS from a year ago and around a 3% decline in revenues.

Seeking Alpha

The management has provided similar numbers. For EPS, the company expects to do between $1.70 to $2.10 a share, which at the midpoint is $1.90 a share, which is quite a bit below the consensus. It is rather a wide range, so it would be hard to pinpoint what the company will manage to achieve. On the revenue side, the company expects to see a decline of 3% to 5%, so it appears that analysts are on the more optimistic side than the management. The company could report within the provided range but may miss analysts’ estimates and that wouldn’t be good for the share price in the short run.

For the full year, the company expects to make anywhere between $8.6 to $9.6 a share ($9.10 at the midpoint), which is also below the average analysts’ consensus of $9.42.

So, how likely is the company to beat these estimates? Over the last 9 quarters, the company beat revenue and EPS estimates 6 out of 9 times, but given such a wide range, it is hard to tell.

Seeking Alpha

I would like to see the company’s margins continue to improve. I am also expecting further inventory de-stocking, which should somewhat improve margins further. Recently, Walmart (WMT) reported its Q1 numbers that surpassed expectations with its advertising business and comparable store sales. I believe Target will also surprise with its comparable store sales figure, and on the advertising side, the company’s Roundel business should continue to perform very well, somewhere around 20% would be a decent number. Anything under that would not be ideal.

I expect the company to at least meet its given expectations, so even if it reports $1.70 a share, it is still a success on its part, while analysts may think otherwise.

Comments on the Outlook

I like how the company has progressed throughout 2023. The controversies it saw, led to a negative sentiment on the company, and its shares fell to 52-week lows back in 2023. Since my first article on the company, that sentiment shifted, and the shares saw massive gains on the last 2 earnings reports.

My biggest concerns in the first article were the company’s involvement in the political side of things, which I thought at that time may not be the end and further short-term pain was ahead. It appears that the company has given in to some of that pressure recently, which may or may not have affected the company’s share price since October of last year. To be honest, it probably didn’t hurt, but the controversies may have been put aside, once everyone saw how well the company has improved in the last two quarters in terms of margins.

This leads me to my second concern from the first article, the margins. Seeing that the company has drastically improved its profitability, and seems to be on track to continue, with lower expenses and costs, as per the latest transcript, the company expects to further deleverage SG&A and get closer to that 6% EBIT. The company also sees further inventory declines, which should help its margins slightly.

I am also expecting freight costs to continue to decline in 2024 and 2025. The so-called “freight recession” is posing challenges for the freight industry, which sees weakening demand. This is going to be a positive for TGT for at least another year and will positively impact the company’s operations.

Overall, a lot of the negativity surrounding the company seems to have eased with the improvements in its operations, which makes me less cautious about the company’s ability to continue to perform well in the coming years, until the next fiasco.

Valuation

It’s been a while since I did a valuation analysis on the company, so I went ahead and updated the model slightly.

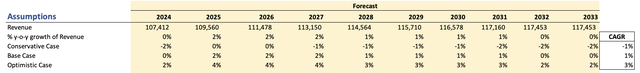

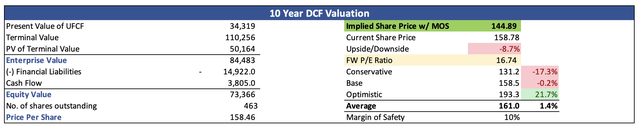

For revenue growth, the company managed to achieve around 4% CAGR over the last decade. However, I like to approach my valuations with a conservative mindset, so I went with hardly any growth, 1% CAGR to be exact over the next decade. This way I am giving myself a decent margin of safety. I am also modeling a more conservative and a more optimistic case, to give myself a range of possible outcomes. Below are these estimates, with their respective CAGRs.

Revenue Assumptions (Author)

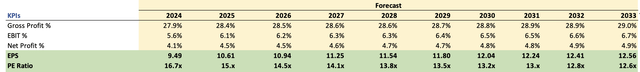

In terms of margins, I am keeping these relatively similar to what the company achieved last year. Over the next decade, the company will see around 100bps improvement across the board overall, which, I think, is very reasonable. The company’s cost-cutting efforts have been commendable and given the fact that the company improved so much in one year, I don’t doubt that over the next decade, TGT will manage to improve by another 1% in total. Below are these estimates.

Margins and EPS Assumptions (Author)

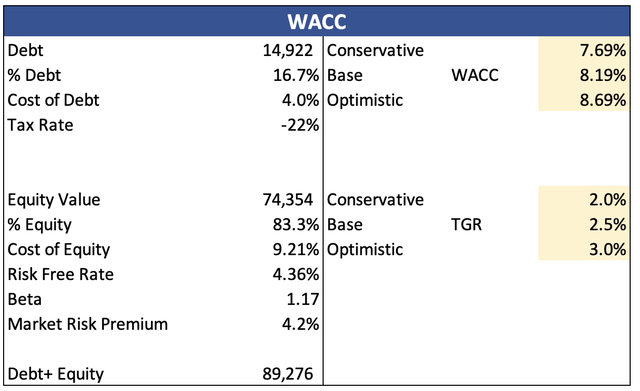

For the DCF calculations, I went with the company’s WACC of around 8% as my discount rate and a 2.5% terminal growth rate, as I would like to see the company at least match the US long-term inflation goals. Below are my WACC calculations.

WACC Calculation (Author)

Additionally, I am going to add another 10% discount to my final intrinsic value calculation, which is much lower than I did previously because the mentioned worries have somewhat passed, and the company seems to be going on to greener pastures. With that said, the company’s intrinsic value is around $145 a share, meaning it is currently trading at a slight premium.

Intrinsic Value (Author)

In my first article, my PT was at around $111 a share while the company was trading at around $109, but as I said, I wasn’t confident because of all the controversy surrounding it. I was also much more conservative on the margin side of things, but seeing how the company has improved over the last while, which led to controversies being pushed aside and forgotten, I am more confident this time around with how it will perform going forward, which is reflected in my upgraded price target.

When it comes to the upcoming report, my model is not going to change much, if at all. The numbers from the upcoming report will not be impactful for me because I like to see a trend forming at least 2 quarters ahead, however, what might alter my model is the company’s guidance, whether that is below expectations or not. So, I will keep my ears open for that. Especially if the company mentions something on the margins side, which will be the main factor in my model.

Closing Comments

So, should you start a position or add to an existing one before the company reports? It is hard to tell what is going to happen on the day. It could skyrocket like it did in the previous earnings, or it could plummet if there is a miss on numbers or the outlook isn’t as favorable as once thought. For me, I am going to hold off from starting a position right now and will wait until the earnings come out. I would like to see the share price come down a little closer to my calculated price. Therefore, I am setting a price alert for around $145 a share and will eagerly await the company’s earnings call. I will particularly listen for the company’s guidance for the year, if it changed at all from what the company told us in the last call. This type of volatility could present a better entry point than now; therefore, I am sticking with the hold rating for now.

The concerns I had back in September seem to have more or less disappeared, which eventually should help the company perform well, as long as the company doesn’t get involved in more controversies and as long as it can maintain this level of profitability.

To be honest, I wouldn’t mind the company coming back down a bit, now that my concerns are pretty much gone.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.