Summary:

- Target Corporation’s shares dropped about 7.5% after disappointing financial results and concerning developments.

- Sales in the first quarter of 2024 fell 3.1% year over year, missing analysts’ expectations by $10 million.

- The number of transactions and average transaction amount both declined, leading to a 3.7% drop in comparable store sales.

- Although shares are cheap, the company is facing some deeper issues that need to be addressed.

- Until this is done, expect the stock to continue to underperform the broader market.

J Studios

May 22 ended up being a very bad day for shareholders of retail giant Target Corporation (NYSE:TGT). As of this writing, around midday, shares of the company are down about 7.5%. This drop was in response to management reporting financial results that fell short of expectations and some other concerning developments that indicate weakness lies ahead. This is rather unfortunate for those involved. It’s also disappointing as somebody who, just over a year ago, rated the business a ‘hold’.

In the article that I wrote back at that time, I was also covering results for the first quarter of the 2023 fiscal year. Back then, revenue had exceeded forecasts, but profits and cash flows fell year over year. This time, both the top line and bottom-line fell short of expectations. Back then, I was also wary of potential economic weakening, even as consumer demand remained robust. Today, I am no longer of the opinion that the economy is likely to weaken. Or if it does, it should only do so marginally. On an absolute basis relative to cash flows, Target does look attractively priced, but there are some other issues that have emerged. When you factor all of these into the equation, I would say that it’s difficult to get behind the company in a positive way at this point in time. And because of that, I have decided to downgrade it to a soft ‘sell’.

A tough time

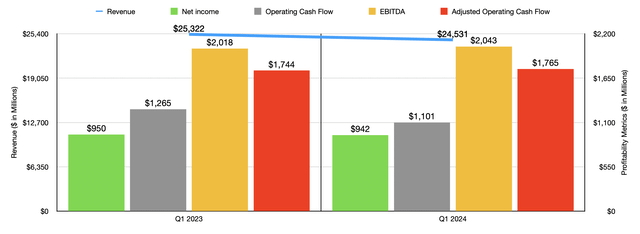

Author – SEC EDGAR Data

To start with, we should probably touch on how the company performed from a revenue and profit perspective. Sales during the first quarter of 2024 came in at $24.53 billion. In addition to representing a 3.1% drop year over year compared to the $25.32 billion generated in the first quarter of 2023, the firm also fell short of analysts’ expectations by about $10 million.

Author – SEC EDGAR Data

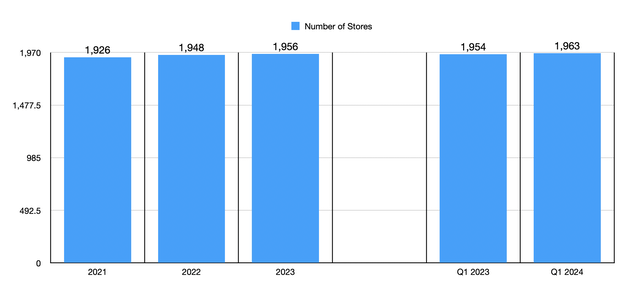

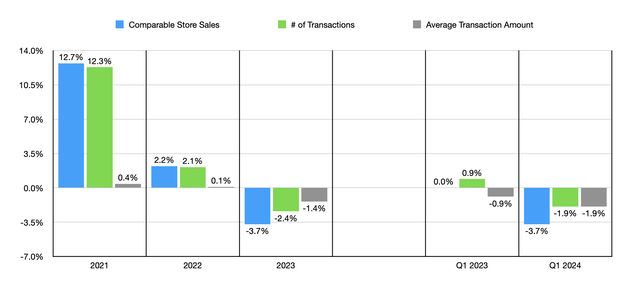

The drop for the business was driven by a couple of factors and came about even as the number of stores the firm has in operation increased from 1,954 last year to 1,963 today. The number of transactions reported by management dropped by 1.9% on a year-over-year basis. At least in the first quarter of 2023, transactions increased by 0.9%. Meanwhile, the average transaction amount fell by 1.9% as well. This is more than double the 0.9% decline reported in the first quarter of last year. When added together, this translated to a 3.7% drop in comparable store sales.

Author – SEC EDGAR Data

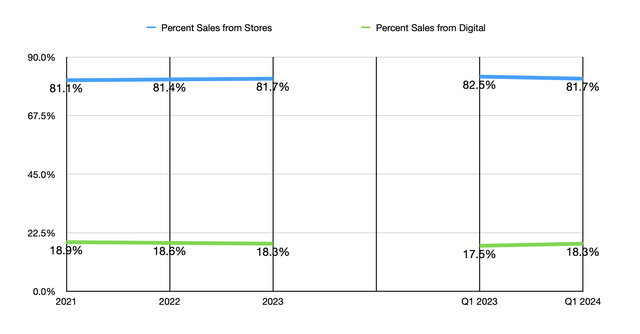

There were some other interesting and painful developments on the revenue side of things. 81.7% of the company’s revenue came from its physical retail stores during the quarter. That was down from 82.5% during the first quarter of 2023. The other 18.3%, up from 17.5% one year earlier, was attributable to digitally generated sales. In a sense, this is positive because many companies are trying to get more activity on the digital side of the equation. However, this is also a double-edged sword because digitally generated revenue is often lower margin than in store revenue because of fulfillment costs. It is noteworthy that the increase in digital exposure marks a turnaround from what the company had experienced in prior years. From 2021 through 2023, the percent of revenue coming from digitally generated activities actually declined from 18.9% to 18.3%.

Author – SEC EDGAR Data

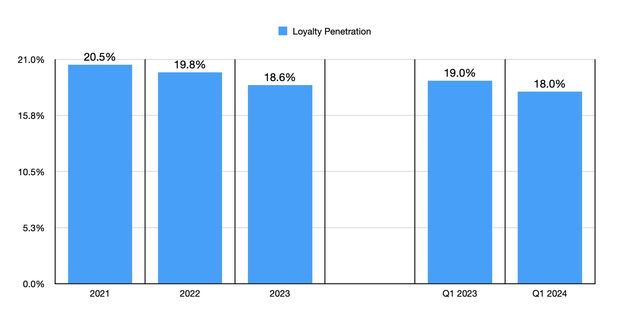

Another concerning statistic is that the number of people using the company’s loyalty program seems to be on a consistent decline. Back in 2021, 20.5% of all purchases involved this loyalty program. By the end of 2023, this number had fallen to 18.6%. During the first quarter of this year, the company reported a penetration rate of only 18%. That’s down from the 19% reported one year earlier. So not only are we seeing fewer people shop at the company and spending less, we are also seeing those choosing to benefit from a loyalty program that grants a 5% discount, choose to shop there and use that program less. This is in spite of the fact that, just this year, management decided to rebrand said loyalty program. Clearly, that rebranding is not proving to be successful. And that is a problem because, according to management, much of the revenue generated from the use of these cards is actually incremental revenue that might otherwise not be generated by the company.

Author – SEC EDGAR Data

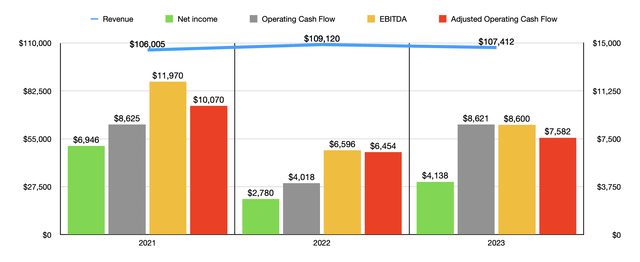

On the bottom line, Target posted some rather disappointing results as well. Earnings per share came in at $2.03. That was down from the $2.05 per share reported one year earlier, and it fell short of expectations to the tune of $0.02 per share. This translated to a decline in net income from $950 million last year to $942 million this year. Other profitability metrics were mixed. Operating cash flow, for instance, fell from $1.27 billion to $1.10 billion. If we adjust for changes in working capital, however, we get an increase from $1.74 billion to $1.77 billion. Meanwhile, EBITDA for the company managed to grow from $2.02 billion to $2.04 billion.

Author – SEC EDGAR Data

The general weakness experienced this year does require some additional context. Even though revenue in 2023 fell short of what was generated in 2022, all of the company’s profitability metrics improved year over year during that window of time. What this seems to represent is a coming down from a pretty solid year. Companies do go through cycles, and a retailer like this would see results fluctuate based on economic conditions and changes in consumer preferences. If it weren’t for the other weak spots that I already pointed out, I would just chalk the results seen so far this year up to that kind of phenomenon. But that’s difficult to do when you have data, outside of just revenue and profits, showing weakness even at a time when the company’s physical footprint continues to expand.

Author – SEC EDGAR Data

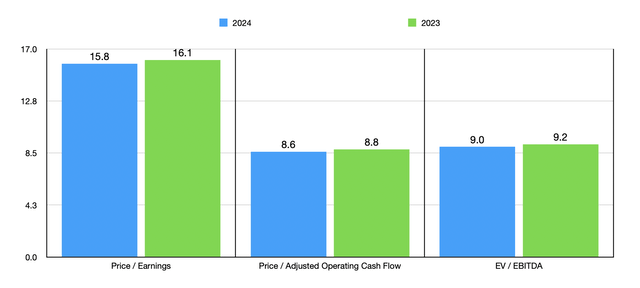

If there is some good news, it’s that management reaffirmed guidance for the 2024 fiscal year. They said that comparable store sales this year will be flat at worst and will be up 2% at best. Earnings per share has been guided to between $8.60 and $9.60. The midpoint there translates to net profit of about $4.22 billion. If other profitability metrics scale like this year over year, we would expect adjusted operating cash flow of $7.74 billion and EBITDA totaling $8.77 billion. With these results, we can easily value the company as shown in the chart above. The stock does look to me to be more or less fairly valued relative to earnings. But relative to cash flows, it does look perhaps a bit cheap. As the table below illustrates, when stacked against five similar firms, Target is most certainly tilting slightly on the cheap side of things. On a price to earnings basis, only one of the five companies was cheaper than it. And when it came to the other two profitability metrics, two of the five ended up being cheaper.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Target Corporation | 16.1 | 8.8 | 9.2 |

| Walmart (WMT) | 28.0 | 15.0 | 13.8 |

| Dollar General (DG) | 18.7 | 13.0 | 11.5 |

| Dollar Tree (DLTR) | 24.9 | 9.4 | 13.1 |

| The Kroger Co (KR) | 18.1 | 5.7 | 6.6 |

| Albertsons (ACI) | 9.2 | 4.5 | 4.3 |

Takeaway

From all that I can see, Target is fairly attractively priced. Normally, this would warrant a degree of optimism on my end. However, I remain concerned based on other data that is available. The decline in transactions, combined with the decline in the average purchase size, does not bode well for the company. The fact that the loyalty program that the company has been running is seeing weakness is also discouraging. There’s also another development that occurred just the other day. On May 20, management announced that the company will be lowering everyday regular prices on around 5,000 frequently shopped items in its stores. This follows a reduction on around 1,500 items that were already in place, with examples including milk, meat, bread, soda, and more. Given that consumers are particularly price conscious at this point in time, this may address the weakness in the number of transactions the company is contending with. But it risks lowering profitability if things go differently than what management is hoping. Given this additional concern, I don’t think it would be wrong to assume that the company will continue to underperform the broader market for the foreseeable future. Because of that, I’ve decided to downgrade it to a soft ‘sell’ at this point in time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!