Summary:

- Target is set to report Q2 results with a potential inflection point, aiming for flat to 2% comparable sales growth.

- I will be monitoring recent price reductions and the effects on sales and earnings, along with management commentary on Target Circle Week and the back-to-school season outlook.

- Despite bullish sentiment elsewhere, I maintain a neutral view on TGT stock heading into the earnings release.

Sundry Photography

Target (NYSE:TGT) is scheduled to report its Q2 results on Wednesday in the pre-market hours. I view the upcoming release as a potential inflection point for the company. Heading in, the retailer is guiding for a comparable sales growth range of flat to 2%. While this would pale in comparison to Walmart’s (WMT) recently reported 4.2% growth in the same metric, it would represent TGT’s first positive reading in the metric in over a year.

Beyond the potential for topline comparable sales growth, I’ll be closely monitoring the effects of recent price reductions. Have these cuts successfully boosted sales without creating a significant drag on earnings? Additionally, management’s commentary on the success of Target Circle Week will be crucial for evaluating how well TGT is monetizing the 1M new members added to their loyalty program in Q1. Lastly, with the back-to-school season poised to be a key driver of Q3 sales, insights into the outlook during the Q2 call will be essential for assessing future sales trends

In previous earnings previews for TGT, I’ve shared both bullish and neutral perspectives. When the stock was near its lows, I speculated that shares might be oversold, and since that update, the stock has climbed nearly 40%. However, in my more recent coverage, I’ve adopted a neutral stance, believing that much of the positive news had already been factored into the stock’s price. Since then, shares have pulled back by about 6%.

Currently, I remain neutral on the stock due primarily to the company’s comparable sales performance. However, a possible inflection in Q2 may warrant a reassessment. As TGT’s Q2 results approach, here are the key metrics to monitor and watch for.

TGT Stock Key Metrics

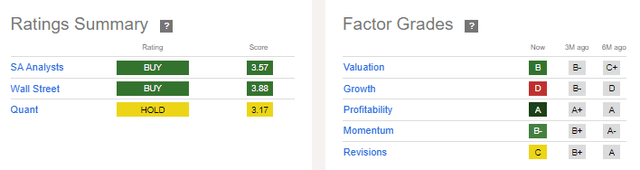

Current sentiment towards TGT is bullish. Both the Seeking Alpha (“SA”) analyst community and Wall Street view shares as a “buy” at current pricing. Among the SA community, about 60% of coverage in the last 90 days have either rated shares as a “buy” or as a “strong buy.” The sentiment is even more bullish on Wall Street, where the consensus price target stands nearly 20% above current trading levels.

Seeking Alpha – TGT Ratings Summary

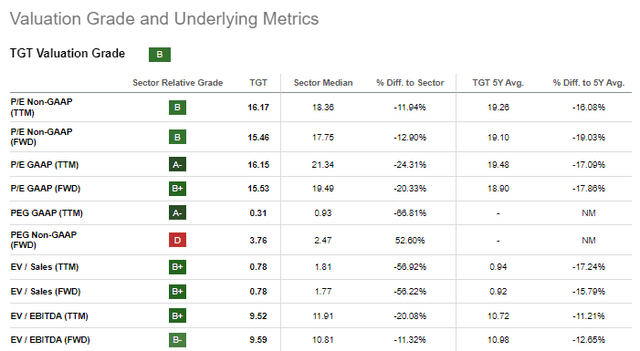

The bullishness is perhaps warranted by TGT’s favorable marks on valuation. At current trading levels, TGT commands a forward multiple of 15x, below its five-year average of about 19x. The stock trades more in-line from an EV/EBITDA perspective, but still commands a multiple below sector averages.

Seeking Alpha – TGT Valuation Metrics

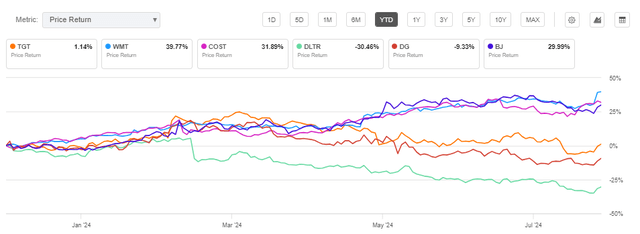

The lower valuation comes as shares in TGT have lagged competitors, such as WMT, in recent periods. Over the last year, shares in TGT are up about 12%, while shares in WMT are up nearly 40%. Even more lopsided is TGT’s rise of just 1% on a YTD basis.

Seeking Alpha – YTD Price Performance Of TGT Compared To Peers

In my view, TGT’s underperformance relative to others within the sector is warranted. TGT has reported comparable sales declines for the last four quarters. The company has also struggled in profitability metrics due in part to rising shrink. WMT, on the other hand, just reported another quarter of positive comparable sales growth. TGT still has some work to do on the topline, and it may entail a rising promotional environment.

TGT Stock Guidance & Outlook

In its Q1 report, TGT reported a 3.7% decline in comparable sales, disappointing those hoping for a sales rebound after three consecutive quarters of declines. Management attributed the declines to the ongoing effects of inflationary pressures and declining consumer sentiment, though CEO Brian Cornell noted some improvement in discretionary spending.

Looking ahead, Q2 is expected to be a potential turning point for TGT. The company projects comparable sales growth between 0% and 2%. If achieved, this would mark the first positive growth in over a year. On the earnings side, after being heavily impacted by inventory shrinkage, Target anticipates its first favorable YOY comparison related to shrinkage in Q2.

Following the Q1 report, lower-than-expected profits and disappointing sales figures caused Target’s shares to drop about 8%. However, a positive result in Q2 comparable sales could drive shares higher. Additionally, Target expects overall EPS to range between $1.95 and $2.35 per share, representing 20% YOY growth. Achieving this target, despite recent promotional activities, could help alleviate concerns about Target’s recent performance

What To Watch When Target Reports Q2 Results

Impacts Of Recent Price Reductions: In his Q1 commentary, Brian Cornell highlighted price cuts made on 1,500 of TGT’s frequently shopped items. He also guided for price cuts on an additional 1,000 items in the summer.

At a time when TGT’s core product offerings have been impacted by shifting consumer behavior, observers should keep an eye on whether these cuts provided any uplift to sales.

Even more importantly, what was the impact of the cuts on margins and to overall EPS? This will be important to assess, especially as TGT aims to return to a period of growth. Among specific product categories, I will be assessing the impacts of price reductions in TGT’s summer categories. With Q2 representing more than half of TGT’s spend on travel gear, I would expect the price reductions to have the most notable impact in this category of goods.

Target Circle Trends: In late June, TGT announced that its Target Circle Week would run from July 7-13, just weeks before the end of its fiscal quarter.

This event, akin to Amazon’s (AMZN) Prime Day, is one of TGT’s largest shopping events of the year. By scheduling their event ahead of Prime Day, which began on July 16, Target likely aimed to capture early sales momentum. However, Amazon’s Prime Day still set a new sales record despite the earlier start of Circle Week.

Lackluster results or commentary regarding Circle Week would be particularly disappointing, given Target’s advantage of timing and its growing base of loyalty program members. Unlike Amazon Prime, Target Circle is free to join, and in Q1 alone, the company added 1M new members.

Investors should also pay close attention to any updates on member upgrades to Target Circle 360, the program’s paid tier, which costs $99/year. During Circle Week, however, members had the opportunity to upgrade for $49/year. A successful Circle Week, in my view, would be reflected in a notable increase in these paid tier upgrades, particularly among the new members who joined in Q1.

Back-To-School Commentary: Although the Q2 topline won’t fully reflect the impact of the back-to-school shopping season, a crucial period where 70% of TGT customers participate, management’s commentary will be key in gauging momentum heading into Q3.

In Q1, EVP Christina Hennington hinted that TGT would be “going bigger than ever” during this pivotal season but offered few specifics. I anticipate more detailed insights during the Q2 update.

Last year, TGT focused on offering savings for value-conscious teachers and college students, along with a broader product assortment. With inflationary pressures easing in recent months, I expect a stronger back-to-school season this year, particularly given the additional price promotions TGT has been rolling out.

A robust performance would counter expectations of flat spending this year, as projected by Deloitte’s annual study. The study also highlighted that major back-to-school shopping destinations like Target and Walmart are facing increased competition from online retailers, as consumers increasingly prioritize convenience for these purchases.

Is TGT Stock A Buy, Sell, Or Hold?

While current sentiment around TGT remains bullish, with both the SA community and Wall Street largely rating the stock as a “buy,” I remain more neutral and maintain a “hold” rating.

Although the valuation of 15x forward earnings appears attractive, considering it’s below the company’s five-year average, the company has underperformed relative to competitors like WMT, particularly in key metrics such as comparable sales.

Target’s Q2 results, however, could mark a turning point, with the potential for the first positive comparable sales growth in over a year and a projected 20% YOY increase in EPS, with a favorable shrinkage comparison. However, the company’s need for price reductions to drive sales suggest that challenges remain.

In my view, investors should closely watch the impacts of recent price cuts, the success of Target Circle Week, and management’s commentary on the upcoming back-to-school season for signs of sustained improvement. Until Target demonstrates a sustained turnaround in comparable sales, I believe a “hold” rating is appropriate.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.