Summary:

- Target missed the mark in Q3, reporting results well below expectations.

- Sour investors sent shares in the stock plummeting over 20% during Wednesday’s trading hours.

- While consumers appreciated Target’s price promotions, investors were clearly more critical.

- At new 52-week lows, I continue to view shares in Target as best left on hold.

jetcityimage

Shares in Target (NYSE:TGT) dropped to a new 52-week low on Wednesday after badly missing Q3 expectations. The sour sentiment contrasts sharply with discount retailers, such as Walmart (WMT) and Costco (COST), both of which continue to reap the gains of cautious consumer spending.

Seeking Alpha – YTD Share Price Performance Of TGT Compared To WMT & COST

In my last coverage on TGT, I previewed the company’s Q2 results and elaborated on my expectations for an inflection in sales growth. A key aspect of my preview was consideration to the impact of TGT’s recent price reductions on 1,500 of TGT’s frequently shopped items, as well as the impact of additional price cuts on more items through the summer.

Consumers appreciated the price reductions; investors, however, not so much. This was the main takeaway from TGT’s Q3 results. Following the release, my position on TGT remains unchanged. I continue to view shares as best left on “hold.”

TGT Q3 Results Recap

Target’s Q3 results landed well below expectations. In prior guidance, the management team guided for comparable sales growth of between flat to 2%. Actual comparable sales growth was just 0.3%. In comparison, Walmart reported U.S. comparable sales growth of 5.3% yesterday in its most recent quarterly report.

TGT CEO, Brian Cornell, highlighted positive traffic trends in his earnings commentary. But there was no sugarcoating the impact of the more promotional environment on both the topline and bottom line. While customers were certainly more engaged with TGT during the quarter, they weren’t necessarily spending more money.

Continued softness in the discretionary categories continues to be TGT’s sore spot. Unlike Walmart, which derives the majority of its U.S. sales from groceries, TGT’s bread and butter is in the discretionary categories. In previous estimates, the management team had noted that the promotional environment would prop up the topline. However, the reality was very different during the quarter.

TGT reported continuing strength in its beauty category, where comparable sales rose 6%. But this was offset by softness in the home and hardline categories, as consumers continue to hold back spending on these larger ticket items.

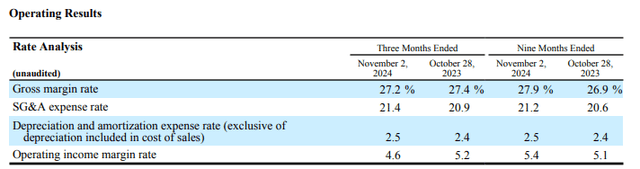

The promotional environment negatively impacted margins, as did cost pressures in health care and general liability expenses. This contributed to a gross margin rate that was 20 basis points lower YOY and an operating margin rate that was 60 basis points lower YOY. This also came as selling & administrative costs increased by about 50 basis points.

TGT Q3 Earnings Release – Summary Of Comparative Gross & Operating Margin Rates

Overall earnings landed at just $1.85/share, $0.45/share lower than estimates and below its previously provided target. While some of this was due to an unexpected hit from the port strike, much of this was from TGT’s own doing, including its rosier forecast provided earlier in the year and a promotional sales mark that failed to live up to expectations.

Market Reaction To TGT Results

Weak comparable sales growth and disappointing earnings weighed heavily on investor sentiment. Adding to the negativity was a sharp reversal in the company’s forward outlook.

In the hours following the earnings release, shares tumbled roughly 18%, marking their steepest single-day drop since mid-2022. At that time, investors punished the stock with a 25% decline following a dismal Q2 FY22 earnings report.

Seeking Alpha – 1-Day Chart Of TGT Shares

While the current declines were not as severe, they were still significant. By the close of trading, the stock had shed approximately 20%, hitting new 52-week lows in the process.

What Is The Outlook For TGT Stock?

Looking ahead to the holiday quarter, TGT’s outlook appears lackluster. Current forecasts project flat quarterly comparable sales at best. Similarly, bottom-line estimates have been revised downward, leading to a reduced full-year midpoint.

This subdued outlook reflects continuing weakness in discretionary categories. Additionally, the shorter holiday shopping season featuring five fewer days between Thanksgiving and Christmas contributes further to the cautious expectations. Earnings commentary attributed approximately a one-percentage-point headwind to Q4 comparable sales due to the condensed calendar.

In my view, ongoing cost pressures and a heavily promotional retail environment are likely to remain headwinds for TGT throughout the holiday season. However, the current negative sentiment surrounding the stock positions it for potential upside in the next earnings report, should results surpass these tempered expectations.

Is TGT Stock A Buy, Sell, Or Hold?

Prior to the earnings selloff, sentiment around TGT remained bullish throughout the year. Both the Seeking Alpha analyst community and its quants rated the stock as a “buy,” with the latter highlighting TGT’s strong profitability metrics. However, TGT’s Q3 results fell short on multiple fronts.

While TGT reported positive traffic and volume trends, these gains were fully offset by declining prices. While customers responded well to promotional efforts, this came at the expense of profitability, disappointing investors. Additionally, cost pressures related to healthcare and general liability expenses further weighed on performance, contributing to lower gross margins and earnings that fell significantly below expectations.

Earnings commentary hinted at some improvement in the discretionary category in October, but TGT continues to face challenges in attracting price-sensitive customers who continue to favor discount retailers like Walmart and Costco.

TGT revised its full-year EPS guidance to a midpoint of $8.60/share, down from the prior $9.35/share. This represents a notable reversal from the earlier upward revisions made earlier this year.

Following the selloff, TGT shares trade at a forward multiple of approximately 14x. This may appear attractive compared to Walmart’s premium of over 30x and Costco’s even higher multiple. Historically, TGT has averaged a 19x multiple over the past five years, suggesting the stock is currently about 13% undervalued. However, TGT’s ongoing operational challenges, including cost pressures and headwinds in its discretionary categories, appear to justify the lower multiple.

I maintain my “hold” rating on TGT shares. Significant improvement in the discretionary category, combined with stable traffic trends and a reduction in promotional activity, would motivate me to reassess. Until then, I would continue to view TGT as a stock better left on the sidelines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.