Summary:

- Target is set to report its Q4 and full-year results this Tuesday.

- In advance of the release, shares have gained more than 40% since my last preview article before its Q3 results.

- Better-than-expected profitability is one significant aspect of Target’s recent outperformance. The bottom line performance has also overshadowed persistent weakness in the top line.

- Looking ahead, I believe much of the earnings strength is already priced into Target’s share price.

- In my view, this warrants a greater focus on sales growth to inspire further bullishness.

Sundry Photography

The 2023 calendar was a rollercoaster of a year for Target (NYSE:TGT). Spirits were high at the beginning of the year as its inventory position normalized following overstocked shelves. It then found itself at the center of an industry-wide spike in retail theft. The hit to margins earlier in the year was compounded by a more promotional environment. Social backlash brought additional unwanted attention. And more recently, Target faced additional uproar surrounding historical misidentification in a children’s educational kit.

Fortunes began to turn following TGT’s Q3 results, which showed better-than-expected profits. The improved outlook in profitability has contributed to the strong performance in the shares over the last several months. While the snafu with the educational kits created negative headlines, it didn’t appear to negatively impact the trajectory of the stock.

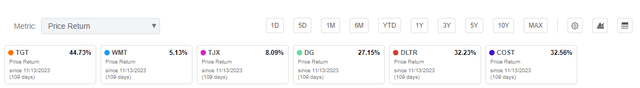

In my last earnings preview article just prior to Q3 earnings, I was bullish on TGT due to its trading level at the time. Shares were trading near 52-week lows and much of pessimism appeared already priced in. Since that preview article, the stock has gained over 40% compared to a 16.5% gain in the S&P (SPY) in the same period. The gains have also surpassed those logged by other retailers, such as Walmart (WMT), which is up just 5%, and the TJX Companies (TJX), up 8%.

Seeking Alpha – Share Price Return Of TGT Compared To Peer Group Since Last Author Update

In advance of TGT’s Q4 results, which are due out Tuesday, I’m more neutral on the stock following its over 40% rise since my update. Like the bullishness I exhibited at its lows relating to the pessimism being priced into the stock, I believe much of the optimism surrounding TGT’s profitability outlook is already priced in at current trading values. This creates additional pressure for topline growth in the months ahead, in my view. While the comparables create a favorable setup, I believe TGT is adequately priced for the topline uncertainty. Here’s what else investors should know before TGT reports results.

TGT Guidance and Outlook

In Q3, TGT reported a comparable sales decline of 4.9%. The decline came as most categories, except beauty, lagged due to the continued rebalancing in consumer spending behavior between goods and services in a period of persistently high inflation and higher interest rates.

The negative headline on the topline, however, was more than offset by TGT’s progress in their profit targets. For the quarter, earnings grew to +$971M vs. the +$685M consensus estimate. The earnings growth, 36% YOY, was in part due to effective inventory and expense management. The better-than-expected profitability sent shares surging nearly 20% immediately following the release of results.

In looking ahead to Q4, Target’s management team guided for continued topline pressure, with comparable sales expected to be down in the mid-single-digit percentage range.

Additionally, despite the stronger profitability performance in Q3, the team was still reluctant to provide an overly optimistic take on Q4 earnings, given that the quarter tends to be more promotional in nature surrounding the holidays.

The range, however, was quite wide for investors. At the low end of the EPS range, $1.90/share, growth would be flat year-over-year. At the high end of $2.60/share, on the other hand, growth would be 37%. The wide range should provide the retailer with a comfortable margin of error when it reports on Tuesday.

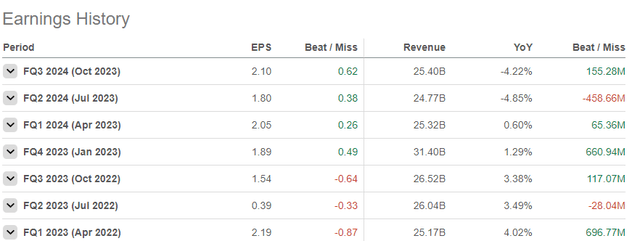

While TGT has a strong record of topping expectations, especially with regards to earnings, the revenue picture has been more mixed in recent periods due in part to the continued uncertainty surrounding consumer discretionary spending patterns.

Seeking Alpha – Earnings/Revenue History Of TGT By Quarter

Three Things To Watch When TGT Reports Results

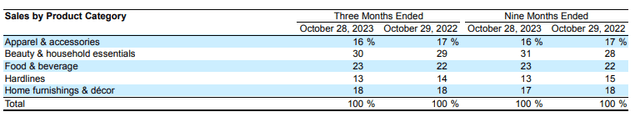

TGT’s Beauty Performance: Softer discretionary consumer spending is evident in all of TGT’s categories except within its Beauty-related products. While overall comparable sales were down nearly 5% in Q3, comparable sales grew in the high-single-digit range across TGT’s core beauty and Ulta Beauty offerings. TGT also benefited from the launch of a new line of Rihanna-specific brands during Q3.

TGT Q3 10Q – Breakout Of Sales By Product Category

Investors should observe whether the positive trend in beauty remained prevalent in Q4. The ongoing strength of TGT’s beauty offerings is important not just for overall sales but to TGT’s margin profile. Unlike categories, such as electronics, the Beauty products are higher-margin offerings. If the positive trends continued in Q4, I’d expect favorable merchandise mix to be one aspect of any beat on earnings and/or margin expansion.

Dealworthy: One initiative that could support revenue growth in the periods ahead is increased consumer adoption of TGT’s private label brands. In the past, TGT has had success in prior rollouts. And recently, the company said that it would introduce a new brand called Dealworthy. If the news is effectively communicated to prospective consumers, it could provide shoppers with a value-based option for 400 basic everyday items, with most priced under $10.

While I view the news as positive, I believe TGT would be joining into a crowded space, with value already being offered by the likes of Walmart, Dollar General (DG), and Dollar Tree (DLTR).

Project Trident: Another way for TGT to support future revenue growth would be through the possibility of a paid membership program. In February, the Bloomberg news division reported that the program, which is dubbed internally at TGT as Project Trident, could be launched this year at the earliest. The launch could also incorporate the inclusion of Shipt, TGT’s grocery-delivery service.

The membership program is one way of competing with Amazon (AMZN) and WMT. But in my view, the launch would be somewhat of a “late to the game” type of play. While it may be of benefit to more loyal TGT customers, the company has imposed itself with self-inflicted loyalty wounds from its response to its Pride campaign, creating a headwind to overall loyalty.

Is TGT Stock A Buy, Sell, Or Hold?

Shares in TGT have been on quite the roll since its Q3 earnings and my last article update. The stock is up more than 40% since my last bullish article and 11% in the last month. TGT also appears to have the runway for further momentum from current trading levels.

In the new fiscal year, TGT will benefit from a more favorable comparable environment in the topline. This should complement their margin profile, which significantly improved in the back half of 2023, a prime factor in the recent run-up in TGT’s share price. Investors may have more to cheer if growth at the topline supports continued margin expansion.

TGT also could benefit from a more normalized discretionary spending environment. The last few years have consisted of more prioritized spending on services and necessities. If falling inflation is ultimately pared with lower interest rates, as is expected, then this could contribute to a more pronounced pivot back to certain discretionary categories.

While the outlook appears promising, much of the optimism appears priced in. Its earnings surprise in Q3 also adds greater pressure on TGT to maintain or expand upon its profitability metrics. A continuation in the trends with theft seen in 2023 or a more pronounced reversal in the freight environment could create a near-medium term setback, not to mention the persistent weakness in the topline.

TGT is currently trading at an 11x EV/EBITDA multiple, above its five-year average of about 10x. It’s also commanding a forward multiple of 18.7x, also above its longer-term averages. TGT’s recent inroads into private label brands and its exploration of paid-membership programs may inspire some bullish sentiment. But both are crowded aspirations. And TGT would be late to the party, in my view.

I was bullish on TGT at more subdued valuations. Following the material appreciation since my last update in combination with the likelihood that much is already priced into the stock, I view shares as adequately priced heading into its Q4 earnings release.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.