Summary:

- Target has charted an impressive YTD rally of +24%, with it well outperforming the wider market at +10%, WMT at +14%, and COST at +10%.

- Despite so, we believe that TGT remains fairly valued, as it laps up the favorable YoY comparison, while delivering a healthier balance sheet and promising FY2024 guidance.

- Moving forward, we expect to see the retailer deliver further excellence, as the management intensifies the membership base growth while expanding the e-commerce revenue share.

- With an increasing e-commerce TAM and enhanced operational efficiency, we believe that TGT remains well positioned for consistent top/bottom-line growth and robust shareholder returns.

We Are/DigitalVision via Getty Images

We previously covered Target (NYSE:TGT) in September 2023, discussing how the management had demonstrated great capital deployment across capex investments, deleveraging, shareholder returns, and balance sheet enhancement.

Combined with the top/bottom line expansions and the safety of its dividends, we had reiterated our Buy rating then, with the correction offering an improved margin of safety for those looking to dollar cost average.

In this article, we shall discuss why we are maintaining our Buy rating for TGT, despite the stock’s immense YTD rally of +24%, with it well outperforming the wider market at +10%.

With the management lapping up the favorable YoY comparison, while delivering a healthier balance sheet and promising FY2024 guidance, we believe that the stock offers an excellent compounding prospect through capital appreciation and dividend incomes.

The TGT Investment Thesis Remains Compelling Here, Despite The Recent Rally

For now, TGT has reported a bottom-line beat in its FQ4’23 earnings call, with total revenues of $31.91B (+25.6% QoQ/ +1.6% YoY) and adj EPS of $2.98 (+41.4% QoQ/ +57.6% YoY).

Otherwise, FY2023 brought forth excellent numbers of $107.41B (-1.5% YoY) and $8.94 (+49.4% YoY), respectively.

The bottom line tailwinds are mostly attributed to the easier YoY comparison, with TGT lapping up a year of drastic price cuts to clear the bloated inventories in FY2022.

The same is observed in the expanding gross margins of 27.6% (+3 points YoY) and operating margins of 5.5% (+1.9 points YoY) in FY2023, nearer to the FY2019 levels of 29.8% and 6.1%, respectively.

The retailer’s inventory level of $11.88B in FQ4’23 (-19.3% QoQ/ -11.9% YoY) is also nearer to the FY2019 level of $8.99B and down drastically from the peak of $17.11B in FQ3’22.

Combined with the growing Free Cash Flow generation of $3.81B (+352.6% YoY) in FY2023, it is unsurprising that TGT has reported a healthier balance sheet, with moderating long-term debts of $13.15B (-12.7% QoQ/ -7% YoY) and growing cash of $3.8B (+98.9% QoQ/ +71.1% YoY).

This is further aided by the operational efficiency efforts with over $500M saved in the year.

Moving forward, we expect to see TGT deliver further excellence, based on the consecutive improvements in its comparable sales over the past two quarters as the management expands its same-day services, including in-store pickup, Drive Up, and Shipt, across more locations.

This may further expand the retailer’s e-commerce revenue share of 18.3% in FY2023 (-0.2 points YoY/ +9.5 from FY2019 levels of 8.8%), further aided by the change in consumer behavior post COVID-19 pandemic.

At the same time, TGT has re-launched the Target Circle membership program, with the aim of expanding its membership revenues while growing the e-commerce sales, effectively taking a page from Costco’s (COST) and Amazon’s (AMZN) playbooks.

For example, Walmart (WMT) has reported that Walmart+ consumers typically “shop more frequently and spend more money” at approximately “+31% more in-store and +206% more at walmart.com,” naturally demonstrating the expansion of its member loyalty.

As a result, we can understand why the TGT management has offered a promising FY2024 guidance, with comparable sales growth of between 0% to +2% and adj EPS of $9.10 (+1.7% YoY) at the midpoint, reversing the uncertain FY2023 with comparable sales of -3.7% YoY.

With massive opportunities in the ecommerce market and growing TAM from $4.93T in 2022 to potentially $5.45T in 2027 in the US, we believe that TGT remains well positioned for consistent top/ bottom-line growth ahead.

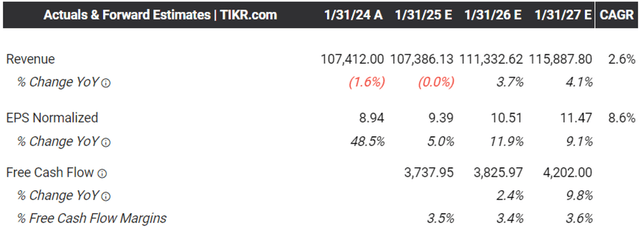

The Consensus Forward Estimates

Tikr Terminal

As a result of the management’s promising guidance, it is unsurprising that the market has raised TGT’s forward estimates, with a projected top/ bottom line expansion at a CAGR of +2.6%/ +8.6% through FY2026.

This is compared to the previous estimates of +2.2%/ +5.2%, while building upon its historical growth at +6.4%/ +8.6% between FY2016 and FY2023, respectively.

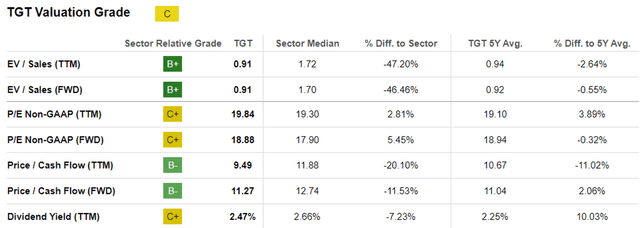

TGT Valuations

Seeking Alpha

These numbers have also triggered the TGT stock valuations’ recovery to FWD P/E of 18.88x and FWD Price/ Cash Flow of 11.27x, compared to its October 2023 bottom of 12.36x/ 5.63x and nearer to its 5Y mean of 18.94x/ 11.04x and sector median of 17.90x/ 12.74x, respectively.

When compared to its similarly thriving peers, such as WMT at 25.48x/ 13.28x and COST at 46.04x/ 31.36x, it is apparent that TGT is relatively cheap here, offering interested investors with the improved margin of safety.

So, Is TGT Stock A Buy, Sell, or Hold?

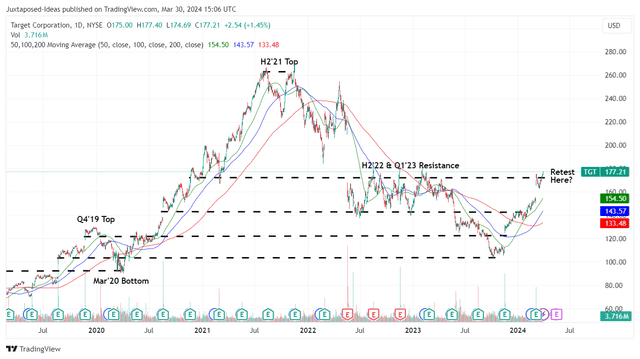

TGT 5Y Stock Price

Trading View

For now, TGT has rapidly broken out of its 50/ 100/ 200 day moving averages, while appearing to retest its H2’22/ Q1’23 resistance levels of $170s.

Based on the FY2023 adj EPS of $8.94 and the FWD P/E valuations of 18.88x, it is apparent that the stock is trading near to our fair value estimate of $168.70.

Based on the consensus FY2026 adj EPS estimates of $11.47, there seems to be an excellent upside potential of +22.1% to our long-term price target of $216.50 as well.

Readers must not forget that TGT is an extremely shareholder friendly stock as well, based on the 52.5M, or the equivalent 10.1% of its float retired since FY2019, with $9.7B of remaining capacity in its repurchase program

This is on top of the 5Y Dividend Growth Rate of +11.51% and expanded forward yield of 2.48%, compared to the sector median of +5.26% and 2.61%, respectively.

As a result of the still attractive risk/ reward ratio at current levels, we are maintaining our Buy rating for the TGT stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.