Summary:

- Walmart’s earnings tide has lifted many boats, including Target’s, but I remain a skeptic.

- Target’s fortunes have diverged from Walmart and a slowing economy might drive Target’s customers towards Walmart, which could partly explain the strong Walmart earnings.

- Shaky geopolitics, leading economic indicators and softer than expected labor market would make me invested only in the strongest of names, and Target is not one of them.

- I rate this company as a Sell in the medium term.

nicoletaionescu/iStock via Getty Images

Walmart’s (WMT) earnings seemed to defy most skeptics of the economy. Contrary to many expectations, Walmart topped Q2 estimates and raised its FY25 outlook. Its net sales and operating income were the highest in two years. This ignited a broad-based rally in the retail sector with Target (NYSE:TGT) being a key beneficiary, but I do not think this was justified. The way I see it, some names are being benefitted while many other companies (NKE, LULU, HD etc.) feel the pain of a weak consumer. Consumers are bargain-hunting, and Target may not be a beneficiary. I rate Target as a Sell.

Target is not Walmart

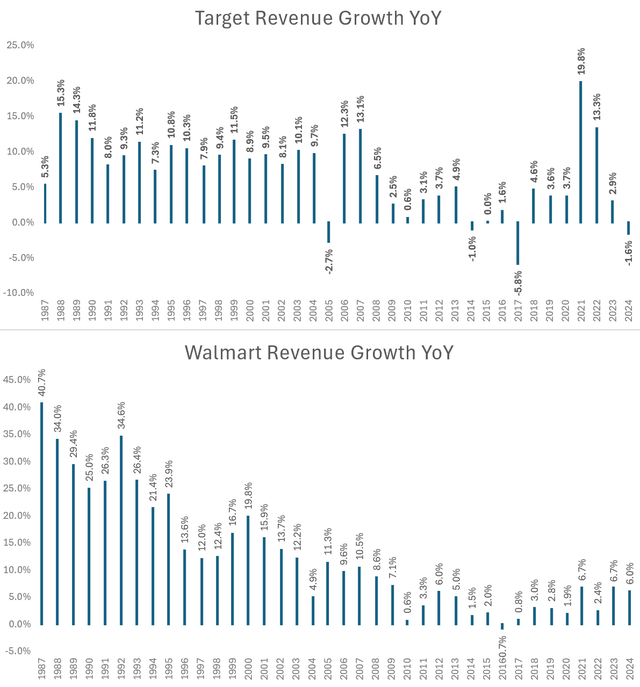

The paths taken by two of the biggest retailers are not entirely the same. Walmart has seen a more steady growth in its fortunes whereas a series of missteps have marked Target. This is to say that Target’s revenues may not be as resilient, and it would be incorrect to think that Walmart’s rising tide will lift Target’s boat.

Author generated from Company data

Over the years the dip in Target’s financials during different years can be attributed to several reasons.

- Competition from Walmart affected Target’s market share and sales growth as Walmart’s aggressive pricing strategies attracted more price-sensitive consumers.

- A massive data breach that compromised the personal information of millions of customers. The repercussions of this breach extended into 2014, eroding consumer trust and leading to a decline in sales as customers were wary of shopping at Target.

- While Walmart has been able to expand and is well-established in Canada, Target’s attempt to expand into Canada faced significant challenges, including supply chain issues and a failure to resonate with Canadian consumers. These difficulties led to financial losses and ultimately Target’s decision to exit the Canadian market in 2015.

- Most recently, high inflation and a slowing economy have affected price-conscious customers who have reduced spending on discretionary items disproportionately affecting Target which makes up a significant portion of Target’s merchandise.

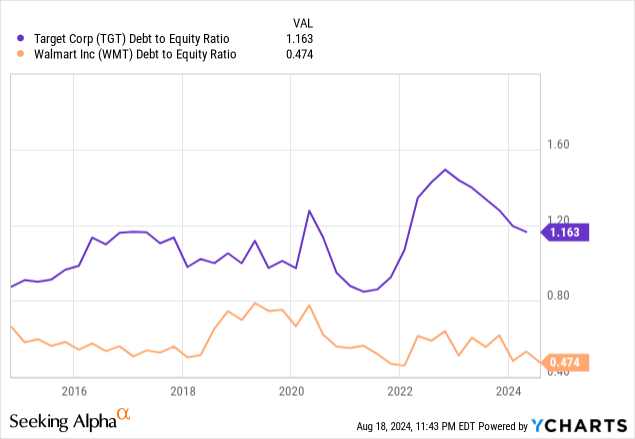

Finally, the fates of their balance sheet has also evolved differently. Walmart debt to equity is down overall, whereas Target’s has always been much higher than Walmart and is up higher than it was a decade ago (So even in the face of a collective downturn for the entire industry Walmart has much higher balance sheet flexibility than Target)

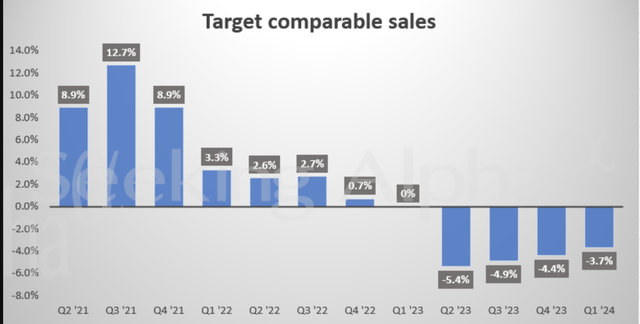

Target’s upcoming Q2 earnings

For Target Corporation, it wouldn’t be surprising to see another down quarter after seeing four consecutive quarters of declining growth. Additionally, for the fiscal year the number of up revisions is 6 for EPS, whereas the number of down revisions is 19. For revenues there are 20 down revisions versus 7 up revisions. In their first quarter earnings call, the management maintained that they are cautious of near term outlook and expect discretionary trends remain under pressure. However, for the quarter they are expecting to finally break out of negative topline growth and expand their profit rate.

In the second quarter, we are planning for a comparable sales increase in the 0% to 2% range. While this is below the growth rate we’d expect to deliver over time, it reflects a continued cautious approach to our near term outlook, which has served us well in recent quarters. On the bottom line in Q2, we’re guiding to a range of $1.95 to $2.35. The midpoint of this EPS range represents a growth rate of approximately 20% over last year as we continue to build on the profit rate expansion we’ve seen over the last few quarters.

– Michael Fiddelke – EVP, COO and CFO

Interpreting from Walmart’s Q2 Earnings call

So while Walmart’s results were positive news for its stock, I am struggling to go along with the market narrative that the consumer is strong and it is a positive for all retail stocks. If anything Target would be more affected by this trend once you start digging into Walmart’s earnings call.

- E-commerce sales were the biggest contributor to profits and also saw a reduction in delivery cost per order improving gross margins

- The company has highlighted the use of Gen AI for increased efficiency and growth behind online sales

- Groceries, accounting for about 60% of Walmart’s U.S. sales, have been a key factor in helping the retailer increase its market share and attract shoppers from various income levels.

- The company’s focus on being a low-cost seller led to reduced prices on 7,200 items with a 35% increase in the number of rollbacks on food items

- International sales rose 8.3% led by big gains in Mexico and China.

Target’s e-commerce sales suffered last year and it continued this year mainly due to its focus on discretionary items which consumers have cut back on whereas Walmart has been able to make up for that due to the strength of their grocery deliveries. While Gen AI may have a significant impact on its operations, the jury is still out on its efficacy and/or how long it takes Target to make it effective enough in its operations. Target is not a low-cost seller and although it has been reducing prices for its items to be better competitive with Walmart, I am doubtful of the margins as its operations may not be optimized enough to compete in the low-cost segment. Finally, Target is only present in the U.S. so no international market opportunities to benefit from.

Trying to predict the economic future through Walmart’s results could present a skewed picture. It was a really strong quarter for Walmart, but I don’t necessarily think that’s a good thing for the economy. People are looking for value, and instead of going to Target, Kroger or wherever else they shop, they’re now going to Walmart for at least a portion of their purchases

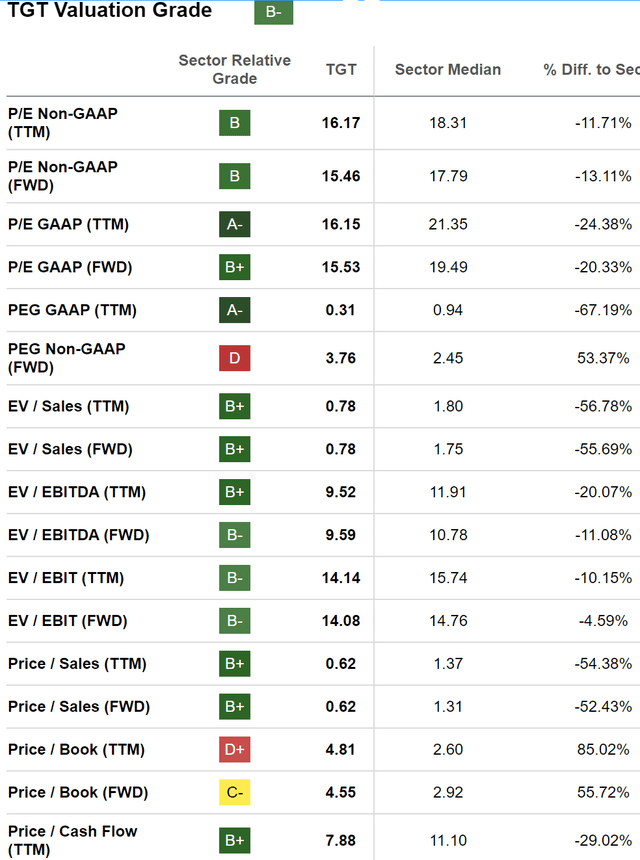

Target’s Valuation and Risks to this thesis

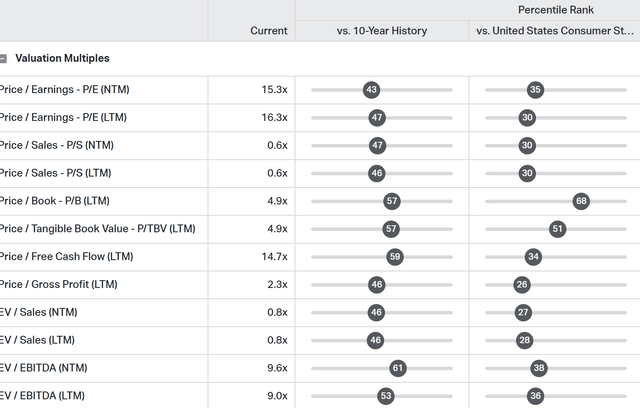

A valid risk to a Sell rating would be Target’s valuation. Currently, Target company trades at 15 times earnings and with an increased outlook on its earnings, its forward multiple is 15.5x. Its EV/EBITDA and its cash flows are also trading at a discount to the sector.

This shows that the market may have discounted a bad short term future already into its stock price. Looking at its percentile rank against its own ten year history and against the Consumer staples sector, it is clear that more than 50% of the time the multiples were trading higher than the present values.

Target’s valuation percentile rank (Koyfin)

So any good news (however slight it may be) may help the short term upside movement in its stock price. But I would personally view a rally from here as a chance to sell till the short term uncertainty in the economy changes. There is enough to make a case for uncertain market. Along with shaky geopolitics on multiple fronts, warnings signs have come in the form of a weakening labor market, the Conference Board’s Leading Economic Index (LEI) on a downward trend, and the highest credit card account delinquency in more than a decade. All in all, I am skeptical of the Walmart driven rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.