Summary:

- Target Corporation’s weak guidance for the holiday season and softness in discretionary categories lead me to initiate a “Sell” rating with a fair value of $112 per share.

- Despite 10.8% growth in digital sales, Target’s physical stores face challenges, with a 1.9% decline in comparable sales.

- Internal issues like SKU optimization and supply chain management, along with high competition, contribute to Target’s underperformance compared to Walmart.

- Weak consumer sentiment and supply chain cost pressures are expected to impact Target’s near-term growth, justifying my “Sell” rating.

jetcityimage

Target Corporation (NYSE:TGT) released their Q3 result on November 20th, providing weak guidance for the holiday season due to softness in discretionary categories. While Target has been growing their digital channel with 10.8% comparable sales growth (SSS) during the quarter, their physical stores continue to face growth challenges. I am initiating with a “Sell” rating with a fair value of $112 per share.

Softness in Discretionary Categories

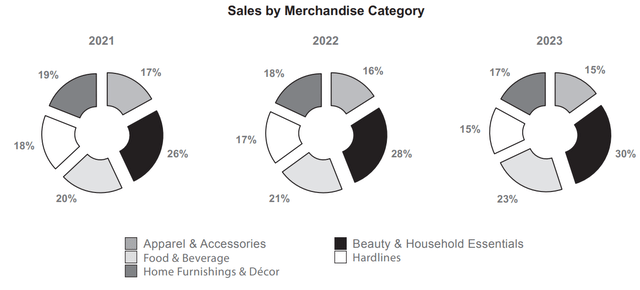

After years of business transitions, Target has increased its sales exposure to beauty, household essentials and food/beverages, as shown in the chart below. In the current high-interest rate environment, I think consumers are cutting their spending on discretionary categories, such as beauty and home furnishing products. As indicated in Home Depot’s (HD) recent earnings call, they continued to see softness in larger discretionary projects where customers typically use financing to fund the project. As such, I am not surprised with Target’s weakness in the discretionary categories such as home furnishing and décor products. During the Q3 earnings call, the management noted continued soft demand in apparel, home, and hardlines categories.

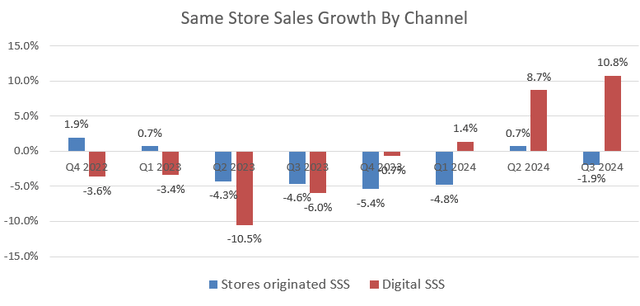

As depicted in the chart below, Target delivered 10.8% comparable sales growth in digital channel but experienced a 1.9% decline in its physical store channel. It is evident that Target has been struggling with their physical store sales growth in recent quarters.

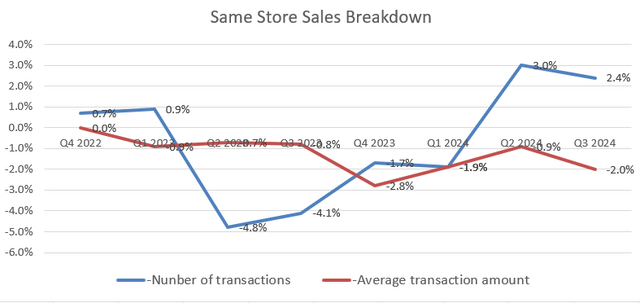

To further analyze their comparable sales growth, I broke down the growth into the number of transactions and the average transaction amount, as illustrated in the chart below. Due to the weak consumer sentiment, Target experienced a structural decline in the average transaction amount, indicating that consumers are cutting their spending that promotional activities are increasing in the retail market. During the earnings call, Target’s management anticipated heightened promotional activity throughout the year, particularly during the holiday season. I believe a highly promotional retailer market reflects a weak consumer demand, especially in the discretionary categories.

Other Internal Issues

While weak consumer sentiment has presented tremendous growth challenges for Target, I believe Target also faces internal issues related to SKU optimization, supply chain management, online channel and operational efficiencies.

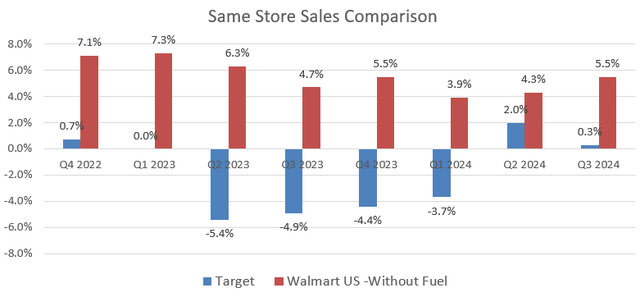

As shown in the chart below, Target has been consistently underperformed Walmart in comparable sales growth. Please note that I aligned Walmart’s quarterly end period with Target’s for comparison purposes. Walmart has been successfully grown its e-commerce channel, delivering 43% year-over-year growth with 290bps contribution to the US comparable sales growth in the recent quarter. Comparably, Target’s digital channel only grew by 1.5% in FY22, followed by 4.8% decline in FY23. Walmart also noted strong performance in the food category in Q3 FY25 with unit volumes growing by their highest level in four years.

Target, Walmart Quarterly Results

In addition, I think Target has struggled with their SKU management, offering too many categories vulnerable to other competition from e-commerce players like Amazon (AMZN). Although Target has increased their exposure to food and beverage recently, the category still represents only 23% of total sales.

Outlook and Valuation

Target is guiding for flat comparable sales growth for Q4, with adjusted EPS of $1.85 to $2.45, a pretty weak guidance, in my view. The weak margin guidance reflects supply chain-related cost pressures stemming from East Coast and Gulf port strikes, as noted during the earnings call.

For their near-term growth, I am considering the following factors:

- Store channel represents more than 80% of total revenue. Amid the high interest rates environment, I expect continued weakness in discretionary categories. Based on historical growth rates, I anticipate store originated comparable sales growth of around 1%, comprising 0.5% transaction growth and 0.5% average transaction amount growth.

- Target has focus on their digital channel recently, launching programs like Circle 360 and same-day delivery services. I believe their digital channel will grow at a high-single-digit rate in the near future, as ship-to-home business is gaining popularity among customers.

- Combining physical and digital channels, I estimate the same store sales will grow by 2.6% annually, driven by 1% physical store sales growth and 8% digital channel growth.

- With 1,956 stores in operation, I anticipate the new stores will contribute an additional 1% growth to the overall topline, aligned with their historical average.

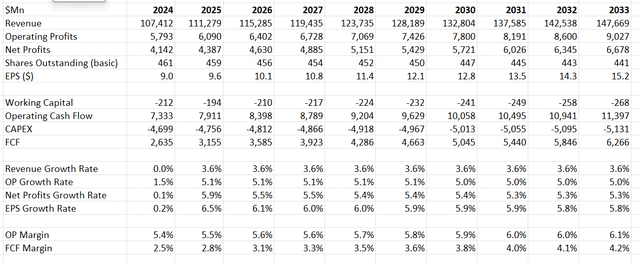

- I forecast 10bps annual margin expansion, driven by the revenue mix shifting to digital channel. I calculate that the total operating expenses will grow by 3.5% annually, leading to 6.1% of operating margin by FY33.

- I calculate the WACC to be 9.4% assuming: risk-free rate 3.8%; beta 0.92; equity risk premium 7%; equity balance $71 billion; Debt $11 billion; tax rate 22%.

The DCF can be summarized as follows:

Discounting all the future FCF, the fair value is calculated to be $112 per share, as per my estimates.

Upside Risks

As I assign a “Sell” rating on Target, I am considering the following potential catalysts for stock upside:

- Target repurchased $7.1 billion of own stocks in FY21 and $2.6 billion in FY22 but did not repurchase any in FY23. Year-to-date, the company has repurchased $506 million of own stocks. As noted in the earnings call, the management expected to repurchase more in Q4, which could support the stock price.

- Target has been making significant investments in their digital business, with strong growth in its ship-to-home segment in recent quarters. The strong digital channel could contribute to an accelerating comparable sales growth, which could be favored by the market. Based on my sensitivity analysis for the DCF model, a 1% increase in comparable sale growth could add nearly 10% to the stock price.

- As the Fed has begun to cut interest rates, consumer sentiment could potentially recover faster than expected. If that is the case, Target might experience a strong recovery in discretionary categories, accelerating Target’s comparable sales growth.

Conclusion

I think the current stock price has not fully reflected the weak growth in discretionary categories and near-term margin pressures. Therefore, I recommend investors avoid Target stock at this time. I am initiating with a “Sell” rating with a fair value of $112 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.