Summary:

- Target has returned to growth and margin expansion, but I rate the stock a hold due to its fair valuation.

- Q2 results show improved traffic, comp sales growth, and margin expansion, driven by better merchandising efforts, reduced shrinkage, and efficiency gains.

- Target’s investments in supply chain and fulfillment have enhanced efficiency, positioning it well for future growth and improved margins.

- Despite operational improvements, economic uncertainties and valuation concerns led me to hold off on buying TGT.

John Kuczala

Investment Thesis

Target Corporation (NYSE:TGT) has returned to top-line growth and margin expansion. After weathering the pandemic and poor inventory management, the company appears primed to recapture some of the magic it had in the 2010s. If TGT achieves the goals that CEO Brian Cornell has laid out, driving increased traffic, expanding operating margin beyond 6.0%, and growing the top line; the stock is likely to deliver solid returns to shareholders. However, I rate the stock a hold due to a fair but unappealing valuation for investors looking for market outperformance.

Fundamentals

Q2 results showed that Target is improving traffic in its stores, which drove comp sales growth of 2% YoY, putting sales at $25.45 billion, 2.74% higher than Q2 2023, beating estimates by $245 million. EPS came in at $2.57 per share, beating estimates by $0.39. Free cash flow was $1.6 billion, a 75% YoY increase, on the strength of increased operating cash flows and lower Capex spending requirements.

Most importantly, TGT’s gross margin expanded 190 basis points to 28.9%. Management cited improved merchandising strategies for driving 90 bps of that improvement, and noted that 90 bps of improvement came from shrink reduction. An improved sales mix also helped, but this was largely offset by digital fulfillment costs and supply chain issues.

With 9% comp sales growth, Target’s beauty segment was the strongest business segment. Apparel grew comp sales at 3%, while food and beverage sales grew in the low single digits, reportedly benefitting from price cuts on nearly 5,000 items. I’m hopeful that reduced inflation in TGT’s consumer staples SKUs will continue to help drive traffic and boost discretionary purchases, but the jury is still out.

Digital sales growth was a key contributor to the positive quarter, with Drive Up and Target Circle 360 growing in the low teens, per management. Same-day services now account for over two-thirds of digital sales, a positive sign for the e-commerce segment.

I believe that Target’s investments in supply chain and fulfillment improvements have positioned the company well for the years ahead. These efficiency improvements are where the 90 basis points of merchandising gross margin impacts came from.

Efficiency Gains

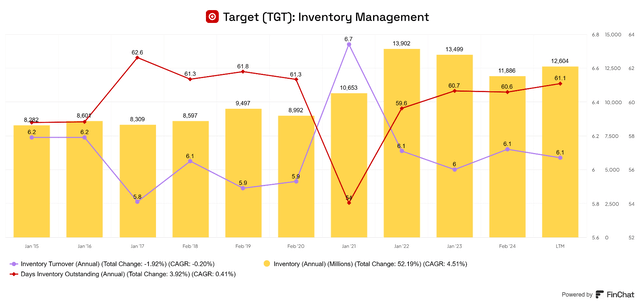

Target continues to make inventory management improvements and optimize its “in-stock reliability.” TGT reportedly reduced out-of-stock items by 500 basis points, and investments in inventory decreased. Inventory on the balance sheet is about 0.6% lower than at the end of Q2 2023, but operating revenue was 2.6% higher. Inventory turnover has come down from 6.7x in fiscal 2020 to 6.1x now and is within its historical range. Days Inventory Outstanding has increased, but is still within a normal range. These metrics look fine for now, but might be something to keep an eye on as newer inventory is potentially valued higher when it converts into COGS (TGT uses FIFO for inventory).

TGT Inventory Management (FinChat)

TGT struggled with inventory overstocking and mismanagement during 2022. This stretched into 2023 before the improvement began to show. Over the last decade, TGT invested roughly $7 billion into improving its business, from store designs to optimizing logistics. Some of this investment went into optimizing its fulfillment network. A $100 million investment in improving its sortation centers has expanded its network, soon increasing it to 15 by the end of 2026. These centers help TGT get products to regional or national carriers or its Target last-mile delivery through Shipt. Once orders are placed online, the system more effectively routes packages. This has increased the speed of delivery and dramatically improved next-day delivery at a lower cost. Sortation centers also free up work that used to be done in-store, increasing store efficiency.

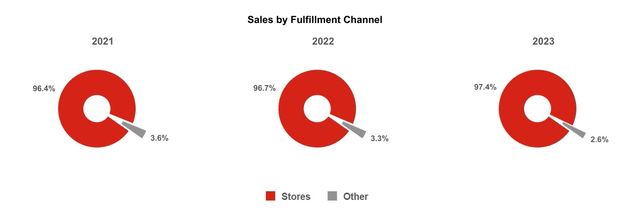

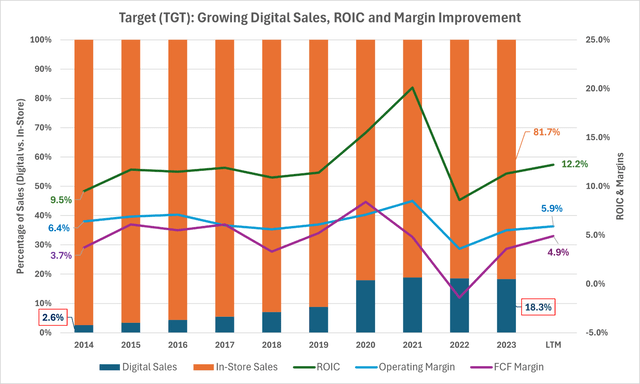

75% of Americans live within 10 miles of a Target store. Its retail locations now act as mini-distribution centers and are integral to the company’s e-commerce growth. Whether acting as a place to store goods that may be delivered or for customers to order online and pick up same-day, TGT is leveraging its footprint for better uses. 80% of online orders were fulfilled from brick-and-mortar locations in 2020, which reportedly helped the company cut fulfillment costs by 40%. TGT has increased its digital sales as a percentage of total sales from 2.6% in 2014 to 18.3% in fiscal 2023. While sales have increasingly gone digital, Target has increased the percentage of total sales fulfilled by its stores, now representing 97.4% of sales in its most recent 10-K.

Target was several years behind Walmart’s push to automate and optimize its supply chain network and fully adopt e-commerce, but the results seem to be showing now. This push is one key driver behind margin expansion and the company’s ability to remain relevant.

If the company can return its margins to pre-pandemic levels and return to top-line revenue growth, the stock may be a good value right now.

Going Forward

TGT raised FY 2024 EPS guidance to $9.00 – $9.70 from $8.60 – $9.60 and expects comp sales growth between 0% and 2% in Q3, with an EPS of $2.10 – $2.40.

With margins recovering, Target’s outlook is improving. Management says its focus is on expanding its operating margin (OM) to and beyond its pre-pandemic level of roughly 6%. Over the trailing twelve-month period, TGT has achieved a 5.9% OM. Now that the company is performing better operationally, FCF margin has improved to 4.9% over the TTM period.

Investments in efficiency and growing digital sales appear to be a key driver of this improvement. As can be seen below, digital sales slowly increased as a percentage of total sales until the pandemic. Digital sales now make up 18.3% of total sales. As digital sales have grown, margins have expanded. Return on Invested Capital (ROIC) has increased since 2014, showing that the investments into logistics, supply chain, and technology for TGT to build this network out were likely advantageous, as margin expansion followed.

Solid ROIC and shift to Digital sales has boosted margins (Author-generated chart)

Cash Flow Potential

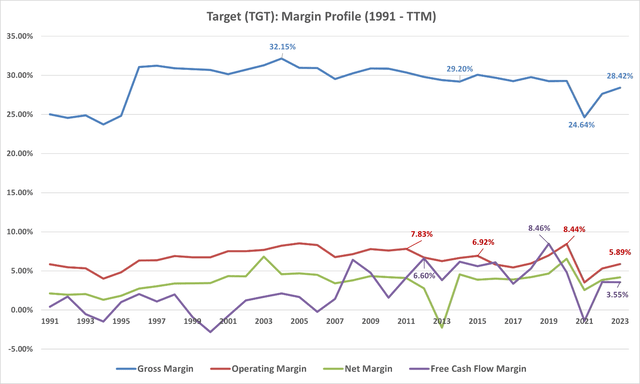

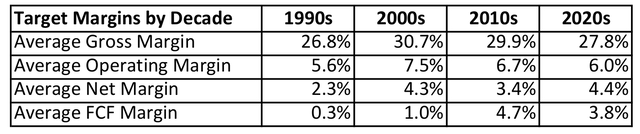

The following chart shows the long-term trend margin profile of TGT. When looking for moats and sustained relevance, I first want to see gross margins being maintained or expanding. In TGT’s case, they have contracted slightly until over-inventory issues forced the company to heavily discount, and inflation increased COGS. Gross margin has rebounded in 2022 and 2023. With that, operating, net and free cash flow margins have also expanded. Target still sits below its historical averages.

TGT Margin Profile (Author-generated chart)

With management committing to returning to pre-pandemic margins, it’s reasonable to use this to then run our valuation on the back of management’s margin outlook. Looking at average annual margins by decade, Target has underperformed since COVID-19 began, and its TTM margins still look worse than in the 2010s.

TGT Average Margins (Author-generated)

Valuation

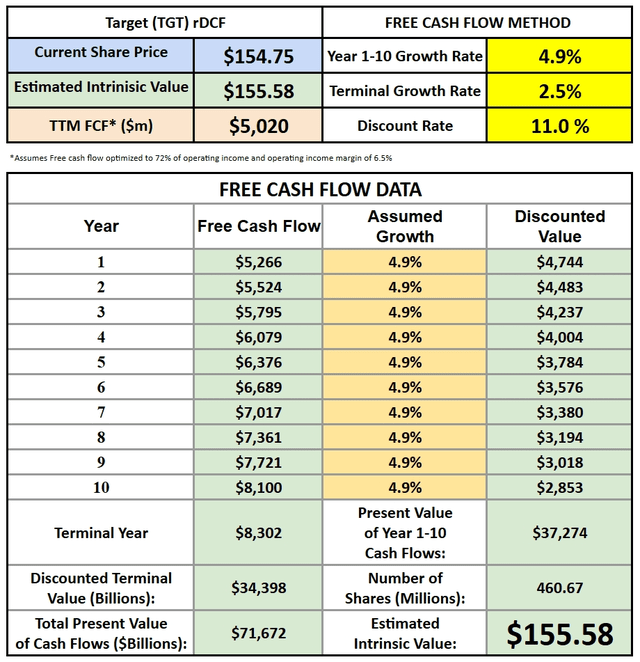

With the company having made significant strides this year, I will run a model assuming that TGT is able to optimize free cash flow rather quickly and then determine what kind of growth would be needed to justify the stock price using a reverse discounted cash flow model. This model assumes that TGT has optimized its FCF margin, and that margin doesn’t change going forward. Given this assumption, we can model the revenue growth needed to justify the stock price.

Let’s say that Target can expand and maintain its operating margin to 6.5%. This would be an improvement from recent years, and still lower than the average achieved in the 2010s. During the 2010s, TGT converted about 72% of operating income to free cash flow, on average. Given TTM revenue, that would be $6.975 billion in operating income and $5.02 billion in free cash flow. I will set this as our base FCF and run our reverse DCF from here.

Using a 2.5% terminal rate, slightly above long-term GDP growth, seems appropriate, considering that TGT has a durable competitive advantage. A hurdle rate of 11% assumes that TGT could return a roughly 11% CAGR under these circumstances and would likely be an adequate enough return to outperform the S&P 500.

If Target was optimized for free cash today, as outlined above, it would need to grow revenue at a rate of 4.9% annually for the next ten years to justify the stock price today.

TGT Reverse DCF (assuming optimized FCF) (Author-Generated DCF Model)

Keep in mind that this is a hypothetical example of TGT quickly optimizing itself for free cash flow generation and not a projection of free cash flows.

Risks

The major risk is that Target loses relevance, however, with margins expanding, it appears that Target is maintaining a leading position in the retail market, at least for now. The company plans to open 300 stores in the coming years, I don’t see this as a legitimate risk right now. However, the macroeconomic outlook has me hesitating on TGT. Perhaps a pullback in shares will be what I need to re-open my position in the stock. There are some potential headwinds brewing this year.

The 2024 holiday shopping season is shorter, with only 27 days between Thanksgiving and Christmas, meaning that the early Black Friday – Cyber Monday (BFCM) deals might be an even more critical tool for retailers this year. Tapcart finds that nearly 60% of shoppers plan to start their holiday shopping in October or November. This is expected to be higher than in years past due to the shorter gap between the two major U.S. holidays.

With a shorter period between holidays, there is the potential for delivery issues and backlogs that could pressure retailers, meaning those who plan BFCM shopping in advance or who turn to the right retailers won’t have that problem. Target seems ready to capitalize on the shorter holiday period by turning to discounts earlier than usual in 2024. This could present the company with an opportunity to maintain its standing as a go-to destination for many holiday shoppers; it can also act as a word of caution as consumers may be getting a little more conscious about their spending.

It appears that discounts may be just what the American consumer is looking for this year. McKinsey finds that customers across all generations are trading down and searching for better prices. 76% of consumers reported trading down in the third quarter, but 86% of Gen Zers and millennials reported trading downtrends. 50% reported changing retailers for a lower price or discount, which increased from 44% last year. Though this might benefit larger discount retailers like Target, too much pressure on consumers could be an issue, McKinsey also found that consumers may be looking to reduce the number of items they purchase this year.

Inflation overhang may be an issue for consumers, as 53% of respondents to McKinsey still say that rising prices are among their concerns compared to 37% who say that stabilizing inflation makes them feel more confident about the economy. Less confidence in the economy might play a role in reshaping shopping behaviors this holiday season and into 2025. Perhaps the lowering of prices on everyday items will help consumers feel more confident and add a few discretionary purchases while they are drawn into stores for their cheaper staple items.

Conclusion

Target has improved its shrinkage problem, inventory management, and overall efficiency. There are signs of improvement that reinforce my confidence in TGT’s ability to get the company on the right long-term path to good shareholder returns. Margins are improving, and inventory management and efficiency gains show the company is on the right track. However, I have my doubts about where we are in the economic cycle and am only looking to add TGT back into my portfolio if I believe there is an asymmetric risk-reward. Otherwise, my funds might be better invested in a broad market ETF or TGT’s more dominant rival, Walmart (WMT). When I wrote about WMT in the summer, I was hesitant to buy the stock, despite realizing that the company might have more growth levers than previously realized. Almost immediately after rating it a hold, the stock rallied. I took a little friendly slack from commenters for that. I have to admit I might have missed the boat on WMT and need to consider if it is still a good buy. The question I have now is whether or not TGT has the same opportunity that WMT has. I suspect that the answer is more complicated, to learn more, I looked into TGT’s push to improve efficiency through investing in its supply chain and fulfillment strategy and came away impressed. However, I still feel that the company is roughly fairly valued at best and rate the stock a hold for now. A pullback in prices or further evidence of the company’s operational turnaround might get me interested in buying the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.