Summary:

- I am downgrading Target from a “buy” to a “hold” and reducing the price target by 21% to $147 due to disappointing Q3 performance and muted Q4 guidance.

- Target’s Q3 saw deceleration in comparable sales growth and deteriorating margins due to higher inventory levels and promotional pressures, leading to underperformance against the S&P 500.

- Despite strong digital sales growth, Target’s overall revenue growth was strained by declining average selling prices and potential market share losses to competitors like Walmart and Costco.

- The potential impact of President-elect Donald Trump’s proposed tariffs on imports also adds uncertainty, likely raising consumer prices and dampening demand, further pressuring Target’s top and bottom lines.

J Studios

Introduction and investment thesis

On September 23, I had initiated a “buy” rating on Target Corporation (NYSE:TGT) with a price target of $185.2.

I believed that Target was well positioned to smash the holiday season as its 1) comparable sales had turned positive, thanks to acceleration in its digital channels, 2) margins expanded from optimal category mix along with a prudent inventory position and 3) Target Circle loyalty program was well positioned to drive higher purchase frequency and order volumes from personalized offers.

Unfortunately, my bullish thesis was proven wrong with the company’s Q3 FY24 earnings report, with the stock underperforming the S&P 500 since the time of my previous publication.

In Q3, Target saw a deceleration in the pace of its comparable sales growth, as the promotional environment weighed down on ASP (Average selling price).

In the meantime, their gross and operating margins deteriorated from expanding inventory levels.

While the sales in its digital channels grew at an accelerating rate, the management’s muted Q4 revenue guidance is concerning, especially with strong holiday spending data from Adobe Analytics, which could be indicating potential market share losses.

Although Target is likely to enter a favorable comps environment in FY25 as per consensus estimates, I believe there is another big unknown- the impacts of President-elect Donald Trump’s proposed tariffs on imports to the US, which could raise overall inflation and dampen consumer demand.

Therefore, I have decided to downgrade my rating on the stock to a “hold”, while slashing my price target by 21% to $147, as the stock will likely be under pressure until it can demonstrate a reversing trend in its top and bottom lines.

Target’s discounting strategy failed to offset decline in ASPs, suggesting potential market share losses

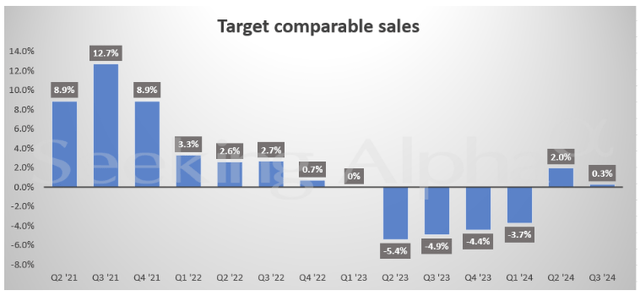

Target reported its Q3 FY24 results where its revenue grew 1.0% YoY to $25.68B, while its comparable sales saw a sequential deceleration in the rate of growth to just 0.3% YoY, which significantly missed consensus estimates of 1.48% YoY growth, severely dampening investor sentiment.

On one hand, while its Digital Comparable sales grew at an accelerated rate of 10.8% YoY, its Store Comparable sales declined 1.9% YoY, bringing down the overall pace of comparable sales growth.

SA: Decelerating pace of growth in Q3 FY24 comparable sales

During the quarter, the company saw traffic grow a healthy 2.4%. However, this was offset by a decline in average ticket size of 2%. Despite Target’s strategy to deliver newness and value to drive a differentiated consumer experience, consumers continued to shop carefully amid stretched budgets. According to the management, “Consumers have become increasingly resourceful in their shopping behaviors, waiting to buy until the last moment of need, focusing on deals, and then stocking up when they find them.”

As a result, the company is seeing a stronger response to promotions, as customers are generally more willing to spend when they find the right balance of on-trend newness at compelling price points. Compared to a year ago, Target’s promotional markdown rates have increased around 100 basis points.

In my previous post, I had discussed that discounting was one of the strategies Target has been using to boost traffic. Unfortunately, the volume of traffic is not sufficient enough to offset the decline in ASPs, which is straining overall revenue growth. While certain categories such as Beauty, Food & Beverage, and Essentials are seeing above-average comparable sales growth, given the company’s initiatives to drive newness and value through greater assortment, their Homes and Hardlines categories continued to remain under pressure.

Last month, Stifel analyst Mark Astrachan had put out a note where he pointed to Target’s underperformance compared to its larger peers, such as Walmart (WMT) and Costco (COST), indicating potential market share losses, while Morgan Stanley noted that Amazon (AMZN), Walmart and Costco are taking 50% of incremental retail sales and more than 75% of incremental e-commerce sales, which means that the rest of the mall retailers and e-commerce players are scrapping for the leftovers.

Higher inventory levels squeezed Q3 profit margins

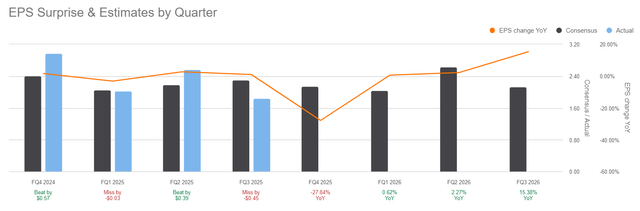

In terms of profitability, Target reported non-GAAP EPS (earnings per share) of $1.85, which also failed to meet consensus estimates of $2.30. On a YoY basis, its EPS grew 1.06%, in line with revenue growth.

However, both its gross and operating margins shrunk 20 and 60 basis points respectively from increasing costs from digital fulfillment and supply chain costs due to higher inventory levels, along with a slowdown in their highest margin discretionary categories, such as Home and Apparel. At the same time, their SG&A expense rate also expanded by 50 basis points as revenue came near the low end of their expected range.

On the topic of inventory levels, the company saw a 3% YoY increase in the level of their inventory, which grew at a faster rate than overall revenue growth. If inventory levels grow faster than overall sales growth, it usually translates to higher cost pressures, like we saw in Q3, along with deeper discounting, which could dampen both ASPs and margins in the process.

During the earnings call, the management attributed the reason behind the increase in their inventory levels to challenges that they faced due to the East Coast and Gulf port strikes, which affected the timing of certain shipments and receipt timing. Coupled with the impact of softer-than-expected sales in certain discretionary categories, this led to a higher inventory level earlier than in a typical year.

Management’s muted Q4 guidance is concerning amid strong holiday spending data

In my previous post, I had pointed to the company’s a) improving comparable sales, b) strong operating rigor with prudent inventory position, and 3) digital momentum in Q2 to be responsible for the company smashing sales in the holiday season.

While Q3 turned out to be a disappointment on the comparable sales and operating rigor front, I believe the company continued to demonstrate strong momentum in its digital channel grew over 10%, with 20% growth in their same-day delivery powered by Target Circle 360, along with double-digit growth in Drive Up. Meanwhile, it enrolled 3M new Target Circle loyalty members in Q3, which is faster than its Q2 rate, empowering the organization to not only drive profitable sales growth but also gain deep customer insights to extend more personalized offers to drive purchase frequency and order volumes.

In the meantime, the company is also focused on delivering the “perfect balance of value, newness, ease, and inspiration” as part of their holiday season plans. What I will note however is that heavy discounting remains a central strategy during the holiday seasons to boost traffic growth during the earnings season.

Unfortunately, the management struck a cautious tone when it came to their Q4 revenue guidance, where they expect ongoing weakness in discretionary categories while projecting flat year-over-year comparable sales growth.

So far, according to Adobe Analytics, holiday shopping is already off to a strong start, with spending reaching a record $6.1B on Thanksgiving, $10.8B on Black Friday, and $13.3B on Cyber Monday, representing a growth rate of 9%, 10.2% and 7.2% YoY respectively, with a total of $131.5B that has already been spent by Americans starting from November 1.

With online retail spending expected to reach $240.8B, it will represent a growth rate of 8.6% YoY along with widespread discounting across several categories. With data suggesting that consumers are spending at a higher rate across apparel, bedding and furniture, groceries, and cosmetics, it is disappointing that Target management anticipates flat year-over-year comparable sales growth, with pessimism in certain discretionary categories.

Target remains committed to its long-term strategy, but there is a big unknown

Finally, despite facing pressures on both the top and bottom lines, the management remains confident in their long-term strategy, where they are investing in their existing and new stores while bolstering their digital experiences and improving the overall efficiencies in their fulfillment capabilities. At the same time, they continue to expand their brand portfolio to gain higher control over quality and costs.

Meanwhile, Target is also going to enter a more favorable comps environment in FY25, as can be seen below. The stock is trading at a 20% discount to its 5-year forward price-to-earnings ratio given the depressed investor sentiment from top and bottom-line weakness, along with lowered forward guidance.

SA: Favorable comps environment in FY25

However, in all of this, there remains a big unknown, which is the impact of President-elect Donald Trump’s proposed tariffs on imports to the US, which will likely put upward pressure on consumer prices for clothing, toys, furniture, and more, thus likely dampening overall demand.

With Goldman Sachs estimating the effect of tariffs to raise Core PCE by 0.3-0.4 pp next year, leaving it at 2.4% by December 2025, Americans could lose between $46B and $78B in spending power each year, or $362-$624 per household.

While US retailers will likely transfer a substantial portion of the price increases over to the consumer, the impact on the top and bottom line is unknown, as the demand environment is hard to predict.

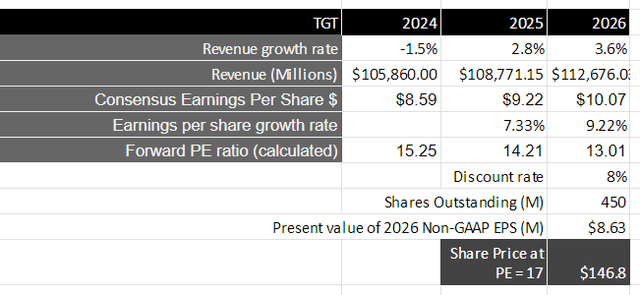

Reducing my price target by 21% to $147

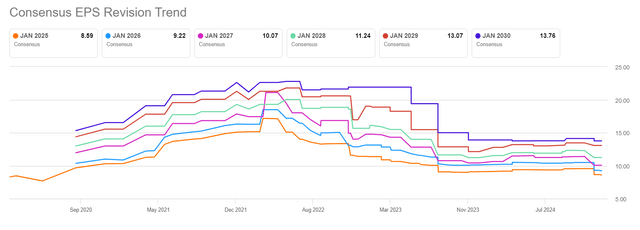

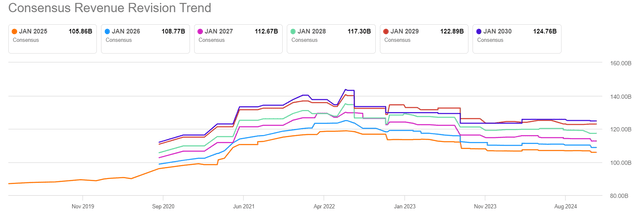

With the management anticipating flat Q4 comparable sales while reducing their FY24 EPS guidance from their previous range of $9.00-9.70 to their present target of $8.30-8.90, the company has received a slew of forward revenue and EPS downgrades as can be seen below.

SA: Downward EPS revisions SA: Downward Revenue revisions

In this valuation model, I will take consensus revenue estimates into account, which call for a decline of 1.45% YoY in FY24, followed by growth in the low single digits after that. Note, that these growth estimates are lower than its larger peers of Walmart and Costco, which is discouraging in my opinion, as it points to market share losses.

From a profitability standpoint, I will take the management’s FY24 estimates of non-GAAP EPS into account, followed by consensus estimates that call for a total non-GAAP EPS of $10.07 by FY26, growing at a faster rate than overall revenue growth. This will be equivalent to a present value of $8.63 when discounted at 8%.

Assigning it a price-to-earnings multiple of 17, which is the average multiple of the S&P 500, where its companies grow their earnings on average by 8% over a 10-year period, it translates to a price target of $146.8, which represents an upside of 11% from its current levels.

My final verdict and conclusions

Although I had initiated a “buy” rating on Target stock in September, I will unfortunately have to downgrade the stock to a “hold”, while reducing my price target by 21% to $147 at this time, after taking a hard look at things.

In Q3, the company failed to deliver on the accelerating trend in comparable sales growth, while suffering from a deterioration in its operating metrics with the expansion in inventory levels. With promotional activity weighing down on ASPs, the company may continue to suffer from margin pressures. At the same time, its muted Q4 guidance points to potential market share losses to its larger peers in the retail industry. Plus, there is the added unknown of how tariffs will impact retailers’ top and bottom lines.

As a result, I believe it will be prudent for investors to stay on the sidelines, as the stock does not offer a compelling risk-reward to initiate a position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.