Summary:

- Retail sales saw a revival in June, particularly in eCommerce, suggesting that we could see a solid back-to-school season.

- I am upgrading shares of Target from a hold to a buy due to resilient consumer spending and a better technical situation.

- Analysts expect a 22% year-on-year EPS jump in the upcoming Q2 earnings report, a significant improvement from previous quarters.

- With better technicals, I highlight key price levels to monitor ahead of the quarterly report in August.

JHVEPhoto

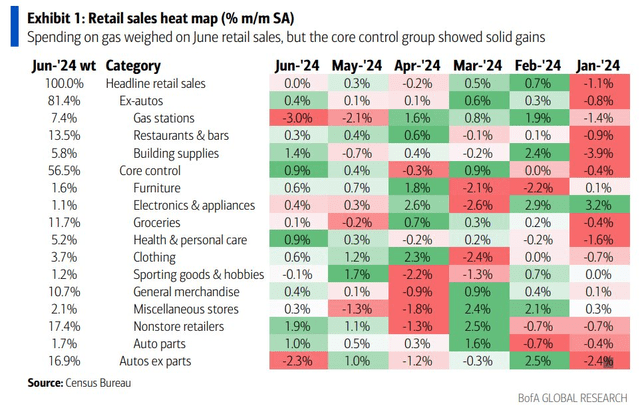

There was a retail revival of sorts in June. The US Census Bureau reported a solid rise in the Core Control group earlier this month, which is a positive sign as the back-to-school spending season kicks into high gear before Target’s (NYSE:TGT) Q2 earnings report due out in late August. Following an outright weak report in May, with shares trading lower post-earnings for the first time following five consecutive positive reactions, there may be subdued expectations this go around.

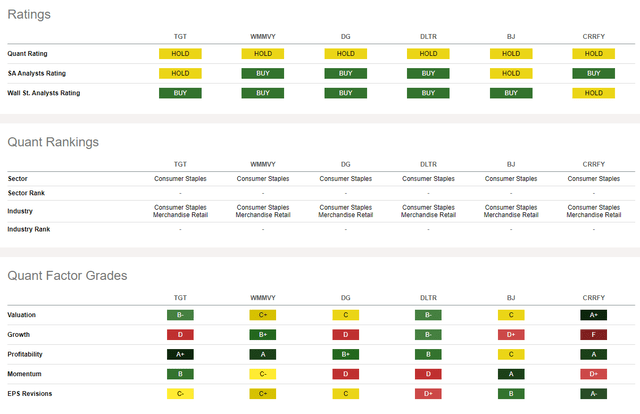

I am upgrading Target from a hold to a buy in light of resilient consumer spending, but I am careful to consider macro risks at play as well as heightened competition from lower-cost peers such as Walmart (WMT), Amazon (AMZN), and even Costco (COST). Target also sports a better technical situation today, but the aisles are by no means all clear, which I will detail further.

Target is down about 8% since I last reviewed it with a hold rating. The poor Q1 report was the primary culprit for the drop, but shares hit key support that I outlined back in April. TGT is also at a better value today, supporting my upgrade back to a buy.

June Retail Sales Solid, Particularly eCommerce (Nonstore Retailers)

Back in May, Target reported an all-around soft Q1. Highlighting softness in the discretionary space, the Minnesota-based retailer reported Q1 non-GAAP EPS of $2.03 which fell shy of Wall Street expectations by $0.03. Revenue of $24.5 billion, down 3% from year-ago levels, was roughly in line. But first-quarter comp-store sales fell nearly 4%, which while sequentially improved, still suggests modest weakness. What was encouraging, though, was that the company’s inventory fell 7% on a year-on-year basis, so hopefully it’s a sign that modest overall cost increases will occur as 2024 progresses.

Target has exciting initiatives ongoing, including its new Target Circle rewards program – this will be key to watch in the earnings report next month. If the management team is upbeat about the progress of new paid subscriptions, then a valuation boost could be in store given a new recurring revenue source. In the here and now, the back-to-school spending situation will be important for the $70 billion market cap firm. An annual study by Deloitte found that this season should see overall spending about on par with that of last year.

Analysts expect non-GAAP EPS of $2.19 in the quarter about to be reported, while Target’s top line is seen at $25.19 billion. The options market, meanwhile, prices in a 6.2% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the report. That is the most expensive straddle since August of 2022, so we could see a significant share-price swing this go around. The stock closed 8% lower after its Q1 report in May.

Key risks include gross margin pressures from larger retail competitors – monitoring its GM trend in the quarterly report ahead will be important. Labor costs remain a challenge as we continue to see higher wages for low-end workers. More sales in its e-commerce channel and grocery could also lead to softer margins. Of course, a macro consumer spending slowdown would be a headwind for the domestic retailer. It remains to be seen how AI impacts Target, but there is some general optimism in that realm.

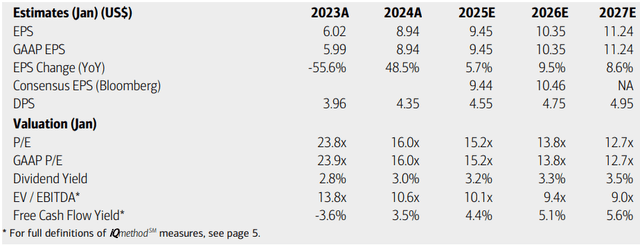

On the earnings outlook, analysts at BofA see EPS rising at a mid-single-digit pace this year, with a profit acceleration in the out year and through 2027. The Seeking Alpha consensus estimates are about on par with what BofA projects, while Target’s revenue is seen holding steady near $107 billion this year before rising at a pace just above the expected inflation rate.

Dividends, meanwhile, are projected to increase by $0.20 annually, and the stock currently yields nearly 3%. Now with a mid-teens price-to-earnings multiple and improving free cash flow, there are some fundamental tailwinds developing, but much depends on its management team executing in a competitive environment.

Target: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

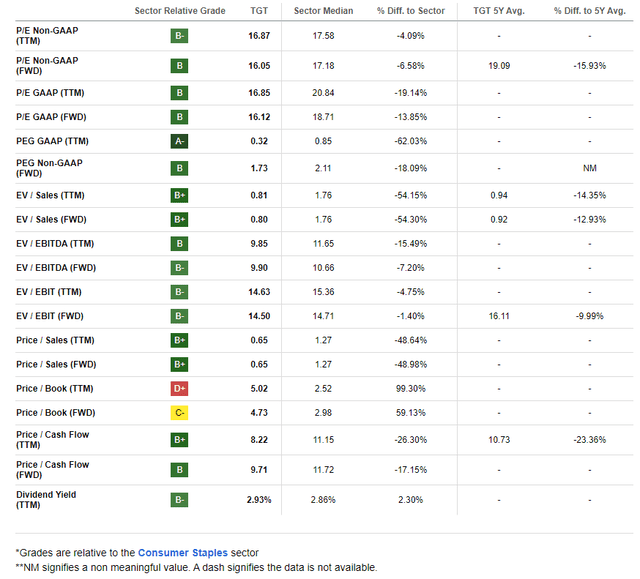

Target has generally favorable valuation metrics. Its 5-year average earnings multiple is slightly above 19, so the current P/E is a full three turns cheaper than the average. If we assume non-GAAP EPS of $9.80, the same expectation as my previous analysis, and apply an 18x P/E, below its 5-year average and three handles cheaper than the broader market, then the stock should trade near $176, making Target attractive on valuation.

I am giving Target a modestly higher P/E given the overall improvement in profitability metrics and sales trends, which I think can continue as time progresses from its 2022 challenges.

Target: A More Attractive Valuation Today

Compared to its peers, Target features a strong valuation rating while its growth trajectory has been soft. But with very impressive profitability trends, we should see that translate into better earnings growth figures in the quarters ahead. Based on the consensus numbers, the upcoming Q2 is expected to see a 22% year-on-year EPS jump.

And with improved share-price momentum, there are technical reasons to like Target shares today, even though the mix of sellside upgrades and downgrades is about equal over the past 90 days.

Competitor Analysis

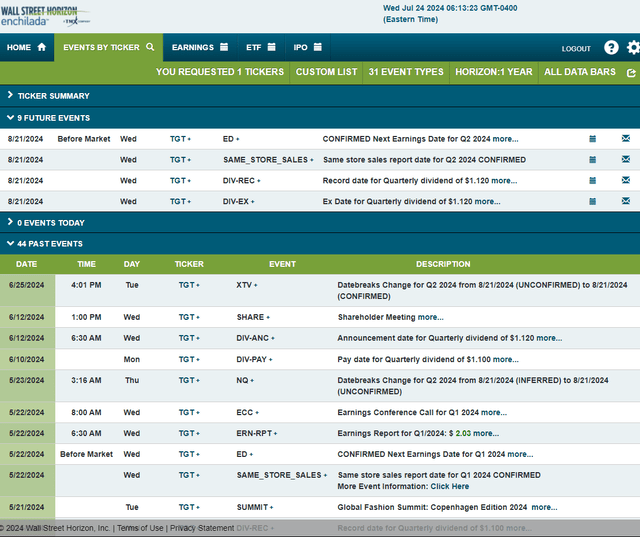

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q2 earnings date of Wednesday, August 21 BMO. Shares trade ex a $1.12 dividend on the same day. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

The Technical Take

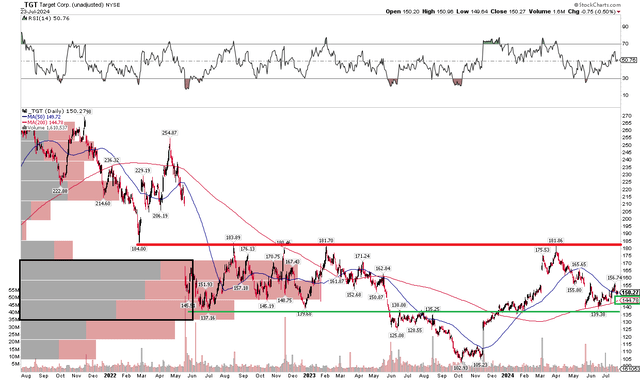

With a more sanguine fundamental backdrop, TGT has some modest technical improvements. Notice in the chart below that shares indeed bounced off key support, as I underscored in my April report. The $139 spot was defended by the bulls. More recently, the rising long-term 200-day moving average is positively sloped, with the stock holding that level in recent weeks.

Still, resistance is apparent in the low $180s, a story that has not changed since the start of the second quarter. There’s now an even higher amount of volume by price in this $140 to $180 zone, so further technical churning could be in the offing. Today’s risk/reward construct is more favorable compared to earlier in the year, however, so I feel confident lifting TGT from a hold to a buy when analyzing the chart trends, too.

Target: Shares Hold Key Support, Rising 200dma

The Bottom Line

I have a buy rating on Target. After a pullback in the stock and with what should be a solid quarter of growth about to be reported, I lean more bullish today.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.