Summary:

- Target’s earnings miss and guide-down were driven by changing consumer demand for discretionary goods and proactive supply chain adjustments due to a port strike.

- The stock’s drop is overdone, with a revised fair value of $144, making Target a Buy at the current price of $122.

- Target’s valuation is attractive compared to Walmart, with similar return on capital and only slightly lower growth.

- Future consumer sentiment and spending patterns, along with continued cost management, are key to Target’s margin recovery and earnings growth.

Sundry Photography

It’s Not About Being “Woke”

Target Corp. (NYSE:TGT) shocked investors with a massive earnings miss and guide-down in their Q3 2024 earnings release. The retailer earned $1.85 per share in the quarter and guided to a range of $8.30 – $8.90 per share for the year. These numbers came in far below consensus estimates of $2.30 and $9.52 per share. The stock dropped over 20% on earnings day, the worst drop since Q1 2022 results were announced. This leaves the share price below pre-pandemic levels of 5 years ago and more than 50% below peak levels reached in 2021.

Target (TGT) 5-year price chart (Seeking Alpha)

Many commenters on Seeking Alpha news articles went right to the political explanation of Target being excessively “woke”, or concerned about specific demographic sub-groups while alienating the larger customer base. It’s rarely a good idea to base investing decisions on politics, especially if it prevents digging deeper to find other reasons. It is true that Target has catered to identity groups for the last several years, and they still have a “New & Featured” menu on their home page featuring several such groups.

Nevertheless, as I pointed out in my last article in March, Target has evolved their messaging in the last year or so to be more inclusive of all customers. This included dialing back displays of rainbow themed merchandise in June 2023 following customer complaints.

Target’s same store sales growth bottomed in mid-2023 at around -5% and has gotten back to positive in the last two quarters. So, it is hard to blame an issue that reached peak visibility a year and a half ago for the current results. Instead, Target’s current problems are similar to the ones that caused the last big drop in the share price in 2022: changing consumer demand and overstocking of inventory. Costs also come into play this quarter, impacting operating margins.

Changing Consumer Demand

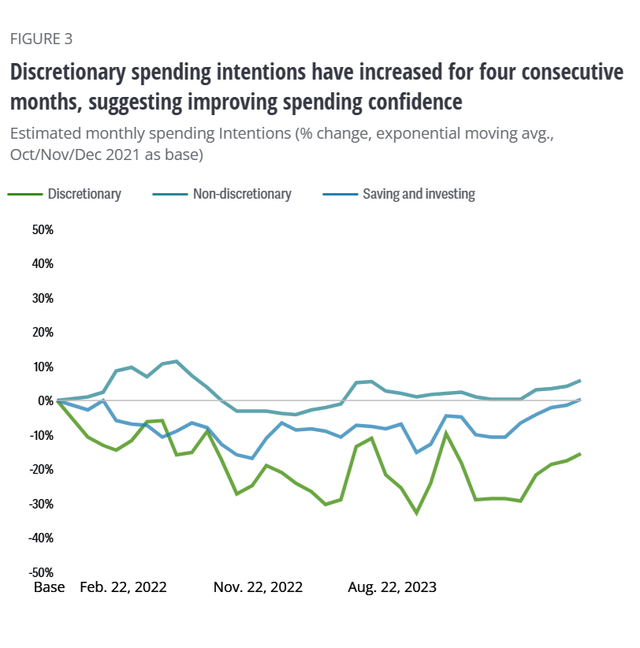

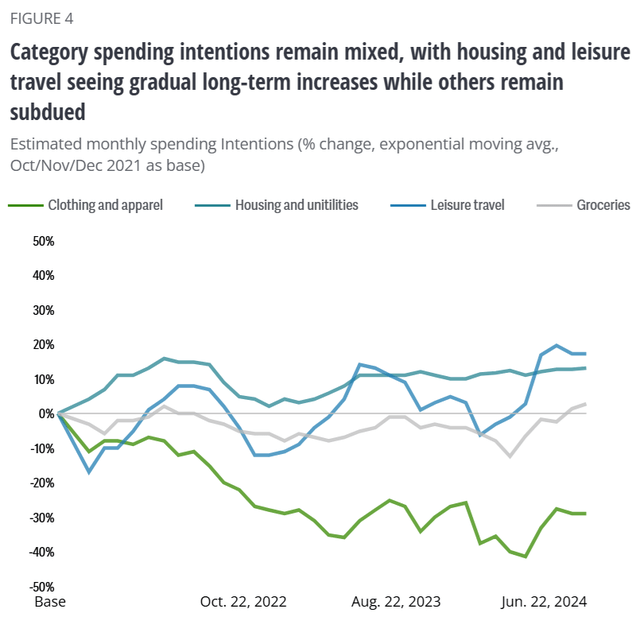

Following years of higher inflation, consumers have dialed back their appetite for discretionary goods. While there has been a slight improvement since June, consumer intent to spend on discretionary items is deeply negative compared to where it was at the end of 2021.

This is especially pronounced in the clothing and apparel category, an important one for Target. Even after high inflation, the post-pandemic trend continues where consumers spend more on travel and leisure while cutting back on goods. Target also experienced lower sales in the home and hardline categories. The concentration in discretionary categories differentiates Target from Walmart (WMT) which is much more dependent on non-discretionary categories like groceries.

When they do spend, consumers are more likely to wait for discounts. As stated by CEO Brian Cornell on the earnings call,

Consumers tell us their budgets remain stretched and they’re shopping carefully, as they work to overcome the cumulative impact of multiple years of price inflation. They’re becoming increasingly resourceful in their shopping behaviors, waiting to buy until the last moment of need, focusing on deals, and then stocking up when they find them. As a result, we’re seeing a stronger response to promotions than we’ve seen in some time.

Reinforcing this theme, management also noted that during the recent Target Circle Week promotion, sales were lower than usual in the week before and the week after.

Looking forward, the next few months will be critical to understand where the consumer is headed. Does the less negative intent to spend on discretionary goods mark a bottom, or just a fluctuation within the range it has been in over the last couple of years? The consumer sentiment survey by the Conference Board shows a similar trend, however underlying metrics like future expectations show clearer signs of improvement. It’s possible that the elections created a sense of uncertainty, and sentiment may improve now that a clear result is known, even if not everyone is pleased with the outcome. We will get more information when the next consumer sentiment survey results are released on 11/26.

Inventory And Cost Management

The port workers’ strike on the US east coast created a risk that Target had to manage in the quarter. While work resumed after a few days, Target had to be prepared for an extended strike which could have caused stock-outs. The company proactively ordered some merchandise early and shipped it through the West Coast ports, which settled their union contract in 2023. This added to supply chain costs, but should be a one-off issue and not an ongoing hit to margins. Target expects to clear out the excess inventory in 4Q and get back to normal operating levels for 2025.

Nevertheless, the operating margin in 3Q was just 4.6%, down from 5.2% last year. Gross margin was down 20 basis points. The negative hit to gross margin was supply chain costs, which were 90 basis points higher, driven largely by the port strike issue, but also the mix impact from higher digital vs. in-store sales. Offsetting this was 20 basis points lower merchandising costs and 50 basis points of reduced shrink, an encouraging sign following years of increasing shrink losses. Selling, general, and administrative costs were 50 basis points higher. Much of this was due to higher general liability and health insurance costs.

It is hard to blame Target for erring on the side of making sure inventory is in stock and being proactive around the port strike. Looking forward, I expect the company to recapture a lot of the 90 basis point hit as the supply chain normalizes. I also expect continued progress in reducing shrink, Finally, if consumer spending patterns shift back toward higher margin discretionary goods, Target will see a margin improvement from product mix. While I am not projecting a return to 6% operating margins in 2025, I think they can get there in the longer term.

One risk to this outlook is a resumption of the port strike, which is only on hold until January 15 as the union and management try to settle a contract. Another risk is the possibility of tariffs under the new administration. It is still too early to predict the level of these tariffs, what products they will apply to, and how much can be passed along to the consumer.

Earnings Model Update

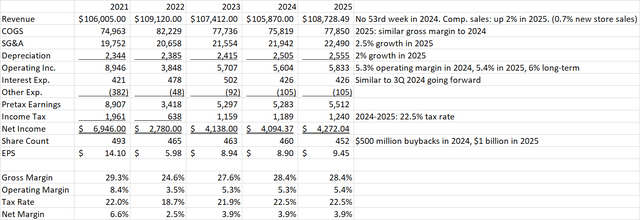

Target is expected to have flat same store sales this year, however the absence of a 53rd week in this fiscal year results in a forecast of lower total sales. Gross margins for the year should be slightly higher, but SG&A and depreciation are also forecasted higher, resulting in a forecasted operating margin of 5.3%. Interest expenses are down due to lower debt, but the tax rate is up slightly to 22.5%. The resulting net income is down about 1% from 2023. The company has bought back $500 million worth of shares, in line with my prior expectation. With the lower share count, EPS is projected to be $8.90, at the high end of company guidance.

Looking forward to 2025, I am projecting 2% same store sales growth and 2.7% total sales growth. I am projecting similar gross margins to this year, 2.5% growth in SG&A, and 2% growth in depreciation. Interest expense and tax rate will be similar to 2024. Finally, share count is reduced by 8 million shares as I am projecting a $1 billion buyback. The resulting EPS projection for 2025 is $9.45, which is 6.2% growth from 2024.

Valuation And Capital Management

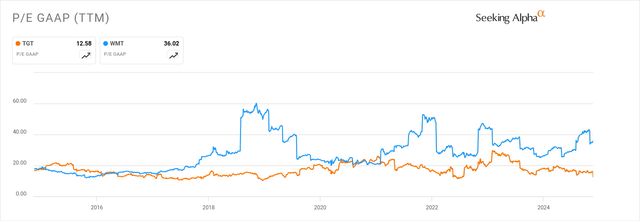

At $122, Target is valued at 13.7 times 2024 earnings. This is now cheaper than the long-term average around 15. Target’s P/E is now barely 1/3 that of Walmart.

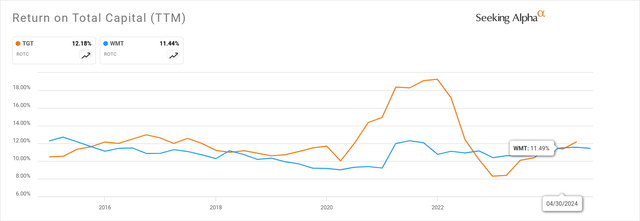

While it has pulled back since the high-earning years during the pandemic, Target’s return on total capital is close to that of Walmart, around 12%.

Looking at consensus estimates, both retailers have 9 years’ worth of forward EPS estimates on Seeking Alpha’s Earnings Estimates page. Using those values, Target has an EPS CAGR of 7.6% per year, while Walmart has an EPS CAGR of 8.6%.

Target’s valuation looks cheap compared to Walmart, given just slightly lower growth and similar return on capital. Using my 2.0 PEG ratio limit, Target’s fair P/E is 15.2, so current fair value is $135 and the 1-year price target is $144. The drop in share price after earnings therefore looks overdone.

Target’s YTD free cash flow was $2.1 billion. This was an improvement over the $1.4 billion in the first 9 months of 2023. Capex was about $2 billion lower this year, offset by around $1.3 billion more working capital build. The $2.1 billion of FCF was used to pay $1.5 billion in dividends and $0.6 billion of share buybacks. The company also drew about $0.4 billion of its cash balance to pay off debt. In 4Q, Target should have its seasonally highest FCF of the year, around $2 billion. The retailer is planning additional capex of $1 billion and the quarterly dividend of $0.5 billion.

Looking ahead to 2025, Target is planning higher capex of $4 – $5 billion. With operating cash flow up slightly, I am projecting $2.8 billion FCF next year. That will support about $2.1 billion of dividends and about $0.7 billion worth of buybacks. Target also has about $1.6 billion of debt due in the next year, which I expect they will refinance.

$2.1 billion of dividends and an average share count of 456 million works out to $4.60 per share for 2025, or $1.15 quarterly, a small increase of 2.6% from this year. At $122, the forward yield is attractive at 3.8%.

Conclusion

Target’s big miss and guide-down with 3Q results was a shock to the market, but investors should avoid using a political lens to analyze the results. The real driver looks like consumers slowing down their purchases of the discretionary goods that make up a bigger part of Target’s sales compared to Walmart. Also, Target proactively adjusted its supply chain to deal with impacts from the East Coast port strike. While the strike lasted only a few days, the company avoided stock-outs that could have happened if the strike lasted longer. These added supply chain costs should not recur in the future, and Target is also making progress reducing the cost of shrink, helping offset growing costs in other areas such as insurance. Consumer preferences aren’t permanent, either, and a boost in sentiment from the resolution to the elections could give shoppers an excuse to pick up their spending again.

My earnings estimate and fair value are revised down compared to my last article in March, but the market reaction to the 3Q results was even more severe. With the market price of $122 below my 1-year target price of $144, Target stock is now a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TGT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.