Summary:

- Affirm stock is down a staggering 90% from all time highs.

- In spite of macro headwinds, the company continues to grow rapidly, with GMV growing by 62% in the latest quarter.

- Affirm maintains a net cash balance sheet with modest cash burn.

- The stock is too cheap at under 2x sales.

B4LLS

Affirm (NASDAQ:AFRM) at first glance might not seem like a “buyable” stock in today’s market. The company makes “buy now, pay later” loans which seems risky in a recessionary environment. Yet AFRM is still benefiting from its partnerships with Shopify (SHOP) and Amazon (AMZN), giving it highly visible growth in the near term. Moreover, the continued high growth posted by the company during a period in which peers are meaningfully slowing down growth may reflect a stronger lending algorithm. AFRM is already operating near non-GAAP operating breakeven and maintains net cash equal to more than 25% of its market cap. The stock is too cheap here and does not give credit to the possibility that this ends up being a runaway winner in alternative financing. AFRM remains an important core position in my portfolio.

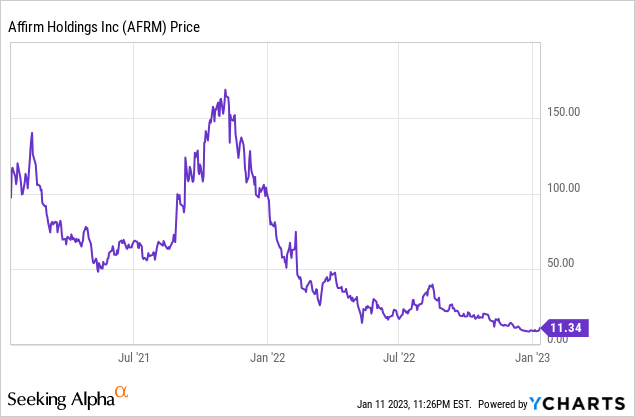

AFRM Stock Price

With the stock trading around $10 per share, it may be hard to remember that AFRM used to trade well into the triple digits. It may be worth noting that CEO Levchin did not sell any stock – in fact he has never sold any stock ever.

I last covered AFRM in December 2021 where I explained why I was avoiding buying the stock due to valuation. With the stock down 90% since then, the valuation has been more than reset and the tables have turned.

AFRM Stock Key Metrics

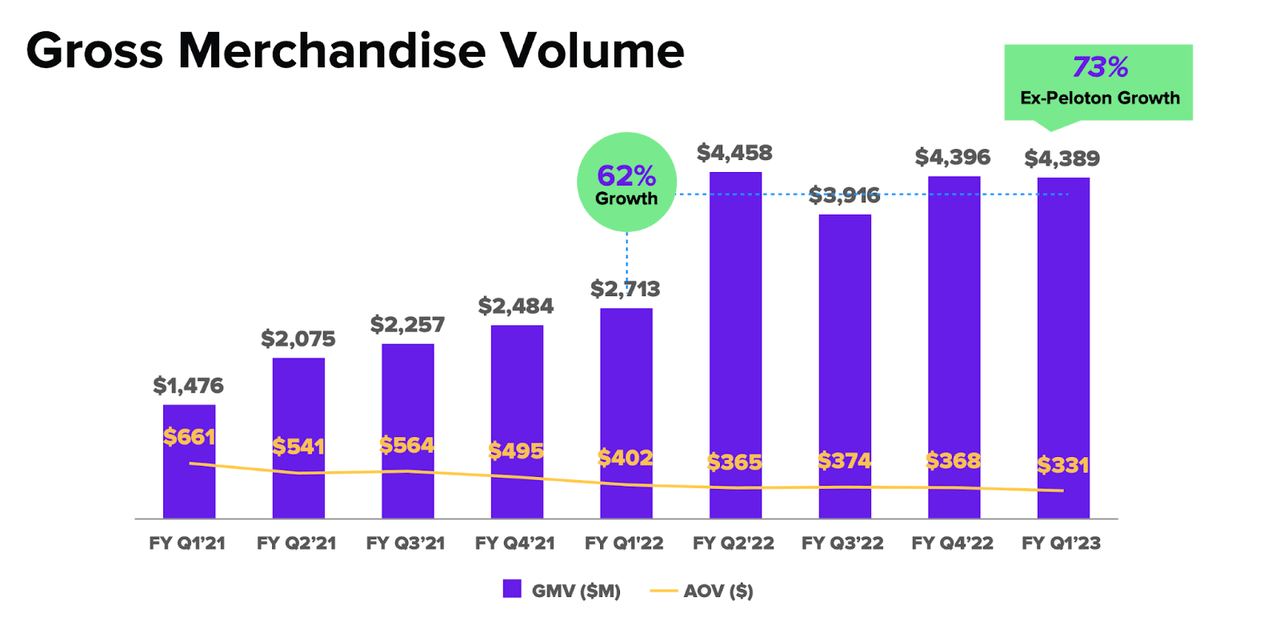

Even as it faces a tough macro backdrop, AFRM delivered 62% GMV growth in the latest quarter including 73% growth excluding Peloton (PTON).

FY23 Q1 Presentation

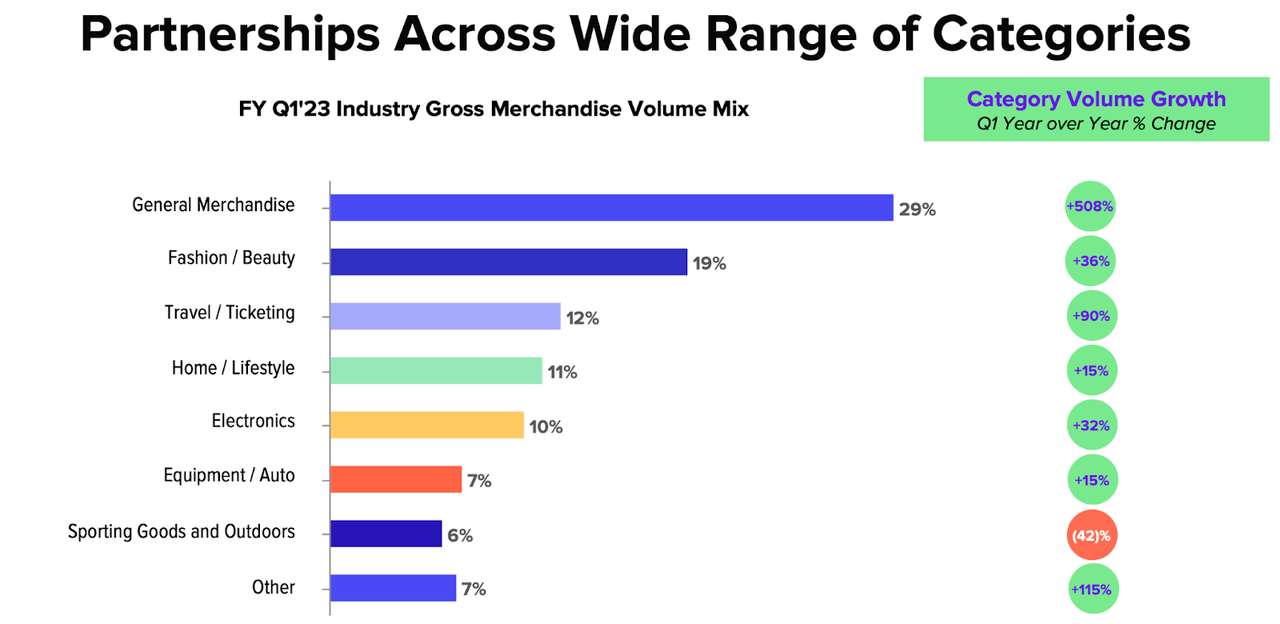

That growth may surprise some as many e-commerce operators are facing the negative impact of tough comparables. AFRM has benefitted from its exposure to a wide range of GMV categories. That has enabled it to sustain strong growth even as industries like sporting goods show decelerating growth due to the pandemic.

FY23 Q1 Presentation

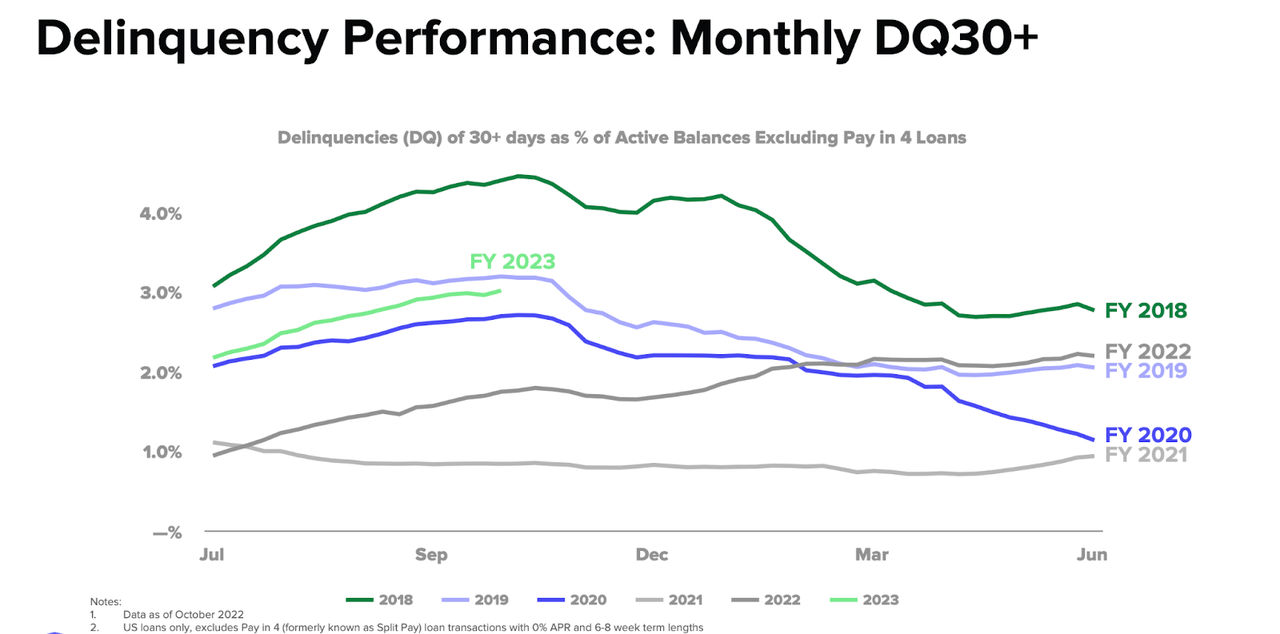

How have the recessionary risks and rising interest rate environment impacted AFRM? Delinquencies of 30 days or more is trending above post-pandemic levels but is still below pre-pandemic levels.

FY23 Q1 Presentation

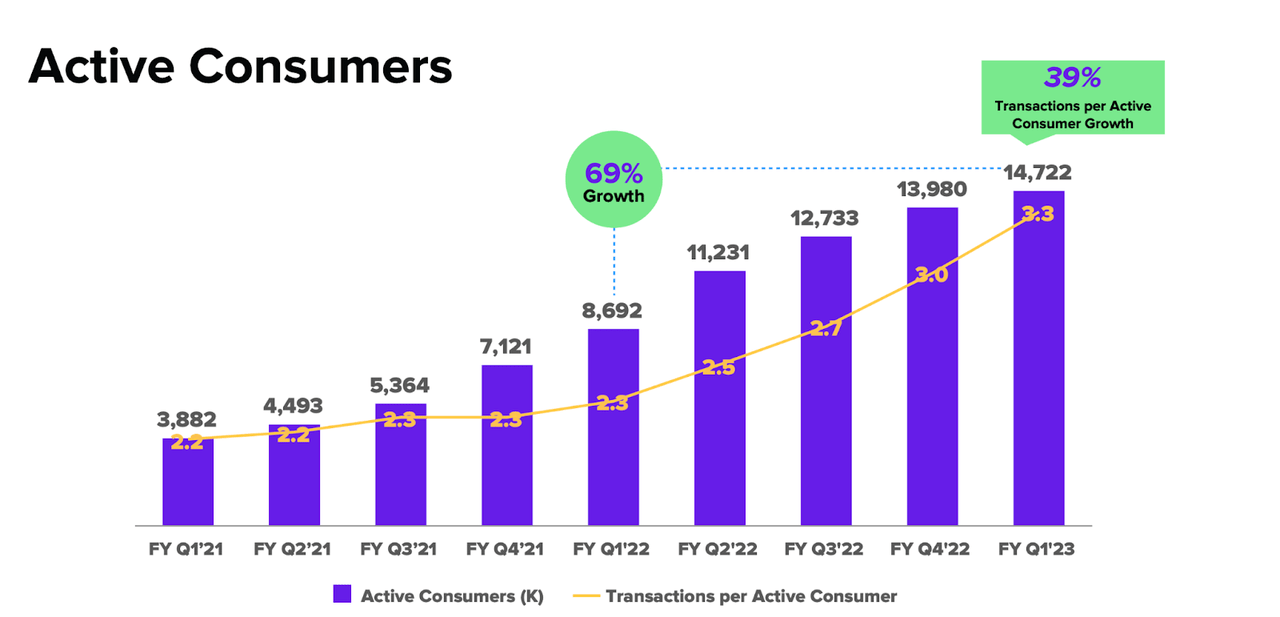

Meanwhile, AFRM continues to increase its consumer base, with active consumers growing 69% YOY. AFRM also reported 39% growth in transactions per active consumer. On the conference call, management noted that 85% of transactions are from repeat users, indicating the stickiness of the product.

FY23 Q1 Presentation

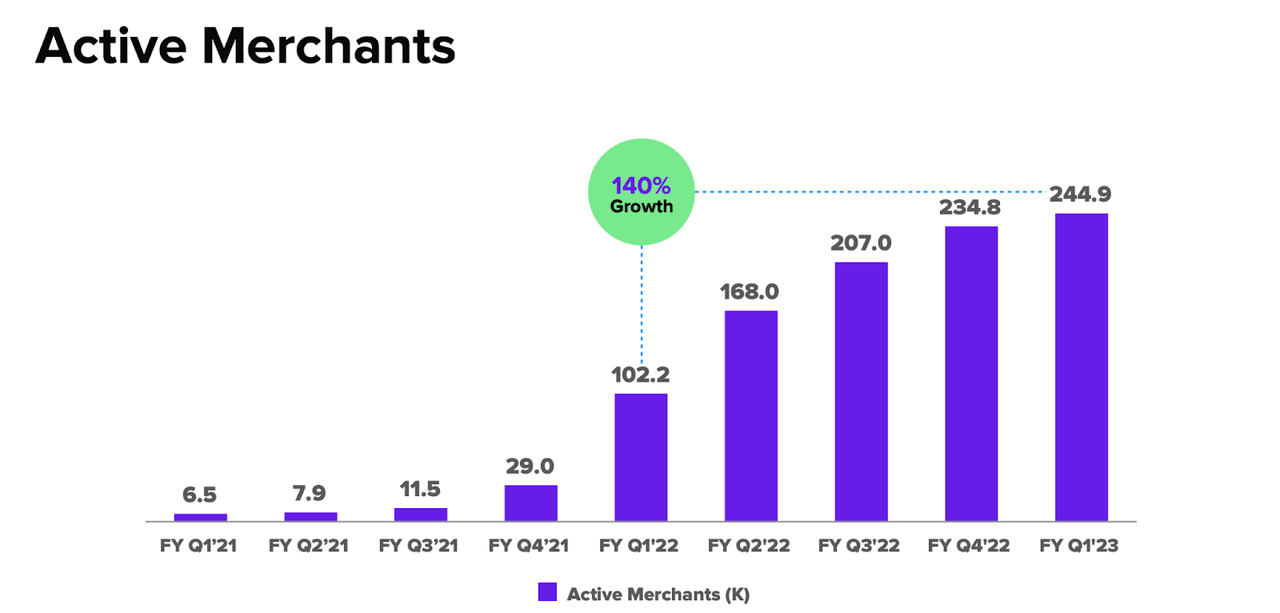

AFRM generated 140% growth in active merchants, indicating the big boost it has enjoyed from its partnerships with Amazon (AMZN) and Shopify (SHOP).

FY23 Q1 Presentation

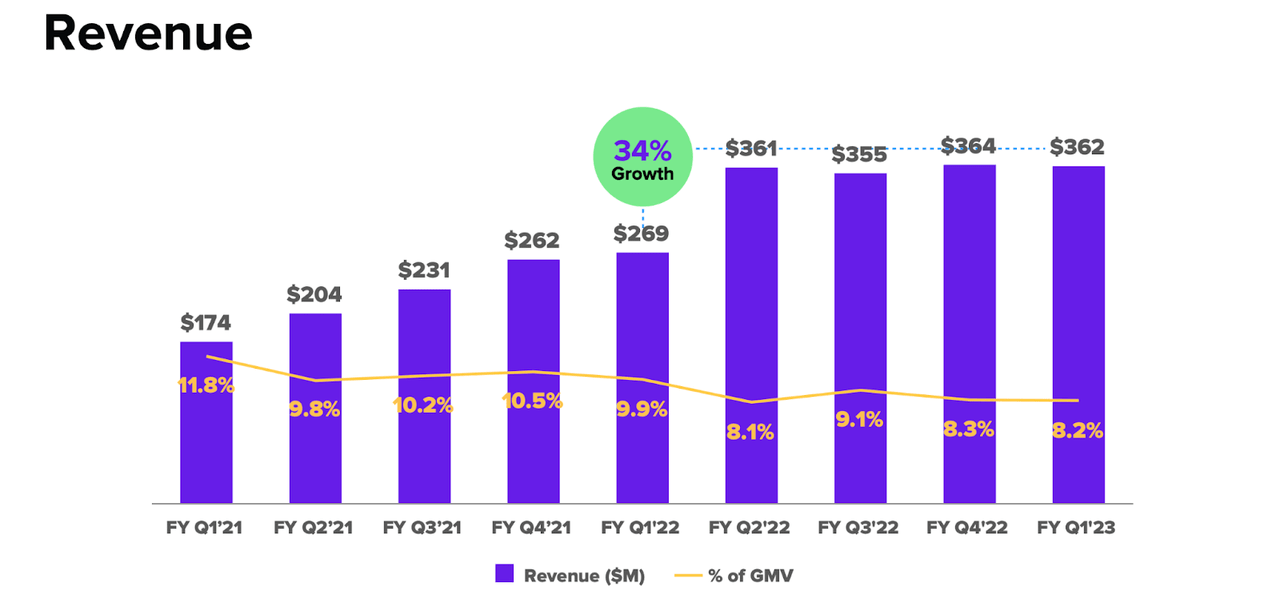

These all led to revenue to grow 34% YOY to $362 million. Both revenue and GMV came essentially at management’s given guidance. I note that revenue growth was slower than GMV growth due to the lower take rates that the company gets from its AMZN and SHOP partnerships.

FY23 Q1 Presentation

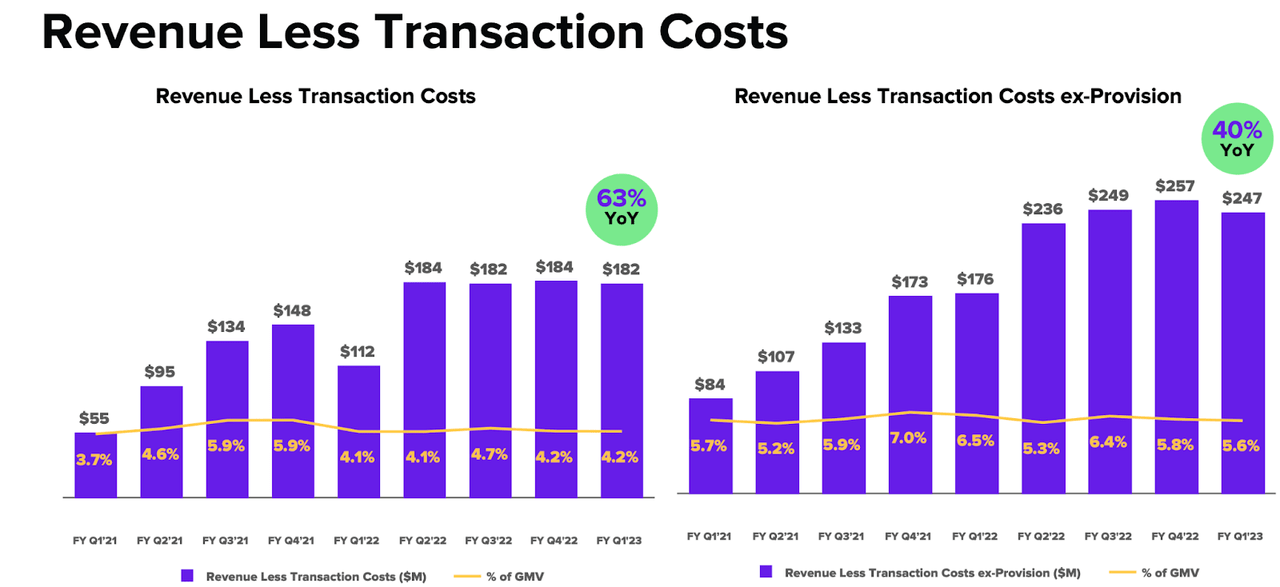

Meanwhile, revenue less transaction costs – what I consider to be gross profits for this business – grew at a 40% clip excluding provision costs.

FY23 Q1 Presentation

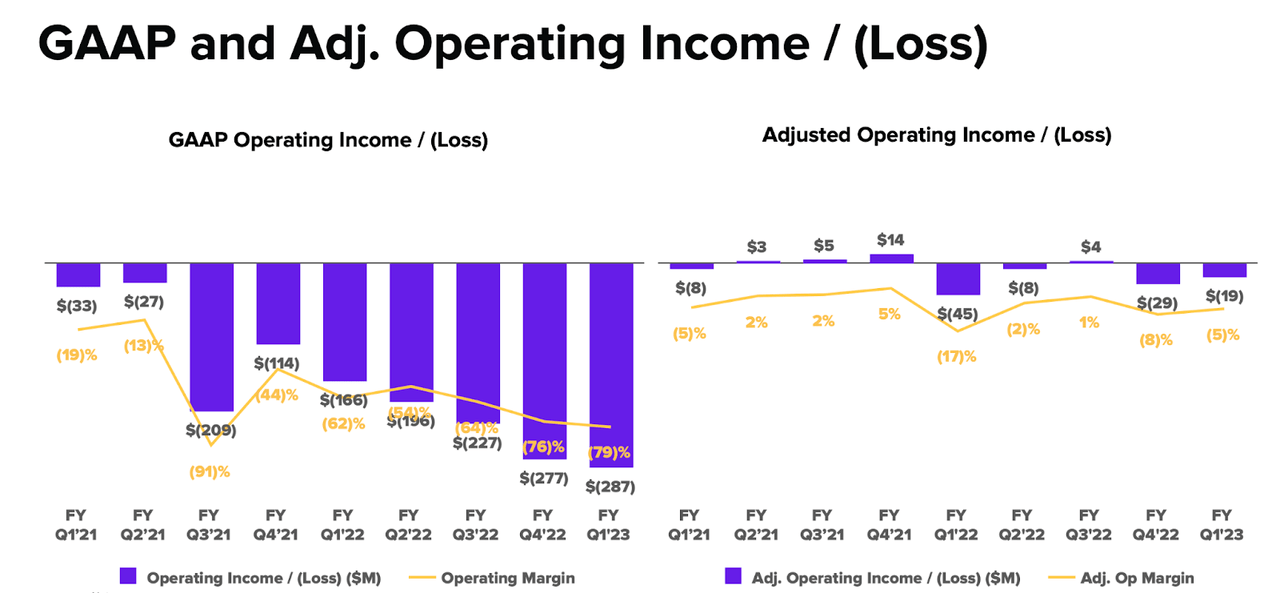

AFRM is still not that close to generating profits on a GAAP basis, but on a non-GAAP basis AFRM has been operating around breakeven for many quarters already. The main difference between the GAAP and non-GAAP metrics is equity-based compensation. How should shareholders view this? The high amount of equity-based compensation should be viewed positively because it reduces the financial solvency risk from large GAAP operating losses. Management reiterated their commitment to sustainable non-GAAP operating profits by the end of this fiscal year.

FY23 Q1 Presentation

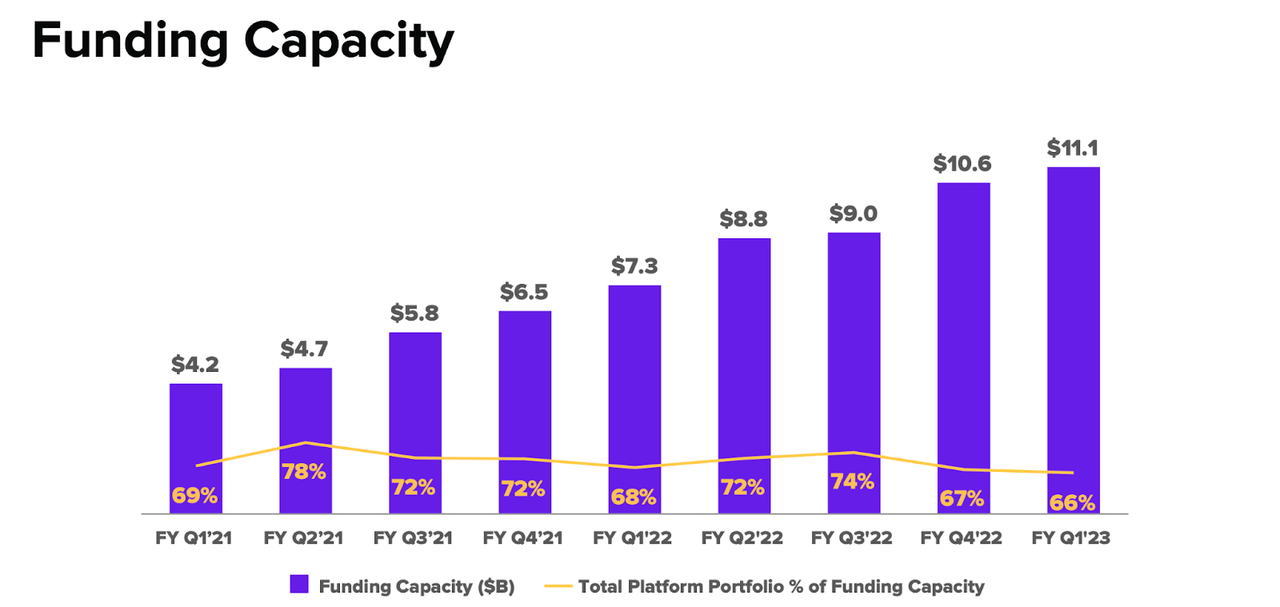

The rising interest rate environment may have increased worries about funding sources for the company. Due to AFRM’s strong market position, that has not been an issue. In fact, AFRM has been steadily increasing its funding capacity over the past quarters. This means that even if AFRM is unable to sell off investment loans through the ABS market, it can still originate loans through its credit sources. Further, because buy now, pay later loans tend to be short term in nature, AFRM can fully fund its growth pipeline using credit sources alone.

FY23 Q1 Presentation

AFRM ended the quarter with $2.77 billion of cash versus $1.7 billion in convertible notes. That $1 billion in net cash is 28% of the current market cap.

How has AFRM managed to deliver strong results even in the face of such tough macro conditions? Management’s strong execution in earning the partnerships with AMZN and SHOP are of course the most critical factors, but on the call management also discussed the possibility that rising interest rates may be causing consumers to seek alternative sources of debt. In other words, rising interest rates may have certain tailwinds for the BNPL market. It is worth noting that AFRM’s high growth rates may be indicative of greater confidence in their underwriting models. BNPL peers like Klarna have reported decelerating growth, something AFRM management attributes to peers needing to slow down growth when faced with tough macro conditions. AFRM management on the other hand believes that its lending platform is able to originate loans profitably in any macro environment, meaning that it does not have to slow down its growth even as macro conditions worsen – at least not to the extent seen at peers.

Is AFRM Stock A Buy, Sell, or Hold?

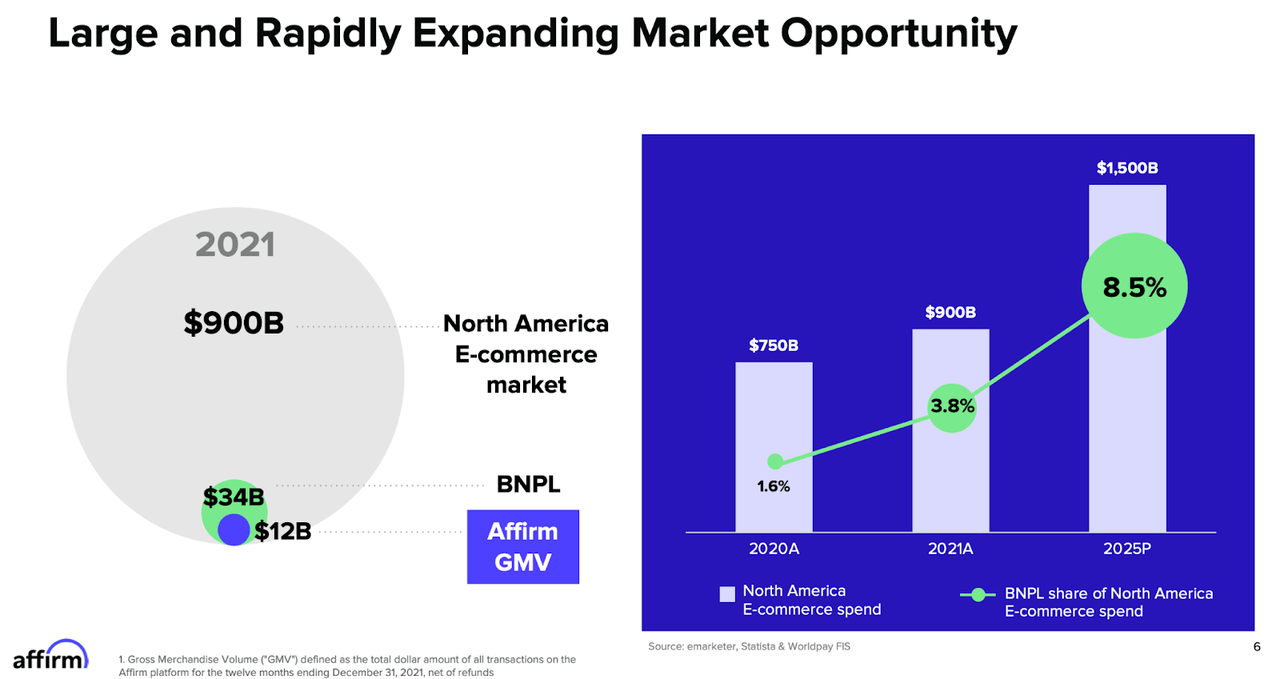

The BNPL market represents a curious intersection of two tailwinds. On one hand, it benefits as e-commerce in general grows, but on the other hand BNPL is projected to take greater share within that e-commerce market.

FY23 Q1 Presentation

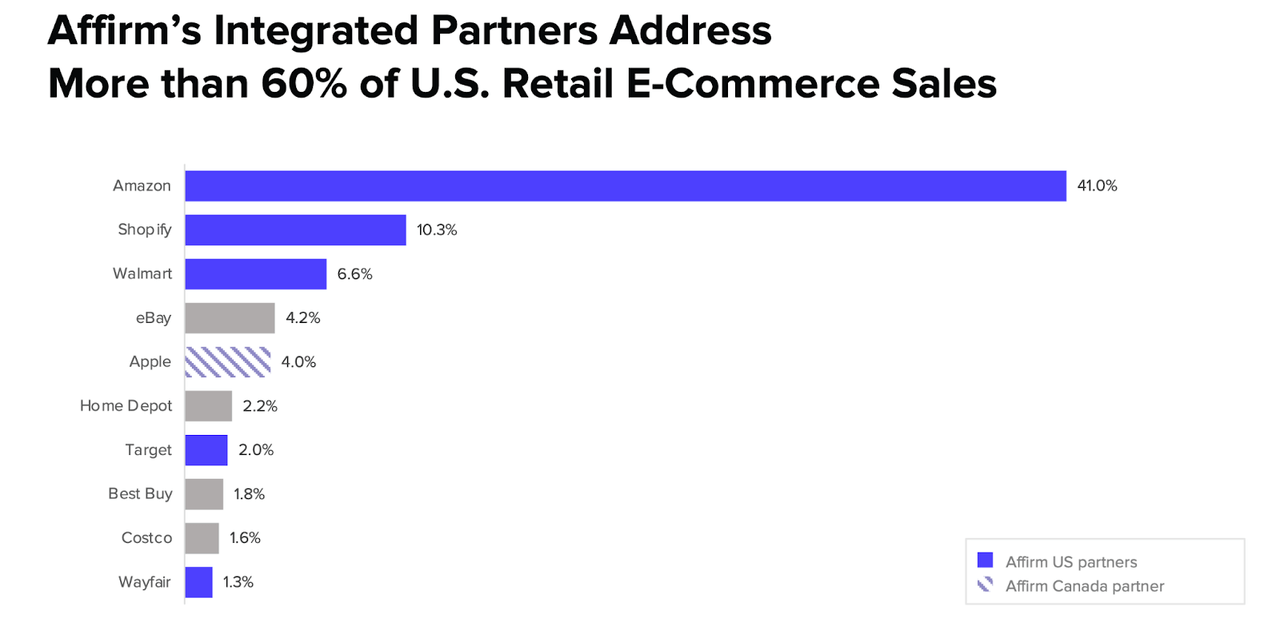

AFRM stands to be big winner in BNPL as it has partnerships with the biggest e-commerce operators in the country.

FY23 Q1 Presentation

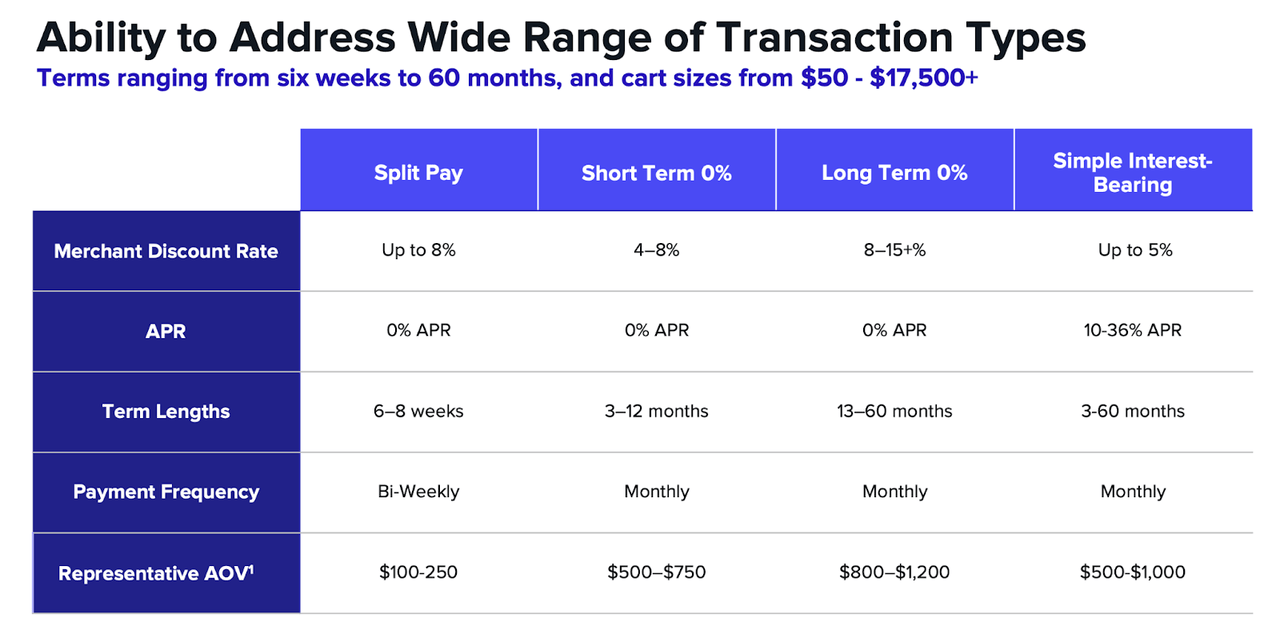

AFRM offers loans of various term maturities and interest rates, with the business model difference being whether the bulk of the profits come from the retailer or consumer. By that I mean a higher interest rate loan will imply greater profits from the consumer and a lower interest rate loan would be funded by a greater take-rate on the retailer side.

FY23 Q1 Presentation

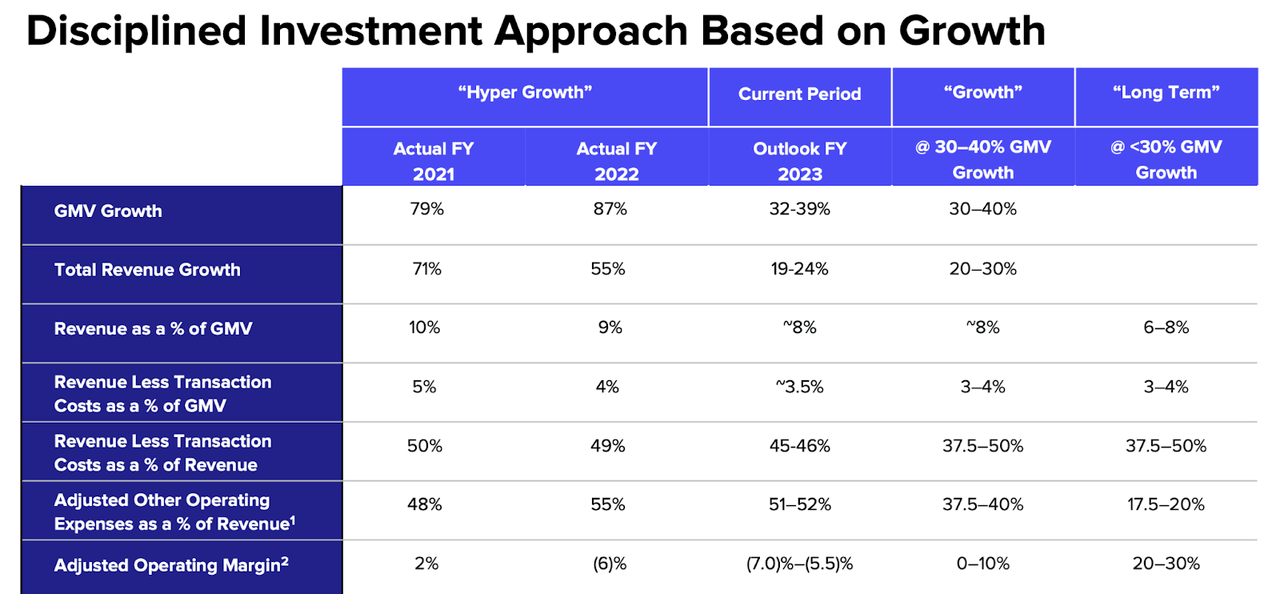

AFRM continues to expect strong, sustained growth over the long term, with adjusted operating margins expected to hit as high as 30% over the long term.

FY23 Q1 Presentation

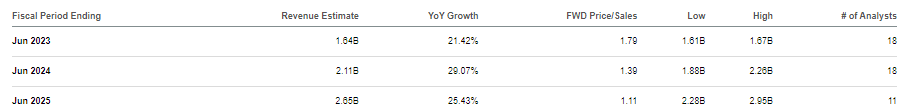

Given that the BNPL industry is in its early innings, such an outlook is more believable even in the face of a tough macro backdrop. At recent prices, AFRM was trading at just 1.8x sales (and that is before accounting for the net cash).

Seeking Alpha

Based on 25% growth, 20% long-term net margins and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see fair value as being around 7.5x sales, representing a stock price of $40 per share. That target may prove conservative if AFRM can sustain rapid rates of growth for longer and achieve higher net margins than expected.

What are the risks? These are numerous. For starters, AFRM will dilute shareholders until it achieves GAAP profitability. It is also unclear how their loan book will perform in a deep recession. Bank stocks have been trading at conservative valuations in spite of rising interest rates due to the possibility of widespread defaults – it stands within reason that AFRM may face a similar overhang. Management has expressed confidence in their lending models but only a real test can prove the validity of such confidence. While AFRM may continue to generate strong growth, its perceived exposure to the broader economy may prevent it from joining in with other tech peers in a tech recovery, at least in the absence of an economic recovery. That said, AFRM stock has seemingly traded in-line with tech peers on the few tech rallies of the past year. There is great competition in the sector, with PayPal (PYPL) and Apple (AAPL) being formidable competitors. One must also wonder about the long-term plans from AMZN and SHOP, as it is possible that they may also eventually seek to bring the BNPL in-house. As discussed with subscribers to Best of Breed Growth Stocks, a portfolio of undervalued tech stocks is an efficient way to take advantage of the crash in tech stocks and beat the market from here. AFRM fits right in with such a basket on account of the strong growth and low valuation – I continue to rate it a strong buy and a core position in my portfolio.

Disclosure: I/we have a beneficial long position in the shares of AFRM, AMZN, SHOP, PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks portfolio.

Growth stocks have crashed. Want my top picks in the market today? I have provided for Best of Breed Growth Stocks subscribers the Tech Stock Crash List Parts 1 & 2, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!