Summary:

- I find Teladoc appealing for contrarian investors, trading at just 6x forward operating cash flow, 60% below the sector median, and industry peers.

- Nonetheless, I believe the company lacks a compelling, forward-looking narrative to drive a turnaround in investor sentiment, despite its low valuation.

- I’m concerned that cost-cutting efforts, like reducing marketing and R&D, won’t generate sustainable growth or shift investor sentiment.

- I believe Teladoc’s new AI virtual sitter could face regulatory obstacles and potentially limited demand, raising doubts about its viability as a growth driver.

- I prefer to stay on the sidelines and pay a premium once the share price breaks $14–$15, signaling stronger investor confidence and a clearer path to a turnaround.

J Studios

I see Teladoc Health, Inc. (NYSE:TDOC) as a prime example of a stock with attractive valuation ratios, yet most investors remain unconvinced (at least for now) that the company is on the right path to a turnaround.

With the share price down 56% YTD and moving sideways over the past month, I believe investors need to see a compelling narrative — something that, in my view, Teladoc currently lacks.

In this article, I will explain the rationale behind my investment style, and I will try to convey in the simplest way possible why the narrative behind a stock is as important (if not more) than its valuation ratios, price action, and fundamentals.

Despite my current skepticism, I believe this stock is eye candy for contrarian traditional value investors. With the share price trading at a very attractive 6x forward operating cash flow, this alone could drive the share price up as more value investors discover this stock. However, there are some situations (TDOC is one of them) where I prefer to pay a premium on the share price at the expense of having a high conviction that the shift in investor sentiment is achievable. As you may know, I use price action to determine the sentiment behind a stock. Therefore, if the share price breaks the $14–15 level, I will reconsider my hold rating. To the best of my knowledge, breaking this level would signal that investors are beginning to regain confidence in the company again.

On The Surface, Teladoc Seems Like a Buy

You will understand in the next section what I mean by “on the surface“.

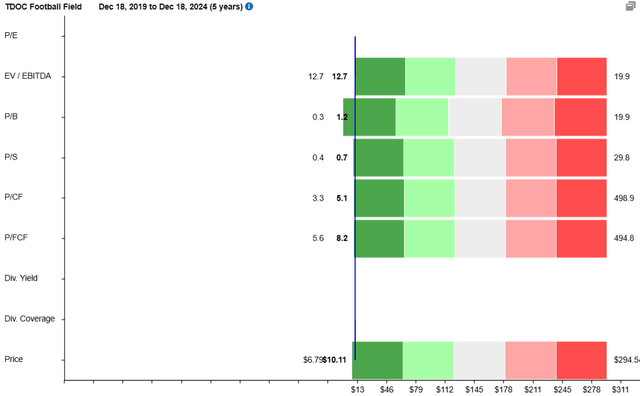

As I said in the intro, I have a high conviction that this stock is eye candy for contrarian traditional value investors. If we look at the company’s valuation metrics, the P/CF ratio stands out among all metrics. On a FWD basis, the company is trading at just 6x its operating cash flow. This is 60% below the sector median. Additionally, the company’s TTM P/CF is 95% below the company’s 5-year average.

The chart above shows where the current valuation ratios stand against their 5-year historical range. Needless to say, the chart looks quite compelling.

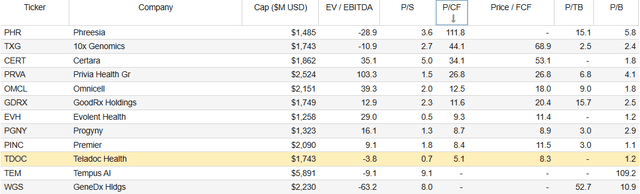

What if we compare these ratios to some of Teladoc’s peers?

The table below shows an industry peer comparison (please, notice not all industry peers are direct competitors), arranged in a descending order by P/CF.

In the comparison above, Teladoc is the cheapest company by P/CF. Additionally, we get similar results if we use other valuation ratios, like P/S.

Needless to say, from a valuation perspective, the company looks significantly undervalued. So, why its share price is not taking off? I share my thoughts in the next section.

Great Valuation. Poor Narrative.

As I said in the previous section, on the surface, this stock looks like a buy. To understand why, you need to know that my investment style focuses more on the story behind a stock than on its valuation metrics, particularly when a company needs to turn around investor sentiment. Just to be clear, the story I look for is mainly forward-looking. I don’t focus much on a company’s past narrative, as that story is mainly priced in.

Knowing this, in my view, Teladoc lacks a compelling, forward-looking, narrative, which is the main reason I rate this stock as a hold.

CFO Mala Murthy stated the following during the past earnings call:

Additionally, during the quarter, we also recorded a $3.6 million charge or $0.02 per share pretax, related to severance costs as well as lease termination costs, as we continue to act upon expense efficiency opportunities.

In my view, when a company focuses on “expense efficiency opportunities” instead of creating new business opportunities, its narrative isn’t particularly compelling. I want to see growth drivers. Particularly, compelling growth drivers to turn around the current pessimism surrounding this stock.

So, do they have anything up their sleeves?

On November 25, the company released a press release that I have to admit, based on the title alone, looked quite compelling. Teladoc introduced a new AI-driven virtual sitter to improve patient safety in hospitals and healthcare centers. To the best of my understanding, their AI system uses pre-trained algorithms to visually detect patient movements that may lead to falls. This would allow for faster intervention by bedside staff before an incident occurs.

Their value proposition is that a single remote staff member can now monitor up to 25% more patients compared to traditional monitoring methods. Additionally, the press release mentioned that 1 million patients annually suffer falls, resulting in over $50 billion in medical costs.

I’ll be bold with my opinion on this initiative: I’m not convinced.

To be clear, there is no doubt there is a market for this product, however, I see too many regulatory hoops to jump before this system is implemented on a mass scale. Among them is the privacy of patients, particularly from a data perspective. I believe it’s too early for the layman public to trust AI with their health. Additionally, I remain skeptical of the cost savings and efficiency improvements from a business perspective. Healthcare support workers are already using live cameras to track patient movements. Additionally, some hospitals have wearable motion sensors to alert the healthcare worker when the patient is moving.

Simply put, I don’t believe there is a strong demand from hospitals for this AI virtual sitter. Existing solutions are already available, and regulations pose a significant obstacle to adoption.

Can I be wrong? Categorically yes. And, in fact, if I see strong demand kicking in for this AI assistant, I will reconsider my rating for this stock. In the meantime, I remain skeptical. In fact, I’d prefer to pay a premium on the share price further down the line, once there are clear signs of strong demand for this product.

Moving on to other growth strategies, management mentioned the integration of previously separate business units under unified leadership structures. In other words, the company is reducing layers of management, combining multiple areas of its US Integrated Care segment, which were previously managed separately, under a single business leadership structure.

Do I think this is enough to turn around the company and shift the current pessimism? Again, my answer is no. Despite incurring $3.6 million in restructuring charges, I don’t see yet any substantial tangible positive results.

One could say that the 42% YoY improvement in net losses (in other words, the company lost 42% less money in Q3 2024 than in Q3 2023) is an encouraging sign of its restructuring plan. However, in my view, this $23.8 million improvement is not driven by the right factors. Let me explain.

First, the company cut down on marketing expenses by $8.7 million YoY. Pausing digital marketing campaigns isn’t something I find encouraging, especially since BetterHelp’s paying user base decreased by 13% YoY in the past quarter.

Another driver was a 14% YoY decline in R&D expenses, which decreased by $11.9 million. Again, in my view, this is not particularly encouraging for a compelling turnaround as I like to see companies who invest in technology to bring new revenue streams.

Other strategic initiatives that I see slightly more positively, are the international market expansion in Canada and the expansion of chronic care management programs, with enrollment rising 5% YoY to 1.18 million participants. Additionally, the company is exploring ways to offer insurance-covered therapy services internationally. To be specific, BetterHelp is developing the necessary internal infrastructure to support insurance claims processing and billing. In my view, this could be the strongest growth driver for the company moving forward, so I recommend keeping a close eye on the pilot programs in the next earnings reports.

If I see an improvement in the number of paying users in the BetterHelp platform, I will reconsider my rating for this stock. However, for the moment, I believe it’s too early to warrant a buy rating as the company is still building internal systems and partnering with select health plans for network inclusion. Again, I’d rather pay a premium on the share price later if it means confirming traction in this growth initiative.

As you may know, over the past year, Teladoc has returned negative 56% returns. The situation looks even worse when we zoom out, with negative 90% returns over the past 5 years. In my view, the company needs a compelling narrative to turn around; I just don’t see it yet.

Conclusion

To wrap up, I rate Teladoc as a Hold.

On the positive side, the company looks quite attractive from a valuation perspective. I admit that I am impressed with its FWD P/FC ratio, which is trading below the sector and its industry peers. Considering the selloff this stock has been experiencing over the past 5 years, its current share price looks quite attractive considering that one is paying just 6x for next year’s cash flows.

On the negative side, I don’t see a compelling narrative that will be able to turn around the current pessimism surrounding this stock. Management is executing a restructuring plan, with some (limited) visible results, however, I don’t see a compelling growth driver to bring new revenue streams. I believe the new AI-driven virtual sitter solution could face some regulatory hurdles before we see it deployed at scale in health centers and the integration of BetterHelp with insurance plans is still at a very early stage.

Nevertheless, the share price is cheap, and sometimes that alone is enough to attract investors. As for me, I prefer to stay on the sidelines and pay a premium price once I see clear signs of a turnaround. To be specific, if I see the share price trading in the $14s – $15s, I will revisit this stock to see if the narrative has changed.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.