Summary:

- Teladoc’s new management has delivered a painful FQ2’24 earnings call, as observed in the BetterHelp impairment costs and withdrawn forward guidance.

- It is apparent that the telehealth company is facing growth issues and elevated marketing/advertising costs, with its near-term prospects likely to remain underwhelming.

- Readers must note the upcoming Livongo notes are likely to trigger further equity dilution, worsening the highly shorted stock’s ongoing insider selling.

- Combined with the potential price decline to penny stock levels, we believe that it may be more prudent to observe the TDOC stock’s movement, while waiting for further clarity in its near-term execution.

Adam Gault

We previously covered Teladoc (NYSE:TDOC) in May 2024, discussing why we had maintained our Hold (Neutral) rating, with the management reporting underwhelming performance metrics in FQ1’24 and numerous other players throwing in the towel on their telehealth ambitions.

With bullish support yet to materialize, the insider selling intensifying, and with the stock increasingly shorted, we had believed that its reversal had been highly speculative.

Since then, TDOC continues to underperform, with the stock pulling back by -33.8% as the wider market recovers by +7.5%.

With the new management reporting a round of BetterHelp related impairment cost in FQ2’24, building upon the three Livongo related impairments in FY2022, we can understand why the recent pullback has been as drastic as it has.

Combined with the withdrawal of its FY2024 guidance and three-year outlook through 2025, it goes without saying that TDOC may be a falling knife here.

TDOC’s Investment Thesis Remains Underwhelming, With Poor Optics

TDOC 6Y Stock Price

Based on the price chart above, it went without saying that TDOC had been a classic example of a burst bubble, after the hyper pandemic demand boom, the stock’s subsequent upward trajectory, mega deals through Livongo, and then, the painful pullback once the company failed to deliver the promised hyper growth.

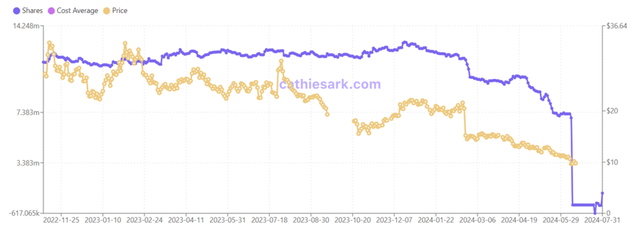

ARKK’s TDOC Holding

It is apparent then, that Cathie Wood’s conviction buy story has not worked out as intended, with ARKK’s Holding also selling out most of their TDOC holdings by Q2’24.

After a staggering $13.4B Livongo related impairment charge recorded in FY2022, the management delivers another $790M in BetterHelp related impairment charge in FQ2’24, with it naturally triggering numerous adjustments to its bottom-line and impacting market sentiments.

TDOC’s numerous charges are disappointing indeed, since the accounting method “reflects a reduction in the value of an asset due to a decrease in its expected future cash flows or fair value,” despite the supposedly expensive Livongo acquisition worth $18.5B in 2020 and (the moderate) BetterHelp at $4M in 2015.

It is apparent from these developments that the new management team is kitchen sinking, after the abrupt departure of the previous CEO in April 2024.

Otherwise, TDOC has reported a somewhat decent FQ2’24 performance, with revenues of $642.4M (-0.5% QoQ/ -1.5% YoY) and adj EBITDA of $89.48M (+41.7% QoQ/ +24% YoY), with the bottom-line expansion highly promising despite the stagnant top-line.

At the same time, the telehealth company continues to report growing member base to 92.4M for the US Integrated Care Members (+0.6M QoQ/ +6.5M YoY) and 1.173M for the Chronic Care Program Enrollment (+0.052M QoQ/ +0.1M YoY), implying its ability to retain existing members while attracting new members.

Lastly, TDOC has been to generate decent (though intermittent on a QoQ basis) Free Cash Flow of $195.86M over the last twelve months, implying its ability to sustainably fund its future opportunities.

Unfortunately, here is where the good news end.

TDOC has highlighted elevated customer acquisition costs through advertising, potentially attributed to the upcoming presidential election in the US, with “a double-digit percentage increase in customer acquisition costs (for BetterHelp) in May versus what we had seen exiting the first quarter.”

This has directly triggered the management’s difficult choice of pulling back ad spend to maintain profit margins, with the expectations of H2’24 bringing forth revenue “decline in the low double digits” as a consequence of the reduced marketing efforts.

Even so, it is undeniable that TDOC’s BetterHelp fundamental performance has been deteriorating, as observed in the segment’s lower H1’24 adj EBITDA margins of 7.7% (-1.4 points YoY), down from the 12% reported in FY2023 (+0.8 points YoY).

While its US Integrated Care Members continue to grow, the Average Monthly Revenue has been moderating to $1.36 as well (-1.4% QoQ/ -3.5% YoY), down from the peak $2.49 recorded in FQ4’21 and $1.46 in FY2021.

As a result of the ongoing headwinds, it is unsurprising that TDOC has opted for the drastic measure of withdrawing the FY2024 and three-year outlook through 2025 guidance, exemplifying the management’s uncertainty about its business prospects.

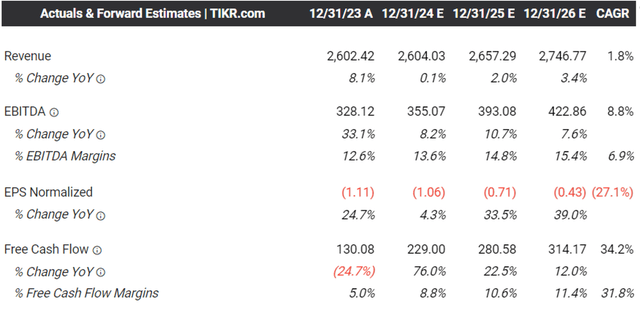

The Consensus Forward Estimates

As a result of these developments, the consensus has also lowered their forward estimates, with TDOC expected to chart lower top/ bottom-line growth at a CAGR of +1.8%/ +8.8% through FY2026.

This is compared to the original estimates of +23.1%/ +12.6% and historical growth at +54.7%/+89.2% between FY2016 and FY2023, respectively.

Even so, with minimal growth prospects and the inherent lack of adj EPS profitability, TDOC’s investment thesis remains underwhelming at these bottom levels.

This is significantly worsened by $550M of its Livongo convertible senior notes maturing in June 2025, with further equity dilution more likely than not.

As a result of these developments and the management’s pessimistic commentary surrounding its prospects, we believe that the company and stock are likely to further underperform in the near-term.

So, Is TDOC Stock A Buy, Sell, or Hold?

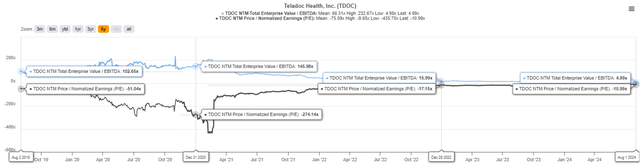

TDOC 1Y Stock Price

For now, TDOC has fallen well below its previous bottom of $9s and plunged to $8s after the underwhelming FQ2’24 earnings call and the withdrawal of its FY2024 guidance.

For context, we had offered a fair value estimate of $15.30 in our last article, based on the LTM adj EBITDA per share of $2.01 ending FQ1’24 (+34% sequentially) and the FWD EV/ EBITDA of 7.64x. This is on top of the long-term price target of $20.30, based on the consensus FY2026 adj EBITDA per share estimates of $2.66.

TDOC Valuations

While those numbers remain valid with TDOC’s LTM adj EBITDA per share still growing to $2.09 ending FQ2’24, it is apparent that bullish support has yet to be found, as seen in the sustained decline in its FWD EV/ EBITDA from the peak valuations of 232.67x in October 2020 to the all-time lows of 4.99x at the time of writing.

The same has been observed in its stock prices, with it charting lower highs and lower lows over the past few months, worsened by the elevated short interest of 20.57% at the time of writing and the higher insider selling at $4.23M over the LTM (+106.3% sequentially).

Combined with the potential price decline to penny stock levels, we believe that it may be more prudent to observe the TDOC stock’s movement while waiting for further clarity in its near-term execution, resulting in our reiterated Hold (Neutral) rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.