Summary:

- Teladoc Health is undervalued due to fundamental flaws like decelerating revenue growth and intense competition in the telehealth market.

- The company has not achieved operating profitability and faces challenges with its business model and high expenses.

- Despite its cheap valuation, TDOC’s strategic weaknesses are reflected in its stock price.

The Good Brigade/DigitalVision via Getty Images

My thesis

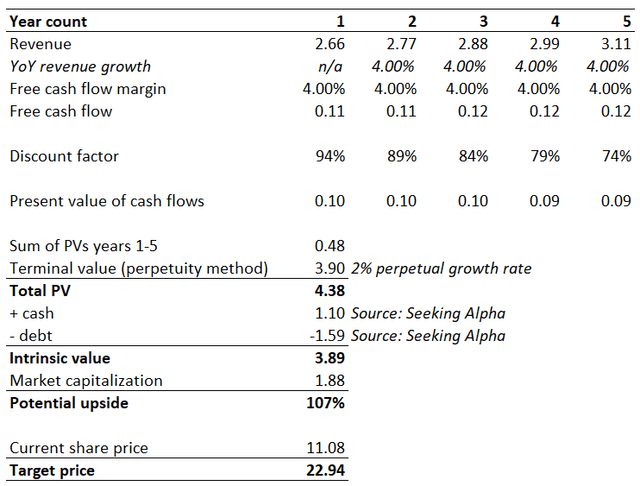

Despite extreme undervaluation based on valuation ratios and the DCF model, I am neutral about Teladoc Health (NYSE:TDOC) and assign it a Hold rating. Deep undervaluation is justified by multiple fundamental flaws like revenue growth decelerating closer to zero before the company achieved profitability, razor-thin free cash flow margin, and extremely intense competition as hundreds of companies joined the U.S. telehealth market in 2023. There is a chance for a turnaround after the CEO left in early April, but I would not bet on it before I see revisions to the business model, which is likely not economically sound. Therefore, I do not recommend buying a 96% dip from 2021 highs.

TDOC stock analysis

Teladoc Health is a virtual healthcare services provider. In FY 2023, 88% of the company’s revenue was generated from access fees. The rest was generated from visit fees as well as sales of hardware and other related services to hospital and health systems.

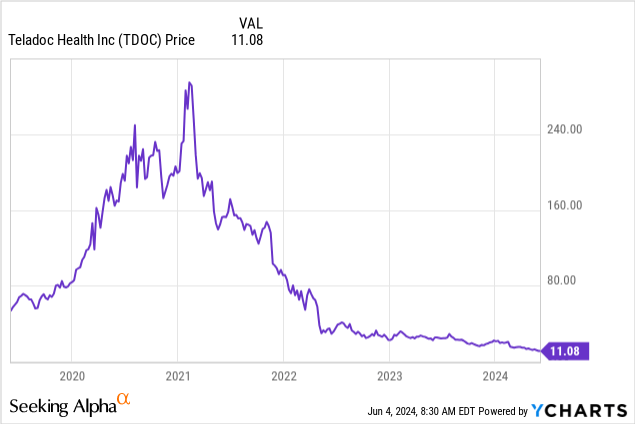

Telemedicine approach was revolutionary when TDOC started, it was founded, in 2002. The company demonstrated rapid revenue growth ten years ago, but it decelerated rapidly before the pandemic-driven spike. Over the last three quarters, TDOC’s YoY revenue growth was in single digits.

Decelerating revenue growth is a problem for any business, but for TDOC the problem is painful because the company is yet to achieve operating profitability. In Q1, TDOC demonstrated an -11% operating margin, which is not a good achievement for 22-year-old company.

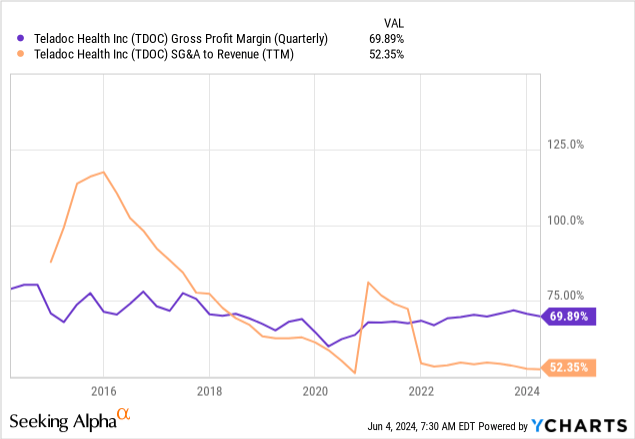

The company still cannot achieve operating break even for two reasons. First, the gross margin has deteriorated from around 80% to below 70% over the last decade. Second, SG&A expenses are extremely high and eat up more than half of the company’s revenue. Looking at the above chart, I have doubts about the sustainability of TDOC’s business model.

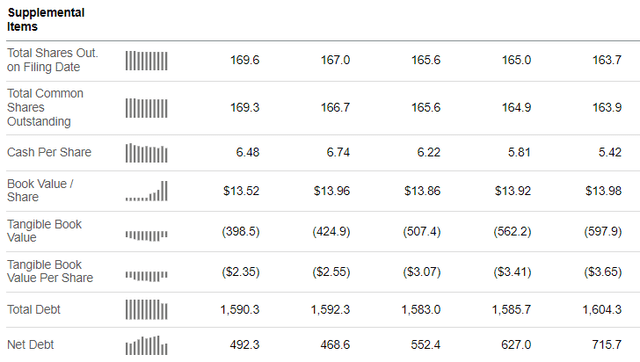

On the other hand, the notable portion of expenses is non-cash, which allows TDOC to consistently generate positive free cash flow (FCF). On a TTM basis, the company generated around $307 million in levered FCF, which is 11.7%. However, there was $198 million in stock-based compensation (SBC). When I deduct SBC, the FCF margin shrinks to just 4%. Nevertheless, consistently positive FCF allows TDOC to maintain a solid financial position with a stable outstanding shares count.

According to Grand View Research, the broad U.S. telehealth market’s size was $101.2 billion in 2023. TDOC generated $2.6 billion revenue in 2023, meaning that its market share is around a modest 2.5%. Another warning sign is that the same source considers telehealth to be a thriving industry, expected to deliver a 23.4% CAGR by 2030. On the contrary, TDOC’s revenue growth is decelerating rapidly, and consensus estimates expect low single digit CAGR by 2030.

This discrepancy in TDOC’s forecasted revenue growth and industry growth trajectory suggests that the company’s market positions are melting rapidly, and competition is fierce. The business model appears to be asset-light and does not require substantial capital investments, meaning that there are almost no barriers for new players to enter the market. According to ibisworld.com, there were 1,306 telehealth businesses in the U.S. as of the end of 2023, 27% higher compared to 2022. I think that this fact speaks volumes about TDOC’s cloudy future prospects.

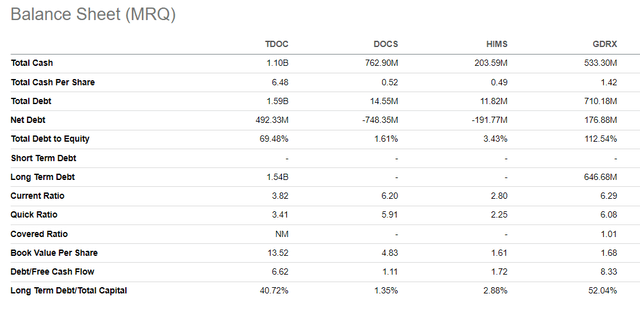

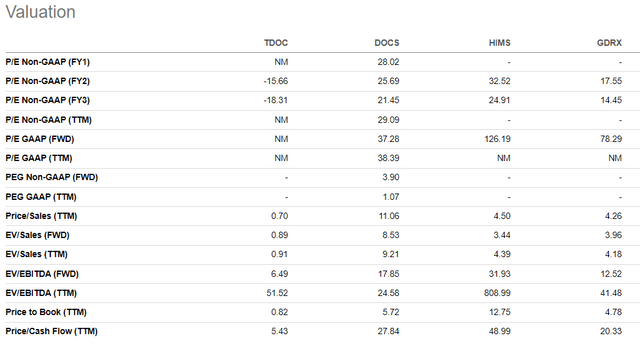

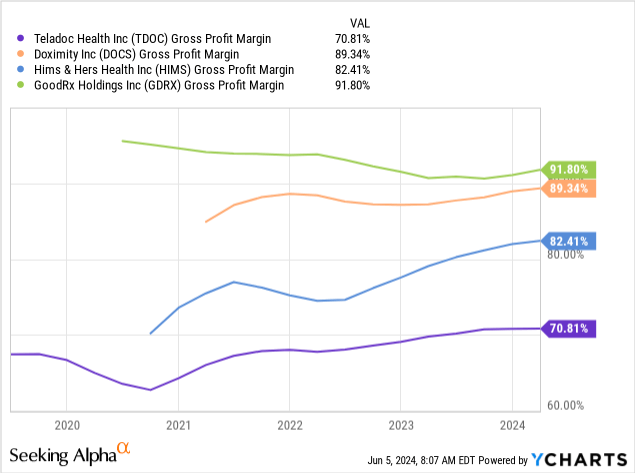

TDOC’s status as industry’s pioneer could have been its competitive advantage. However, there are already several telehealth players with larger capitalization compared to TDOC. Despite generating less revenues than TDOC, companies like Doximity (DOCS), Hims & Hers Health (HIMS), and GoodRX (GDRX) are much more profitable. That is the main reason why these companies are valued higher by the market. Moreover, DOCS and HIMS have much cleaner balance sheets, which makes them better equipped to invest in further growth.

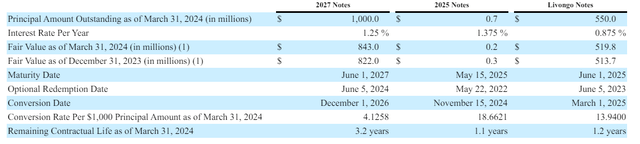

In closing, despite TDOC’s net debt position improving in recent quarters, the indebtedness is still significant. Total debt is $1.5 billion, higher than the outstanding cash balance. Since TDOC’s operations are still unprofitable and its adjusted FCF margin is razor-thin, elevated indebtedness means substantial credit risks for investors. Optimists might disagree that the credit risk is low, the company’s debt is represented by convertible notes.

Indeed, the debt can be converted into TDOC’s shares without cash being repaid. It will increase the outstanding shares count, diluting shareholders’ value. This will have an adverse effect on the share price.

Intrinsic value calculation

TDOC is cheap compared to multiples of other public companies providing telehealth services. However, the gap in valuation might be explained by the fact that all peers are profitable, as they have positive P/E ratios.

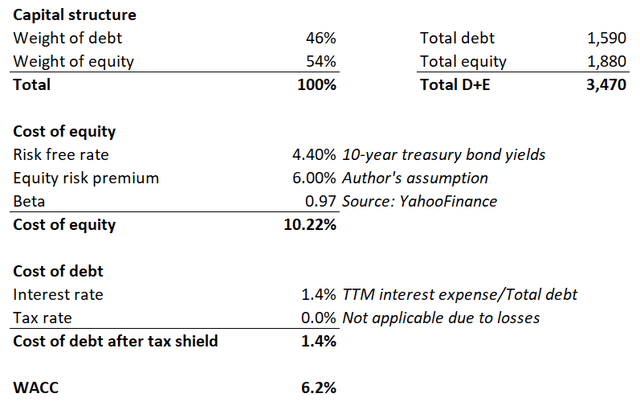

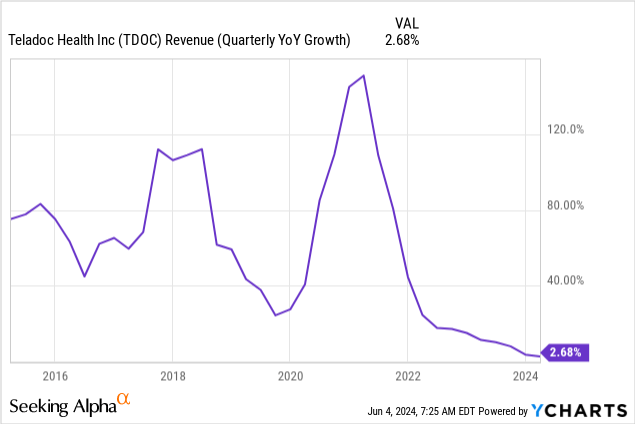

I need to calculate the exact intrinsic value estimate to understand the potential upside/downside. Starting with WACC, below is my working with all the assumptions and sources outlined explicitly.

TDOC’s WACC is 6.2%. As I mentioned earlier, consensus estimates give the company a low single digit long-term revenue CAGR. Therefore, for my DCF, I incorporate a 4% revenue CAGR for the next five years and a modest 3% perpetual growth rate. I also mentioned above that the company’s adjusted TTM levered FCF margin is 4%. Due to modest revenue growth and inflationary factors, I expect the margin to be flat.

Readers can see that TDOC’s intrinsic value is more than twice as high as the current share price. On the other hand, the DCF model ignores qualitative factors. As I outlined in my TDOC stock analysis, there are multiple fundamental flaws. Therefore, I believe that TDOC’s extremely cheap valuation is fair and reflects the company’s strategic weaknesses.

What can go wrong with my thesis?

In April 2024, the company’s former CEO, Jason Gorevic stepped down from his position. Under new management, there is always the probability of a turnaround, especially for a company with a relatively strong balance sheet and positive free cash flow. Moreover, TDOC is a pioneering company in its niche, which helps with brand awareness. If the new management outlines a sound and achievable turnaround plan, this might be a massive positive catalyst for the stock price.

Teladoc is rather aggressive when we talk about acquisitions. Despite the risky nature of growth through acquisitions, underscored by Teladoc’s sour experience with its record $18.5 billion acquisition of Livongo, there is always an opportunity of a lucky strike. The company might find quite a synergetic acquisition target which will help drive revenue growth or boost profitability. This scenario will also work against my thesis.

Summary

I am neutral about TDOC. Fundamentals are weak as revenue growth started decelerating notably before the company achieved profitability, which is a big pain for any growth investor. The business model likely needs to be adjusted towards greater monetization and cross-selling potential. The business is no-moat as the competition is intensifying rapidly. However, all these fundamental flaws are already priced in as the stock is extremely cheap.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.