Summary:

- Teladoc Health, Inc. shows signs of bottoming out after withdrawing guidance due to customer acquisition issues, particularly in the BetterHelp division.

- The new CEO must drive product innovation to capitalize on growth opportunities in weight loss management and chronic care management.

- The stock is trading at a deep valuation, around 5x EBITDA targets, providing a potential investment opportunity despite current challenges.

Morsa Images

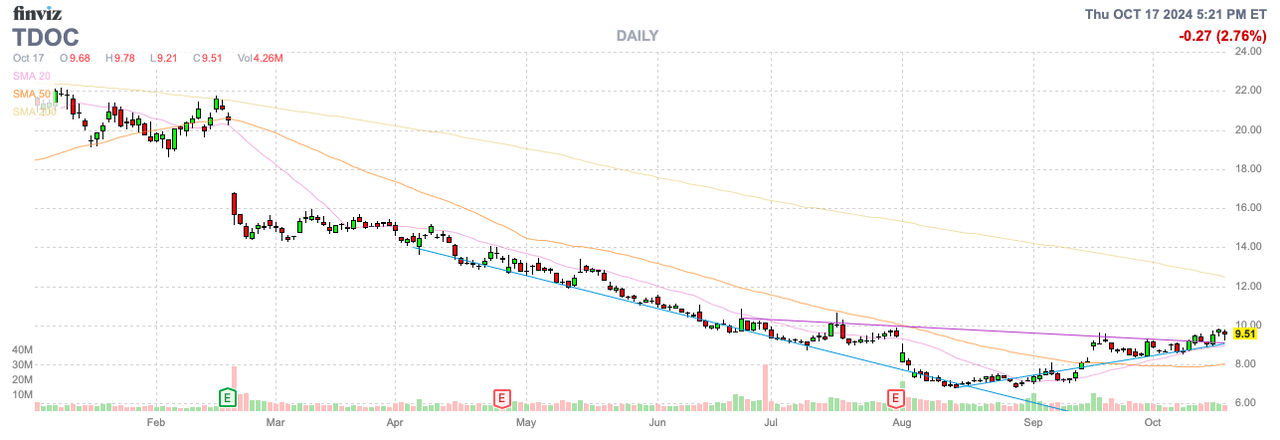

Teladoc Health, Inc. (NYSE:TDOC) is showing signs of hitting bottom after the company withdrew guidance following a big quarterly miss with the new CEO. The telehealth platform is still looking for the next growth catalyst, which could be weight-loss management. My investment thesis remains Bullish on the stock due to deep valuation, but the enthusiasm for the business is waning.

Customer Acquisition Problems

Teladoc Health pulled guidance for the year due to the issues with the mental health business. The BetterHelp division relies heavily on customer acquisition, and the company missed Q2 results due to this issue.

Compounding the problem is elevated spending for the U.S. Presidential election likely pressured advertising expenses, limiting any potential for this business to rebound. Back on the Q2 ’24 earnings call, CFO Mala Murthy highlighted a scenario where a double-digit revenue dip might occur for BetterHelp in the 2H (emphasis added):

Therefore, to provide a baseline, we note that if customer acquisition costs continue at current levels, we would expect second half 2024 revenue to decline in the low double digits.

The BetterHelp business accounts for 41% of the total revenues at $265 million in the quarter. While the mental health service is online, this segment isn’t really based on a superior technology to acquire customers. The issue mostly comes to whether the customer acquisition costs via online advertising is worth the cost.

The U.S. Presidential election most definitely boosts customer acquisition costs, especially considering Teladoc Health ran into unacceptable cost levels in Q2 with a 10% boost starting in May. The business just doesn’t appear to have the strong moat due to technology or quality of therapists.

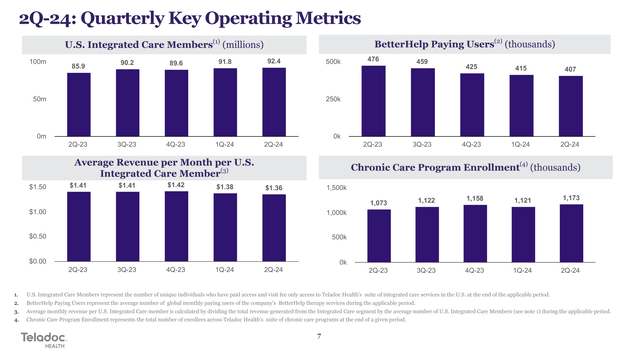

BetterHelp paying users dipped from 476K last Q2 ’23 to only 407K in Q2 ’24. The company still spent a combined $170 million in advertising and marketing, only down $9 million YoY, while watching patients dip substantially.

Source: Teladoc Health Q2’24 presentation

The Integrated Care business is the growth engine of the business, but Teladoc Health guided to mostly flat revenues in Q3 ’24. This segment had the potential to benefit from the Weight Management program, but the business isn’t very dynamic anymore with a reliance on the selling season.

Again, the original excitement over investing in Teladoc Health was a business focused on virtual technology solutions for healthcare. Now, the company is tied into more traditional advertising and sales cycles, not grabbing customers due to a better telehealth solution that draw patients.

The whole weight loss sector is on fire. Telehealth solution providers are using compound pharmacies to participate in the business. However, Teladoc Health is tied too much into integrated care with insurance providers and hospitals without any dynamic plan to change the healthcare system for the better, or at least for profit.

Hitting Bottom

The new CEO started only on June 10. Thus, the stock has likely bounced due to some signs of the company kitchen sinking the results in the last quarter with a big impairment charge and the pullback on spending for customer acquisition. Teladoc Health pulling guidance for the BetterHelp segment was sightly dramatic, helping to create the bottom.

The stock has already bounced from a low of below $7 to nearly $10. The market cap is only $1.7 billion while revenues are forecasted to be stuck around $2.6 billion, leaving Teladoc Health trading far below 1x sales targets.

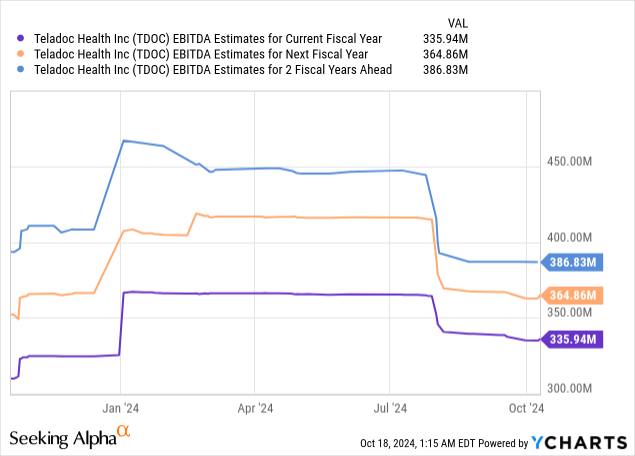

The consensus estimates have Teladoc Health producing in the range of $350 million in annual adjusted EBITDA the next couple of years. Even after the recent rebound, the stock trades at ~5x these targets.

On the upcoming Q3 earnings report on October 30, investors will definitely want to hear a focus on product innovation while building a moat for the mental health business. The company has potential catalysts in the weight loss management sector, along with chronic care management in general.

The consensus analyst estimates have revenues dipping over 4% to just $632 million. The key focus is whether the new CEO can push forward growth going forward, or whether new processes disrupt current revenues and impact the stock rebound.

At just 5x EBITDA targets, the stock is just too cheap to abandon here. The DEA continues to allow pandemic-ear flexibilities for telehealth firms, again signaling the benefits of virtual health. However, Teladoc Health has to figure out where the company has a technological advantage to drive growth in a sector where care providers aren’t necessarily interest in paying additional feed to access for virtual healthcare.

Takeaway

The key investor takeaway is that Teladoc Health has the general prospects in the telehealth sector and the cheap valuation to warrant investor interest. The new CEO has to provide product innovation to drive growth, but the opportunity still exists.

Investors can still get Teladoc Health at a good valuation, but one has to be wary of the value trap potential, especially if BetterHelp is just a telesales operation going forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Q4, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.