Summary:

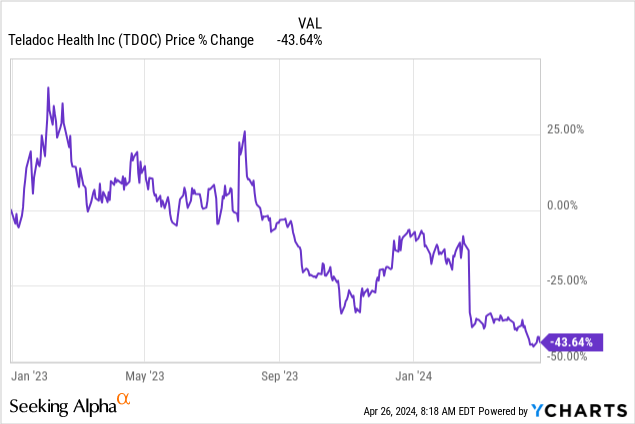

- Teladoc’s share price has fallen to new multi-year lows, losing almost 40% in value year to date, as financial numbers keep disappointing.

- Management predicts weak sales growth and a loss of $0.95 per share for 2024, still being years away from break-even.

- Teladoc’s lack of growth and profitability raises concerns about its valuation and cost control measures.

- Management needs to improve business execution and show the promised effects of scale.

Morsa Images/DigitalVision via Getty Images

The strong rally on the stock markets since 2023 has also led to a solid stabilization of share prices for many former high-flyers. Normalized expectations met with an increasing risk appetite among investors. This was not the case with Teladoc (NYSE:TDOC): the share was unable to benefit from this in any way. After a few attempts to stabilize in spring 2023, the share fell back to new multi-year lows in the third quarter and the share has also lost almost 40% in value year to date in the new year.

This sell-off also seems justified given the results presented. But now is the time to find out whether the time has finally come to stay away from the share or whether there is hope for improvement despite all the pessimism. The biggest problem with Teladoc does indeed seem to be its inability to benefit monetarily from subscribers and achieve economies of scale. For this, we take a look at the latest numbers first.

Disappointing year ahead

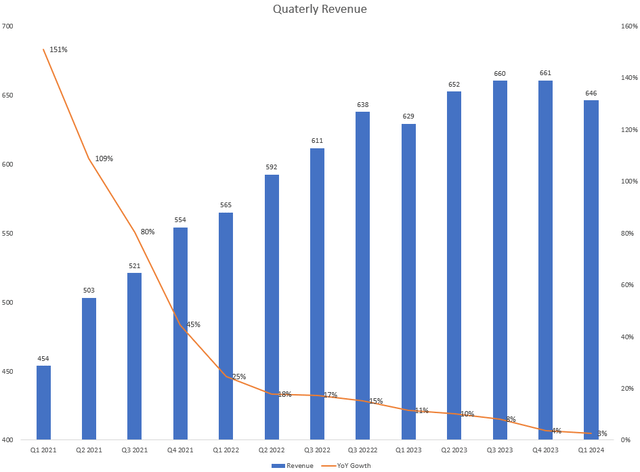

Management had already announced that 2024 would be a very weak year after presenting the annual figures, after forecasting average sales of 2.675 billion for 2024, which corresponded to a growth of a meager 2.8%. This was quite a shock, as the 10.8% growth in 2023 was already very low for investors given the opportunities in the market, which management constantly emphasizes. In the first quarter, sales growth was 3%, but the outlook for the second quarter is for no growth. Investors are therefore already having to ask themselves whether the annual targets can be met.

Quarterly Revenue and annual Growth Rate (Authors Calculation, Teladoc Financial Statements)

The hope that the flattening growth would at least allow the company to take faster steps toward GAAP profitability has also been dashed. Management continues to expect a loss of $0.95 per share, which corresponds to a loss of 160 million, i.e. a 6% margin. Although this is an improvement from the previous year, when the negative net margin was 8.5%, it is nowhere near the cost leverage needed to keep investors happy. Salesforce (CRM) is a good example here of how they have compensated for flattening growth through strong cost reductions and thus achieved high-profit growth.

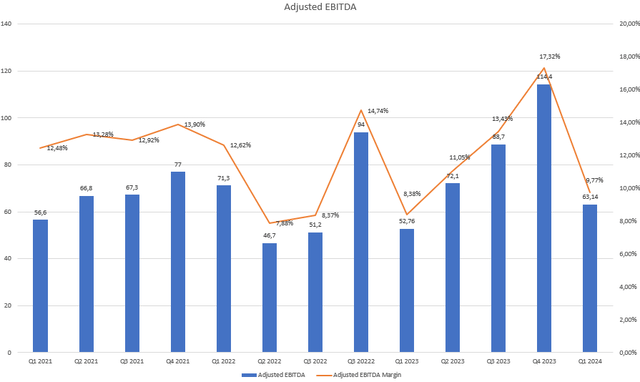

But if Teladoc offers neither growth nor profits, what is left? Well, management continues to focus primarily on improving adjusted EBITDA. This is expected to grow by 14% in 2024 with a 14% margin and a good start was made in the first quarter with 20% growth. One could therefore say that Teladoc appears to be quite favorably valued at 6 times AEBITDA. But there is a problem: AEBITDA is not a particularly good metric for company valuation. For growth companies, it can be useful to get an indicator of long-term profitability and at least have a benchmark.

Adjusted EBITDA and Margin (Authors Calculations, Company Fillings)

However, Teladoc is no longer growing and therefore this figure is not very meaningful. The only key figure that gives hope is free cash flow. Teladoc has managed to reduce the costs for capitalized software since 2022 and has kept them fairly constant since then. For 2024, the management expects an average free cash flow of USD 225 million. That would be a price to free cash flow of 10, which is fine but doesn’t seem overly favorable when you consider that companies like Bristol-Myers Squibb (BMY), for example, can be had for 7 times free cash flow.

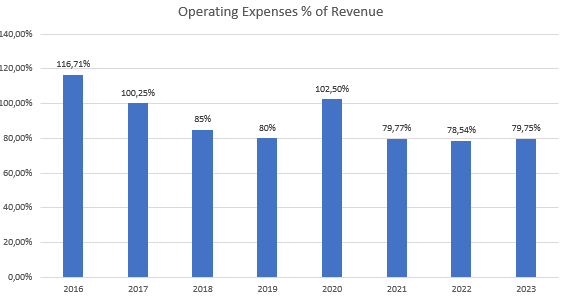

Looking for the scale

Management has been talking about economies of scale for several quarters, but the company is not making any progress in controlling its costs. To be specific: since 2019, operating costs have accounted for around 80% of revenue (except for one-off effects in 2020).At that time, Teladoc had an average of 31 million subscribers in its system. Today, there are almost three times as many at 91 million. This rightly raises the question of the advertised economies of scale.

Operating Expenses as % of Revenue (Authors Calculations, Teladoc Fillings)

Almost the only progress was made in improving the gross margin from 67% in 2019 to 71% in 2023. In addition, G&A expenses were reduced from 28% of sales to 18%. However, the big problem cost is marketing. In the past, around 20% of sales was spent on marketing, but since 2022 this has jumped to 26% and most recently to 28%. This begs the question: Why is 30% of sales being put into marketing if sales growth of 2.5% is expected in the end?

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| COGS | 129 | 184 | 391 | 652 | 746 | 760 |

| Gross Margin | 69% | 67% | 64% | 68% | 69% | 71% |

| Advertising | 85 | 110 | 226 | 417 | 623 | 689 |

| % Of Revenue | 20% | 20% | 21% | 21% | 26% | 26% |

| Sales | 59 | 65 | 154 | 252 | 227,1 | 213,29 |

| % Of Revenue | 14% | 12% | 14% | 12% | 9% | 8% |

| Technology | 54 | 65 | 165 | 311 | 338 | 347,6 |

| % Of Revenue | 13% | 12% | 15% | 15% | 14% | 13% |

| Acquisition | 10 | 8 | 88 | 27 | 16 | 25,3 |

| % Of Revenue | 2% | 1% | 8% | 1% | 1% | 1% |

| G&A | 117 | 158 | 498 | 437 | 449 | 466,5 |

| % Of Revenue | 28% | 28% | 46% | 22% | 19% | 18% |

| Amortization | 36 | 39 | 70 | 203 | 255 | 333,543 |

| % Of Revenue | 9% | 7% | 6% | 10% | 11% | 13% |

Either the management is desperately trying to generate growth again through aggressive marketing or the number of existing customers is falling sharply, which makes this expenditure necessary to acquire new customers and at least keep subscribers constant. It currently appears to be a very inefficient allocation of capital.

Let’s assume that Teladoc would cut the marketing budget to 15% of sales, which would free up approx. 350 million dollars. EBIT would then no longer be -150 million dollars but +150 million dollars. In this case, investors would be much more willing to forgive Teladoc for the lack of sales growth.

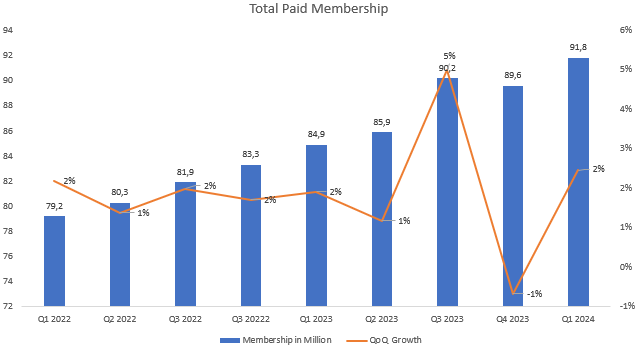

However, it is not only on the cost side that there are no economies of scale; there are also no positive effects on customers. Teladoc has managed to grow quite strongly in terms of paying subscribers for several quarters. In this quarter alone, there were 8% more than in the previous year, resulting in almost 92 million paying customers. That’s a pretty impressive figure when you consider that Apple Music has a similar number of subscribers and YouTube Premium is not that far behind with 100 million subscribers.

Total Paid Membership Teladoc (Authors Calculations, Teladoc Fillings)

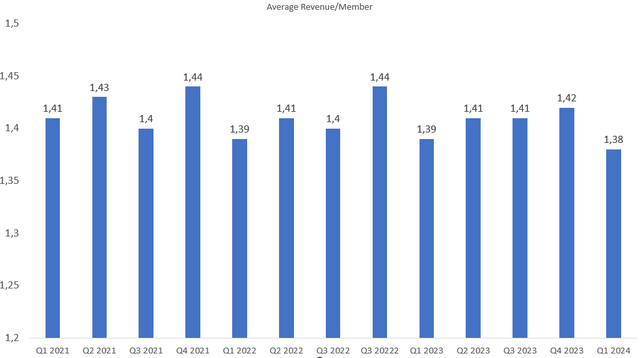

The steady growth also shows that the demand for telehealth services is still there, despite popular claims to the contrary. However, it is not possible to monetize this number properly. Since 2020, the revenue/member/month figure has been touted as a major growth opportunity. Back then it was at USD 1.41, today at USD 1.38 without any signs of an upward trend. The opportunity via this leverage is huge. A value of 1.5$ would already make a difference of 130 million dollars or 5% growth over the year. But at this stage, it is pure speculation.

Revenue per Member (Authors calculations, Teladoc Fillings)

At least the new customers are helping to ensure that the Integrated Care segment is still growing reasonably overall. This is in contrast to the BetterHelp segment, which was the beacon of hope for growth in 2022 but has currently lost all momentum. Sales have been declining here for several quarters, and the number of paying customers has fallen from 476,000 to 415,000. The next quarter is expected to see at least a small turnaround with stagnating or minimally growing sales, but it remains to be seen how sustainable this is.

Outlook

In the earnings call, the management expressed confidence that by replacing the leadership in the BetterHelp segment, the company is on the way to better customer retention and better marketing returns, which should already be reflected in dynamically growing subscriber numbers and improved margins in the second half. That would be very pleasing, but it has to be said that the management has made a lot of promises that have not materialized in retrospect (4b revenue target in 2024, significantly higher revenue/member…)

The current outlook for the next three years looks much less ambitious, even if it is quite disappointing. Annual revenue growth of around 3-4% is expected over the next three years. That would mean sales of around 2.75 billion in 2025 and 2.85 billion in 2026. 425 million AEBITDA is also expected to be achieved in 2025, i.e. a 15% margin. That’s fine, but achieving GAAP profitability still doesn’t seem to be on the cards soon. And things don’t look so good for the share at the moment either. The management must now finally prove that it can pull a lever of scale.

Either by improving cost structures or expanding the willingness of existing customers to pay. However, as long as we have a company that is barely growing and is not profitable, the current share price is probably justified. I allowed myself to be influenced by the statements of the management for too long and based my investment case on them, but I have learned dearly from this mistake. I am therefore lowering my rating to Hold until there are decisive improvements in the figures.

q

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TDOC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.