Summary:

- I believe Teladoc Health’s current challenges have already been priced into its stock.

- I’m watching closely for signs of stabilization in Teladoc’s revenue growth rates.

- I’m neutral on Teladoc for now but see potential at a 10x to 12x forward free cash flow multiple.

- If Teladoc’s fundamentals improve, I might upgrade my rating to a clear buy.

Solskin

Investment Thesis

I believe that anyone who wanted out of Teladoc Health, Inc. (NYSE:TDOC) has now fully capitulated on this name. And the investors who are left right now are those that are unlikely to sell, no matter how much worse the bad news becomes, since they are so heavily underwater.

Even though I’m on the fence about this name at present, I’m watching very carefully to see when its prospects start to stabilize.

More specifically, I believe that this stock is priced at around 10x to 12x forward free cash flow and that a lot of bad news has already been factored into its share price.

Rapid Recap

Back in July, I said,

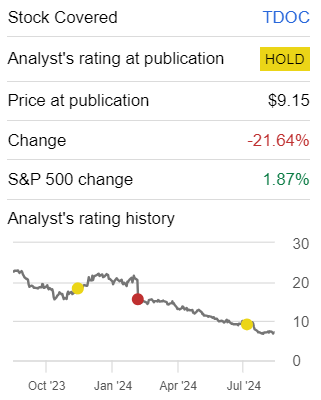

Having been bearish on Teladoc stock for some time, I now no longer believe it makes sense to sustain this bearish outlook. Even as I recognize that Teladoc today operates as a shadow of its former self, I nevertheless contend that this insight has already been priced into its stock.

Author’s work on TDOC

The graphic above is scary. And reinforces my argument that anyone who wanted out of TDOC is now gone.

Teladoc’s Near-Term Prospects

Teladoc is a company that provides virtual healthcare services, allowing patients to consult doctors and other healthcare professionals remotely. They leverage technology to match patients with the right providers and manage millions of interactions. Their services cover a wide range of healthcare needs, including physical and mental health.

Teladoc is currently focused on improving execution, streamlining its organization, and enhancing performance.

The company is evaluating its strategic direction, cost structure, and product offerings to unlock greater value and drive long-term shareholder returns. However, Teladoc has withdrawn its guidance for the BetterHelp segment and for the company as a whole, citing uncertainties in customer acquisition costs and poor visibility.

What’s more, Teladoc faces challenges too. The most significant is the rising customer acquisition costs for its BetterHelp segment, which led the company to cut back its guidance.

Furthermore, Teladoc is dealing with client-driven delays in its Chronic Care Enrollment, which will slow revenue growth in the near term, further complicating its outlook.

Given this balanced background, let’s now delve into its fundamentals.

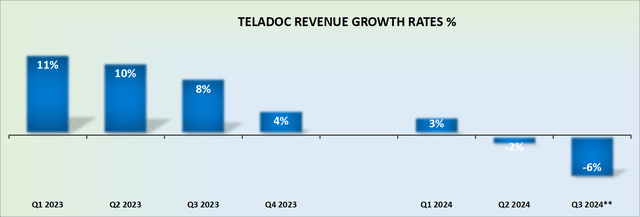

Teladoc Revenue Growth Rates Could Turn Negative

Teladoc is no longer a high-growth company. Indeed, come to think about it, Teladoc is likely to report negative growth rates in its Q3 2024 earnings report next month.

In short, there’s no point in looking back to what could have been a secular growth-disruptive business. The facts are in, and this business’ growth rates have fully stagnated. I know this. You know this. Everyone knows this. And so, too, this is already priced in many times over.

But where things start to get interesting is now. Why? Because the comparable growth rates for Teladoc are going to get a lot easier starting Q4, 2024.

So unless things get awful in 2025, Teladoc could stabilize its revenue growth rates, and this would massively change its narrative from one that is viewed by many as a dead company walking.

TDOC Stock Valuation — 12x Forward Free Cash Flow

Teladoc’s management is guiding for approximately $260 million of EBITDA this year. This is a very rough estimate on my part. Here’s the math behind this estimate.

We know that Teladoc is guiding for approximately 15% EBITDA margins with its Integrated Care segment. This implies that relative to the prior year, this segment should make around $220 million of EBITDA.

Then, moreover, its BetterHelp segment should make some profit. Obviously, it’s difficult to have much visibility into this segment, since management withdrew its consolidated guidance.

But if we take the fact that even in Q2 2024, Teladoc’s BetterHelp segment delivered $25 million of EBITDA and then, add to this a margin of safety, I believe that this segment could deliver around $80 million of EBITDA.

This means that both segments together should be on the path towards $300 million of EBITDA. But it’s better to operate with a wide margin of safety. Therefore, it’s possible that only around $260 million of EBITDA rather than $300 million of EBITDA gets reported.

Moreover, I suspect that once Teladoc’s business stabilizes, its capex figure will be around $150 million. This is a figure that runs slightly higher than its H1 2024 figure of $65 million would lead one to estimate, but again, I believe it’s best that we operate here with a wide margin for error.

All in all, this means that Teladoc will deliver at least $90 million of free cash flow this year.

Now, what complicates matters further is that TDOC has just over $1.5 billion of convertible notes, with slightly over $500 million made current. So even though Teladoc holds about $1.2 billion of cash and marketable securities, its balance sheet is in a net debt position of approximately $300 million.

Clearly, for a business set to deliver approximately $90 million of free cash flow, Teladoc will have to work hard to use all its excess free cash flow to pay down debt, rather than return any cash to its shareholders.

However, I believe that all these insights and then some have already been priced in. After all, I’ve taken the most bearish estimates possible, and the business is still profitable and priced at 12x forward free cash flow.

If things improve ever-so-slightly, it’s possible that this free cash flow multiple will drop to around 10x forward free cash flow, at which point I will give this stock a clear buy rating.

The Bottom Line

Teladoc’s narrative may improve if the company can stabilize its revenue growth and manage its challenges effectively. While I’m currently neutral on TDOC, the stock’s valuation at 10x to 12x forward free cash flow presents a compelling entry point.

If Teladoc Health, Inc. successfully addresses its near-term headwinds and achieves even modest improvements, the market’s perception could shift, potentially leading to renewed investor interest and a rebound in its stock price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.