Summary:

- Teladoc’s valuation could be reaching a bottom at the current LTM FCF yield of 20%.

- BetterHelp which currently accounts for 41% of revenue, is a key component of Teladoc growth potential.

- Investors should wait to see if the new CEO makes a strategic swift especially for BetterHelp which could be more profitable as a B2B offering.

svetikd/E+ via Getty Images

Introduction

Teladoc Health (NYSE:TDOC) is one of the largest telehealth providers in the US with around 92m members, which is still growing year-over-year. Teladoc business is split up between “Integrated Care,” which includes virtual care and “BetterHelp,” the B2C mental health provider. Looking at Teladoc’s share price, it’s up there as one of the largest destructors of wealth in the market with the valuation falling 97% over 3.5 years from the peak in 2021.

Currently the business is valued at $1.57bn in terms of market cap and $2bn in enterprise value. Over the years Teladoc health has revised expectations numerous times, most recently was the removal of BetterHelp’s annual guidance in Q2 and lower EBITDA guidance, due to escalating customer acquisition spending.

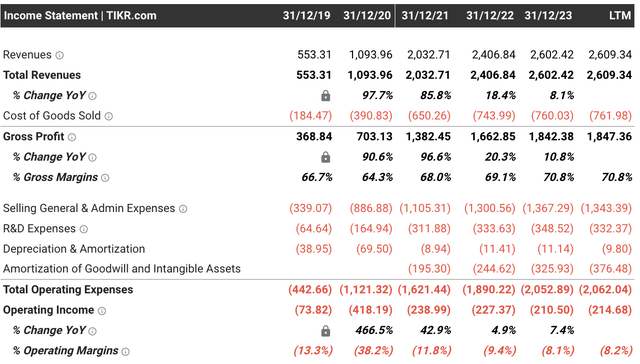

Q2 results also saw the first appearance of newly appointed CEO Chuck Divita, who told investors he’s activity examining the separate business units. Due to the severely depressed valuation, there could be an argument that Teladoc has reached rock bottom at the current 20%+ FCF yield (LTM FCF = $323m). On an operating income and net income basis the company is unprofitable due to goodwill right downs on BetterHelp and previously similar write-downs on the huge $18.5bn Livongo acquisition (these are non-cash costs).

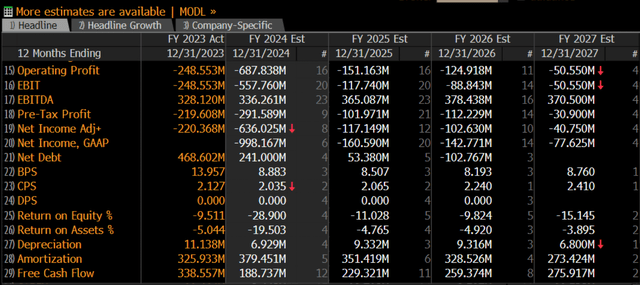

However Wall Street expects the net income losses to narrow over the coming years, furthermore and more importantly the company is expected to be profitable on a FCF basis annually around $200-300m. The difference with FCF is that its represents tangible cash flowing into the business after capital expenditure, whereas net income represents profit after all costs which includes non-cash items like depreciation & amortisation & stock-based compensation.

Thus there is possible upside if the incoming CEO can strip OpEx costs while also being to grow the overall business. While the company has challenges Teladoc remains one of the scaled telehealth providers and is still gaining members across its Integrated Care Business which is profitable and is expected to grow to 95m members by end of 2025. As for BetterHelp there’s potential to transition this business model to a B2B type offering, however I will wait to see from the incoming CEO what strategic changes are made.

Integrated care (58% of Q2 revenue)

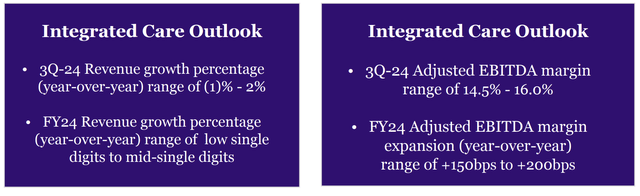

Integrated Care is a relativity stable business with flat revenue QoQ. The two main areas of Integrated Care are virtual care and chronic care. Virtual care provides patients with access to doctors under insurance coverage, this segment is scaled but mature with 92m members. Chronic care is virtual care for patients with chronic illnesses which can develop and become more costly for payers if this group is not given access to healthcare. This largely includes diabetics and overweight patients, which due to GLP-1s has slowed the growth of members on the Chronic Care Program.

One significant risk is larger uptake of GLP-1s as more iterations come to market making them more assessable (in the next 5yrs) and potential causing Teladoc’s chronic care segment to experience a shrinking TAM for weight related segment. Although this segment is still growing and I personally don’t expect GLP-1s to derail this business, in fact Chronic Care patients grew 9% in Q2 from a year ago with now 1.17 million patients on the Chronic Care Program. Overall the Integrated Care segment is expected to be stable with management guiding LSD grow in FY24 and EBITDA margin expansion of 1.5-2%.

BetterHelp (41% of Q2 revenue)

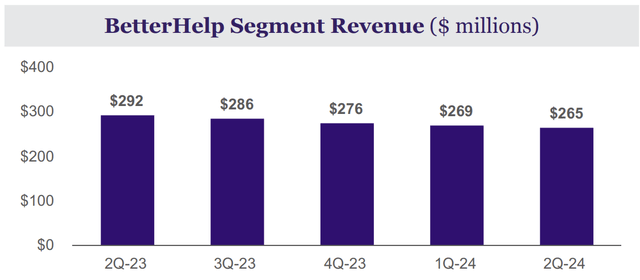

BetterHelp is a virtual B2C platform giving mental health customers access to licensed therapists. Customers pay a membership fee of under $300 per month which gives members once weekly access to a a therapist. This business is EBITDA positive however members and revenue have been shrinking consistently.

In Q2, paying members fell from 467,000 to 407,000 YoY, making the marketing spending and customer acquisition cost look ineffective. One strategic swift would be to transition BetterHelp to a B2B provider for employee health plans and insurance plans in order to capture more steady revenue. The incoming CEO said during the Q2 earnings call in relation to BetterHelp;

“Several initiatives are being pursued to positively impact results going forward, ranging from furthering international expansion, pursuing insurance coverage access in the U.S. and continued product enhancements”

However its unknown what cost this would be charged at to insurance plans who maybe reluctant, although the cost could cheaper for them as BetterHelp pays therapists $40-100 per session. Mental health is covered by medicaid and some insurance plans, plus a study Deloitte estimated that mental health was costing UK employers £51bn per year highlighting the underlying international demand as well.

If management is able to transition to a B2B model, they can stabilise churn and potentially improve margins due to lower marketing costs. However the company is still spending well over a $150m+ per quarter on advertising and marketing. Therefore this is one area to watch closely moving forwards as BetterHelp could have significant upside if the business model were to tap into insurance coverage, rapidly increasing the membership count.

Valuation

In respect to valuation, Teladoc appears to be cheap due to its positive FCF which ignores non-cash items like goodwill impairments and D&A. Looking at FCF its expected to remain between $200-300m over the next four years, implying a FCF yield range of 12-19%.

EBITDA is expected to fall between $300-400m annually implying a forward EV/EBITDA range of 5x – 6.6x. In terms of GAAP net income, the business is expected to remain unprofitable largely due to ongoing amortization which is expected to be $300m annually. Assuming a minimum FCF yield of 10% is what the market wants to pay if Teladoc can correct itself, the shares could have 95% upside based on todays valuation ($3bn market cap).

However there could be revisions to these figures in 2025 depending on the level of shake up by the new CEO who may strip costs further and pivot the BetterHelp business. This could be a potential catalyst in 2025.

Regardless the positive FCF provides room for buybacks if the valuation remains this low or it can be used to pay down the $550m convertible note due in 2025. Teladoc also $1.1bn in cash sitting on the balance sheet.

Conclusion

Teladoc continues to face legacy issues from failed Livongo acquisition in 2020 but the valuation could be reaching a bottom with the current LTM FCF yield of 20%. If the incoming CEO can stabilise BetterHelp churn and/or pivot the business I believe the market will begin valuing the shares more favourably based on the large FCF ($200-300m) the company produces.

Although on a net income basis, the company is unprofitable and it’s expected to remain that way due to large brand amortization costs ($300m per year) related to the Livongo acquisition. Without these costs, Teladoc would be producing almost $600m per year in FCF. Due to ongoing deterioration of the BetterHelp unit and large non-cash items, I believe its fair to give Teladoc a ‘hold’ with the potential to change to a buy if there’s a strategic shift in 2025 or a fundamental improvement in expected earnings.

I also think Teladoc could be a strategic buyout from a larger healthcare provider if the valuation remains cheap, but I not sure how reciprocal current investors will be given the dramatic fall in equity value in the past three years. I also noticed Point72 increased their holding to 8.6m shares in Q2 making them the third-largest shareholder, Point72 could become an activist if the company doesn’t make a strategic swift in 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.