Summary:

- Teladoc reported its Q1 FY24 earnings where revenue and earnings grew 3% and 20% YoY respectively, driven by its Integrated Care Segment.

- Unfortunately, the company’s BetterHelp segment continued to struggle with a decline in paying users, leading to revenue and earnings slowdown of 3.5% and 12% YoY respectively.

- Although the management is optimistic about growth picking up in both its segments in the second half of FY24, it kept its guidance unchanged.

- Assessing both the “good” and the “bad”, I believe that although there are budding signs of a turnaround, there are still too many uncertainties, making the stock a “hold”.

nensuria/iStock via Getty Images

Introduction & Investment Thesis

Teladoc (NYSE:TDOC) is a virtual healthcare services company that has massively underperformed the S&P 500 and Nasdaq 100 YTD. I had put a “hold” rating in my previous post on March 24th, and my thesis was predicated on my belief that investor optimism will likely remain muted until the management can show sufficient evidence of a turnaround in its business segments, especially in BetterHelp. Unfortunately, the stock has dropped 25% since then.

The company reported its Q1 FY24 earnings on April 25th, where revenue and earnings grew 3% and 20% YoY, respectively, driven by its Integrated Care segment, as it successfully drove its cross-selling efforts across their existing customer base while acquiring new customers for a total of 91.6M members. Unfortunately, the weakness in its BetterHelp segment continued, where revenue declined 3.5% YoY from a shrinking number of paying users, coupled with margin pressures as the return on their social media advertising spend remained lackluster.

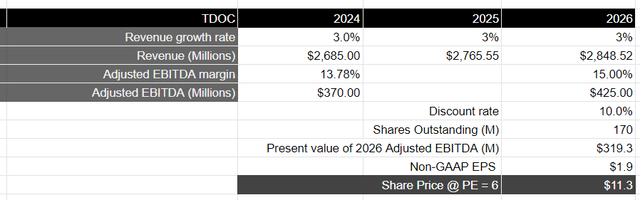

While the management believes that growth across both its Integrated Care and BetterHelp segments will pick up in the second half of the year, driven by enrollment ramp in the former and better member acquisition and retention in the latter, their FY24 guidance remained unchanged. For the full FY24, the company expects to grow its revenues by 3% to $2.685B, coupled with a margin expansion of approximately 100 basis points. Meanwhile, the company is also in a state of transition as it is in the search for a new CEO, with Mala Murthy appointed as the Acting CEO in the interim period.

Assessing both the “good” and the “bad,” I believe that while there are budding signs of a possible turnaround forming, there are still too many uncertainties, which has probably led to the management holding its guidance instead of raising it higher. Until then, I believe that investor optimism will remain subdued, while I will stay on the sidelines and rate it a “hold” at its current levels.

The good: Integrated Care Segment saw its member base grow, coupled with growing Revenue and expanding profitability

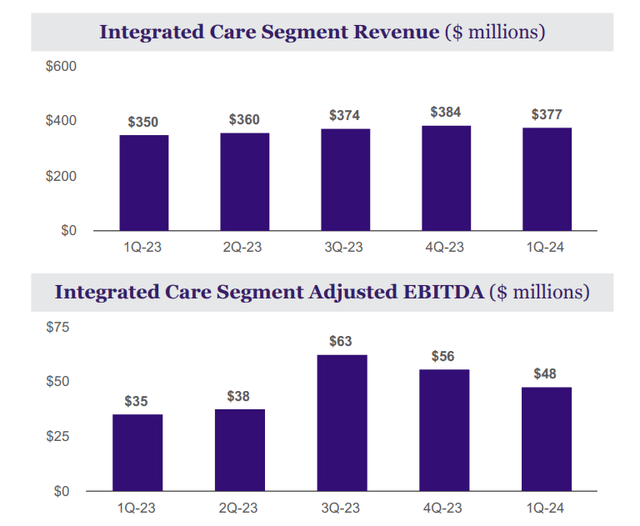

Teladoc reported its Q1 FY24 earnings, where it generated $646.1M in revenue, growing 3% YoY. Out of the $646.1M in revenue, Integrated Care segment contributed 58% of Total Revenue, growing 7.7% YoY as it saw its customer installed base grow sequentially and YoY to 91.8M members.

I believe the strength in Teladoc’s Integrated Care Segment was driven by the success of cross-selling their breadth of product portfolio, where two-thirds of their bookings in the quarter came from deepening adoption among their existing customer base, while the remaining third came from acquiring new clients, as it saw a 9% increase in their Chronic Care enrollment. In Q1, the company added their diabetes program to a large health benefits provider, which had previously purchased their telehealth solutions only. Meanwhile, the company is also seeing growing interest in weight management solutions from employers, as employee demand for GLP-1 products is on the rise. During the earnings call, Mala Murthy also outlined her optimism in driving increasing product penetration across their install base of nearly 92M members as existing and prospective clients demonstrate increased intent in their Chronic Care plus bundle solutions.

Q1 FY24 Earnings Slides: Revenue and Profitability growth in the Integrated Care Segment

In terms of profitability, the company generated $63M in Adjusted EBITDA, which grew 20% YoY, which represented a margin of 9.7%. In terms of its segments, the Integrated Care segment saw its Adjusted EBITDA grow 36% YoY to $47.6M at a margin of 12.6%, which improved 260 basis points YoY. I believe the margin outperformance in the Integrated Care Segment was driven by successful cross-selling among its existing customer base, coupled with growing Chronic Care program enrollment, which improved its bottom-line performance. Although Average Integrated Care Revenue per US member declined slightly on both a sequential and annual basis, I believe this could be attributed to the timing of new client onboarding and enrollment ramp.

The bad: BetterHelp segment continues to bleed paying users, FY24 guidance unchanged reflecting slowing revenue growth and modest margin expansion.

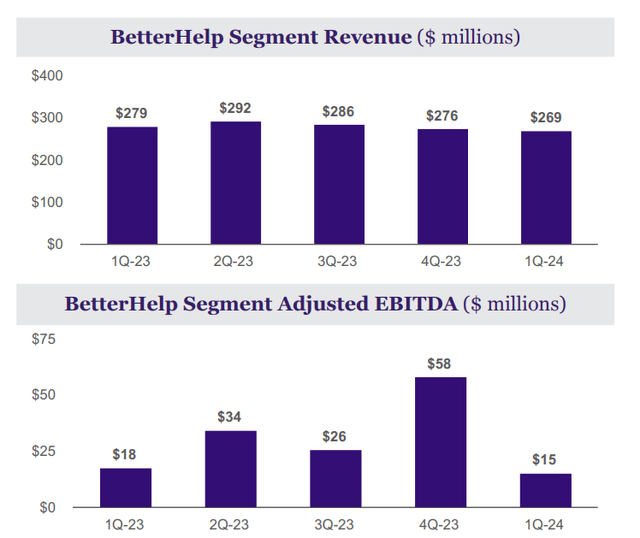

Meanwhile, the company’s BetterHelp segment continues to struggle, where it saw its revenue decline sequentially and YoY to $269M, as paying users were reduced by 11% YoY. Additionally, the company also experienced lower returns on their social media advertising spend to acquire new customers, which put downward pressure on Adjusted EBITDA which declined 12% YoY to $15.4M, with a margin of 5.7%, which represents a deterioration of 60 basis points YoY.

Q1 FY24 Earnings Slides: Revenue and Adjusted EBITDA in the BetterHelp segment

In terms of guidance for FY24, the company expects to generate $2.685B in revenue, which represents a growth rate of 3%, slower than last year’s 8% growth rate, coupled with an Adjusted EBITDA of $370M, representing an improvement in margin of approximately 100 basis points to 13.7%. While the management is demonstrating its efforts to improve profitability, the growth picture is not looking bright, with their Integrated Care Segment projected to grow in the low to mid-single digits for FY24. Although the management expects the second half to be stronger than the first in terms of revenue growth for their Integrated Care Segment, driven by the enrollment ramp in Chronic Care from the 6M new Integrated Care members that they have added since Q2 FY23, the year-over-year slowdown in revenue growth is concerning in my opinion, indicating that it could be facing competitive pressures that are hurting its growth trajectory, despite the management’s optimism of deepening its product adoption among 92M members.

On the other hand, the company’s BetterHelp segment continues to show weakness, and the management expects the segment to remain flat or grow in the low single digits in FY24, coupled with flat to +50 basis point expansion in margin. In my previous post, I discussed that Teladoc had hired a new leader to help advance BetterHelp’s revenue growth. During the earnings call, the management outlined that they expect to see acceleration in its BetterHelp segment in the second half of the year, as they see improvement in retention as well as growth in select international geographies offsetting some of the impact of the higher cost per acquisition in the US. However, despite the management’s renewed optimism around membership growth and customer retention, coupled with its international opportunity, they did not raise their guidance for the BetterHelp segment in this quarter, which could be driven by the management’s caution in managing investor expectations, especially as the company is going through a big transition as they are on a search for a permanent CEO post the departure of Jason Gorevic.

Revisiting my valuation: Teladoc remains a “hold”.

In my previous post, I discussed that the management has a lot to prove to regain investor confidence. While we saw member growth in the company’s Integrated Care segment in Q1, coupled with management’s optimism for both its Integrated Care and BetterHelp segments to see stronger growth in the second half of the year, there has been no upward revision for FY24 revenue and earnings guidance.

Therefore, taking the management’s guidance into consideration, it should grow its revenue 3% YoY to $2.685B driven by low to mid-single-digit revenue growth for its Integrated Care segment and flat to low single-digit growth in the BetterHelp segment. While the company is in a state of transition, it is making efforts to deepen its product penetration in its Integrated Care Segment, while injecting life back into its BetterHelp segment by focusing on new member additions and its international opportunities. However, until the company sees their efforts turn into tangible outcomes in the form of accelerating revenue growth in its segments, I will assume that it grows in the low single-digit range over the next 2 years until FY26, which would translate to a total revenue of $2.8B.

Assuming that it can continue to grow its profitability during this period of time to close to 15% led by its Integrated Care Segment as it sees deepening of its product adoption, especially across its Chronic Care suite of products, it should generate close to $450M in Adjusted EBITDA, which is equivalent to a present value of $319 when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period with a price-to-earnings ratio of 15–18, I believe that Teladoc should trade at least 0.375x the multiple, which will translate to a PE ratio of 6. In my previous post, I assumed a PE ratio of 8; however, given the sufficient lack of evidence of a turnaround, I believe it is necessary to further compress my PE ratio. This gives me a price target of $11, which is where the stock is currently trading.

Conclusion

Although the stock is trading at a fair value, I will not be initiating a position yet in Teladoc. Although there are potentially early signs of a turnaround forming where Integrated Care Segment is seeing an uptick in its members, coupled with management’s optimism of a possible recovery in both its segments in the second half of the year, there are still too many uncertainties, especially as the company is on the search for a new CEO. As a result, I will rate the stock a “hold” at its current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.