Summary:

- Teladoc Health, Inc. is currently undervalued, trading at 11x forward free cash flow, presenting a compelling investment opportunity despite its dire outlook.

- The company’s strength lies in its scalable virtual healthcare services, with a focus on chronic condition management and international expansion.

- Stabilizing revenue growth rates to around 1% in 2025 is crucial for Teladoc’s valuation and future prospects.

- Assuming modest growth and cost optimizations, I project a price target of $15 per share by early 2026.

ShutterOK/iStock via Getty Images

Investment Thesis

Teladoc Health, Inc. (NYSE:TDOC) stock is primed to move higher in 2025. That’s a bold statement, right? After all, if we are honest, Teladoc’s current outlook appears bleak.

And yet, that’s precisely where I see the opportunity. At present, investors are pricing the stock at just 11x next year’s projected free cash flow.

Additionally, I believe the arrival of a new management team will inject fresh energy and a commitment to transformation.

While it’s too early to predict whether these changes will be entirely positive, change itself will be inevitable.

Given that the stock has already plunged roughly 90% from its peak, even modest improvements could have a significant positive impact.

All in all, I see a price target of $15 per share by early 2026.

Teladoc’s Near-Term Prospects

Teladoc is a healthcare company specializing in virtual medical services, enabling patients to consult healthcare professionals via video from virtually anywhere.

Teladoc’s offerings address diverse healthcare needs, including general medical issues, mental health support, and chronic disease management, all through an integrated care model.

By prioritizing accessibility and convenience, Teladoc aims to provide high-quality care without requiring physical visits, saving patients time and effort. The company’s strength lies in its ability to deliver these services at scale, particularly benefiting individuals with limited access to in-person healthcare.

In the short term, Teladoc’s outlook appears average, driven by membership growth and its “land and expand” strategy, which focuses on acquiring new members and cross-selling additional services.

The company has demonstrated resilience, achieving reasonable client retention rates, and expanding its presence internationally. Moving forward, Teladoc plans to sustain its growth by emphasizing chronic condition management and further international expansion.

2025 Growth Prospects Will Improve

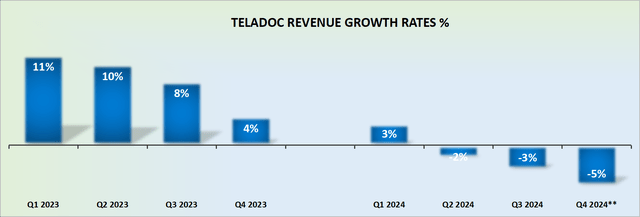

Many investors see Teladoc as a dead company walking. It’s easy to see why, too. Right away, its guidance for Q4 2024 points to yet another awful quarter ahead. This will mark the more than 12th consecutive quarter of decelerating revenue growth rates, with Q4 2024 likely to deliver negative 5% y/y revenue growth rates.

But as an Inflection investor, you should know this. It doesn’t matter what it looks like now. It matters what people will think about Teladoc in 6 months. As they look ahead to the back end of 2025.

That being said, I do believe that unless 2025 turns out to be a disastrous year for Teladoc, its comparables are now so easy, that Teladoc should be able to deliver at least 2% to 4% topline growth rates in 2025.

And yet, I want to highlight the following aspect.

TDOC revenue growth rates

For now, the sell side is expecting more of the same as this year. They are extrapolating the current dim outlook for Q4 2024 into 2025.

And that, I believe, is where this opportunity is found. This is one of my classic Inflection setups. Getting involved now when the outlook is extremely dissatisfying.

Because I know that in 2025, investors will be eyeing up a “more stable” Teladoc and optimism around its prospects will be materially higher than it is right now.

TDOC Stock Valuation – 11x Forward Free Cash Flow

Teladoc has a net debt position of $400 million. This is not an ideal situation, and it will restrict its maneuverability and propensity to return excess free cash flow to its shareholders. I know this. But I believe this is already factored into its share price many times over.

What’s more, Teladoc is highly free cash flow generative. Basically, this is the core of my bull thesis and why I own TDOC and recommend it to Deep Value Returns subscribers.

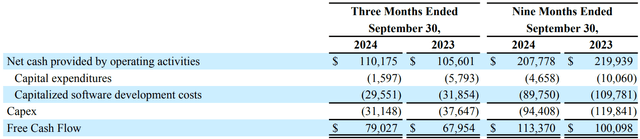

Let’s look at the table below to form a view of what Teladoc’s 2025 free cash flow profile could look like.

What you see here is that TDOC is probably going to deliver about $175 million of free cash flow in 2024.

Accordingly, if I presume that in 2025, on the back of “some” topline growth, as light as 1%, Teladoc can continue to optimize its cost structure, there’s room for Teladoc to deliver about $190 million of free cash flow in 2025.

This leaves Teladoc priced at 11x its 2025 free cash flow. A figure that, I believe, is incredibly attractive.

Investment Risks

The bulk of my investment thesis here is contingent on Teladoc’s revenue growth rates in 2025 stabilizing. If Teladoc’s revenue growth rates fail to stabilize to around 1% topline growth, then, my investment thesis would not have worked out.

Furthermore, I do not believe that a cheap stock alone is a worthy investment. The business must deliver stability and free cash flow to be a rewarding investment. Simply put, I would like the business to be able to successfully monetize their 94 million members.

Next, Teladoc faces challenges in the competitive telehealth and virtual care market, where companies such as MDLive and others are also vying for market share.

The rising cost of healthcare and tightening budgets for health plans add pressure, with Teladoc noting a slower-than-expected 2025 U.S. selling season, particularly in chronic care management. This has resulted in competitive pressures that may weigh on the company’s profitability in 2025.

This is an element that, I believe, is already priced in, but it’s nevertheless an aspect to keep mindful about in 2025.

The Bottom Line

I believe paying 11x forward free cash flow for Teladoc is a classic Inflection opportunity.

Despite its current struggles, the market’s dire outlook has driven the stock to a level where even modest stabilization could deliver outsized returns. With new management injecting fresh energy and a sharp focus on cost efficiency, Teladoc is positioned to generate substantial free cash flow.

While challenges remain, I am confident the narrative will shift by late 2025 as the company’s operational improvements become evident.

At this valuation, the risk/reward setup is compelling, making Teladoc a buy.

Price target of $15 by early 2026.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TDOC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Deep Value Returns recommends TDOC.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.