Summary:

- Warren Buffett is selling Bank of America shares, likely due to a potential recession, high valuation, and weakening consumer financial health.

- Bank of America faces headwinds like increasing credit losses, leverage risks, and lackluster loan growth, making it less attractive.

- The bank’s competitive moat is weakening as digital banking rises, and its valuation is high compared to peers.

- Buffett prefers redeploying capital to better opportunities, as Bank of America doesn’t meet Berkshire Hathaway’s ideal high-ROE, growth-focused criteria.

J. Michael Jones

Warren Buffett is once again making news by aggressively selling down one of his major equity stakes. We have already talked about Apple (AAPL), and this time it’s Bank of America (NYSE:BAC), where Berkshire Hathaway (BRK.A)(BRK.B) has sold roughly $6.2 billion in just a few weeks. While neither Berkshire nor Buffett have shared the reasons for the selling of the stock, we have some ideas of what could be motivating Buffett to take this course of action.

One thing we know for sure is that Berkshire Hathaway does not need the money right now, given that its cash and short-term investments have surpassed $277 billion.

We believe in some ways, it is easier for Buffett to sell Bank of America compared to The Coca-Cola Company (KO), given that he probably has a lower emotional connection with the product. He has shared many times how much he enjoys drinking a can of Coke, but we have never heard him say that he enjoys queuing at his local Bank of America branch. In any case, below, we share ten economic reasons that we believe motivated the sale of Bank of America shares.

I. Consumer Weakness

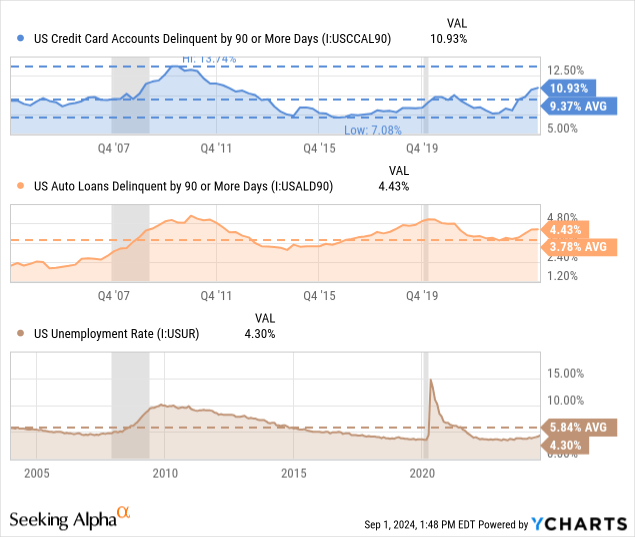

Bank profitability is highly correlated to the financial health of consumers and corporations. Lately, there have been increasing signs pointing to a weaker consumer. For example, indicators like the percentage of credit cards delinquent by 90 days or more are now approaching levels last seen during the global financial crisis. Similarly, delinquent auto loans are significantly above the average for the past twenty years. This is despite the rate of unemployment still being relatively low, although it too is trending higher.

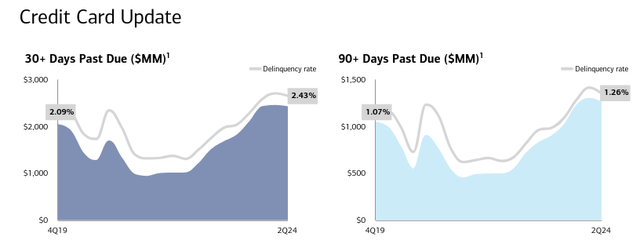

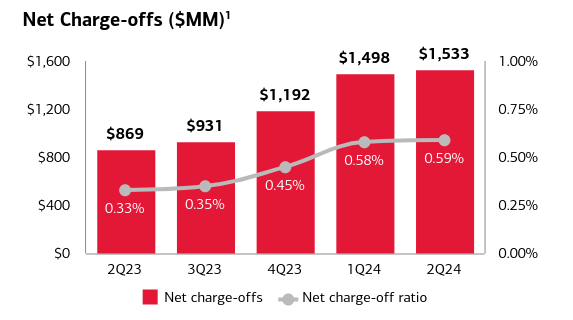

It is therefore no surprise that Bank of America is starting to increase its provisions for credit losses, which rose to $1.5 billion compared to $1.1 billion in the second quarter of financial 2023. While their credit card delinquencies appear lower than the industry’s average, they have also increased significantly, and are now above the pandemic high.

Bank of America Investor Presentation

Both consumer and commercial charge-offs are increasing very significantly, and this will likely prove a headwind to earnings for some time. This is especially true if the economy continues weakening, or if it goes into recession.

Bank of America Investor Presentation

II. Leverage

There are only three ways a smart person can go broke: liquor, ladies and leverage. – Charlie Munger

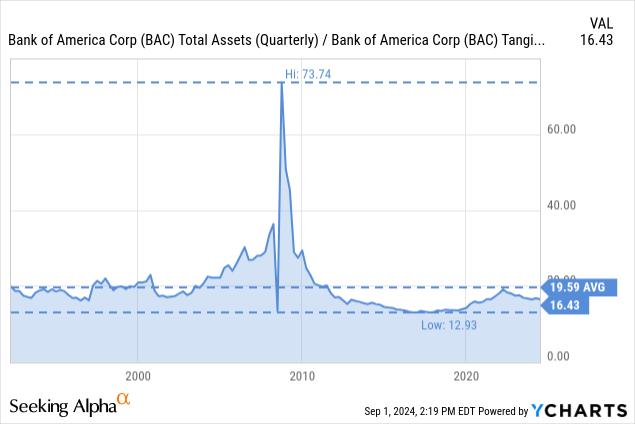

It is important to remember that banks are highly leveraged by design, it is part of their business model. The problem is that this greatly amplifies problems, and a small increase in credit losses can erase as significant portion of the company’s capital. While Bank of America’s leverage is still below its 20-year average, as measured by dividing total assets by its tangible book value, it has increased from the low it reached of ~12.9x. With a weakening consumer and issues in the commercial property sector, leverage could quickly cause problems for the company.

III. Peak Cyclical Rates

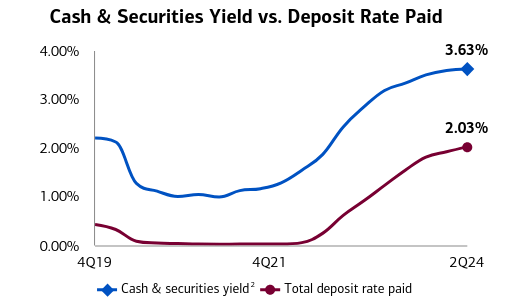

Powell has finally admitted that ‘the time has come’ to start cutting interest rates, which means we have probably seen the peak in short-term interest rates in the U.S. It will be interesting to see how fast banks like Bank of America lower the interest they pay depositors, but historically, they seem to be able to earn a higher spread when rates are higher compared to when rates are very low.

For example, when interest rates were close to 0% they were making roughly a 1% spread by investing excess deposits in cash and securities. Recently they have been making an almost 1.6% spread on the roughly $854 billion in deposits in excess of loans. This has been easy money for banks, but there is a risk that customers that have gotten used to receiving a decent yield on their deposits will not respond well if the bank tries to lower the deposit rate paid to customers too fast.

Bank of America Investor Presentation

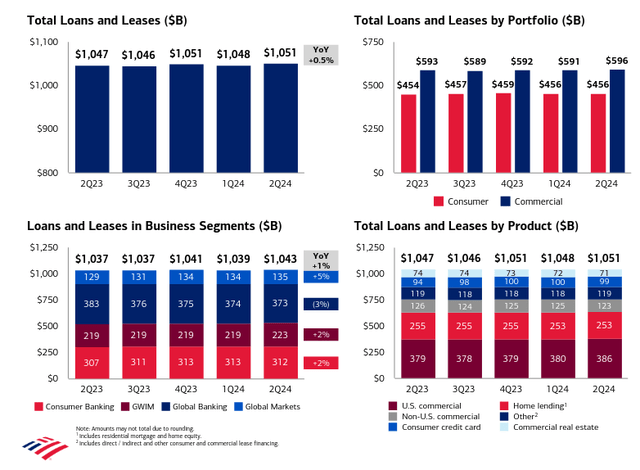

IV. Lackluster Growth

The bread-and-butter business of a bank is supposed to be making loans, and here we see that Bank of America is delivering negligible growth. Adjusting for inflation, it would actually be negative growth. In the second quarter of financial year 2024, total loans and leases experienced growth of only 0.5% year-over-year.

Bank of America Investor Presentation

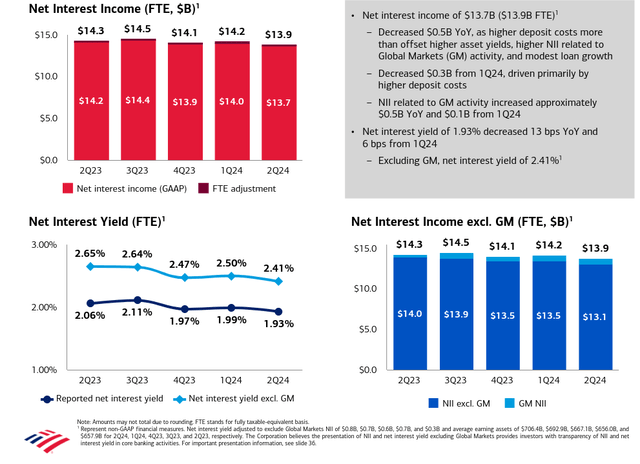

If Bank of America is not growing the amount of business it does, it could still increase earnings by lowering costs. However, its efficiency ratio has been hovering around 64% for several quarters, so we do not see much potential there either. Adding more headwinds, its net interest yield has been trending down for several quarters now.

Bank of America Investor Presentation

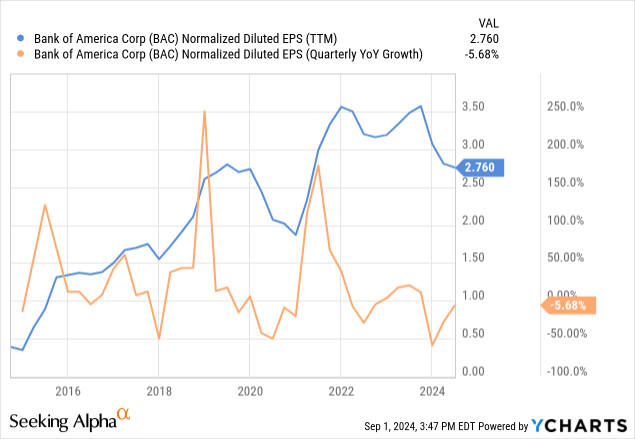

As a result of these headwinds, the trailing twelve months (TTM) normalized diluted earnings per share [EPS] are well below their peak reached some quarters ago.

V. Weakening Competitive Moat

We tell our managers we want the moat widened every year. – Warren Buffett

Buffett has famously said that for him, it is more important to see the business moat widened than to see higher profits that year. Maintaining or strengthening a competitive moat should allow higher profit margins, pricing power, and taking market share in the long-term, even if it might require lower short-term earnings.

One of Bank of America’s main competitive advantages is its massive branch and ATM network. Unfortunately for the company, this is becoming less important for customers, who increasingly prefer to do most of the banking online. In fact, this could go from a competitive advantage to a disadvantage, as the rent costs might not justify the benefit in many locations. This is increasingly becoming a reality, and Bank of America has been announcing branch closures, and we would not be surprised if they continue reducing their real estate footprint in the coming years. In some countries, this dynamic is playing out faster and digital banks are already overtaking traditional banks in market capitalization. For example, UK digital bank Revolut already saw its valuation surpass that of Barclays PLC (BCS), one of the largest traditional banks in the United Kingdom.

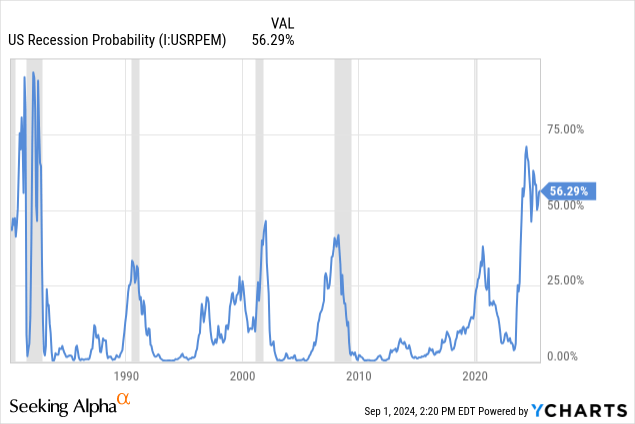

VI. Recession Draw-downs

Two sectors that traditionally experience large draw-downs during recessions are consumer discretionary (XLY) and the financial sector (XLE). This makes intuitive sense, as consumers will first cut discretionary costs, and might start defaulting on their credit cards and loans. Businesses are also more likely to default on their bank loans during a recession, and the leverage with which they operate further complicates things for banks. This makes it a risky time to be holding bank shares, as the probability of an upcoming recession is currently very high. According to the Estrella and Mishkin model, the probability of a recession arriving soon is close to 56%. Historically, the U.S. has entered a recession if the model exceeds a 30% probability threshold.

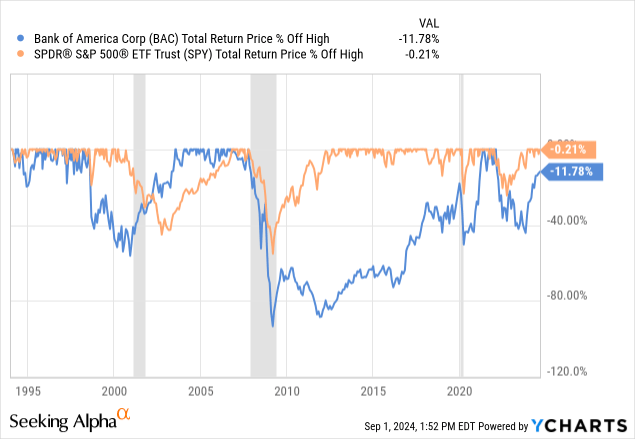

Unsurprisingly, Bank of America has usually had more severe share price draw-downs during recessions compared to the S&P 500 Index (SPY)(SP500).

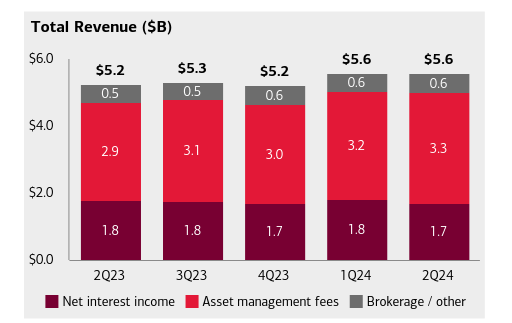

Not only does a recession cause higher losses as a result of credit losses, but even their crown-jewel business, “Global Wealth & Investment Management”, is negatively affected when asset prices decline, as some of their fees are based on assets under management [AUM], which tend to decline during downturns.

Bank of America Investor Presentation

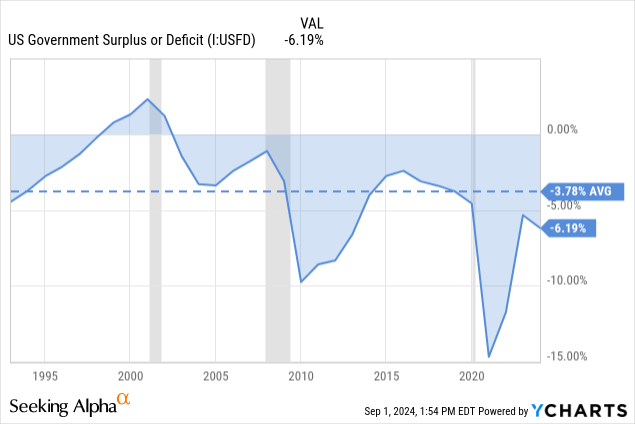

VII. Higher Capital Gains Taxes

Buffett has said that he believes capital gain taxes might have to be increased given the substantial government deficits. Still, while this might be an added motivation to take some gains now, we do not see him selling shares of The Coca-Cola Company (KO) or of American Express (AXP), but he is selling Apple and Bank of America, which means he likely sees these two companies as fully valued, or perhaps even overvalued.

VIII. High Valuation

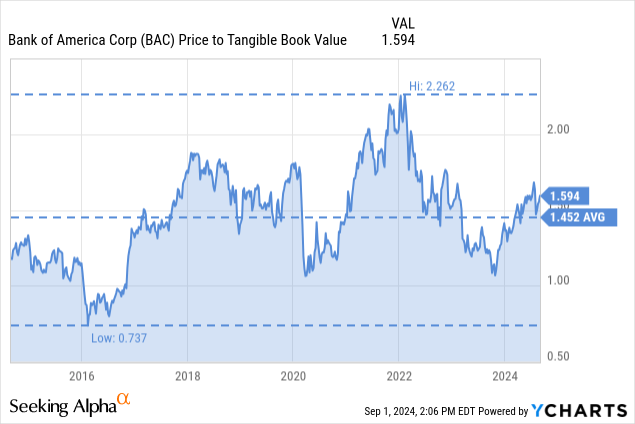

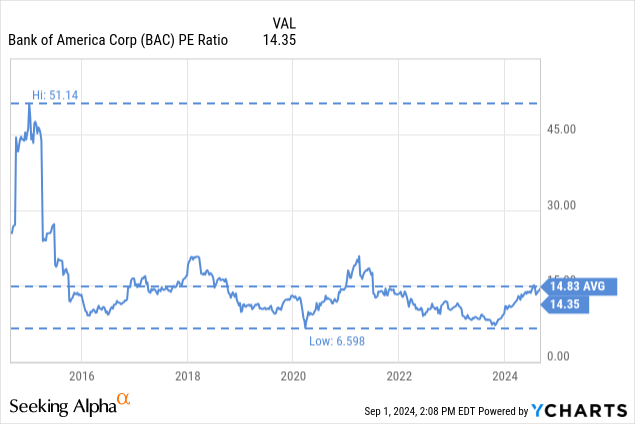

Talking about valuation, Bank of America does not look particularly cheap at the moment, especially if a recession could be around the corner. It is currently trading above its ten-year average price to tangible book value ratio.

Similarly, it is trading very close to its average ten-year price/earnings multiple and more than twice the low it has reached during this period. This is also a premium to competitors like JPMorgan & Chase & Co. (JPM) and Wells Fargo & Company (WFC), which are trading with a price/earnings ratio of close 12x. Bank of America’s price/earnings ratio also exceeds the financial sector’s 13x median multiple.

IX. Hidden Risks

So far we have discussed issues that are easy to see, but banks and financial institutions tend to have higher-than-average hidden risks. This can range from bad decisions the company made, but are not apparent, to external factors like new regulations or fines. While these are “unknown unknowns”, some potential issues that could become real problems include the commercial property refinancing wall, with low-quality office and mall properties looking particularly vulnerable.

X. Opportunity Cost

Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns – Charlie Munger

Finally, there is the fact that Bank of America is just not that great of a business. Buffett was able to invest in the company under very favorable terms, but it can now probably redeploy the capital to better opportunities. Buffett has said that time is the friend of the wonderful company, and the enemy of the mediocre.

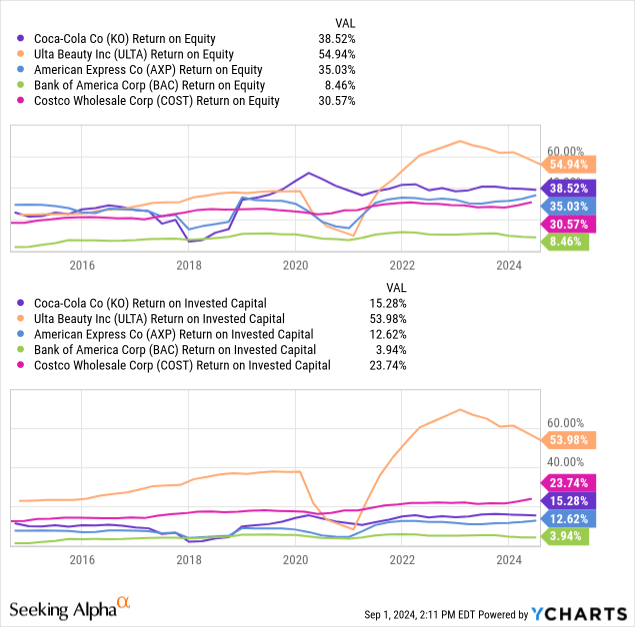

Looking at Bank of America’s return on equity [ROE] and return on invested capital [ROIC], it is clear that it is closer to a mediocre business than a wonderful one. Bank of America’s return on equity is in the single digits despite its business model that relies on leverage, with an even lower ROIC. When compared to other famous Berkshire Hathaway investments like Costco (COST) and recently added Ulta Beauty (ULTA), it is clear that Bank of America is a significantly less attractive franchise. Even for dividend investors, there are probably much better opportunities, including Bank of America’s Series L Non-cumulative Perpetual Convertible Preferred shares (NYSE:BAC.PR.L). They currently yield more than twice what the common shares offer, with a current yield of ~5.8%, compared to ~2.5%. The company can force conversion into 20 BAC shares, should they trade above $65 for 20 of any 30 consecutive trading days, which we do not see happening any time soon. Even if it were to happen, that would probably result in a small gain compared to the recent price of 1,246.95, as long as BAC shares remained close to or above $65. Still, it seems Buffett is opting to redeploy capital to common stock of other companies like ULTA.

Takeaway

Buffett invested in Bank of America with very generous terms and has generated enormous profits, but right now, shares look fully valued and vulnerable to a potential recession. While neither Buffett nor Berkshire Hathaway have shared the reasons for disposing BAC shares, we see several potential reasons that would explain the move.

As we know, Berkshire Hathaway does not exactly need the money, given that it has more cash and short-term investments than even some countries. It is more likely that Buffett sees shares as fully valued, or perhaps even overvalued, and is worried about a potential recession. Bank of America in particular, and banks in general, tend to perform very poorly during recessions. The company also does not seem to fit the Berkshire Hathaway ideal company, which tends to have high returns on equity, growth, and a strengthening competitive moat. With shares trading at a premium to the sector, poor growth prospects, and elevated recession risk, we are therefore not surprised Buffett is taking some profits.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.