Summary:

- Tesla stock is down 23% in 2024, as the company’s growth expectations slow and it faces increased competition from Chinese automakers.

- The company’s financial results show a decline in gross profit and margins, raising concerns about its valuation.

- CEO Elon Musk’s statements about Tesla’s future seem unrealistic, to say the least.

Eshma

The year 2024 is off to a bad start for Tesla, Inc. (NASDAQ:TSLA), down about 23% as the S&P 500 (SP500) continues to update its all-time high. The main problem remains the same: we are talking about a very good company, but it is overvalued. Growth expectations are slowing down dramatically, and this certainly does not please shareholders.

In my last Tesla article, I highlighted factors related to the reduction of margins as well as the deterioration of brand perception. In addition, Chinese competitors – especially BYD Company (OTCPK:BYDDF, OTCPK:BYDDY) – are taking an increasingly important role. Well, all of these issues are not yet resolved; in fact, they are getting worse. For this reason, my rating remains a strong sell.

Tesla’s narrative diverges from financial results

The bull narrative is that Tesla is more than a car company and deserves valuation multiples even in the triple digits given its growth prospects. While there is no question that Tesla is a great company, there is also evidence that growth rates are slowing and there is no way to justify the current valuation.

Tesla, Inc. (TSLA) Q4 2023 Earnings Call

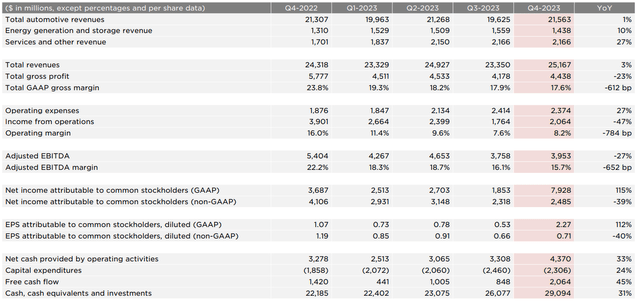

In Q4, total automotive revenues grew only 1% quarter-on-quarter and were responsible for 85.67% of revenues. Energy & Storage and Services increased by 10% and 27%, respectively, which is encouraging but cannot compensate for the stagnant growth in the core segment. But this is not the most negative aspect of this quarterly.

Gross profit declined by 23% and reached $4.43 billion; gross margin fell by as much as 612 basis points. As surprising as this deterioration may seem, it really is not at all, and I already predicted it in my last article. The continued discounts offered by Tesla prevented a sales meltdown, but in doing so, squeezed margins. In fact, operating income saw a 27% reduction, with operating margin plummeting by 652 basis points.

In the face of such results, there is very little to be optimistic about, yet the tone during the conference call seemed anything but pessimistic.

- Several times the growing demand for the Cybertruck was mentioned, elevating it as the best vehicle Tesla has ever produced. Still, it will take time to meet demand, and it will take years for it to become profitable. For now, it remains just a money-burning vehicle; in the future, we shall see.

- 2025 could be the year of the Tesla Redwood, an EV with a rather affordable price tag of $25,000. For the bulls, this is positive news, for me, it is not at all since the model deteriorates the premium vehicle brand. I am mainly referring to the Model X and Model S, those with higher profit margins. Potentially, the Tesla Redwood could help with revenue growth but would further fuel the margin deterioration process.

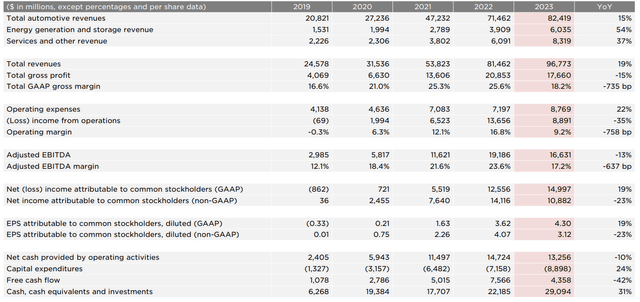

- The Model Y, despite not being affordable by anyone, was the best-selling vehicle of the year with 1.20 million units delivered. Very good, but all this did not help to increase full-year 2023 profits, which declined 23% YoY.

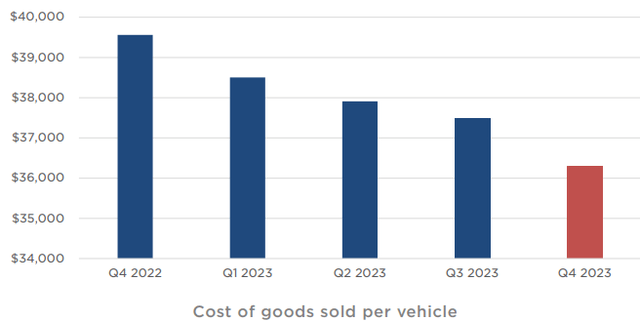

Last but not least, the gradual reduction of COGS per vehicle was mentioned repeatedly.

Tesla, Inc. (TSLA) Q4 2023 Earnings Call

Certainly, there has been an improvement over Q4 2022, but it is unlikely that this trend will continue at this rate. First of all, 2022 was a year where commodity prices were very high, so 2023 benefited from lower prices. Second, there are natural limits beyond which COGS per vehicle cannot fall. Be that as it may, gross profit has dropped dramatically despite these improvements, and given the increase in wages I expect there to be further downward pressure on operating profit as well.

Tesla, Inc. (TSLA) Q4 2023 Earnings Call

In general, the bull narrative on Tesla justifies the current valuation multiples, given the strong growth prospects. However, financial results say otherwise, and the current macroeconomic environment is not in favor of the automotive market. After all, buying a car almost always requires a loan, and at current market rates, it may not be that advantageous.

The 54% growth in the Energy & Storage segment and 37% growth in the Services segment is undeniable, but what is the point if profits plummet 23% YoY? By the way, total revenues have also dropped sharply in growth.

China and other considerations

In a Bloomberg interview in 2011, Elon Musk laughed when he was asked what he thought of BYD’s cars. His response was, “Have you seen their cars?

Many years later, much has changed, and BYD has overtaken Tesla as the world’s best-selling electric car manufacturer. Competition from Chinese companies is now fierce, and Tesla is no longer the only alternative in China. In this quarterly report, I would have preferred more information regarding sales in China. In any case, there was in my opinion an important statement by Elon Musk:

Well, our observation is generally that the Chinese car companies are the most competitive car companies in the world. So I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established. Frankly, I think if there are not trade barriers established, they will pretty much demolish most other car companies in the world. So they’re extremely good.

Certainly, his opinion has changed toward Chinese companies, and the fact that their sale outside China depends on tariffs or trade barriers should make shareholders think. This implies that Chinese cars are far better than we may think and that the only reason holding back their spread at the moment is government barriers. However, they are obviously not there in China and I doubt Tesla can maintain the same market share in the future. That would be a heavy blow since about 1/5 of sales come from China.

Probably over the past few years, Tesla has underestimated Chinese technological progress too much, and this could have negative consequences as early as the next few quarters.

Finally, I do not understand the point of declaring market cap targets:

I do see a path where Tesla could one day be the most valuable company in the world. I do emphasize that is not an easy path and a very difficult one, but it is now in the set of possible outcomes and previously I would not have thought it is in the set of possible outcomes.

If anything, it would make sense to make estimates of long-term earnings growth, since it is the latter that drives market cap over the long term and not the other way around. Personally, I believe that estimating such targets is a way to keep shareholder enthusiasm high while putting the main issues on the back burner. Yet, this is not the first time such statements have been made by Elon Musk:

I see a potential path for Tesla to be worth more than Apple and Saudi Aramco combined. So, now that doesn’t mean it will happen or that will be easy. In fact, I think it will be very difficult. It will require a lot of work, some very creative new products, manage expansion and always the luck. But for the first time, I see a way for Tesla to be roughly twice the value of Saudi Aramco. And I think I haven’t quite seen that yet. I mean, this is the first time I’ve seen that potential.

This statement belongs to Q3 2022, and from what you can see the pattern is always the same: shooting an almost impossible-to-achieve goal by declaring that it will not be easy, but he sees for the first time in Tesla the potential to achieve it. As far as I am concerned, it is absurd to believe this, and the reality of the facts is gradually coming to the surface. After all, the market is rational in the long run.

Conclusion

Tesla is a great company, no one doubts that. However, one must separate the company from its valuation. Since it has a market cap/free cash flow of 151x, I expect it to grow very rapidly, which has not happened for several quarters. This Q4 2023 has shown nothing new, in fact, the problems related to profit margins as well as earnings growth continue. Although the company is working on new projects, in my opinion, it will not be able to overcome Chinese competition, a key market for Tesla. Finally, the macroeconomic environment is unfavorable, and as much as I hold Elon Musk in high regard, I do not fully understand his statements about Tesla’s future. If I had invested in it, as a shareholder, I would have preferred more concreteness and less fairy tales about Tesla’s future market cap.

With multiples this high, you don’t even need a DCF model to show that this company is highly overvalued. As far as I am concerned, $100 per share is a possible Tesla, Inc. stock target.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.