Summary:

- I reiterate a “Strong Buy” rating for Tesla with a one-year target price of $305 per share, driven by market recovery and innovative battery technology.

- The Fed’s interest rate cut cycle is expected to boost EV market growth, aiding Tesla’s automotive business recovery in the second half of FY24.

- Tesla’s in-house 4680 battery, especially with dry cathode processing, could significantly enhance margins and drive future growth, starting with Cybertrucks next year.

- Despite restructuring challenges, Tesla’s energy and storage segment shows strong growth potential, contributing to an overall 25% revenue growth forecast from FY25 onwards.

Sven Piper

I assigned a “Strong Buy” rating to Tesla, Inc. (NASDAQ:TSLA) in my previous article published in July 2024, despite their near-term challenges with declining production/deliveries and the delay of the Robotaxi event. As the Fed has already entered into an interest-rate cut cycle, I forecast the electric vehicle (“EV”) market will resume rapid growth soon. Tesla’s in-house 4680 battery will be used on Cybertrucks next year, which could serve as a significant catalyst for Tesla’s margin improvement. I reiterate a “Strong Buy” rating with a one-year target price of $305 per share.

Market Recovery Is On the Way

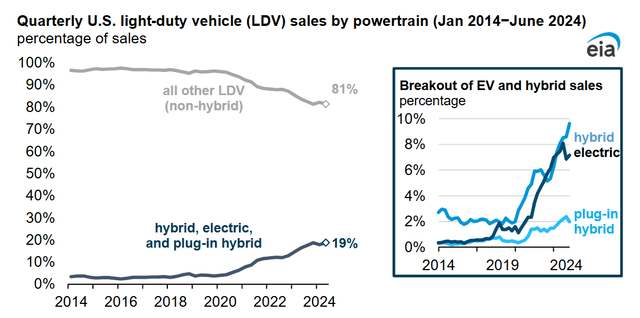

According to the U.S. Energy Information Administration (EIA), the share of electric and hybrid vehicle sales in the U.S. increased in Q2 2024 after a slight decline in Q1 2024m as illustrated in the chart below. EV and hybrid cars led the recovery in Q2, with Tesla accounting for nearly 49% of the total EV market.

U.S. Energy Information Administration

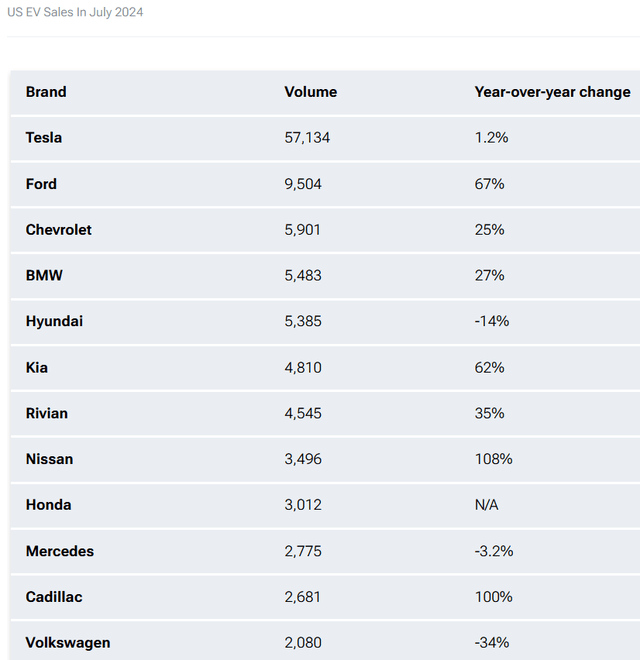

As reported by Carscoops, the total number of EV registrations in the U.S. market jumped to 118,273 this July, a significant increase from last year. Tesla maintained their market-leading position, with 1.2% year-over-year growth in July.

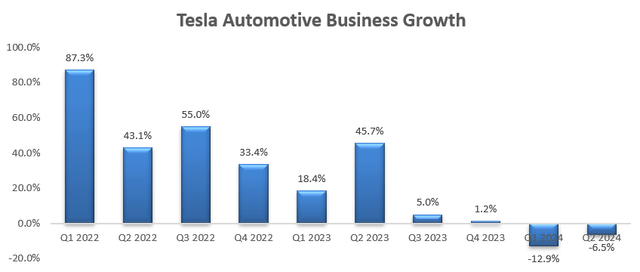

Based on industry data trends, it is evident that the EV market bottomed in Q1 FY24, began a recovery in Q2, and accelerated in July. The industry trend explains Tesla’s performance in the first half of FY24. As depicted in the chart below, Tesla’s automotive revenue declined by 12.9% in Q1, but the decline moderated to 6.5% in Q2.

With the Fed entering an interest rate cut cycle, I expect the automotive market to gradually recover, as U.S. consumers will likely have more cash flow for discretionary and large ticket spending. As such, I anticipate Tesla’s automotive business will recover to positive growth in the second half of FY24.

4680 Battery On Cybertrucks

As reported by the media, Tesla delivered 5,175 Cybertrucks this July, compared to a combined 5,546 registrations of all non-Tesla electric trucks, which includes the Ford Motor Company (F) F-150 Lightning, Rivian Automotive, Inc. (RIVN) R1T, Chevy Silverado EV, and Hummer EV. This indicates that the Cybertruck is gaining momentum, with strong demand ahead. As indicated over the Q2 earnings call, Tesla is still in the process of ramping up the production of both Cybertrucks and Model 3. Additionally, Tesla has already built their first validation Cybertruck using a dry cathode process on its mass production equipment. The management highlighted this as a major milestone for Cybertruck’s in-house battery technology and plans for a full production launch with dry cathode in Q4 this year. I think the dry cathode could be a considerable deal for Tesla for the following reasons:

- Tesla held a battery day event in 2020, arguing that the dry cathode could potentially reduce their battery costs by 50%. During the earnings call, the management disclosed that production of their dry cathode-based 4680 cells ramped up strongly in Q2, growing 51% compared to Q1. They currently produce more than 1,400 Cybertrucks 4680 cells per week and the ramp-up in cell production could significantly boost Tesla’s future gross margin.

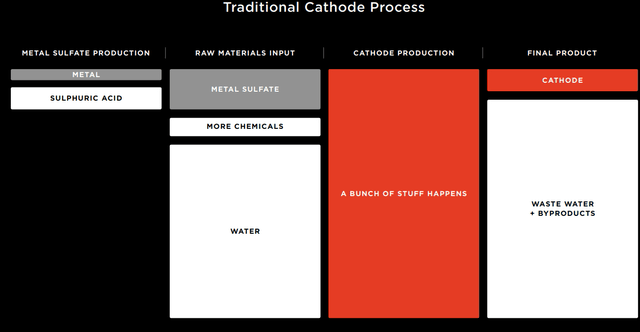

- According to Tesla, processing represents around 35% of total cathode manufacturing costs, and traditional processing produces substantial wastes and by-products. In contrast, Tesla’s dry cathode process only uses metal and water as inputs, producing less by-products and wastes, which improves the cell manufacturing efficiency and reduces costs.

Recent Result, Outlook & Valuation

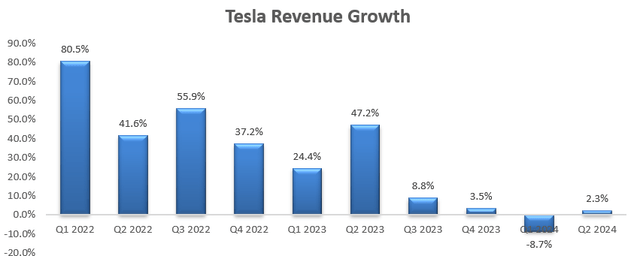

Tesla released its Q2 on July 23rd, reporting a 2.3% growth in revenue. As analyzed previously, Tesla’s automotive business showed early signs of demand recovery. Notably, the energy generation and storage business grew by 99.7% year-over-year, led by strong market demands for Megapack and Powerwall.

I forecast the EV market will begin to recover from Q3, as analyzed previously. Historically, an interest-rate cut cycle has been accompanied by rising demand for automotives. I estimate Tesla will deliver 2% revenue growth in FY24. For the normalized revenue growth from FY25 onwards, I am considering the following factors:

- Automotive: The EV market is still in the early stages, and massive market penetration could contribute to tremendous growth for Tesla. Precedence Research predicts that the EV market will grow at a CAGR of 23.42% from 2024 to 2033. I anticipate Tesla will grow their automotive business by 23%, aligned with the market growth.

- Energy & Storage: The segment only accounts for 6.2% of total revenue. Due to the energy transformation, I assume Tesla’s Megapack and Powerwall will continue rapid growth trajectories. I forecast the segment will grow by 50% annually.

- Services: I forecast Services will sustain the growth momentum, growing by 20% in the near term.

As such, I calculate Tesla will grow its revenue by 25% from FY25 onwards. As discussed, the dry cathode processing technology could potentially become a major catalyst for gross margin expansion. I model 90bps annual operating margin expansion, driven by 60bps from gross margin expansion due to in-house battery technology and business scales, and 30bps from operating leverage from R&D and SG&A.

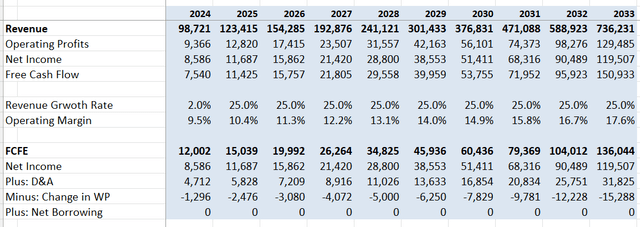

The DCF summary and free cash flow from equity (FCFE) can be found in the table below:

The cost of equity is calculated to be 16.8% assuming: a risk-free rate of 3.6%; beta 1.89; and equity risk premium of 7%.

Discounting all the future FCFE, the one-year target price is calculated to be $305 per share.

Key Risks

Tesla has been restructuring their operations and charged $622 million to their P&L during the quarter. Given that this is not the first time Tesla has undertaken such restructuring, I am not surprised by its ongoing efforts to optimize operations and improve productivity. As reported, Tesla eliminated 3,332 jobs in California, and 2,688 jobs in Texas. The total number of layoffs represented around 10% of the total workforce. It is quite reasonable to assume there could be some business disruption due to this reorganization.

End Note

In short, the 4680 battery with dry cathode processing technology is poised to be a significant development for Tesla next year. I believe the automotive market recovery is on the horizon. I reiterate a “Strong Buy” rating with a one-year target price of $305 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.