Summary:

- Tesla, Inc. faces several headwinds with no quick turnaround in sight.

- Growth and earnings estimates over the next several years have been revised lower which makes the stock’s premium valuation difficult to justify.

- We see room for more downside in Tesla stock price.

DNBSTOCK/iStock Editorial via Getty Images

Tesla, Inc. (NASDAQ:TSLA) has been full self-driving (“FSD”) in reverse, with the shares down 35% year-to-date near a ten-month low. The backdrop includes not only the last disappointing earnings report but otherwise terrible sentiment, compounded by a string of new Wall Street sell ratings.

We last covered TSLA in early 2023 with a bullish view, suggesting any weakness was a buying opportunity at the time. While there was some upside from that point, a lot has changed and that article is now underwater. We’re taking the opportunity to reassess our view with a more bearish tone and an expectation for more near-term downside.

While the electric vehicle (“EV”) maker is no stranger to volatility, what’s different here is that in contrast to prior corrections, there is a sense that this current weakness is based more on company-specific factors rather than just the macro environment. That’s concerning as it appears pillars of the long-running thesis for the stock have lost their shine with no quick turnaround in sight. We highlight 5 reasons TSLA will likely remain under pressure.

Seeking Alpha

1) Weak Margins and Disappointing Earnings

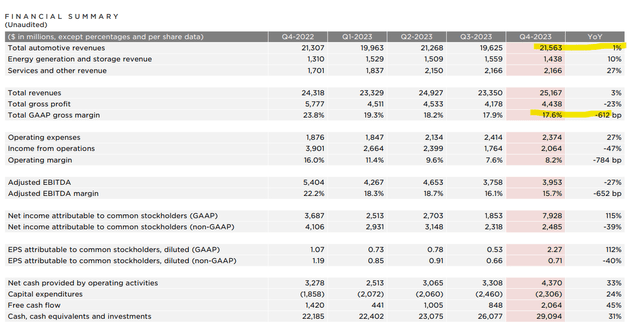

TSLA ended 2024 on a down note reporting Q4 EPS of $0.71, missing expectations by $0.03, and down from $1.19 in Q4 2022. Revenue of $25.2 billion climbed just 3.5% y/y, notably $590 million below estimates.

Even as total deliveries across all models climbed by 20% from Q4 2022, total auto revenue was up just 1% based on lower pricing. This trend was only partially balanced by stronger momentum from the smaller energy and services segments.

The gross profit margin of 17.6% fell from 23.8% in the period last year, reflecting Model 3 and Model Y aggressive price cuts in certain regions as an effort to balance what has been weaker demand as an industry trend globally. 2023 free cash flow of $4.4 billion was down compared to $7.6 billion in 2022.

In terms of guidance, the comment that stood out from the press release was an outlook for vehicle volume growth potentially “notably lower” than the 35% rate achieved in 2023. Beyond limited CyberTruck production, the effort is to launch a next-generation vehicle at the Texas Gigafactory facility to support a new wave of growth into 2025 and beyond.

By Tesla’s admission, there’s not much to get excited about in 2024 as something of a transitional year, and that’s a big reason shares have sold off.

2) Complete Reset of Growth Expectations

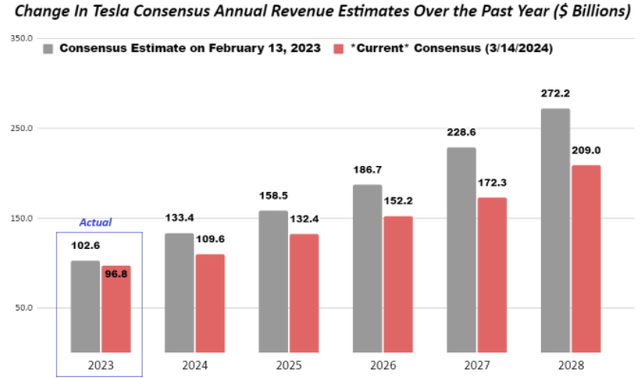

More importantly, we’re eyeing what has been a major reset of growth and earnings expectations even beyond 2024. Going back to our last TSLA article, we featured a screenshot of Tesla revenue and EPS forecasts from February 2023 and made a comparison here to the current consensus estimates.

For 2024, the market expects sales to reach $109.6 billion, representing a 13% annual increase, but well below the $133.4 billion the market was looking for previously. The path for Tesla sales through 2028 has been deeply discounted from a 22% average annual growth rate as the baseline of estimates early last year to a current level closer to 16%.

The figures here are significant. For 2027 as a reference point, the market now sees revenues of $172 billion, $57 billion less compared to $229 billion as the prior estimate. The interpretation here is that the timetable for global penetration of the EV market is being pushed farther out.

Seeking Alpha (chart by author)

Even including the expected launch of the next-generation vehicle, ramp up in CyberTruck deliveries, the New Tesla Roadster, Model 3/X/Y refreshes, and advancements in self-driving capabilities; the difference here over the next several years translates into an outlook for millions of fewer cars being produced and delivered. The layer of uncertainty comes down to the actual average pricing and the potential margins.

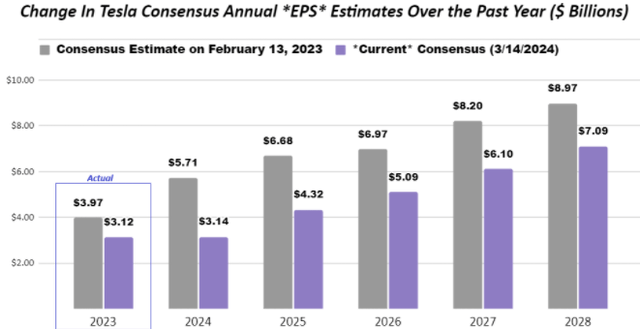

That dynamic is also observed in the EPS estimates that have been revised sharply lower through the next five years. For 2024, the market expects TSLA to reach an EPS of $3.14, flat from 2023. This estimate is well below the $5.71 consensus early last year that helped the stock rally as high as $300.

For context, the market now only expects TSLA to approach that same $5.71 EPS level in 2027. By our calculation, the $10.79 difference in EPS forecast through 2028 implies the company is set to earn approximately $38 billion in less profits than what had been expected around this time last year.

Seeking Alpha (chart by author)

3) Auto Market Weakness

To be clear, the headwinds on the demand side facing Tesla today are not unique in what remains a very challenging environment for all car makers. The research group S&P Global Mobility is forecasting a modest 3% increase in global auto sales for 2024 with a theme being normalizing pricing and higher dealer inventory levels balanced by the impact of high interest rates.

While pricing, inventory, and incentive trends are seemingly moving in the correct directions, respectively, to promote new vehicle sales growth, high-interest rates, and uncertain economic conditions continue to push against any consistent upshift for demand levels.

One way to think of this is that the market share gains Tesla captured in recent years have slowed. The latest developments considering the new round of economic data are renewed uncertainty on how soon those auto loan costs will come down. Tesla would not be immune to a determination of the broader macro environment that would further hit automobile demand.

The headlines surrounding electric vehicles, particularly in the United States, haven’t helped. Signs of slowing demand and others have forced other automakers to push back on their planned transition from ICEs. Industry forecasts that EVs including battery-electric and plug-in hybrid adoption would reach 30% penetration by 2030, from around 9% this year, are being questioned as likely too optimistic.

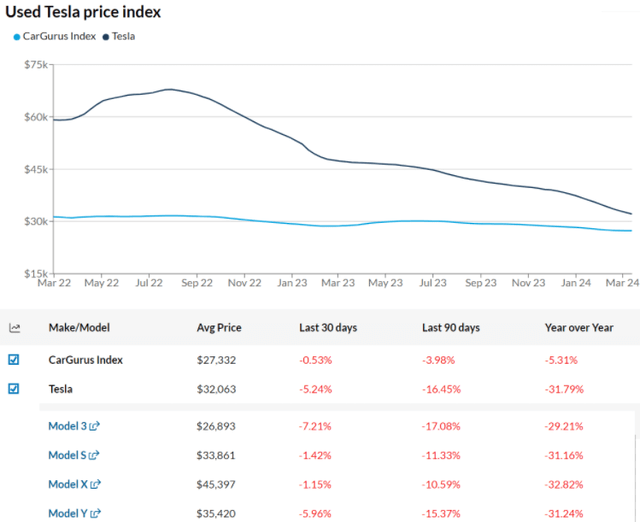

We can also bring up the implications of a weak used car market that becomes a more and more compelling alternative to new vehicles. As a consequence of Tesla price cuts, the make has seen its average used price fall by -32% over the past year, well beyond the -5% decline in the CarGurus Used Price Index.

One line of thought that hasn’t received much attention is the possibility of disgruntled buyers, who have seen the value of their vehicles collapse, going against a previously held notion that Tesla’s hold up in value.

It’s possible this trend could translate into a decline in “brand loyalty” going forward, from where Tesla has traditionally earned high marks while pushing potential buyers to consider other EV options. All this plays into the stock price sentiment and weakness in shares we are seeing now.

4) Harder to Justify Premium Valuation Spread

The story with Tesla for much of the past decade was that the company’s potential was only constrained by how fast it could produce new vehicles. The current outlook suggests that line of thinking has its limits, and has been the biggest reckoning for us in reversing our opinion of the stock.

The core bearish case for TSLA when the stock hit $400 in 2021 was that its growth potential was overestimated. Bears from that time have been proven right, with the same idea potentially still true today.

Simply put, even if the company could magically double its 2023 vehicle production from 1.85 million units to 4 million globally by next year, we’re skeptical the market would be there to absorb that supply which is a scenario unthinkable two or three years ago.

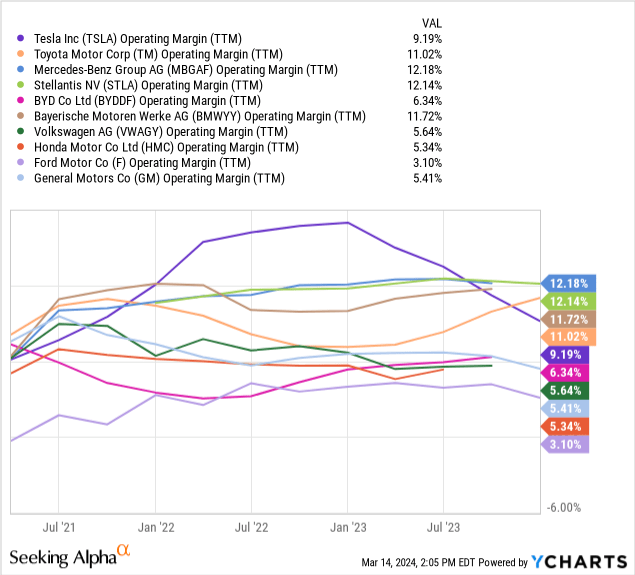

Ultimately, we see margins structurally narrowing against what has become a more and more competitive EV market. What’s missing is the pricing power which has disappeared and may not return.

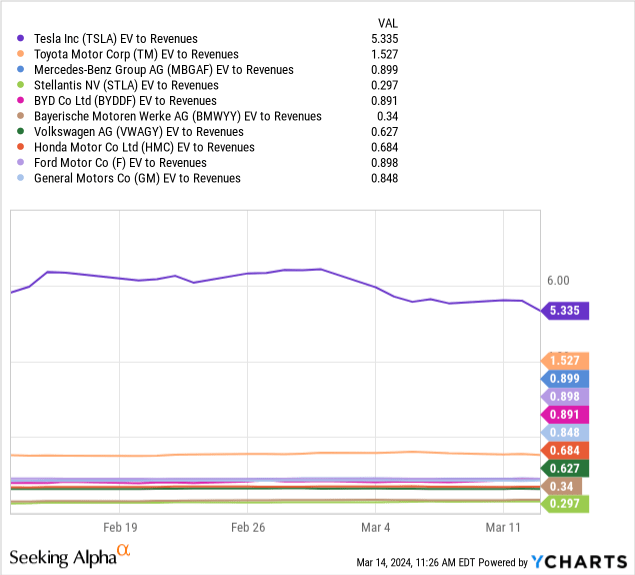

It becomes harder and harder to justify Tesla’s premium valuation. With an EV-to-sales multiple of 5x, this level is well above the average for global automakers closer to 1x.

We’ll give Tesla the benefit of the doubt and note its diversification into services as well as the charging network opportunities, but the funnel starts with vehicle deliveries as the stress point. The case here is for the valuation spread to at least move in the direction of a name like Toyota Motor Corp (TM) at 1.5x.

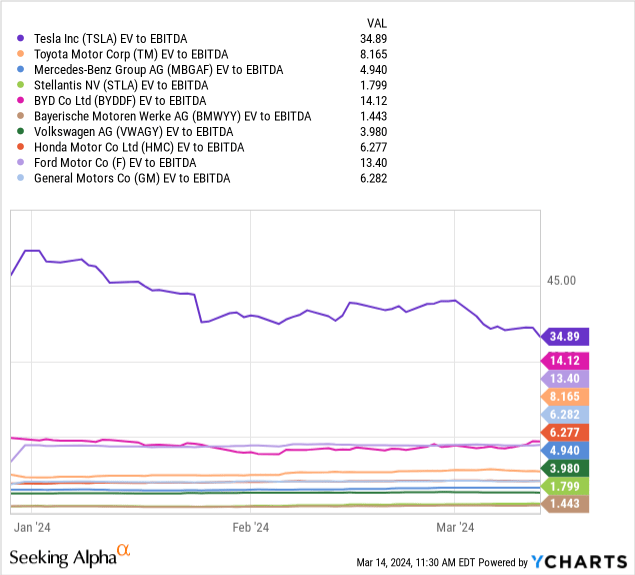

From an earnings perspective, TSLA trading at 35x EV to EBITDA is more than double the level of Ford Motor Co Ltd (F) or even China’s high-growth BYD Co. Ltd. (OTCPK:BYDDF), both closer to 14x.

The potential that Tesla’s valuation premium just “splits the middle” and coverages halfway lower is where we start getting into scenarios where the stock could sell off toward the early 2023 low when it traded at $102 per share.

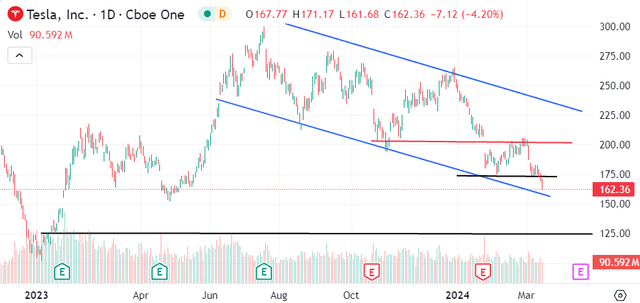

5) A Terrible Technical Picture

TSLA has made a series of lower highs and new lows in a long-running downtrend since Q3 last year. The break below $200 coinciding with the last earnings report appears to have shifted the trading action defined by more bearish sentiment. We don’t see that changing anytime soon.

By this measure, $200 now represents an important area of technical resistance that will be difficult for TSLA to reclaim without a significant new development. The next catalyst could be the Q1 production figures and deliveries update expected in early April, although we doubt a marginally better-than-expected data point would be enough to sustain a major rally.

As is, we expect the stock to see more downside, with $150 and $125 being the next areas of support.

Final Thoughts

Putting it all together, Tesla, Inc. as an investment idea looks a lot different today than where it stood 5 or 10 years ago. Revenue growth has slowed to an unacceptable level, and the argument we make is that the earnings outlook today is materially weaker than at any time since the pandemic. The message we have is that the 2023 lows for the stock are back on the table as a downside target.

We rate shares as a sell, with an expectation that the macro setup continues to represent a challenge for Tesla’s expansion efforts. The risk here is that the economic outlook deteriorates, and Tesla would not be immune to a broader market selloff.

Into the Q1 earnings report, expected on April 19th, the market will want to see signs vehicle margins are stabilizing and the pace of deliveries re-accelerating. Just meeting the consensus estimates may not be good enough.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.