Summary:

- Tesla, Inc.’s financial performance has significantly deteriorated compared to a few years ago due to increased competition, EV sales failing to live up to hype etc.

- Tesla’s stock price was declining in April 2024 before its FSD deal in China, which is unlikely to provide much help to its long-term valuations.

- Moreover, Tesla’s downsizing of its supercharger business implies every automaker will increasingly be out for itself and rely as little as possible on common infrastructure.

- Tesla valuations may be negatively impacted as it becomes increasingly viewed as just another auto company rather than a broad EV platform, e.g., providing superchargers and autonomous driving technology.

Justin Paget

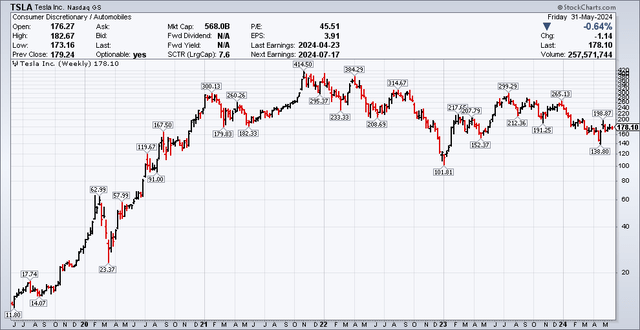

Tesla, Inc. (NASDAQ:TSLA) stock has declined from a peak of $414/share in late 2021 to $179 as of May 26, 2024. Tesla’s stock was down to $138 before bouncing back after Elon Musk’s surprise China visit. Is this the start of an upward move or a dead cat bounce? I think it may be time to sell now.

TSLA stock price (stockcharts.com)

This article consists of 3 parts:

Part 1 discusses the deterioration in Tesla’s financial performance amidst significant long-term challenges

Part 2 discusses the recent FSD and Robotaxi announcements by Tesla in the context of the challenges it faces.

And Part 3 discusses the recent news around Superchargers, which I believe overshadows any positivity from the FSD announcement, as they mark the start of Tesla becoming just another auto company and becoming priced like one as well.

Part 1: Significant long-term challenges for Tesla as competition catches up

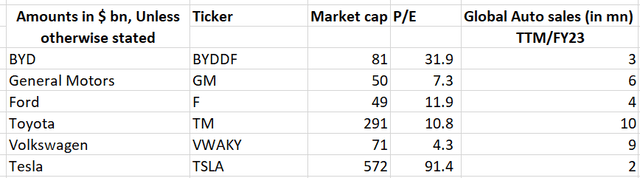

Though Tesla’s stock price has fallen over half from its peak in 2021, Tesla’s market cap of $572 billion is still significantly higher than any other major auto company. While I would hesitate to use the word “overvalued” given all the impressive results that Tesla has achieved, I would posit that Tesla is facing significant long-term challenges.

Automaker comparison (Seeking Alpha, online sources)

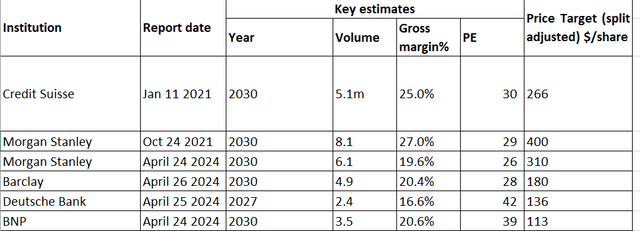

By comparing and contrasting analyst opinions on Tesla in 2021 and present day April 2024, it is quite evident what type of expectations Tesla’s stock price was baking in (many of which are being reappraised now):

Tesla research report comparisons (Online)

Note:

(i) This adjusts for the 3:1 split announced on August 25, 2022, by dividing by 3 any per share amounts, including price targets before 2022. In other words, if you look at the original price targets in the research reports, they were 3 times that of the amount shown in the above table.

(ii) “Base case” projections underlying their price target in each analyst report are shown, given that many show a wide range of scenarios.

Three common narratives stand out in these research reports, and expectations in these three areas are all being ratcheted down:

1. Expectations of huge volume growth in vehicle sales:

In 2021, analysts were expecting significant growth in Tesla vehicles sales by 2030. In 2024, these have been massively reduced (e.g., Morgan Stanley now expects 6.1 million by 2030 compared to previously 8.1 million, while a more pessimistic forecast from BNP expects only 3.5 million in 2030 which is less than double that of 2023 volumes), as electric vehicle (EV) market segment performed much worse than expected and competition increased.

Tesla’s own publications previously stated a goal of selling 20 million vehicles a year by 2030 (which has recently been removed).

2. Sustained higher profitability from “cost advantage”:

In 2021, analysts were extrapolating off Tesla’s lead in profitability into perpetuity.

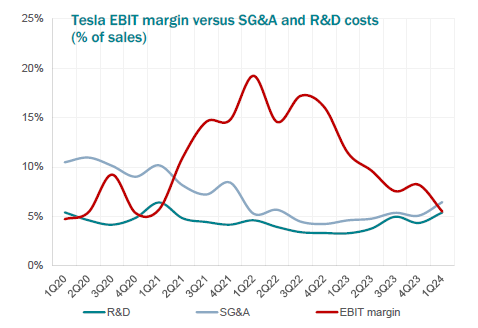

In 2024, this much vaunted cost advantage turned out to be transitory. EBIT Margins are way lower than in 2021 and 2022 from a peak of 20% to just 5%.

Tesla EBIT margins (BNP research report on Apr 24 2024)

It is increasingly evident that the assumption Tesla would forever massively lead determined competitors that were pouring hundreds of billions of dollars into electric vehicles is not reflective of actual industry dynamics. BYD (and a dozen other Chinese companies) can figure out how to make EVs competitively, and so can BMW and Ford and Toyota and other major automakers. Tesla may have had a significant lead over the competition in 2021, but by 2024 this has evaporated and even if there are still any significant leads, it is not showing up in the financials.

To delve a bit deeper on why superb profitability for Tesla is probably not realistic, we can take a step back and consider the significance of the auto industry. The auto industry is not just about making cars, it is a key to industrial competitiveness and other considerations:

- Without a strong auto industry, a country would lose important industrial capacity and know-how. For example, while the auto industry is only 5% of German GDP, this probably understates its economic significance. German industrial associations estimate 24% of German total manufacturing value add is generated by the auto industry. So the auto industry is about more than just profits: whether Ford or Volkswagen or Toyota make a few billion dollars a year or not (though obviously, it’s preferable they can stand on their own feet) is only one piece of the puzzle.

- For China, EVs have the additional strategic impact of reducing oil imports (which China imports around $300 billion annually) so the standalone profit/loss of the EV industry is only part of the holistic consideration.

Since the auto industry has strategic value far beyond making a few billion dollars in profits, nations encourage capacity, which increases supply and reduces profitability compared to industries such as fast food or soft drinks where there is no such additional impetus to add capacity.

3. Potential monetization of other income streams:

Research reports such as Credit Suisse’s report published on Jan 11 2021, just assumed Tesla would achieve significant revenues from other income streams, such as software, energy storage, insurance, Robotaxi, supercharging etc. Credit Suisse justified a 30X P/E multiple on 2030 profits based on assuming these revenues would kick in, which is mind-boggling if you think about it: 2030 profits already project rapid growth in volumes, persistently high profitability and then a 30X multiple is placed on it assuming all other revenue streams are monetized. By 2024, these potential income streams are being viewed through a more critical lens. See parts 2 and 3 for my thoughts on this.

Part 2: Does Tesla’s recent moves in FSD or Robotaxi change the picture? No.

Not only is Tesla’s core electric vehicle business deteriorating financially, the new stories that Musk touts are probably not game-changing and just buy Tesla more time:

FSD: Tesla’s autonomous driving (“FSD,” for full self-driving) faces much competition, as argued in this Bloomberg article. While the terms of Tesla’s cooperation in China with Baidu are unclear, it does not bode well for Tesla’s competitive position: either it needs to collaborate with Baidu on technology, or it’s sharing some of the tech with Baidu to obtain the approval to operate in China. With competition, it seems quite possible to me that FSD will eventually just be another basic feature in cars that is not necessarily monetizable, as an example, despite all the new features in cars in the past two or three decades, the stock price of Ford (F) has gone nowhere.

Robotaxis: Musk announced that a Robotaxi will be unveiled starting August 8, 2024. If cars don’t make money and FSD is in a sea of competition, how much money is putting the two together going to generate? Let’s say Tesla’s Robotaxis completely takes over from Uber, which has a market cap of $134 billion, and that completely becomes part of Tesla’s long-term value. That’s still only 23% of Tesla’s $572 billion market.

As an additional point, Tesla investors face uncertainty about which new products will be built within Tesla. Per Bloomberg, in January 2024, to lean on the board to give him stock awards, Elon Musk stated that unless he had 25% voting control at Tesla, he’d rather build AI and robotic products elsewhere. Tesla shareholders are recently urged by a major proxy advisory firm to reject the proposed $56 billion pay package that will be up for voting on June 13, 2024.

Part 3: Free for all – Each Automaker for Itself as Tesla downsizes Supercharger business

Tesla’s recent move to downsize its Supercharger business, though understandable from a business perspective as it conserves cashflows, may further worsen its position. In my opinion, Tesla’s market cap contained a key assumption: Tesla would benefit from overall sector growth because it could earn from laying down infrastructure such as Superchargers or FSD for the entire industry and collect “rent” when others caught up. Tesla convinced competitors to embrace its plugs as an industry standard.

But Tesla shattered such confidence when it abruptly massively downsized its Supercharger team, though more recent news reports suggest Tesla is rehiring the Supercharger team, the damage has probably been done, and I would surmise other automakers are taking this lesson to heart, to not rely on Tesla for key infrastructure. Not for superchargers, not for energy storage, and likely not for autonomous driving software. Each automaker will increasingly strive towards self-reliance (or relying on a non-automaker third party to provide services, such as Waymo) and reduce reliance on Tesla.

This means Tesla’s revenue potential will be less based on the overall EV market and more based on the cars it can sell and service in an increasingly crowded playing field. And if Tesla is just another auto company, I believe it will probably be eventually priced like one (i.e., $50-100bn market cap that other auto companies are fetching, plus a premium for Musk’s innovative track record, but definitely not worth $572bn).

Risks to bearish thesis:

1. I am not advocating shorting Tesla, but it may be time to trim holdings on the long side, especially for funds with low-risk tolerance (e.g. retirement savings).

2. Elon Musk has trounced skeptics many times, and perhaps he could make Robotaxis, FSD etc. work and sustain or grow Tesla’s market cap, at least in the short run.

3. The market dynamics of EVs may improve as many auto companies cut or delay EV projects and reduce supply. However, I think eventually, Tesla’s margins are probably unlikely to be consistently higher than competitors to the point that justifies a market cap that is 5-10X larger.

Conclusion:

I think Tesla is a sell because:

Tesla’s profitability has suffered in the past few years and key assumptions that were used to justify its high market cap during its heydays are falling apart, namely (i) high vehicle sales growth, (ii) sustained high profitability and (iii) new products and services. Its financial results are unlikely to ever recover to any level that justify its current market cap, as major nations worldwide maintain excess capacity in autos for strategic reasons beyond the profit motive.

FSD and Robotaxi are unlikely to save Tesla’s market cap. In addition, the confusion over its Supercharger business with the downsizing and rehiring will make Tesla untrusted by other auto companies, which will reduce their reliance on Tesla infrastructure such as charging etc. and push towards internal solutions or an external third-party vendor (e.g., Waymo).

Tesla likely will not be able to collect “rents” from the EV industry in general but will eventually become just another automaker and should be priced like one (i.e., market cap of $50-100bn).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.