Summary:

- Q3 wasn’t the best quarter for Tesla, Inc. — lower ASP and margin compression did not translate to strong growth.

- Tesla just held its Cybertruck delivery event — the base model turned out to be priced 50% higher than initially promised.

- Given Cybertruck’s complexity, Tesla’s production targets seem overambitious as well.

- In addition, high-interest rates are inflicting more damage than anticipated.

- As such, demand for the Cybertruck may not be as strong as anticipated.

Roman Tiraspolsky

Introduction

Tesla, Inc. (NASDAQ:TSLA) reported lackluster Q3 earnings over a month ago, which is why the stock dropped nearly 10% the following day.

A couple of weeks ago, Tesla also delivered its first Cybertruck — but the Cybertruck event was underwhelming, to say the least.

After looking through the company’s Q3 results and initial Cybertruck numbers, I can’t help but notice a few problems that Tesla followers might want to know.

Look, I think the Cybertruck is a revolutionary piece of invention — its design, utility, and specs are just out of this world.

But I think investors need a sanity check — the numbers just don’t add up.

Combine that with premium valuation and a weak near-term outlook, Tesla shares may not move much from here.

Growth

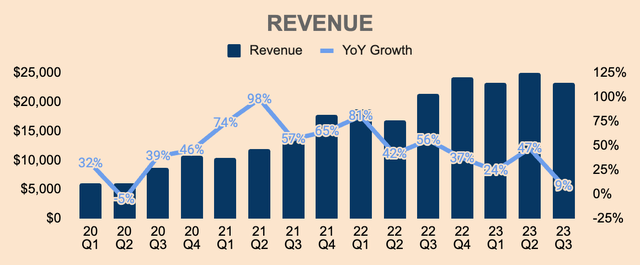

Q3 Revenue was $23.4B, up only 9% YoY. This missed analyst estimates by $790M.

What’s rather concerning is that growth decelerated meaningfully from 47% in Q2. In addition, this marks the first time in 3 years where quarterly growth dropped to single digits.

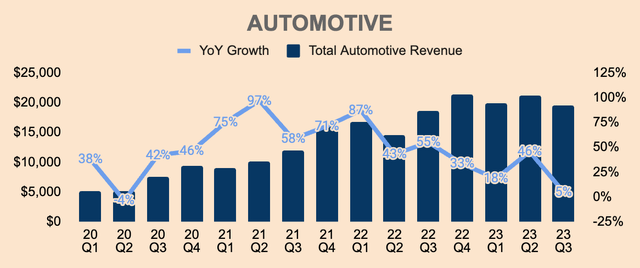

Breaking it down by segment, Tesla’s Automotive segment grew slower than the overall company, up only 5% YoY to $19.6B.

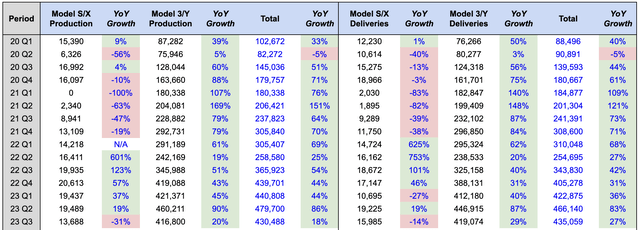

Regardless, the slight growth in Automotive Revenue in Q3 was due to a 29% YoY increase in Model 3/Y deliveries, partially offset by a 14% YoY decline in Model S/X deliveries. As you can see, even despite lower average selling prices (ASP), deliveries for both Tesla’s low-cost and luxury lines slowed down significantly, largely driven by high interest rates.

Nevertheless, Tesla delivered a total of 435K vehicles in Q3, up 27% YoY.

It’s also important to note that Q3 production slowed down as well — much more than deliveries — due to temporary shutdowns for factory upgrades.

Overall, Tesla produced a total of 430K vehicles, which is up 18% YoY.

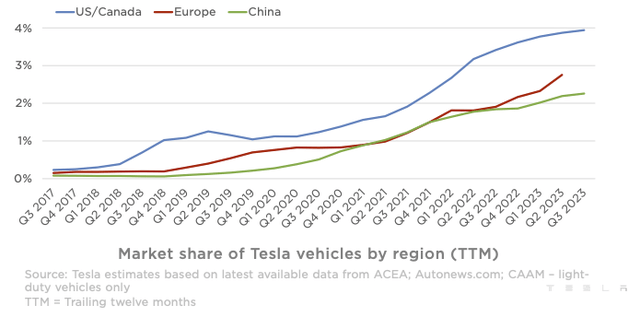

Despite the slowdown, that didn’t stop Tesla from expanding its market share. This reflects the price-cutting strategy that management initiated a few quarters ago.

As you can see, Tesla’s market share continued to improve sequentially across all regions, which is a testament to the company’s superior EV offering and value.

However, we might see that narrative change — particularly in China — as Tesla’s China-made EV sales slid 18% YoY in November while rival BYD Company (OTCPK:BYDDF) increased deliveries by 31% YoY. As such, we can expect Tesla’s China market share to be flat or dip slightly in Q4.

Tesla FY2023 Q3 Investor Update

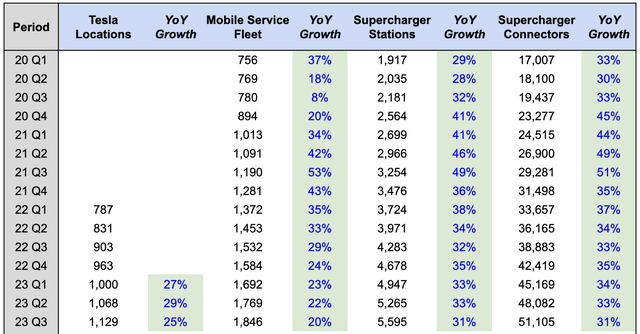

In other news, Tesla’s EV network continues to grow rapidly, with Tesla Locations, Mobile Service Fleet, Supercharger Stations, and Supercharger Connectors showing robust growth YoY. As the global fleet expands, more customers will utilize these ancillary services.

As such, Tesla’s Services and Other Revenue outgrew the company, increasing by 32% YoY to $2.2B.

Despite the strong growth, we may see this segment accelerate in future quarters as Tesla has signed deals with multiple car manufacturers including Ford (F), General Motors (GM), and Mercedes (OTCPK:MBGYY), for access to Tesla’s Supercharger network. Just recently, Tesla worked a deal with Toyota (TM) and Subaru (OTCPK:FUJHY) as well. These deals are expected to go live as early as the first half of 2024.

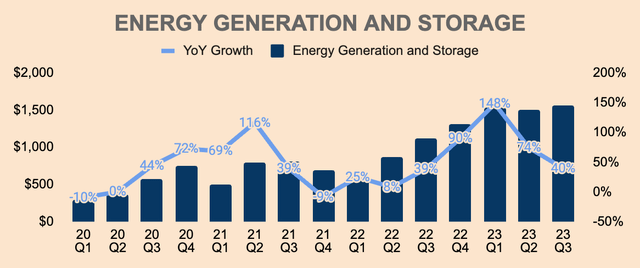

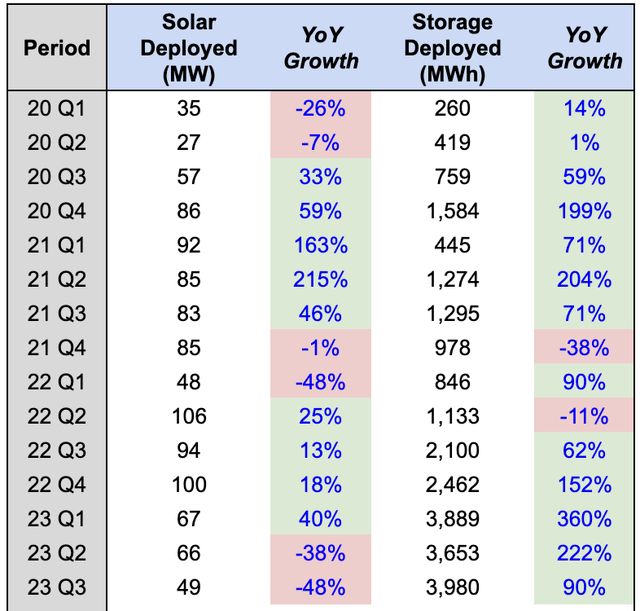

Moving on, Q3 Energy Generation and Storage Revenue was nearly $1.6B, up 40% YoY, mainly driven by surging Megapack deployments.

As you can see, Q3 storage deployed increased 90% YoY, to almost 4.0 GWh, Tesla’s highest quarterly deployment ever.

In contrast, Q3 solar deployed dropped 48% YoY to 49MW. Similar to what we’ve seen with solar companies like Enphase (ENPH), elevated interest rates and the California NEM 3.0 transition are causing an inventory glut in the solar industry, thus leading to plummeting solar demand nationwide.

That being said, homeowners and solar installers are adjusting to this high-interest rate environment, and therefore, demand should pick up again eventually, especially when the Fed begins cutting interest rates next year.

Nevertheless, Tesla Energy continues to be the most promising segment for the company, in my view.

All in all, despite the slowing growth numbers, Tesla’s growth story remains intact as the company accelerates the world’s transition to sustainable energy.

Tesla is at the forefront of multiple megatrends and remains the undisputed leader in the EV space.

The auto and solar industry is cyclical, and given that the Fed hiked interest rates to levels only seen during the Great Financial Crisis, it’s no surprise that demand for high-ticket products such as cars and solar equipment dried up.

However, it seems that we’re at the bottom of the rate cycle as inflation cools and the Fed stops hiking interest rates. As the macro situation continues to improve, the Fed should begin cutting rates, catalyzing a surge in demand and a return to strong growth.

But in the meantime, endure the pain.

Profitability

The great debate around Tesla relates to its profitability and whether it is sustainable in the long run.

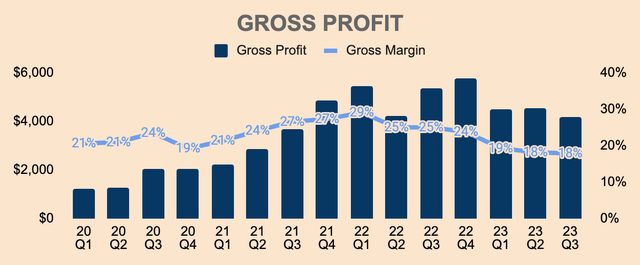

In Q3, Gross Profit was $4.2B, down 22% YoY, representing an 18% Gross Margin.

As of recently, Gross Margin has been on a decline which worried many investors. It’s reasonable for Tesla to lower ASP and sacrifice margins in return for upsized growth, but in Q3, Tesla sacrificed 600 basis points of Gross Margin just to grow 9% YoY.

Not a good look at all.

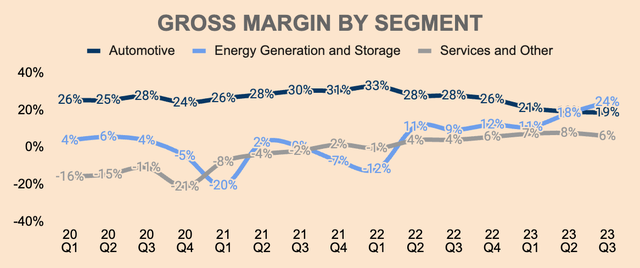

If we look at Gross Margins by segment, we can see that:

- The star of the show is the Energy Generation and Storage segment, with Gross Margin expanding 1,500 basis points YoY and 600 basis points QoQ, to 24% in Q3, driven by increased sales of high-margin Megapack. For the first time ever, Tesla Energy has the highest Gross Margin profile within the company.

- Similarly, Services and Other Gross Margin has been improving as the segment achieves economies of scale through a larger Tesla fleet.

- On the other hand, the Automotive segment is the main culprit for the overall margin decline, with a Gross Margin of 19%, down from its peak of 33%. Of course, this is mainly due to lower ASP.

That said, it’s great to see that profitability in the first two segments is improving, which helps balance the declining Automotive Gross Margin.

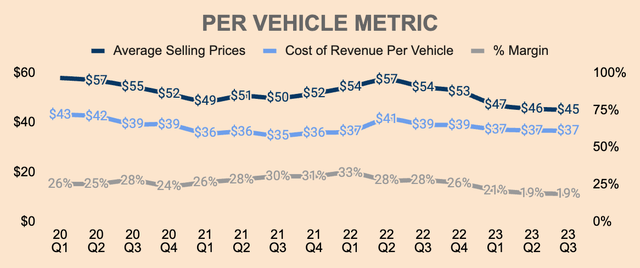

As you can see below, ASP has dropped roughly $12K from about $57K in Q2 last year, to just $45K in Q3 this year.

On the bright side, Tesla’s Cost of Revenue per vehicle continues to drop QoQ. This is despite macro headwinds, factory shutdowns, and ongoing ramp at new factories. Thus, Cost of Revenue per vehicle can drop even more once everything stabilizes, which should be reflected in future quarters.

That said, ASP is declining at a much faster pace, thus the worsening Automotive Gross Margins.

Granted, Tesla is sacrificing margins today to gain as much market share as possible, allowing the company to one day collect high-margin Revenue through features like Full Self Driving.

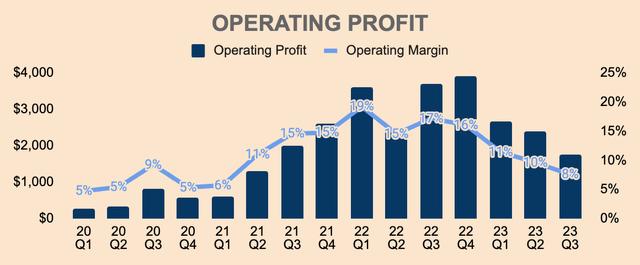

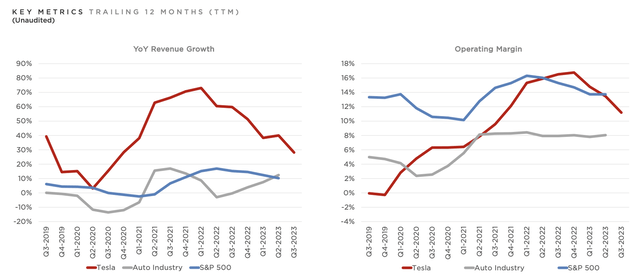

Moving down the income statement, Operating Profit is getting worse as well, which was $1.8B in Q3. This represents an Operating Margin of 8%, which has been shrinking over the last few quarters, due to 1) lower ASP, 2) higher expenses driven to fund projects like Cybertruck and AI, as well as 3) temporary factory inefficiencies.

Without question, Tesla is investing heavily for growth, and that’s why margins are under pressure.

Even so, Tesla’s Operating Margin remains higher than the auto industry, reflecting cost advantages moats. However, that moat may be at risk as Tesla’s Operating Margin continues to dwindle.

Tesla FY2023 Q3 Investor Update

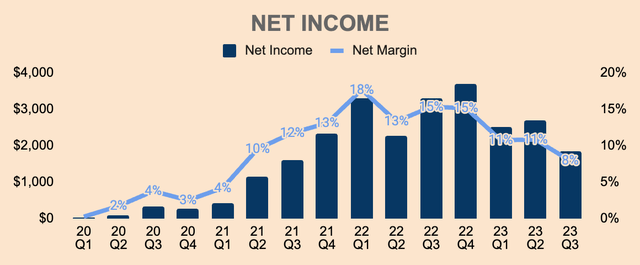

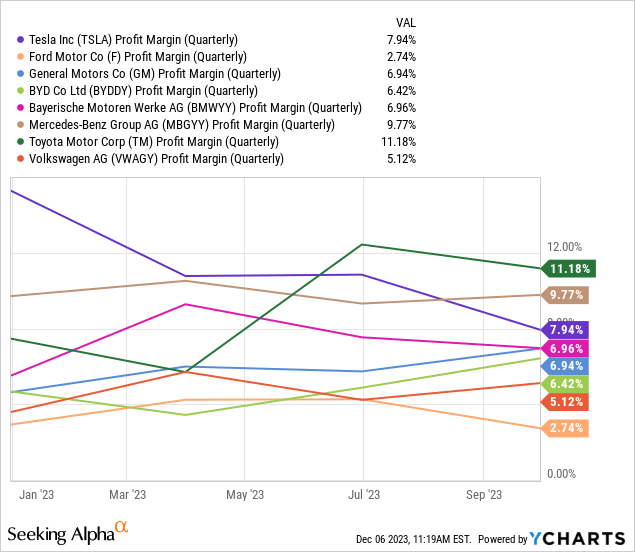

Finally, Q3 Net Income was $1.9B, which represents a Net Income Margin of 8%.

Tesla’s Net Margin used to be a key differentiator for the company. However, it has fallen to a point where Tesla is now blending with the rest of the industry.

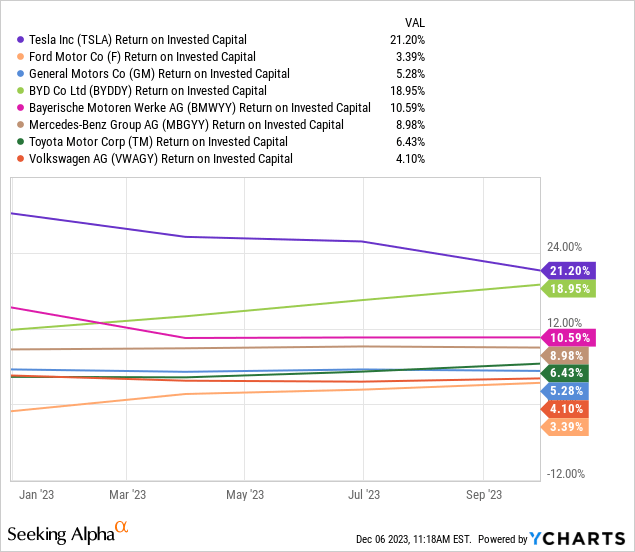

However, what sets Tesla apart from competitors is its superior ROIC, beating all other major mass car producers. This makes Tesla the most capital-efficient automaker today, which should reward shareholders in the long run.

At the same time, Tesla is growing faster than most, if not, all major competitors, which should supercharge shareholder returns.

All in all, Tesla is sacrificing short-term profitability for long-term growth and value creation. The problem is that Tesla is not growing as fast as it should or has been, even factoring in the recent price cuts.

Fortunately, those price cuts drove market share gains for Tesla, which is management’s top-most priority.

With more Tesla cars in the hands of customers, Tesla can unlock massive value when it fully rolls out FSD, which is going to generate high-margin Revenue at little to no distribution costs, thus boosting Tesla’s margins and earnings potential.

Furthermore, Tesla will be ramping up Cybertruck production in the coming quarters and the company is investing heavily in AI — once these projects scale, Tesla’s margin headwinds should ease.

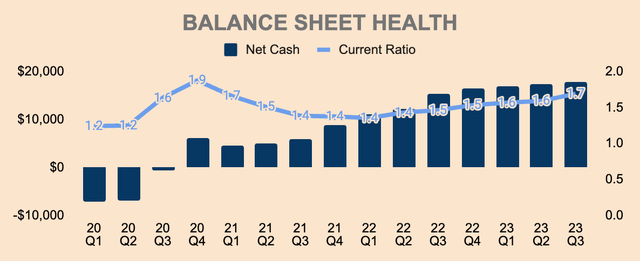

Health

Tesla grew its Cash position by $3.0B sequentially to $26.1B as of Q3, driven by financing activities of $2.3B. Total Debt stands at $8.2B, which puts its Net Cash position at $17.9B as of Q3. As you can see, despite the challenging macro environment, Tesla’s Net Cash position continued to build up over the last few quarters, solidifying its financial position.

Tesla’s low debt position is one of the company’s main advantages over competitors, especially since most major car producers have very high Net Debt balances, which limits their growth potential. For reference, Ford, Toyota, and Mercedes have Net Debt balances of $114B, $147B, and $95B, respectively.

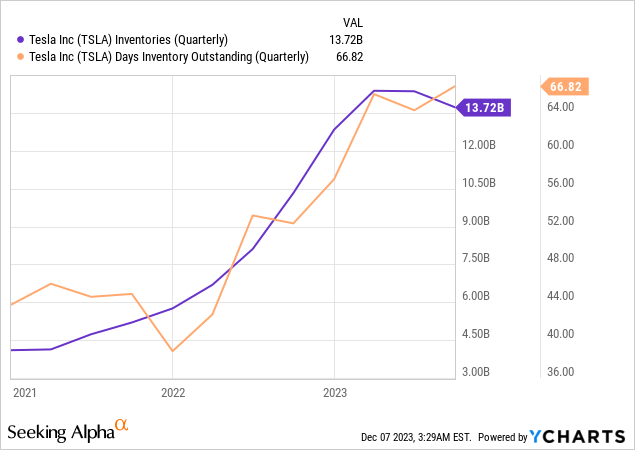

In other news, Inventory took a slight dip in Q3, likely due to the temporary factory shutdowns. But notice that inventory has been building up over the last few years. That’s common as a company scales, but notice that Days Inventory Outstanding has been on the rise as well, which means that it’s taking longer for Tesla to sell its cars.

Perhaps, that is why Tesla is lowering its ASP.

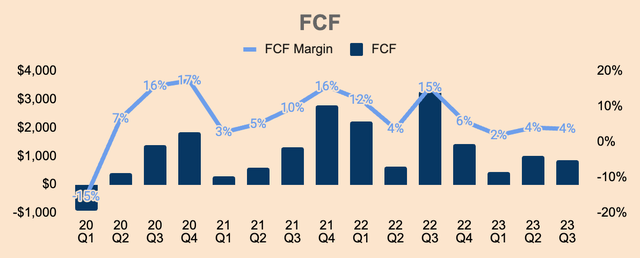

Moving on, Q3 Free Cash Flow was $0.8B, which is a 4% FCF Margin. Similar to profit margins, Tesla’s FCF Margin has been struggling lately. That’s understandable considering management’s focus on growth, as seen in its high OpEx and CapEx lines.

That said, Tesla has a highly capital-efficient business model with low debt, positive Net Cash, and positive FCF, which gives the company a strong financial advantage over competitors — both in good and bad times.

Outlook

For 2023, management expects to remain ahead of the long-term 50% CAGR target with around 1.8 million vehicles produced for the year. Given Tesla’s decelerating growth and larger base, I’m not sure how Tesla is going to maintain a 50% CAGR in the foreseeable future.

That aside, Tesla produced around 1,351K vehicles in the first three quarters of 2023, which leaves around 449K more vehicles that need to be produced in Q4, for the company to reach its 2023 target.

Assuming 449K vehicles delivered at an ASP of $45K, Tesla should generate around $20.2B of Automotive Revenue in Q4. That is a 2% decrease YoY.

Given the high interest rate environment, we could see Tesla’s Total Revenue remain flat YoY in Q4 — or worse, drop to negative territory for the first time in over three years.

If that happens, a selloff is likely.

Whatever it is, Tesla still has a long growth runway due to several secular trends such as EVs, solar, and energy storage, to name a few.

Furthermore, the company is investing heavily in several exciting projects that could expand Tesla’s total addressable market. This includes Dojo in the chips industry, Optimus in the robotics industry, and FSD in the autonomous driving industry — all of which could unlock monumental value for Tesla shareholders.

In addition, Tesla has yet to scale the Cybertruck and the Tesla Semi, as well as launch its Next Gen Platform and the Roadster — these new vehicles should boost growth in the long run.

But given its recent event, I want to specifically zoom in on the Cybertruck.

During the earnings call, Elon Musk gave an update on the Cybertruck (emphasis added):

So, I just want to temper expectations for Cybertruck. It’s a great product, but financially it will take, I don’t know, a year to 18 months before it is a significant positive cash flow contributor. I wish there was some way for that to be different, but that’s my best guess. The demand is off the charts. We have over 1 million people who’ve reserved the car. So it’s not a demand issue, but we have to make it and we need to make it at a price that people can afford, insanely difficult things.

(CEO Elon Musk — Tesla FY2023 Q3 Earnings Call).

Later in the call, he added (emphasis added):

I think we’ll end up with roughly a 0.25 million Cybertrucks a year, I don’t think we’re going to reach that output rate next year. I think we’ll probably reach it sometime in 2025. That’s my best guess.

(CEO Elon Musk — Tesla FY2023 Q3 Earnings Call).

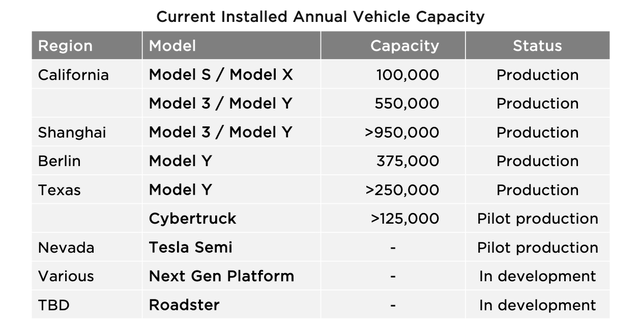

In addition, management pointed out that Tesla has an initial capacity of at least 125K Cybertrucks.

Tesla FY2023 Q3 Investor Update

With this information, I see five major problems for the Cybertruck.

First, assuming 125K units in 2024 and 250K units produced in 2025 and beyond, person number one million on the waitlist would have to wait at least four more years to get his or her Cybertruck.

Well, that Cyber-sucks.

Sure, Tesla can scale production by opening more Gigafactories, but given the complexities of the new Cybertruck — which Elon mentioned repeatedly during the call — I doubt we reach more than 250K Cybertrucks produced per year.

Second, one million reservations may not paint an accurate demand picture since these reservations were made with a refundable deposit of $100. If it was a deposit of $5K or $10K, that one million preorders may actually be accurate.

In addition, those reservations were made with the expectation that the Cybertruck would sell for $40K. However, Tesla just revealed that the base model will start at $61K, which is over 50% of what the company promised back in 2019.

As such, there’s reason to believe that a lot of people would be refunding their deposits due to the high price tag, which means demand may not be as strong as management claimed.

Third, the mid-tier Cybertruck has a price tag of $80K, which is similar to the Model S and X — Tesla’s luxury line.

And let me remind you, Tesla produced and delivered 73K and 63K Model S/X in the last twelve months, so for Tesla to target a production rate of 250K Cybertrucks a year is quite ridiculous.

I would say an annual rate of 100K is more realistic — maybe still too optimistic.

Fourth, the Cybertruck is also priced similarly to other electric trucks, such as the Rivian R1T (RIVN) and the Ford F-150 Lightning. If it was $40K, it would be a screaming deal. Unfortunately, it’s not.

Finally, the high interest rate environment may put immense pressure on demand for a while. Even Elon Musk agrees (emphasis added):

I’m worried about the high interest rate environment that we’re in. I just can’t emphasize this enough that the vast majority of people buying a car is about the monthly payment. And as interest rates rise, the proportion of that monthly payment that is interest increases naturally.

So, if interest rates remain high or if they go even higher, it’s that much harder for people to buy the car, they simply cannot afford it.

(CEO Elon Musk — Tesla FY2023 Q3 Earnings Call).

Given the challenging macro environment, I don’t think Cybertruck sales will be strong in the next couple of years. There may be a spike in sales at first, but I think the hype will die down eventually as people “simply cannot afford it.”

So, based on Elon Musk’s gloomy remarks, it seems like it’s going to take way longer than expected for the Cybertruck to ramp up to full-scale production.

Having said all that, while the near-term outlook looks gloomy, the long-term outlook remains as bright as ever as Tesla continues to be the most dominant force in renewable energy solutions.

As Elon mentioned, “Tesla is an incredibly capable ship” that won’t sink in this macroeconomic storm. “The weaker ships will sink” but Tesla will come out stronger when the storm subsides.

Valuation

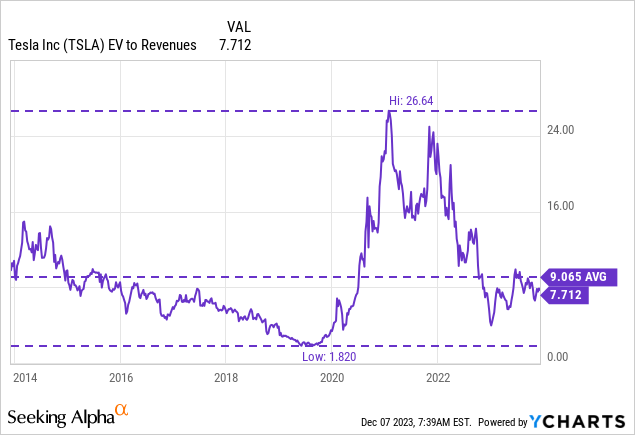

Looking at Tesla’s valuation, the stock is trading at an EV to Revenue multiple of 7.7x, which is lower than its 10-year average of 9.1x, and certainly its peak of 26.6x. By historical standards, Tesla stock looks slightly below fair value.

However, the lower multiple is justified given Tesla’s slowing growth rates, lower margins, and weak near-term outlook.

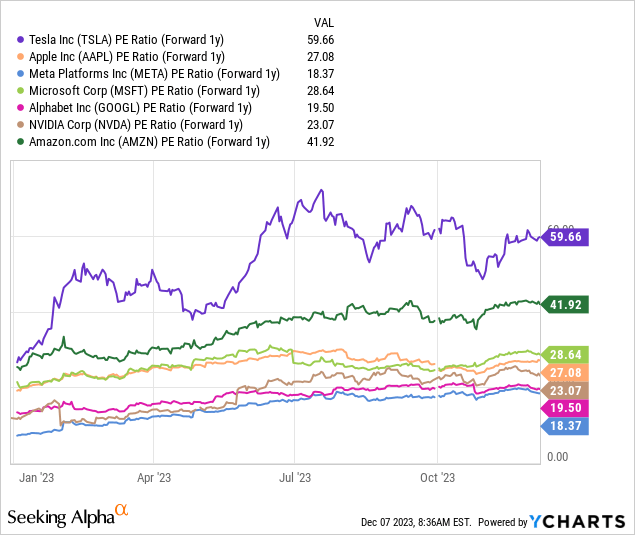

On the other hand, Tesla trades at a Forward P/E Ratio of nearly 60x, which is quite expensive and is something not to be ignored. For comparison, Tesla’s multiple is higher than the rest of the magnificent seven.

Whether you value Tesla as a car company or a solar company or a tech company, there’s no denying that Tesla stock is richly valued and priced to near perfection.

If the outlook is great and analysts expect better results, then the higher multiple would be justified. However, throughout the year, analysts have been revising down Tesla’s 2024 estimates:

- At the start of 2023, analysts expect 2024 EPS of $6.78. Today, they expect only $3.98, roughly a 40% reduction.

- The same goes for Revenue — analysts were expecting $143B next year. Today, they expect only $119B, about a 17% decrease.

Despite the large downward revisions, Tesla’s stock is up 120%+ year-to-date.

The disconnect is real, and that could hurt shareholders if they get too complacent.

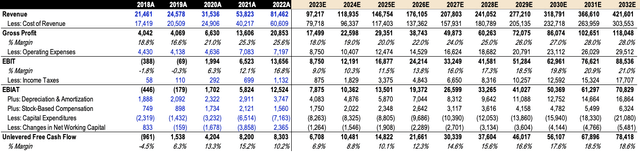

My discounted cash flow (“DCF”) model shows that Tesla is trading close to fair value.

Here are my key assumptions:

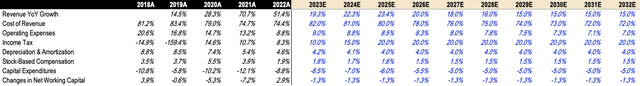

- Revenue growth follows analyst estimates for the first three years and gradually falls to just 15% in 2029 and beyond.

- Gross Margin expands from 18% this year to 28% by 2032 as Tesla Energy continues to outgrow the Automotive segment and Tesla introduces higher-margin Revenue like FSD, Dojo, and potentially, robotaxis.

- FCF Margin expands to nearly 19%, due to higher Gross Margins and economies of scale.

By 2032, I expect Tesla to achieve $422B of Revenue, generating $78B of FCF in the process.

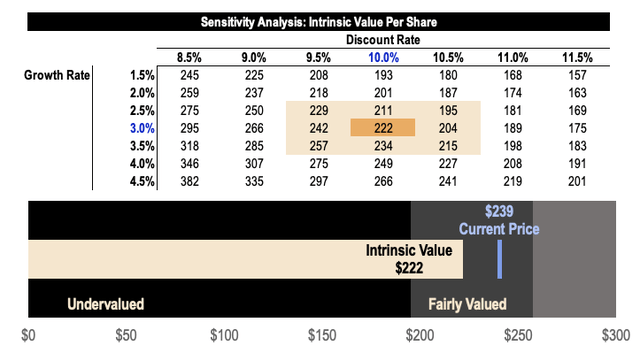

Based on a discount rate of 10% and a perpetual growth rate of 3%, I get an intrinsic value of $222 per share for Tesla, which is close to its current price of $239.

While I do like Tesla as a long-term investment, I don’t think there’s sufficient margin of safety to merit a table-pounding buy.

Risks

Competition

Bulls hate to hear it. I’m a bull too, but it’s ignorant on my part to completely write off competition.

Yes, Tesla may be superior compared to peers, but competition is catching up.

This includes pure EV startups like Rivian as well as legacy automakers like Ford.

That said, keep an eye out for Automotive Gross Margins, and if it continues to fall, it’s a strong indicator of rising competition as well as slowing demand for Tesla vehicles.

Higher for longer

Elon Musk is worried about high interest rates — and so should you.

He has PTSD from 2009. He saw how elevated interest rates and a broader economic recession led to demand destruction.

That could happen again and that may put a pause on Tesla’s growth ambitions.

Thesis

As we’ve seen with its Q3 results, Tesla’s growth is slowing down materially due to factors such as high interest rates and lower ASP. To make matters worse, margins are getting worse with each passing quarter.

The Cybertruck could be the catalyst that propels Tesla back to strong growth. However, given Elon Musk’s grim remarks on the economy and the sheer complexity of the Cybertruck, I believe it may take longer than expected for the Cybertruck to reach volume production.

Furthermore, demand for the Cybertruck may not be as strong as anticipated, due to its higher-than-expected price tag.

Even so, customers further down the waitlist would have to wait a few more years to get their hands on the Cybertruck.

Sounds more like Cyber-suck.

Don’t get me wrong — I love Tesla, Elon Musk, and his mission to accelerate the world’s transition to sustainable energy.

I’m bullish on the company — but a proper sanity check, helps me dial down my expectations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.