Summary:

- Tesla’s dominant position in EVs, AI, and robotics, coupled with perpetual innovation, positions it for rapid sales and profitability growth in coming years.

- Technical indicators suggest a substantial breakout above $300, supported by favorable fundamentals and a constructive inverse head and shoulder pattern.

- The upcoming potential $25,000 compact EV and robotaxi fleet could significantly boost Tesla’s market share and profitability, driving future stock price appreciation.

- Despite Wall Street’s bearish stance, Tesla’s potential in high-margin segments like FSD, AI, and energy solutions could lead to considerable price target upgrades.

gremlin

With the Tesla, Inc. (NASDAQ:TSLA) Robotaxi event, finally here, Tesla’s blockbuster moment has arrived. I discussed why I was buying the Tesla dip in my previous article. I have been a Tesla bull for a long time and have been long the stock on and off for over ten years (since October 2013). However, after having limited Tesla exposure in recent years, this year, I’ve steadily accumulated mainly around the $140-180 range, and with about a 12% portfolio weight, Tesla is now my most significant portfolio holding.

Many of you may wonder why I want such a significant Tesla position, as it is often perceived as risky and remains a crucial battleground stock. Many market participants perceive Tesla as “a risky company,” but I believe that the potential benefits of owning Tesla’s stock outweigh the risks considerably.

Despite the transitory slowdown, Tesla remains the global leader in EVs and will likely continue spearheading this explosive, rapidly expanding global market segment. Moreover, Tesla is a global leader in AI, energy solutions, robotics, FSD, and much more.

Further, Tesla’s AI potential may be severely underappreciated and underpriced here, as many market participants still view Tesla as primarily “a car company.” On the contrary, I and other analysts believe Tesla may be one of the most undervalued AI stock in the market, as its enormous global ecosystem and advanced infrastructure should provide it with numerous competitive advantages.

Tesla’s dominant market-leading position, perpetual innovation, and unique ability to stay ahead of its competition in many respects should enable Tesla to continue expanding sales rapidly while substantially increasing its profitability potential in the coming years. Due to the favorable fundamental, technical, and psychological setup, Tesla’s stock could appreciate considerably in future years.

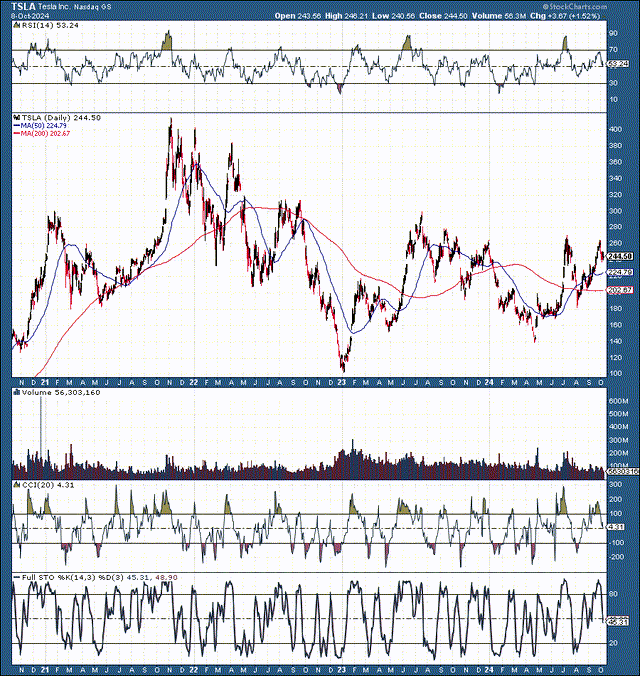

Technically – The Breakout Approaches

Tesla’s stock has basically moved sideways for about four years, which is excellent because it has allowed it to consolidate, digesting the monster rally from previous years. Also, we see a constructive inverse head and shoulder pattern forming in 2024, with the low point (the head) around $150 and the shoulder (neckline) breakout area around the $280-300 range.

We recently saw the 50-day MA cross over the 200-day MA, implying an intermediate and long-term momentum improvement. Other technical indicators, such as the RSI, CCI, full stochastic, and others, suggest that Tesla’s stock may continue moving higher and have a substantial breakout above $300, especially if the fundamental factors don’t let down the stock.

Robotaxi Fleet – If Tesla Builds It, They Will Come

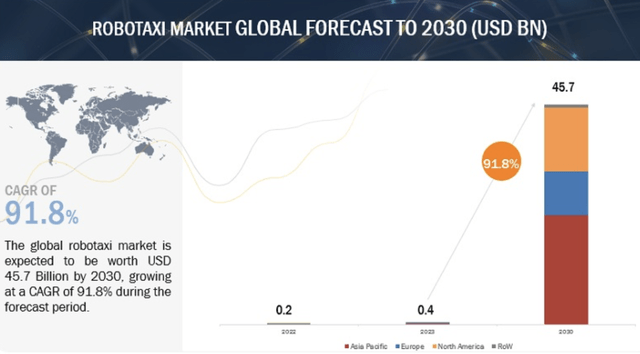

The highly anticipated Robotaxi event is approaching. While some market participants feel it may turn into a “sell the news” event, I believe it will be a success. People are often skeptical of new technologies and fresh ideas. Yet, these things enable innovation, and robotaxis is a logical next step in our civilization’s development process. Also, I don’t think many people realize how massive the robotaxi market will likely be relatively soon.

Robotaxi market growth est. (marketsandmarkets.com)

The global robotaxi market is expected to be worth around $45.7B by 2030, which represents a staggering CAGR of 91.8%. This relatively nonexistent space can grow into an enormous revenue stream for Tesla in future years. Some investors believe Tesla’s robotaxi business could drive its valuation into the trillions, from only about $780B.

Tesla’s expertise in car manufacturing, its unique infrastructure, advanced supply chain, and numerous other advantages could make it a dominant player in the robotaxi race. This dynamic could translate into billions in annual revenues for Tesla and substantial profitability increases in future years.

Tesla’s New Vehicle – Another Blockbuster Moment

Tesla’s “Model 2” vehicle could be a game changer and another blockbuster moment for the company. Whether or not Tesla’s new mass-market vehicle will debut at the “Robotaxi” event remains to be seen. However, Tesla’s affordable new compact EV has been confirmed for 2025.

The starting price tag may only be around $25K, opening up an enormous new market for Tesla. Also, the vehicle is designed as a crossover/hatchback (mini-Model Y), which could potentially make it the best-selling car in the U.S. and worldwide.

Please consider this – Tesla sold roughly 440,000 Model 3/Y vehicles just last quarter alone and about 1.8 million cars last year, most of which were Model 3/Y vehicles. If Tesla can sell this many cars capable of dominating their respective segments with an average selling price “ASP” of around $40K, imagine the sheer volume and sales Tesla can achieve with a genuinely mass model variant at just around $25K.

Tesla’s $25,000 range vehicle will enable it to effectively compete with the lower price range legacy automaker and Chinese EVs. However, much like the Model 3/Y, I expect Tesla’s new lower-priced mini crossover/hatchback vehicle to capture substantial market share from various ICE vehicles selling in a similar or slightly higher price range. Therefore, Tesla’s new low-priced vehicle could contribute billions of dollars to Tesla’s bottom line in future years, and it will likely become profitable, contributing to the bottom line in time as well.

Also, I don’t believe the global car market will experience “Tesla fatigue.” Are people getting iPhone fatigue? Everyone I have ever talked to who owns a Tesla loves it, and Tesla will likely continue gaining market share in the auto and other crucial economic segments as we advance in my view.

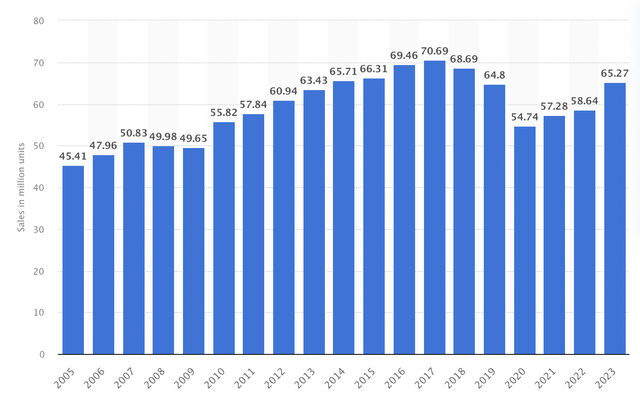

Global Passenger Car Sales Growth Likely to Increase

Worldwide passenger car sales (statista.com)

Also, about 65 million new passenger cars were sold globally last year, and only about 1.8 million, roughly 2.7%, were Teslas. Therefore, Tesla has much more market share to absorb, and the global passenger car market should continue expanding after its transitory slowdown phase, compounding Tesla’s growth effect in future years.

Wall Street Is Much Too Bearish

Price targets (seekingalpha.com)

I expect future price target upgrades because many current price targets don’t appear to account for many of the future potential business revenue streams or higher margins from higher-margin segments like FSD, AI, energy, and other services.

Instead, they appear to focus mainly on Tesla’s car businesses. The consensus 12-month price target forecast is only about $209, about 10-15% below Tesla’s current price. This isn’t anything new because Wall Street has consistently been behind the curve on Tesla.

To be fair, higher-end price targets go to $300+, but the takeaway here is that many price target estimates may be predicated on lowballed estimates and may not consider the future potential of some of Tesla’s projects and how they may reflect on the sentiment concerning the stock. Therefore, we could see considerable price target upgrades leading to a much higher stock price in the next 12 months.

The Bottom Line: Tesla May Be Too Cheap Here

Tesla is too cheap here, in my view, and the market has been behind the curve on Tesla a lot throughout its history. The current period reminds me of the pre-Model 3 launch days. Many market participants did not realize that the Model 3 and Y could dominate their respective segments successfully, pushing Tesla’s stock price much higher.

I believe we are at a similar inflection point now as Tesla has the Cybertruck, Tesla Semi, “Model 2,” robotaxi, robotics, AI, and many other prospects that could propel its sales, profitability, and stock price to the next level.

The Estimates Could Be Too Low Here

EPS vs. estimates (seekingalpha.com)

Due to high rates, a relatively slow economic environment, a transitory slump in general EV sales, and other temporary factors, Tesla recently delivered slightly lower-than-expected EPS. Therefore, the market has become overly negative on Tesla’s earnings potential.

Moreover, as Tesla’s new products and services continue hitting the market, its sales and earnings should expand more rapidly than currently anticipated. Furthermore, recent earnings were impacted by the Cybertruck ramp-up and other temporary costly factors. Also, while Tesla may appear expensive here on a traditional EPS basis, I don’t think this is the correct way to value a company like Tesla.

Forward Earnings Estimates Likely to Increase

EPS projections (seekingalpha.com)

Future EPS estimates have gotten battered due to the recent transitory underperformance and could be lowballed right now. Tesla’s 2026 consensus EPS estimate is only around $4.17 now. Yet, the higher-end estimates range to an EPS of about $5.50. Still, Tesla’s earnings revisions have been extreme.

For instance, the consensus EPS for 2026 was around $6.70 just a year ago. Therefore, in a more bullish case scenario, I believe Tesla could earn more than just $5.50 in 2026. Nonetheless, given that Tesla’s stock is around $240 here, $5-6 in EPS would equate to a forward (2026) P/E ratio of about 40 for Tesla, arguably inexpensive given its massive future revenue and profitability generation potential.

Tesla’s Q3 Earnings Preview

Sales

Model 3/Y: 426,800 (adjusted for lease accounting) x $40,000 = $17.07B.

Other Models: 22,700 (adjusted for lease accounting) x $100,000 = $2.27B

Regulatory Credits: $500M

Automotive Leasing: $460M

Total Automotive Revenue: $20.03B

Energy Generation & Storage: $3.3B

Services & Other: $2.9B

Total Q3 Sales: $26.23 Billion

Gross Profit Margin: 18.2%

Gross Profit: $4.77B

R&D: $1.2B

SG&A: $1.25B

Total Operating Costs: $2.45B

Operating Profit: $2.32B

Operating Margin: 8.8%

Net Income: $2.1B (8% net income margin)

EPS: $0.65 (Non-GAAP)

Note: All estimates are based on prior results and publicly available information.

While my projections are slightly higher than the consensus estimates, I think I am being relatively conservative. These results could suffice to push the stock higher, to potentially $280-300 in the near term. Additionally, Tesla could show better-than-anticipated profitability metrics, including a higher gross margin, lower operating costs, and more. Therefore, there is a high probability of a positive earnings surprise on October 16th, and the stock may finally break out above $300 soon.

Where Tesla’s stock could be in the future:

| The Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $106 | $140 | $175 | $215 | $265 | $320 | $375 |

| Revenue growth | -3% | 32% | 25% | 24% | 22% | 20% | 18% |

| EPS | $3 | $5.50 | $8 | $12 | $17 | $22 | $28 |

| EPS growth | 7% | 83% | 85% | 50% | 42% | 29% | 27% |

| Forward P/E | 55 | 55 | 54 | 53 | 52 | 50 | 48 |

| Stock price | $303 | $440 | $650 | $900 | $1,144 |

$1,400 |

$1,600 |

Source: The Financial Prophet.

Given Tesla’s numerous constructive tailwinds, I am using a relatively modest sales growth rate. Also, there is a crucial point to emphasize here, and it’s that due to the recent transitory harmful elements plaguing Tesla’s stock, it is now around a low point in sales and EPS growth-wise, and its margins are temporarily low. This dynamic is why its profitability metrics appear less than stellar now, and its stock price has suffered.

However, as Tesla advances, more revenues should come from higher-margin businesses like servicing, FSD, AI, software, and other substantially higher-margin segments. Thus, Tesla’s profitability could improve faster and more than expected as the company can go through an extended high EPS growth period.

- My 12 to 18-month base-case price target range for Tesla is $440-600.

Risks To Tesla

Of course, Tesla faces various risks. There is the constant risk of competition from legacy automakers and EV startups. The hottest competition could appear to be coming from China, from another EV giant, BYD. In my view, BYD is a solid company, but Tesla and BYD can both do well and succeed going forward.

There is also the risk of general lackluster demand for EVs, and the market may be oversaturated with EVs in the near term. A worse-than-expected economy or a recession could also affect sales and Tesla’s stock price.

Margin compression has also been a risk. Tesla must show that it can achieve higher margins in its auto unit. Also, its higher-margin businesses should start making up a more substantial portion of general sales. Investors should examine these and other risks before investing in Tesla.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!