Summary:

- Tesla’s recent performance has been a reflection of mounting risks and increasingly what seems poor execution.

- A major strategy change and other risks mounting at the company give investors a legitimate reason to sell Tesla to re-evaluate the company’s strategic direction.

- The company recently missed deliveries for the first time in four years, suggesting that the benefits of price cuts may have run out.

- Recent layoffs will take time to be digested before their effects can be fully felt and evaluated.

Tramino/iStock Unreleased via Getty Images

Progress is a new season and the rule of progress is everything in its season. -Henry Ford

One dreaded problem of Tesla (NASDAQ:TSLA) customers is if the car gets “bricked up.” Essentially, a battery can get so low from low temperatures that a car needs to be towed away, although other causes can also result in the same outcome. A brand-new car can become a very heavy inconvenience. Indeed, rather than address mounting issues on the last Q4 conference call, Mr. Musk and his management seemed to brick up and simply didn’t address the major issues facing the company.

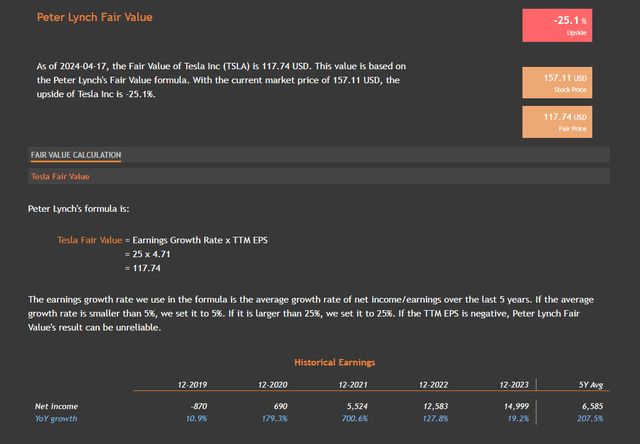

Tesla Gross Profit Margin (Koyfin)

It takes a lot to make Tesla bull Dan Ives mad, but he said this of the call, “We were dead wrong expecting Musk and team to step up like adults in the room on the call and give a strategic and financial overview of the ongoing price cuts, margin structure, and fluctuating demand. Instead, we got a high-level Tesla long-term view with another train wreck conference call.” The stock tumbled 8% after the disappointing call. Aside from the concerning earnings calls, issues have been mounting:

- Buyers have experienced repeated delivery delays with the new Cybertrucks. Rumors as to exactly what is causing the issue are swirling, but the delays are very real as reported by WSJ.

- The company missed deliveries for the first time in four years this quarter. Wall Street expected the company to deliver 454,200 vehicles but it only delivered 386,810 well below the 430,371 cars it produced.

- The missed deliveries are particularly concerning as margins have been under pressure in 2024. The price cuts that had been stimulating demand no longer appear to be working as effectively.

- Tesla announced widespread layoffs of about 10% of its 140,000-person workforce. The move may cut some costs, but many inside Tesla complain the cuts may be too deep.

- Most importantly, the primary end-strategy of Tesla’s EV strategy, to produce a low-cost family EV for less than $30,000, has now been canceled. While the firm has said they will instead pursue autonomous robo-taxis, these will likely not be in the high volumes that were expected to be a key feature of the low-cost model.

- CEO Elon Musk appears increasingly distracted since his purchase of Twitter. He is trying to assume more control of Tesla while the stock price has plummeted and major setbacks and strategy changes are occurring. The ‘founder risk‘ at Tesla has been elevated with recent departures.

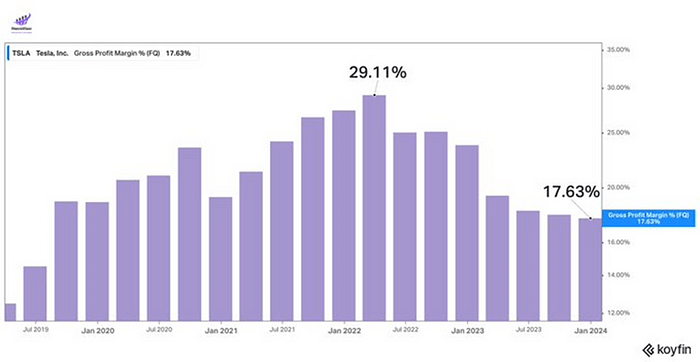

Of course, like many pieces of news surrounding Tesla, there was initial hysteria around ‘bricking’, and the issue ultimately proved rare. Unfortunately, for Tesla shareholders, the stock now seems all bricked up. The convergence of the above risks is enough for me to advise a SELL on the stock. I had been aware of building risks, but the major change in strategy and a replacement with a product dependent on very hazy and unproven autonomous driving technology is simply too much for me as a shareholder. The stock is also overvalued, which makes the above risks much less tolerable.

There are simply higher growth stocks with clearer strategies and less risks where I will be putting my money. The price has been underperforming the S&P 500 for the last six months and in our opinion the founder has been asleep at the wheel. The price cuts and margin compression have left management with seemingly too little flexibility and too much valuation risk. While many might think the stock is an easy buy near a 52-week low, I think the chickens have come home to roost for Tesla. I am not alone in thinking that Mr. Musk will have a very difficult time shifting strategies in midstream.

It seems as if the season of the more pure an EV play, the higher the valuation, is over. What was a strength yesterday, is seeming more and more like a weakness today. I discussed this concept in a recent article I did on Ford that suggested the Detroit stalwart was a better place for your capital while global pessimism about EVs continues to play out:

Of course, this reality has helped EV valuations come back down to Earth now. But the legacy automakers with more flexible EV plans never quite got the multiple boost that pure EV plays got during the bull market. However, now what seemed like a weakness, the legacy internal combustion engine (“ICE”) business, seems like a distinct strength against the pure EV plays like Tesla, particularly given the significantly higher margin of error that Ford has compared to Tesla for our specific purposes. –Riding Out the EV Blues: Buy Ford Instead of Tesla

Tesla has languished lately. Of course, many bulls speculate that a turnaround is just around the corner and that the firm’s prolific founder has something dazzling in store with AI, robotics, or maybe the Giga Press. But the Street’s patience is growing increasingly thin with the eclectic Mr. Musk. However, the blind faith in the founder is getting old for many serious investors who expected Mr. Musk to take his responsibilities as a public CEO with a bit more decorum and optimism. Unfortunately, on the last Tesla earnings call, Mr. Musk infuriated a lot of Tesla investors with his seemingly detached performance.

G-Zero Media, Ian Bremmer

His erratic behavior and flaunting of expectations for officials of public companies needlessly created risk, even if it is part of his image and contrarian allure. Tesla’s strategy to be relatively adversarial toward the state relative to its mega-cap peers paid off in the past, but as Mr. Ford said in the introductory quote, everything in its season. The rising power of Uncle Sam and of the state itself relative to the corporate entity might mean the season for Mr. Musk’s approach has passed.

One of the main roles of a CEO is always a cheerleader, as glorified as the post may have become in our modern economy. This is why Mr. Musk’s lack of engagement on the last conference call was particularly concerning. Furthermore, Uncle Sam might and our current President might not be the most thrilled with him. This is an election year, and his penchant for being political could be extra risky for shareholders during an election year.

Risks and Where I Could Be Wrong

Doubting Tesla has proven very expensive for many short-sellers in the past. While I understand the stock has been brutalized lately, and much of the downside might have already played out, I also don’t see any immediate resolution to the main risks that are warding me off from owning the stock. I am a big fan of Mr. Musk’s past achievements, and the company’s storied break-in to the auto industry is as incredible as it was unlikely.

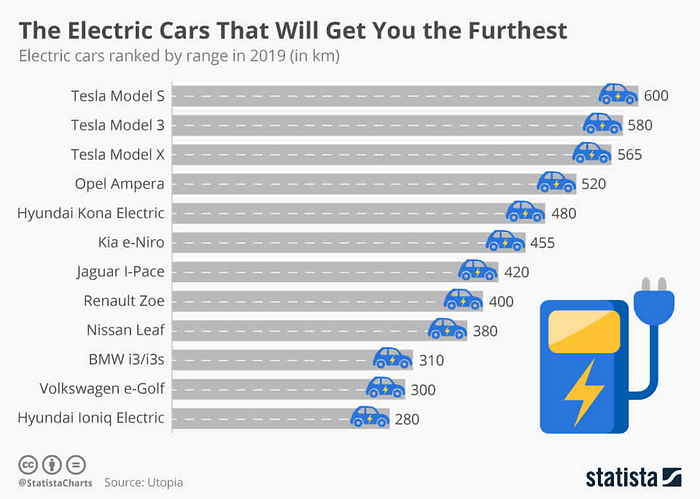

Statista

The company still has several major advantages over incumbent automakers, particularly in battery technology. These technological advantages are hard to erode given the massive investment Tesla has already made and given that it largely sets the tempo of technological progress with regards to the EVs. Tesla’s pivot toward Robo-taxis may prove immensely successful. Furthermore, Tesla has invested a lot in artificial intelligence, and it is always possible that the firm is able to captivate investors with a fresh narrative/strategy involving the market’s favorite theme.

Tesla has the best charger network, and it has probably spent the most on autonomous driving and adjacent technologies. Apple (AAPL) leaving the field of competition is a positive for Tesla, although the reasons for Apple leaving also highlight Tesla’s core problems. Technological progress in areas that are proving obstacles to mass EV adoption and popularity could reverse the tide for Tesla and bring back an environment of excessive investor enthusiasm for all things involving EVs.

Conclusion

The argument for liberty is not an argument against organization, which is one of the most powerful tools human reason can employ, but an argument against all exclusive, privileged, monopolistic organization, against the use of coercion to prevent others from doing better. ― Friedrich August von Hayek

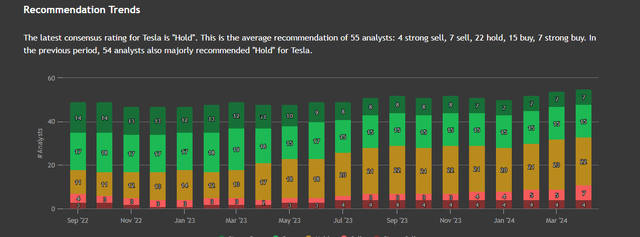

Tesla has had an amazing run and has broken into one of the most difficult industries there is, operationally speaking. The good news is that it did the impossible. The bad news is that now it is in one of the most difficult and capital-intensive industries there is, and it is facing challenges on multiple fronts. Not only that, the eclectic founder is raising concerns among key stakeholders and botching important earnings calls where shareholders have legitimate questions that go unanswered. More analysts have been growing pessimistic on the stock over the last months.

I do not doubt that Tesla will potentially have more great days ahead of it, but I am not willing to shoulder the mounting risks of owning the stock under leadership that I have lost confidence in. Mr. Musk himself is a capable and proven leader in many respects, but his autocratic style is more congruent with a company earlier in development than a massive global auto OEM manufacturing millions of cars. While the myth of the invincible founder is emotionally enticing, the centralization and complacency it creates have the potential to foment very real issues.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.