Summary:

- CEO Elon Musk got his 2018 pay package re-approved after a Delaware court blocked the $56 billion pay package, contributing to the stock weakness.

- Musk shifting focus to AI investments away from Tesla caused concern among investors.

- ARK Invest is bullish on Tesla, raising the price target to $2,600 by 2029 based on the robotaxi opportunity, though a more logical goal is $500+.

- TSLA stock isn’t cheap based on normal financial measures, but the company has multiple shots at trillion-dollar businesses to warrant the risk of overpaying here.

baileystock

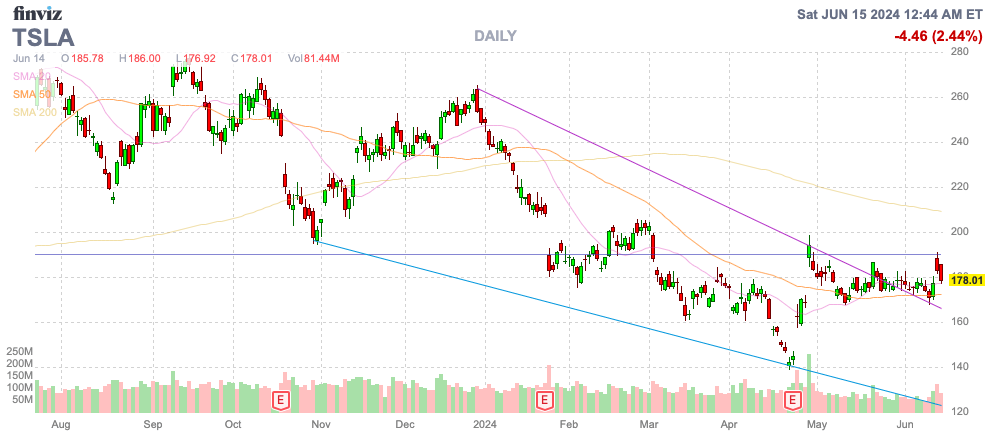

Tesla Inc. (NASDAQ:TSLA) had a rough year in part due to the shareholder battle with their CEO over his previously approved pay package. Whether fair or not, Elon Musk appeared less engaged with Tesla following the Delaware court disallowing a previous pay award based on performance of the stock. My investment thesis is more Bullish on the stock trading at multi-year lows with Musk now fully enthused to focus on Tesla and the upcoming opportunity in robotaxis.

Source: Finviz

Contentious Pay Package

At the end of January, the Delaware Court of Chancery struck down the $56 billion pay package of CEO Musk on the basis of the original approval determined by “friendly” directors. The 2018 pay package included 12 tranches of stock options giving Musk ~303 million shares of the stock with a $23 strike price (adjusted for stock splits) worth $56 billion at the time of the Delaware court ruling.

Investors can question whether Musk deserved or needed the vast amount of stock options, but the pay package required a stock with a $60 billion valuation to soar to $650 billion. Along with revenue and profit targets, Tesla hit all of the metrics by 2022 with Musk being rewarded with all of the stock options.

Following the court loss and right after weak Q4’23 earnings, the stock fell from the $260 level to end 2023 all the way to $140 in late April. While the EV market has become highly competitive and the domestic market has lost momentum, a bigger issue is that Musk has pushed AI investments towards xAI and away from Tesla.

The EV manufacturer has ambitions in turning the EV car sales business into a robotaxi business, along with the potential for Optimus prime robots to play a big role in future growth. Either way, Musk spent the period from the end of January until now raising $6 billion for xAI at a $24 billion valuation and transferring ~12K H100 GPUs to the new business and away from Tesla.

The big issue is that Musk claimed to not control enough of Tesla in order warrant his focus on AI. One of the biggest claims of Musk is that he wants a larger control of a future AI business to ensure safety is a priority.

Either way, Musk sent the 12K H100 GPUs from Nvidia (NVDA) to xAI. The executive claims Tesla wasn’t ready to use the GPUs needing to complete the south extension of the Gigafactory in Texas, but a normal company wouldn’t have effectively helped the competition in AI.

Apparently, Tesla still plans to buy 50K additional H100s for FSD training. Musk estimates Tesla will spend an incredible $3 to $4 billion on GPUs this year out of at least $10 billion spent on AI ambitions. Legitimate or not, the stock still suffered this year as questions popped up on his focus, especially if the pay package wasn’t re-approved.

Even with the approval, some 529 million shares voted against the re-approval of the large pay package.

Big Robotaxi Price Target

Tesla plans a robotaxi event on August 8. Musk continues to suggest the EV manufacturer is only months away from a launching a robotaxi service while market research continues to question this timeline. Musk has promised a robotaxi service for years.

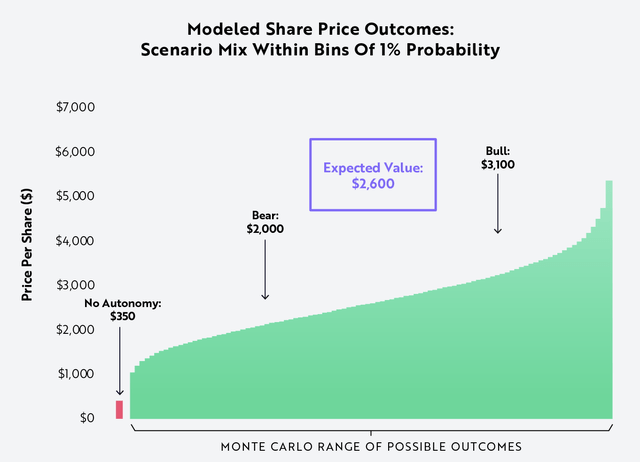

Cathie Wood and ARK Invest (ARKK) continue to push a major investment in Tesla based on the robotaxi opportunity. In fact, ARK Invest just upped the price target for Tesla to $2,600 by 2029 based primarily on the robotaxi opportunity.

ARK Invest places a 50% probability on the $2,600 outcome with 90% of the valuation assigned to the robotaxi business and a valuation of only $350 for Tesla without autonomy.

The prime inputs for achieving the bull case of a $3,100 price target in 2029 are the following:

- Cars sold – 14.4 million, up from 1.8 million in 2023

- Robotaxi revenue – $951 billion

- Gross margin – 53%, up from 18% in 2023

- EBITDA margin – 32%, up from 17% in 2023

As Musk highlights in this shareholder meeting video, Tesla plans to take multiple routes to run the robotaxi business. The company will operate a fleet of robotaxi vehicles ensuring a consistent supply of cars in service and owners will have the option to buy Tesla vehicles and turn the EV into a robotaxi by simply pushing a button.

The biggest issue is that Tesla is no longer ahead of the game. The EV company launching the robotaxi service in 2025 doesn’t provide much of a lead on competition with Waymo, owned by Alphabet (GOOG) already offering service in multiple cities.

The biggest problem is that Tesla doesn’t have a basis for launching a robotaxi service outside of internal tests. The company hasn’t worked with regulators to officially test the service and the use of GPUs for a neural network never fully allows FSD to focus on the ever adapting terrain and driving conditions where a robotaxi service can’t rely on prior road conditions.

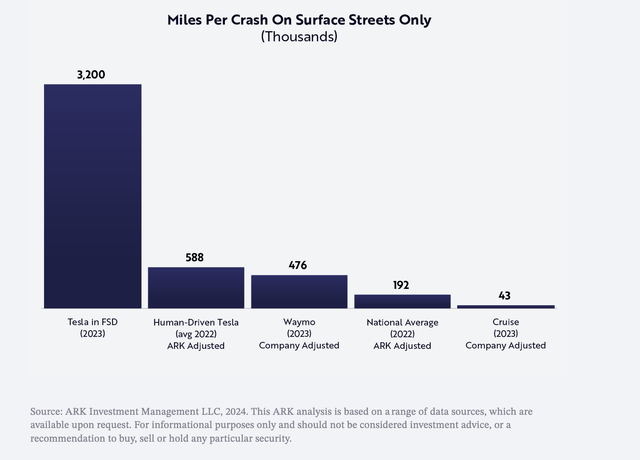

ARK Invest suggests FSD is ~5x safer than human drivers and other self-driving services, but the data isn’t clearly apples to apples. Tesla doesn’t technically have an AV service, so any traffic accidents would be highly limited due to drivers having to remain engaged with eyes and hands. Technically, the company shouldn’t have any accidents with drivers in position to prevent collisions.

The ARK Invest targets appear far more fantasy than reality, though this exact scenario is what led to the original Musk pay package blocked by the Delaware court. Musk and Tesla hit those targets and a successful robotaxi service along with the potential of Optimus robots could lead the stock to $2,600 in the future, with ARK Invest estimating the robots market could reach $24 trillion in the future.

The key here is that an investor only needs the stock to hit $350 in 2029 to be happy. A mere double requires just successful EV growth and maybe a kicker of Optimus robot hype. Or maybe, the robotaxi service is successfully launched in a few years and business is accretive to selling EVs, but without the massive success outlined by ARK Invest.

A re-engaged Elon Musk now has the same incentives to build the robotaxi service or Optimus business. While neither seems probable to turn Tesla from a sub-$600 billion valuation to 10x+ the current valuation, it wouldn’t be the first time Musk achieved this accomplishment and both markets appear to legitimately have trillion dollar opportunities.

Uber Technologies (UBER) doesn’t even produce $50 billion in annual revenues for their ride-hail service now. Tesla definitely has the ability to produce higher margins, collecting all of the revenues with corporate robotaxis and eliminating the cost of the driver, but the market opportunity will likely take far beyond 2029 to scale to nearly $1 trillion.

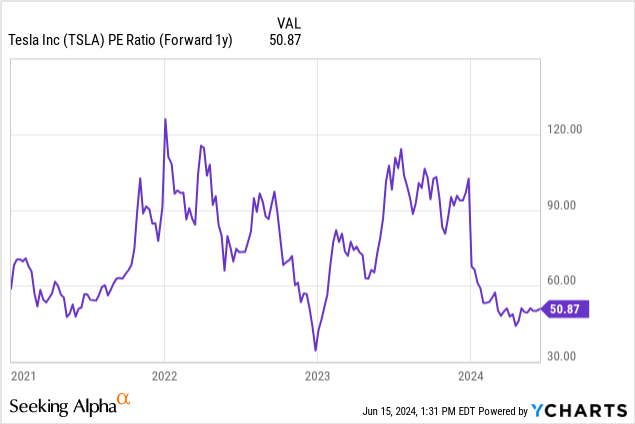

Even at the dip to $178, Tesla is expensive at over 50x 2025 EPS targets. The reason to buy the stock is CEO Musk re-engaged in the business and the trillion dollar opportunities in robotaxis and robots, along with AI services as an additional kicker.

A more practical view is that Tesla drives the robotaxi business to higher revenues than the current $250 billion consensus target for 2029. Instead of the dramatic ARK Invest target of $1.35 billion in 2029 revenue, a more logical outcome is $100 billion upside to the $250 billion estimate due to robotaxi revenues and 30% EBITDA margins.

Tesla would produce $100 billion in EBITDA and the stock could nearly triple from the current price to $500+. The targets from Cathie Wood are Extreme Bull outcomes.

Takeaway

The key investor takeaway is that Tesla feels back in growth mode with CEO Musk fully re-engaged owning ~25% of the business now. The stock is expensive based on current analyst estimates and the robotaxi service has a lot of legitimate questions regarding timing and success, but Musk is pushing aggressively full-speed ahead while competitors like Cruise Automation, owned by GM (GM), are resetting the business. The Cathie Wood price targets are aggressive, but it wouldn’t be the first time for Musk to hit those targets in a 5-year period.

Investors should use Tesla trading at multi-year lows as an opportunity to load up on the re-engagement of Elon Musk and the potential in a couple of trillion dollar markets in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.