Summary:

- We continue to be sell-rated on Tesla, Inc. post-earnings as CEO Elon Musk apparently prefers higher volumes over higher margins and signals more price cuts ahead.

- Consistent with our expectations, Tesla’s price cuts failed to materially boost demand and simultaneously painfully hit margins.

- The stock is down roughly 11% since we last published, compared to the S&P 500, up nearly 1% during the same period.

- We recommend investors count their profits and exit the stock at current levels as we see more downside ahead.

Justin Sullivan/Getty Images News

We remain sell-rated on Tesla, Inc. (NASDAQ:TSLA) post the disappointing but expected 1Q23 earning results. We expect the downward trend to continue toward 2H23 as macroeconomic headwinds pressure consumer spending behavior. The stock is down roughly 11% since our pre-earnings note, underperforming the S&P 500 (SP500). Consistent with our expectations, Tesla’s price cuts that began more seriously early this year have painfully hit margins; the company’s GAAP gross margin is down 977bp in 1Q23 to 19.3% compared to 23.8% a quarter earlier.

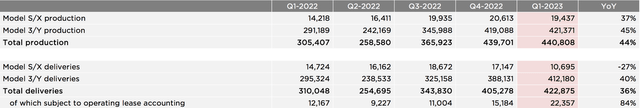

We pick up the question we posed in our last note, what’s happening to Tesla’s demand? After 1Q23 earnings results, we confidently say not much. Tesla’s price cuts, up to 11% on Model X this year and 20% on Model Y, haven’t meaningfully boosted demand. Tesla’s production levels still significantly outweigh deliveries, despite the massive price cuts.

The following table outlines Tesla’s deliveries and production up to 1Q23.

Tesla reported a 24% Y/Y drop in net income this quarter as the company puts higher volumes ahead of higher margins. Tesla CEO Elon Musk signaled that price cuts would continue, saying, “We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin.” We expect Tesla’s margins and profits to continue to be under pressure in the near term as Musk sees the price-cut strategy through. We recommend investors exit Tesla stock at current levels and revisit once the near-term downsides of weaker margins and macro headwinds have been priced in.

Price cuts 2.0

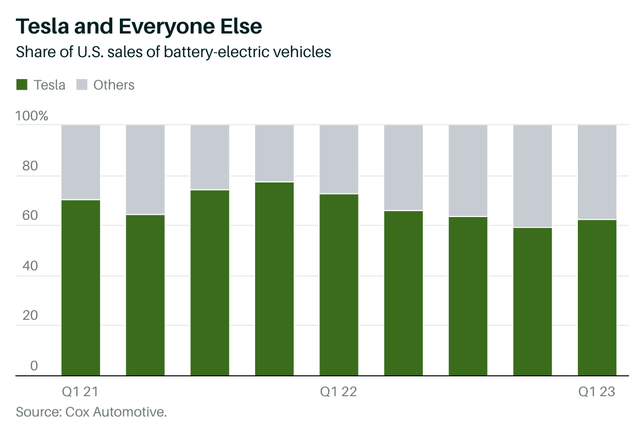

Musk signaled that price cuts were not a one-time occurrence; the company will continue to cut prices. The news caused Chinese stocks rivaling Tesla in the electric vehicle (“EV”) space to drop; XPeng Inc. (XPEV) down 8%, Li Auto Inc. down 4%, and NIO Inc. (NIO) down roughly 6%. We believe Musk is trying to take advantage of the macroeconomic headwinds to cut prices and expand Tesla’s market share in the EV space, which has been under pressure as competition intensifies. The fear of competition doesn’t only pertain to the Chinese EV market- the company faces strong competition globally as EV adoption increases rapidly. Tesla’s market share in California, the company’s biggest U.S. state for zero-emission vehicles, tumbled in 1Q23; the company controlled around 60% of the battery electric market in California this quarter, down from about 73% during 2022. Tesla rivals Volkswagen AG (OTCPK:VWAGY) and General Motors Company (GM) increased their market shares during the same period but still remained in the single-digit range.

Fears over Tesla’s shrinking market share were flagged late last year, when an S&P Global study forecasted Tesla to own less than 20% of the U.S. EV market by 2025, down from 79% just two years ago. We believe the price cuts aren’t just Musk’s reaction to the macro environment but also Musk playing the pricing power card on the competition. The following chart outlines Tesla’s shares of U.S. sales of battery EVs up to 1Q23.

Tesla’s 1Q23 earning results highlight that Tesla’s deliveries could have been much worse had the company not slashed prices. This signals how bad the weaker spending environment is as consumers have less disposable income to allocate to new vehicle purchases amid high-interest rates and persisting inflationary pressures. We expect price cuts to continue pressuring margins in the near term.

Risks to our sell-rating

We are more constructive on the company’s market share expanding in the mid-to-long run due to the now more affordable nature of Tesla vehicles. Tesla retains the pricing power advantage over the competition, and if Musk’s strategy does materially increase delivery volumes, then the company would be better positioned to make more money after the initial vehicle sale through service and software income. We expect the price cut strategy may be a long-term growth driver to consolidate Tesla’s leading position in the EV space rather than a near-term Hail Mary attempt to increase delivery volumes. If this is the case, Tesla stock is likely to outperform in the long run. Our bearish sentiment, however, is driven by our near-term outlook for the stock.

We also expect the company’s efforts to reduce costs will be beneficial; Tesla noted that its upcoming next-generation EV platform would be able to reduce costs by around 50% over the next five years. Tesla reducing costs while increasing volumes will help ease the negative impact price cuts have on margins. Still, we believe cost reduction will materialize meaningfully in the mid-to-long run, maybe even as soon as 2024, but don’t see costs reducing significantly in 2H23. We don’t see favorable entry points into Tesla stock at current levels, as another wave of price cuts is on the way.

Valuation

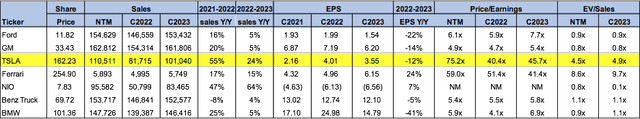

Tesla stock is relatively expensive, trading at 4.9x EV/C2023 Sales versus the peer group average of 2.6x. On a P/E basis, the stock is trading at 45.7x C2023 EPS $3.55 compared to the peer group average of 18.8x. We believe the stock is highly valued for the near-term headwinds pressuring margins. We don’t see favorable entry points into the stock at current levels and recommend investors exit the stock at current levels and revisit it once the downside risks have been priced in.

The following table outlines Tesla’s valuation.

Word on Wall Street

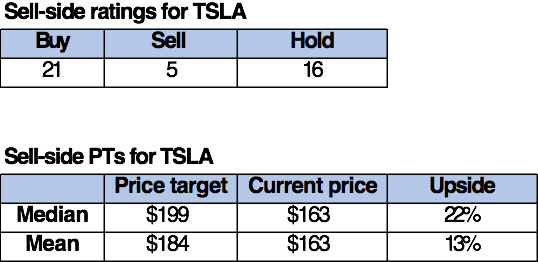

Wall Street is divided on the stock. Of the 42 analysts covering the stock, 21 are buy-rated, 16 are hold-rated, and the remaining are sell-rated. It’s hard to maintain a bullish sentiment on the stock as higher interest rates and inflationary pressures weigh on consumer spending behavior, negatively impacting Tesla’s main stream of revenue: automotive revenue. In 1Q23, the company reported total automotive revenue of $19,963M, up 18% Y/Y but down roughly 6% sequentially.

The following table outlines Tesla’s sell-side ratings.

TechStockPros / Refinitiv

What to do with the stock

Tesla stock is down roughly 52% over the past year, underperforming the S&P 500, down 4% during the same period. We recommend investors against buying Tesla stock just yet. We expect more downside ahead for Tesla, Inc. stock toward 2H23 as Musk pushes the price cut strategy to retain and expand the company’s market share at the expense of near-term margins.

We’re bullish on Tesla, Inc. in the long run, but don’t see favorable entry points at current levels. Hence, we believe investors should exit Tesla stock at current levels and revisit once the near-term headwinds have been factored into the stock price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.